You're covered if you meet these requirements

Dealing with back pain suffered from a fracture related to osteoporosis can be challenging. A kyphoplasty procedure is an appealing option to those who need more than just medication but don't want to endure major surgery. Medicare covers Kyphoplasty under Part B, but you must meet certain conditions. Let's see what those are below.

Speak with a Medicare Advocate

What is Kyphoplasty?

Kyphoplasty, also known as vertebroplasty, is a minimally invasive procedure used to treat painful vertebral fractures that can be caused by osteoporosis or another injury. It involves the insertion of medical balloons into the fractured bone and then filling them with bone cement. With kyphoplasty, most people who get the procedure are sent home the same day. The benefits of kyphoplasty include reduced pain, improved posture, better mobility, and improved quality of life.

How does Medicare cover Kyphoplasty?

In order to be eligible for Medicare coverage, you must meet certain Medicare requirements:

The procedure must be performed in an outpatient hospital setting that is certified by Medicare.

It must be determined to be medically necessary by your doctor or a Medicare-approved provider.

You must have proof of a vertebral fracture (such as an X-ray or MRI).

Talking with your doctor is critical before opting for this procedure. This content is for informational purposes only and does not constitute medical advice.

What are the costs associated with Kyphoplasty?

The cost of kyphoplasty varies depending on the facility and other factors. Medicare will typically cover 80% of the cost, but you may be responsible for any remaining costs or copayments. Be sure to check with your healthcare provider and Medicare before having the procedure done.

How to find a doctor who performs Kyphoplasty procedures?

Before having Kyphoplasty, you'll need to find a qualified healthcare provider who can perform the procedure. You can search online for doctors and hospital listings that specialize in Kyphoplasty procedures and contact them for more information. Be sure to ask about their experience with the procedure, qualifications, and costs. Also, check your Medicare Advantage plan to see if it covers Kyphoplasty.

The risks and side effects of Kyphoplasty

Potential side effects should also be discussed with your doctor prior to the procedure. While Kyphoplasty is generally considered safe, it can cause complications such as infection and nerve damage, so it is important that you understand all of the risks before proceeding.

Takeaway

Kyphoplasty is a minimally invasive procedure that can help reduce pain, improve posture, and improve mobility. Medicare Part B covers Kyphoplasty under certain conditions, but it is important to check with your healthcare provider and Medicare before having the procedure done. This content is for informational purposes only. Call a Fair Square Medicare expert today for all your Medicare-related questions.

Recommended Articles

Does Medicare Cover Kidney Stone Removal?

Nov 23, 2022

Does Medicare Cover SIBO Testing?

Dec 1, 2022

Does Medicare Cover the Urolift Procedure?

Dec 6, 2022

Is Botox Covered by Medicare?

Jan 19, 2023

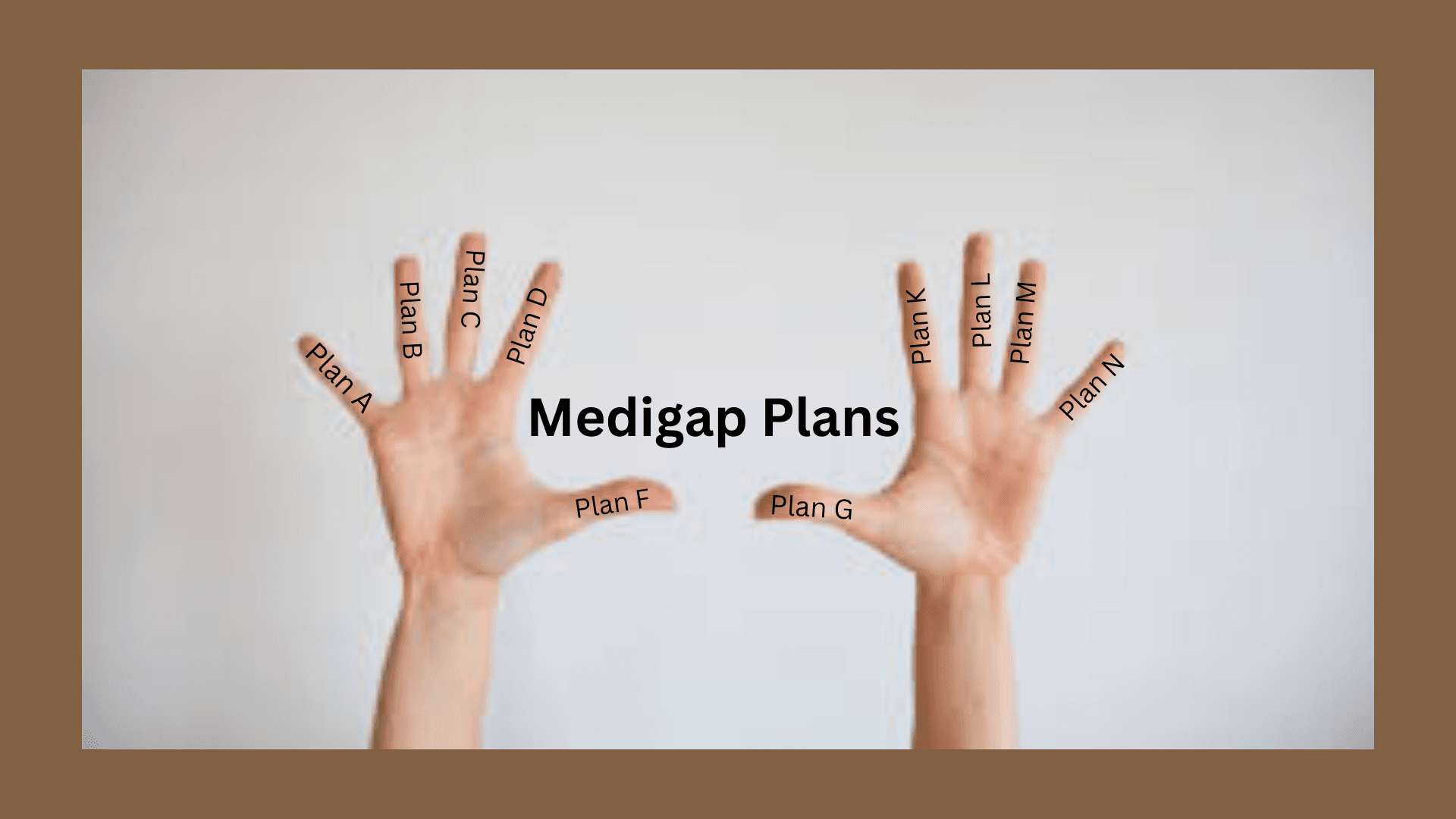

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

Does Medicare Cover Stair Lifts?

Nov 18, 2022

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Does Medicare Cover Geri Chairs?

Dec 7, 2022

What's the Difference Between HMO and PPO Plans?

Dec 1, 2022

Does Medicare Cover Ketamine Infusion for Depression?

Nov 23, 2022

Can I Use Medicare Part D at Any Pharmacy?

Aug 28, 2023

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

How to Choose a Medigap Plan

Jan 10, 2023

How Do Medigap Premiums Vary?

Apr 12, 2023

Does Medicare Cover Wart Removal?

Jan 17, 2023

Does Your Plan Include A Free Gym Membership?

Jul 12, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Cost of Living Adjustment

Can Doctors Choose Not to Accept Medicare?

Can I Choose Marketplace Coverage Instead of Medicare?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Help with the Cost of Tyrvaya?

Denied Coverage? What to Do When Your Carrier Says No

Do I Need to Renew My Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Flu Shots?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Nexavar?

Does Medicare Cover Ofev?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Pay for Emergency Room Visits?

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Enroll in Social Security

Is Fair Square Medicare Legitimate?

Is PAE Covered by Medicare?

Medicare & Ozempic

Medicare Consulting Services

Medicare Explained

Plan G vs. Plan N

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Are Medicare Part B Excess Charges?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What Is the Medicare Birthday Rule in Nevada?

What People Don't Realize About Medicare

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Leaves Your Network

What You Need to Know About Creditable Coverage

What's the Deal with Flex Cards?

Which Medigap Policies Provide Coverage for Long-Term Care?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare