Important Considerations:

Health becomes a top priority as we age, and having the right healthcare coverage is essential. Medicare Supplement Plan G (Medigap Plan G) is a reliable and cost-effective choice to complement Original Medicare coverage. In this article, we'll explore the benefits of retaining your Medigap Plan G and explain why keeping your plan is a good idea.

Speak with a Medicare Advocate

Medicare Supplement Plan G

Comprehensive Coverage: Plan G offers comprehensive coverage, filling the gaps left by Original Medicare (Part A and Part B).

Predictable Costs: Your out-of-pocket costs are predictable and manageable. Once you meet the annual Part B deductible, the plan covers the rest of your Medicare-approved expenses for the year. This predictable structure provides financial peace of mind, especially for seniors on a fixed income.

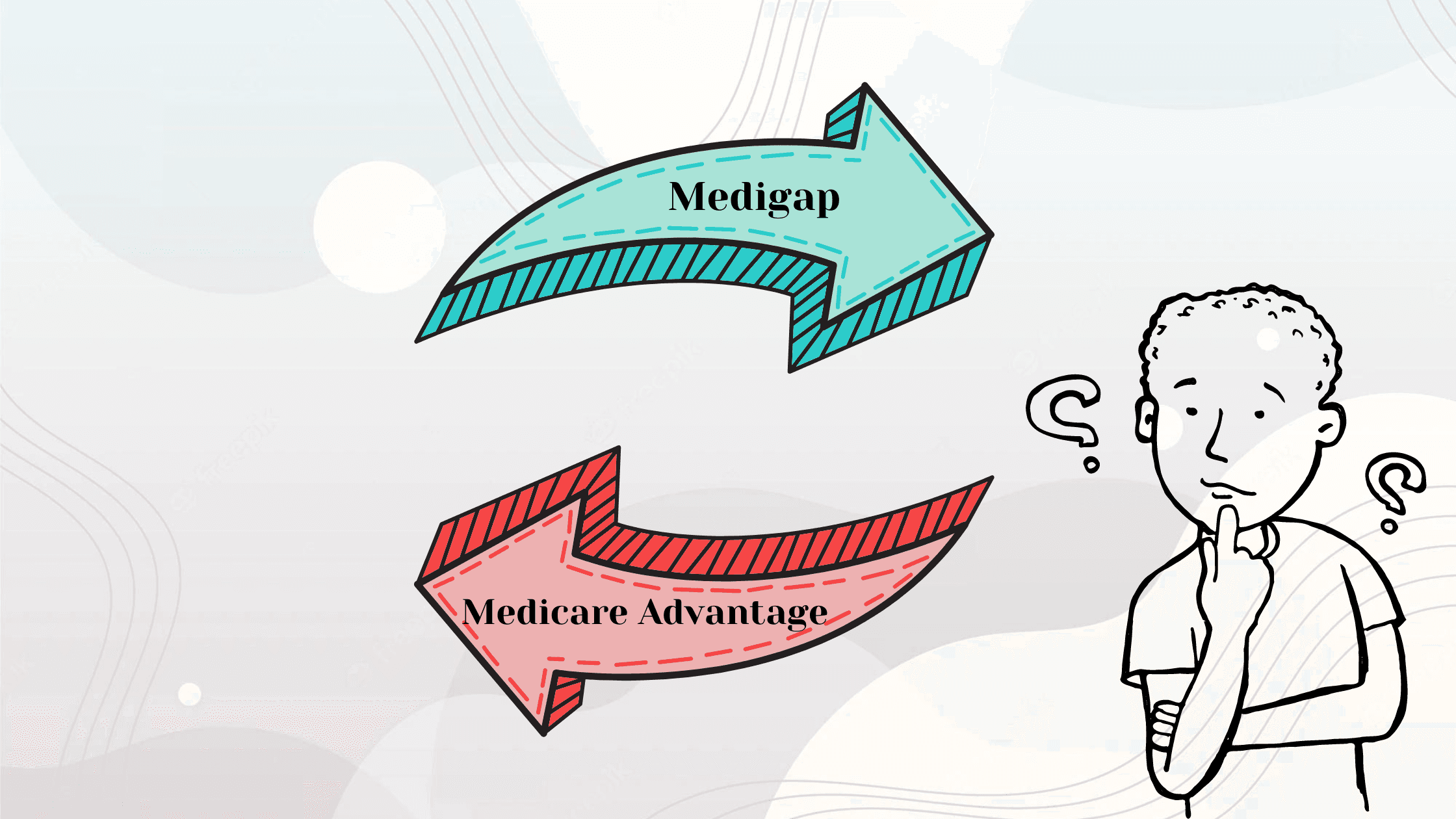

Freedom to Choose Doctors: Unlike Medicare Advantage Plans, which often restrict you to a network of healthcare providers, Medigap Plan G allows you to see any healthcare provider who accepts Medicare. You don't need referrals to see specialists; you can receive care from the doctors and hospitals you trust.

No Copayments for Doctor Visits: Medigap Plan G covers your Part B coinsurance and excess charges, meaning you won't have copayments for doctor visits and other outpatient services, saving you money.

Stability: Once you enroll in a Medigap plan, you can keep it for as long as you want, as long as you pay the premium. The benefits and coverage won't change so you know what to expect.

Advantage Plans

Network Restrictions: You are often limited to a network of providers, and out-of-network care can result in higher costs.

Cost Structure: Typically have copayments, deductibles, and varying cost-sharing structures, which can be challenging to predict.

Yearly Changes: Advantage plans can change their benefits, formularies, and networks yearly, potentially leading to coverage gaps and higher out-of-pocket costs.

Qualifying for Medigap Plans as You Age

Qualifying for a Medigap plan becomes more challenging as you age. The best time to enroll in a Medigap plan is when you turn 65 (or start Medicare Part B). During this period, insurance companies can't deny you coverage or charge higher premiums based on your health status. If you apply for Medigap plans later, you'll likely have to pass Medical Underwriting, which allows insurers to consider your health conditions when deciding whether to offer coverage and at what price. Pre-existing conditions could result in higher premiums or even denial of coverage. These factors can make it very difficult to return to your Medigap plan if you decide to leave it.

Conclusion

Retaining your Medicare Supplement Plan G offers many benefits, including comprehensive coverage, predictable costs, and the freedom to choose your healthcare providers. While it may be tempting to enroll in an Advantage plan you see advertised, it's essential to consider the impact changing plans could have on your future. Making a change without talking to an Expert could lead to long-lasting consequences. Schedule an appointment with one of our Medicare Experts at fairsquaremedicare.com

Recommended Articles

Does Medicare Cover SIBO Testing?

Dec 1, 2022

Does Medicare Cover Service Animals?

Nov 29, 2022

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

Does Medicare Cover Diabetic Eye Exams?

Jan 11, 2023

What Happens to Unused Medicare Set-Aside Funds?

Jan 20, 2023

13 Best Ways for Seniors to Stay Active in Columbus

Mar 8, 2023

How Much Does Open Heart Surgery Cost with Medicare?

Jan 27, 2023

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

What Is Medical Underwriting for Medigap?

Apr 14, 2023

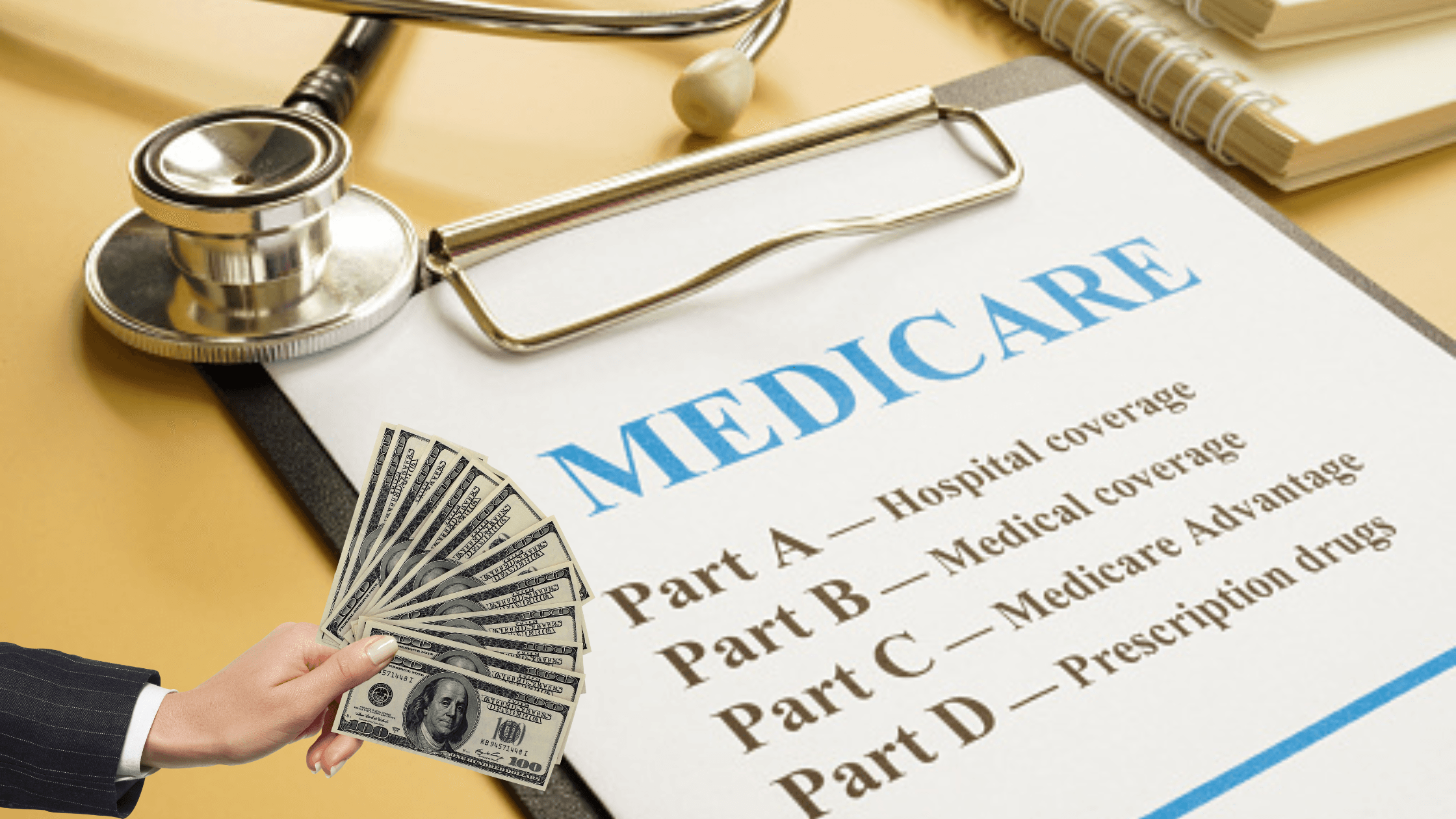

How Much Does Medicare Cost?

Jul 25, 2022

15 Best Ways for Seniors to Stay Active in Denver

Mar 9, 2023

What's the Deal with Flex Cards?

Dec 15, 2022

Can I Change My Primary Care Provider with an Advantage Plan?

Aug 25, 2023

Does Medicare Cover Piqray?

Dec 2, 2022

Health Savings Accounts (HSAs) and Medicare

Jan 24, 2024

Medicare Explained

Jan 3, 2022

Does Medicare Cover Cervical Disc Replacement?

Jan 20, 2023

Does Medicare Cover Qutenza?

Jan 13, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

2024 Cost of Living Adjustment

2024 Fair Square Client Retention and Satisfaction Report

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Help with the Cost of Tyrvaya?

Do You Need Books on Medicare?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Ilumya?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Nexavar?

Does Medicare Cover Ofev?

Does Medicare Cover Ozempic?

Does Medicare Cover PTNS?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover TENS Units?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Vitamins?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Estimating Prescription Drug Costs

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do Medicare Agents Get Paid?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Apply for Medicare?

How to Choose a Medigap Plan

How to Deduct Medicare Expenses from Your Taxes

Is Botox Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare 101

Medicare Consulting Services

Medicare Savings Programs in Kansas

Medigap vs. Medicare Advantage

Moving? Here’s What Happens to Your Medicare Coverage

The Easiest Call You'll Ever Make

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What Is a Medicare Advantage POS Plan?

What to Do When Your Doctor Doesn't Take Medicare

When to Choose Medicare Advantage over Medicare Supplement

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare