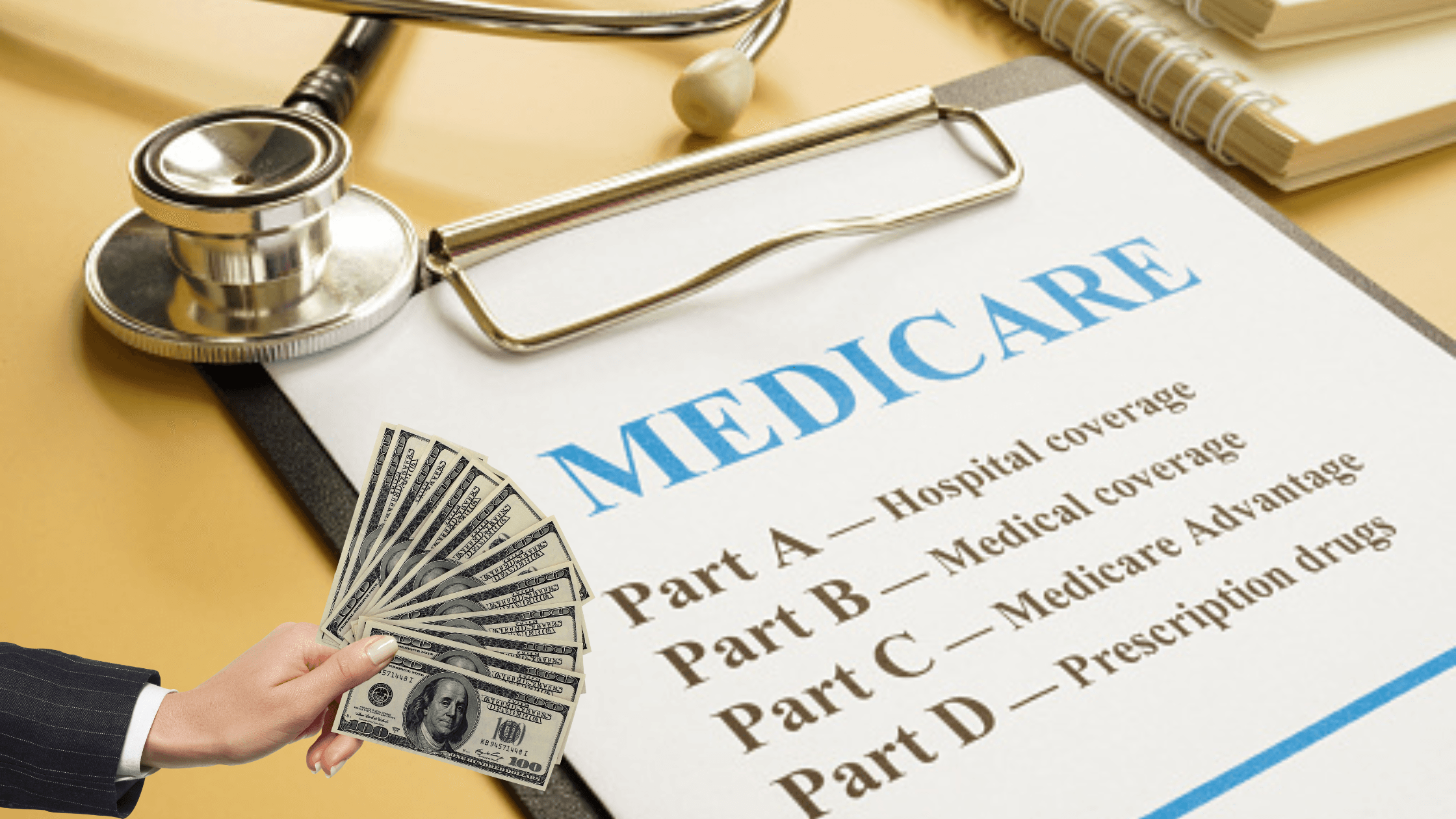

How your costs might change in 2025

The cost of Medicare can fluctuate each year. The core structure of Medicare Part A has not, and is unlikely to change. But the costs associated with Part A have increased slightly going into the new year. Let's go through how it might affect you.

Speak with a Medicare Advocate

Do you need to pay a monthly premium?

Generally, no. Medicare Part A, which covers hospital inpatient services, typically has no premium for most people. However, those who are not eligible to receive premium-free Part A may need to pay a monthly premium. For 2025, Medicare Part A has a standard premium of $285 or $518 per month depending on if you or your spouse paid taxes toward Medicare. Generally though, most people don't have to pay the Part A premium.

How much is the deductible?

Starting in January 2025, the Part A deductible is $1,676 for each benefit period. A benefit period starts when you go into the hospital, and it ends when you haven't received any inpatient care for 60 days in a row. This deductible means that after you are admitted to the hospital, you will have to pay the first $1,676 for inpatient care.

What about copayment?

In addition to the deductible, you must also pay a copayment for each day you are in the hospital during your benefit period. You must start paying copayment after you pay your deductible if you have been in the hospital for 60 days. Starting on days 61-90, you will have to pay $419 per day in copayment, and on days 91 through 150 beyond you will be responsible for $838 per day while using your 60 lifetime reserve days. After day 150, you pay all of the cost.

Additional Part A coverage

If you are in a Skilled Nursing Facility (SNF) covered by Medicare Part A, you will have $0 copayment for days 1-20. For days 21-100, you will be responsible for $209.50 each day. After day 101, you are responsible for all the costs.

For both home health care and hospice services, Medicare Part A covers that completely.

Conclusion

Medicare Part A costs have increased a bit for 2023. But the core coverage of Part A have not changed. If you have any additional questions about your Medicare coverage going into the new year, give us a call at 1-888-376-2028 to speak with a Medicare expert today.

Recommended Articles

Plan G vs. Plan N

Jan 28, 2022

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

Does Medicare Cover Zilretta?

Nov 28, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

What to Do When Your Doctor Leaves Your Network

Jul 15, 2025

Does Your Plan Include A Free Gym Membership?

Jul 12, 2023

Is the Shingles Vaccine Covered by Medicare?

Nov 17, 2022

How Do Medicare Agents Get Paid?

Apr 12, 2023

Do All Hospitals Accept Medicare Advantage Plans?

Apr 11, 2023

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Does Medicare Cover Cosmetic Surgery?

Nov 28, 2022

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

Does Medicare Cover Macular Degeneration?

Nov 30, 2022

How Much Does Medicare Cost?

Jul 25, 2022

Can I Use Medicare Part D at Any Pharmacy?

Aug 28, 2023

Does Medicare Cover Nuedexta?

Nov 30, 2022

Medicare & Ozempic

Jul 20, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

15 Best Ways for Seniors to Stay Active in Denver

2024 Fair Square Client Retention and Satisfaction Report

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Laminate My Medicare Card?

Costco Pharmacy Partners with Fair Square

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover COVID Tests?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Fosamax?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Inqovi?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

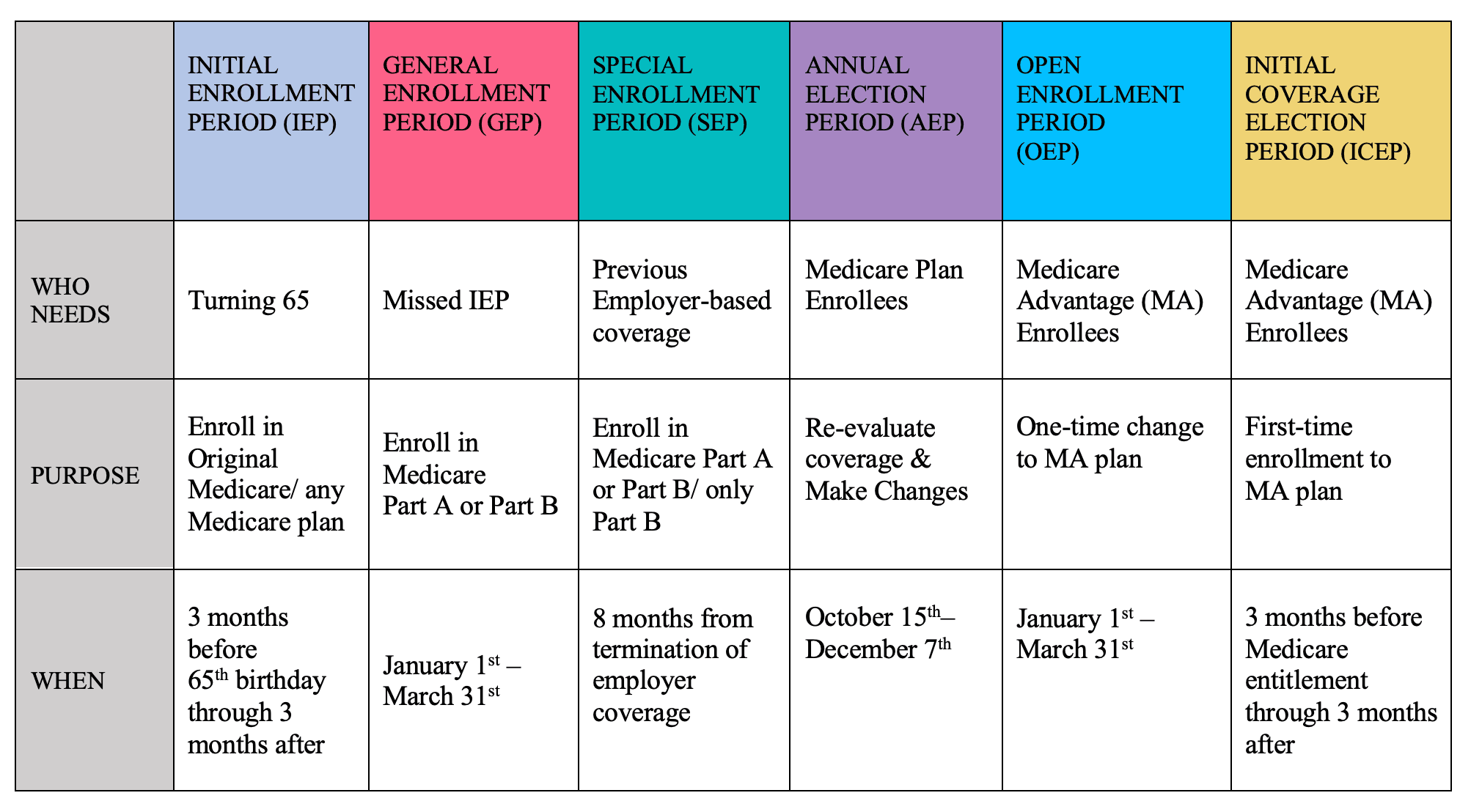

Explaining the Different Enrollment Periods for Medicare

Finding the Best Dental Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Does Medicare Cover Colonoscopies?

How is Medicare Changing in 2025?

How Much Does Medicare Part B Cost in 2025?

How to Apply for Medicare?

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Medicare 101

Medicare Advantage MSA Plans

Medicare Deductibles Resetting in 2025

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Saving Money with Alternative Pharmacies & Discount Programs

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What Does Medicare Cover for Stroke Patients?

What Is a Medicare Advantage POS Plan?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare