Good news; you're covered

For Medicare beneficiaries seeking treatment for myelofibrosis, knowing that you have coverage can offer peace of mind. Luckily, all Medicare Part D prescription drug plans cover Jakafi. Read more to learn about Medicare coverage and potential restrictions on coverage.

Speak with a Medicare Advocate

What is myelofibrosis?

Myelofibrosis is a type of blood cancer that can cause anemia, enlarged spleen and liver, fatigue, and night sweats. It is rare but serious, so it is important to understand the symptoms so you can seek medical help right away if necessary.

What treatments are available for myelofibrosis?

There are several treatments that may be prescribed to manage the symptoms of myelofibrosis, including chemotherapy and targeted therapies such as Jakafi. Jakafi is a pill taken twice daily that helps reduce spleen size and improve anemia in people with myelofibrosis by targeting the protein in cells.

How does Medicare coverage work for Jakafi and other myelofibrosis treatments?

Medicare Part D plans cover Jakafi and other treatments for myelofibrosis. There may be restrictions on coverage, such as prior authorization requirements or quantity limits, so it is crucial to understand your plan's terms before beginning treatment.

You can review your plan's formulary (list of covered drugs) to learn more about your plan's coverage and restrictions. If you need help understanding or navigating your plan, contact your Medicare Part D plan provider or the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE (1-800-633-4227).

Generally, Jakafi is listed as Tier 5 on many Medicare plan formularies, making it among the more expensive drugs covered by Medicare. Your out-of-pocket costs will be determined by which coverage phase

Questions to ask your doctor about myelofibrosis treatment?

When discussing treatment with your doctor, it is wise to ask the right questions. Here are some examples of questions to consider asking:

What treatments do you recommend for myelofibrosis?

What are the benefits and risks associated with these treatments?

How will this treatment affect my lifestyle?

What side effects can I expect from this treatment?

Does my Medicare Part D plan cover Jakafi and other medications for myelofibrosis?

How much will I pay out of pocket for my medication?

Understanding your coverage is an important part of treating any condition, so ask your doctor these questions and any others you may have. With the right information, you can make informed decisions about your treatment and care.

Tips for living with myelofibrosis

Living with a serious health condition like myelofibrosis can be difficult. Here are some tips to help manage your symptoms and keep you feeling your best:

Stay active by doing light exercises like walking or swimming.

Take advantage of available resources, such as support groups or counseling services.

Eat a healthy, balanced diet and make sure to get plenty of rest.

Talk with your doctor about any concerns or questions you have.

Stay up to date on your medications and treatments.

These tips can help make life with myelofibrosis more manageable. If you’re ever feeling overwhelmed, talk to your doctor or reach out to a healthcare professional for help.

Conclusion

Myelofibrosis is a serious health condition, but it can be managed with the right treatment and support. Jakafi is covered by most Medicare Part D plans. However, there may be restrictions on coverage. Make sure you talk to a doctor before taking any new medication, including Jakafi. This content is for informational purposes. For all your Medicare-related questions, call an expert at Fair Square Medicare.

Recommended Articles

Does Medicare Cover Kyphoplasty?

Dec 9, 2022

Does Medicare Cover Fosamax?

Nov 30, 2022

Can I Laminate My Medicare Card?

Dec 22, 2022

Why Is Medicare So Confusing?

Apr 19, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Does Medicare Cover TENS Units?

Nov 23, 2022

How Much Does a Pacemaker Cost with Medicare?

Nov 21, 2022

Does Medicare Cover Jakafi?

Dec 12, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Is Vitrectomy Surgery Covered by Medicare?

Dec 2, 2022

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

Do I Need Medicare If My Spouse Has Insurance?

Dec 19, 2022

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Does Medicare Cover Cosmetic Surgery?

Nov 28, 2022

What's the Deal with Flex Cards?

Dec 15, 2022

Medicare Supplement Plans for Low-Income Seniors

Mar 23, 2023

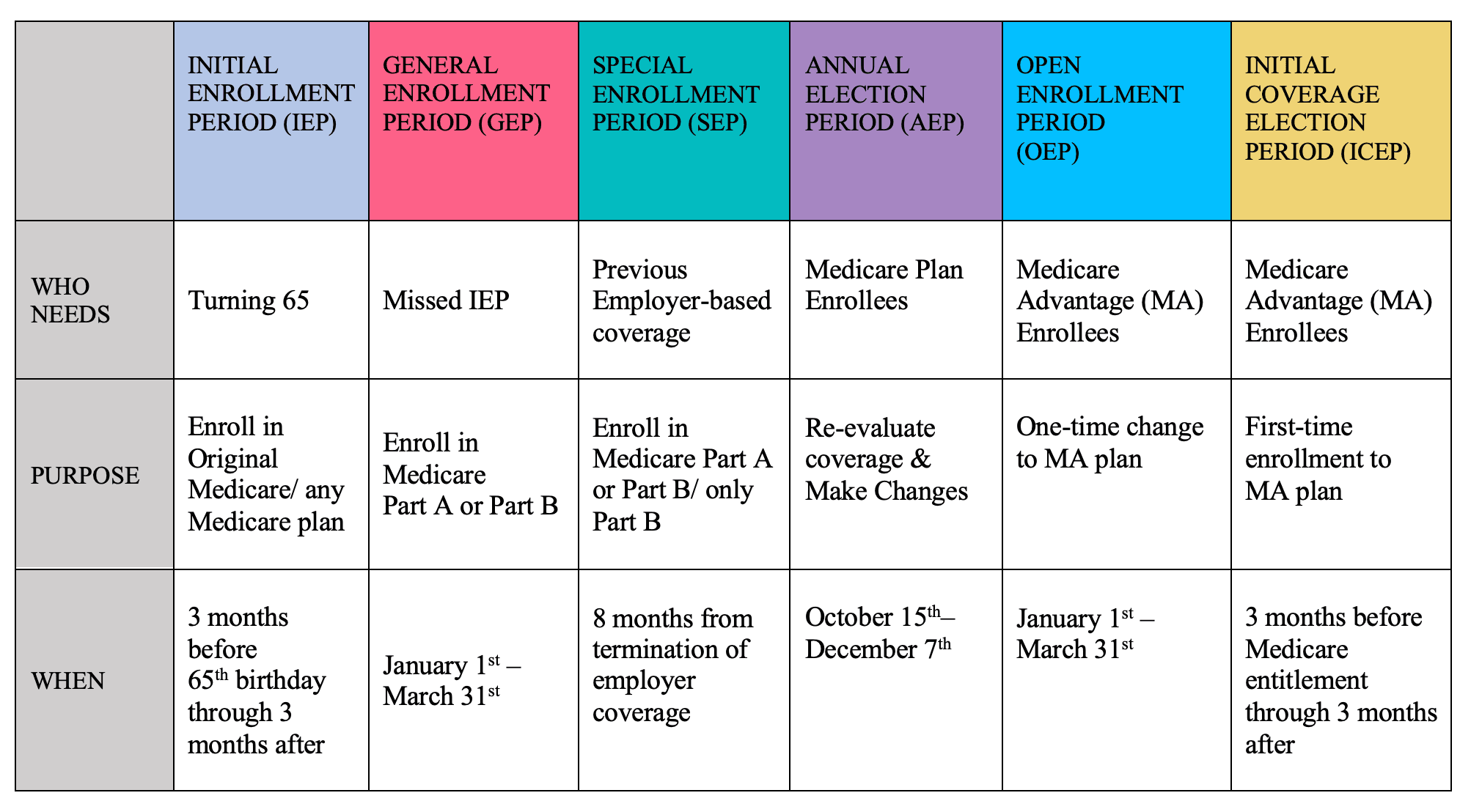

What is the Medicare ICEP?

Apr 7, 2023

Does Medicare Cover Hoarding Cleanup?

Jan 10, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

15 Best Ways for Seniors to Stay Active in Denver

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Help with the Cost of Tyrvaya?

Comparing All Medigap Plans | Chart Updated for 2025

Denied Coverage? What to Do When Your Carrier Says No

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover an FMT?

Does Medicare Cover Boniva?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Compounded Medications?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Geri Chairs?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nuedexta?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Xiafaxan?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Bunion Surgery?

Does Your Medicare Plan Cover B12 Shots?

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Can I Get a Replacement Medicare Card?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Botox Covered by Medicare?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is PAE Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Happens to Unused Medicare Set-Aside Funds?

What If I Don't Like My Plan?

What is Plan J?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Leaves Your Network

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare