Medicare drug plans usually cover Ozempic, but it may depend on your specific plan.

Disclaimer: This content is for informational purposes only and should not be used as a substitute for medical advice. Consult a qualified healthcare professional before taking any prescription medication.

Speak with a Medicare Advocate

Diabetes is a chronic condition that’s becoming increasingly common among seniors. Managing diabetes often involves continuous medication, resulting in significant expenses over time.

Ozempic helps control your blood sugar level. However, it can be expensive, especially if you're uninsured.

Fortunately, most Medicare

Let's look at Ozempic, how Medicare covers it, and how you can get financial assistance to help with your out-of-pocket costs.

What’s Ozempic?

Ozempic is a prescription medication used to treat type 2 diabetes.

Type 2 diabetes is a chronic condition where your pancreas doesn't produce enough insulin or your cells don't use insulin effectively, leading to high blood sugar levels.

Ozempic's active ingredient, semaglutide, imitates the hormone GLP-1 stroke

Note: Ozempic has received FDA approval only for treating type 2 diabetes. Prescribing Ozempic for weight loss is considered "off-label" use, which means it's being used to treat a condition not approved by the FDA. It's important to follow your doctor's advice and use Ozempic only as prescribed.

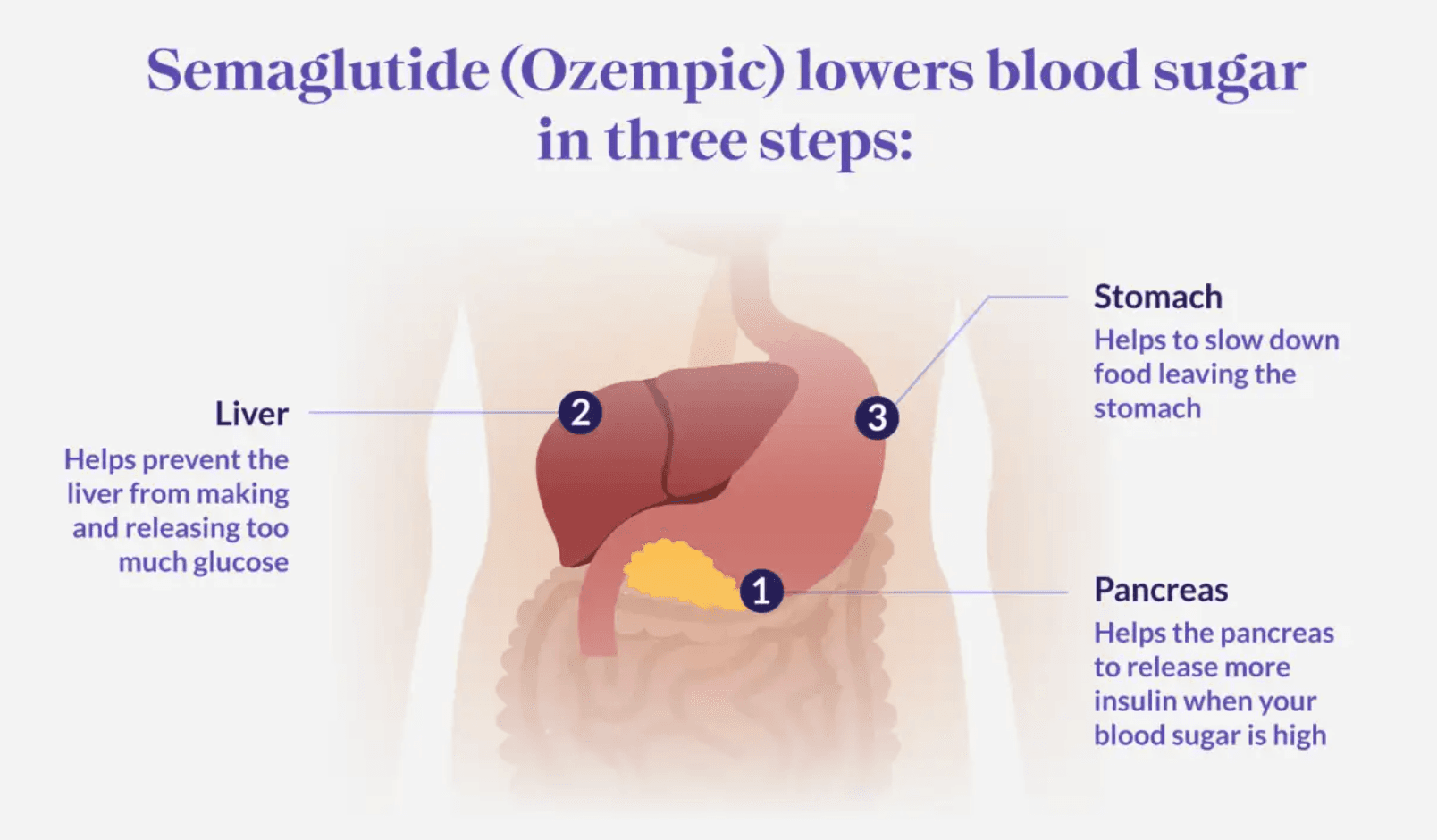

How Does Ozempic Work?

Ozempic lowers blood sugar levels in 3 ways:

Stimulating the pancreas to release more insulin in response to high blood glucose levels.

Inhibiting the liver from producing and releasing excessive glucose into the bloodstream.

Reducing the rate at which food empties from the stomach after a meal.

[

Ozempic's Mechanism of Action | HealthMatch

]( https://healthmatch.io/weight-management/is-ozempic-safe-for-weight-loss

Ozempic is typically administered via an injection pen once per week into a thin layer of fat in the arms, thighs, or abdomen.

Does Medicare Cover Ozempic?

Yes. Medicare covers Ozempic, but it may depend on your specific plan.

Here's a detailed breakdown of how different parts of Medicare may cover Ozempic:

Medicare Part D — Most Medicare Part D plans cover Ozempic. Check your plan's formulary or ask your insurance provider to confirm your coverage

Medicare Advantage Plan — If you're enrolled in a

Medicare Advantage Plan

that includes prescription drugs and Ozempic is included in your plan's formulary, then you might get coverage for the medicationMedicare Part B — If you receive Ozempic in a doctor's office or at a skilled nursing facility, your

Medicare Part B

may provide coverage for the medicationMedicare Part A — If you receive Ozempic while you're admitted to a hospital or a skilled nursing facility,

Medicare Part A

may cover the cost of the medication

How Much Does Ozempic Cost?

The typical retail cost of Ozempic is approximately $1,000. However, this cost may vary depending on the pharmacy you purchase from, your insurance coverage and your dosage.

If you have a Medicare prescription drug

1. Deductible Stage

If you haven't met the annual deductible, you’ll be responsible for the total retail price of the drug.

2. Post-Deductible Stage

Once your deductible is met, you’ll move into the Post-Deductible phase (also known as the Initial Coverage stage), where you’ll be responsible for a copay, and your plan will cover the remaining drug expenses.

Your co-pay can be as little as $35 per month, depending on your plan. The average co-pay is around $209 per month.

3. Coverage Gap

During the Coverage Gap phase (also known as the Donut Hole

4. Catastrophic Coverage

Once you reach the Catastrophic Coverage phase, Medicare should cover most of your drug expenses.

Can I Get Financial Assistance to Pay for Ozempic?

Ozempic can be expensive, especially if you don't have insurance. Even with coverage, the costs can still add up quickly.

Here are some ways you can get Ozempic at a lower price:

Use a Coupon

Ozempic coupons can be a cost-effective option instead of relying on Medicare, especially if your Medicare co-pay is higher than $935.42. Companies such as GoodRx SingleCare

The Novo Nordisk Patient Assistance Program

The Patient Assistance Program

A Savings Card

Individuals with private or commercial insurance coverage may be eligible

Medicare Extra Help

If you have a limited income, you can seek financial assistance by applying for the Medicare Extra Help eligible

Bulk Order

Obtaining a three-month supply of medication from certain mail-order pharmacies can be a cost-effective option compared to traditional retail pharmacies. It also provides the convenience of having the medication delivered to your doorstep every 90 days. Check with your insurance provider if you're eligible for this option.

Compare Costs

Different pharmacies provide medications at different rates. To obtain Ozempic at the lowest cost, compare the price of the medication at your nearby pharmacies.

Alternate Medication

If you're uninsured or your insurance provider denies your request for Ozempic's prior authorization, you can ask your healthcare provider to suggest less expensive alternatives to Ozempic.

Plan Wisely for the Best Coverage

Ozempic (semaglutide) is a prescription medication that mimics the hormone that helps regulate blood sugar levels. Along with a healthy diet and regular exercise, Ozempic can effectively decrease blood sugar levels.

Diabetes management requires continuous medication, which may lead to significant expenses in the long run. Fortunately, the Medicare Part D and Medicare Advantage plans that include prescription drugs help cover the cost of Ozempic. Various programs are also available to help alleviate your out-of-pocket costs if you’re uninsured or have limited income.

If you have any questions regarding Ozempic coverage or want to learn more about ways to reduce your out-of-pocket costs, call us at 1-888-376-2028. Our advisors can help find the best healthcare plan for you.

Recommended Articles

Will Medicare Cover it?

Oct 3, 2023

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

How Often Can I Change Medicare Plans?

May 5, 2023

What to Do When Your Doctor Doesn't Take Medicare

Feb 24, 2023

14 Best Ways to Stay Active in Charlotte

Mar 9, 2023

How to Enroll in Social Security

Apr 28, 2023

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

Denied Coverage? What to Do When Your Carrier Says No

Jul 15, 2025

14 Best Ways for Seniors to Stay Active in Seattle

Mar 10, 2023

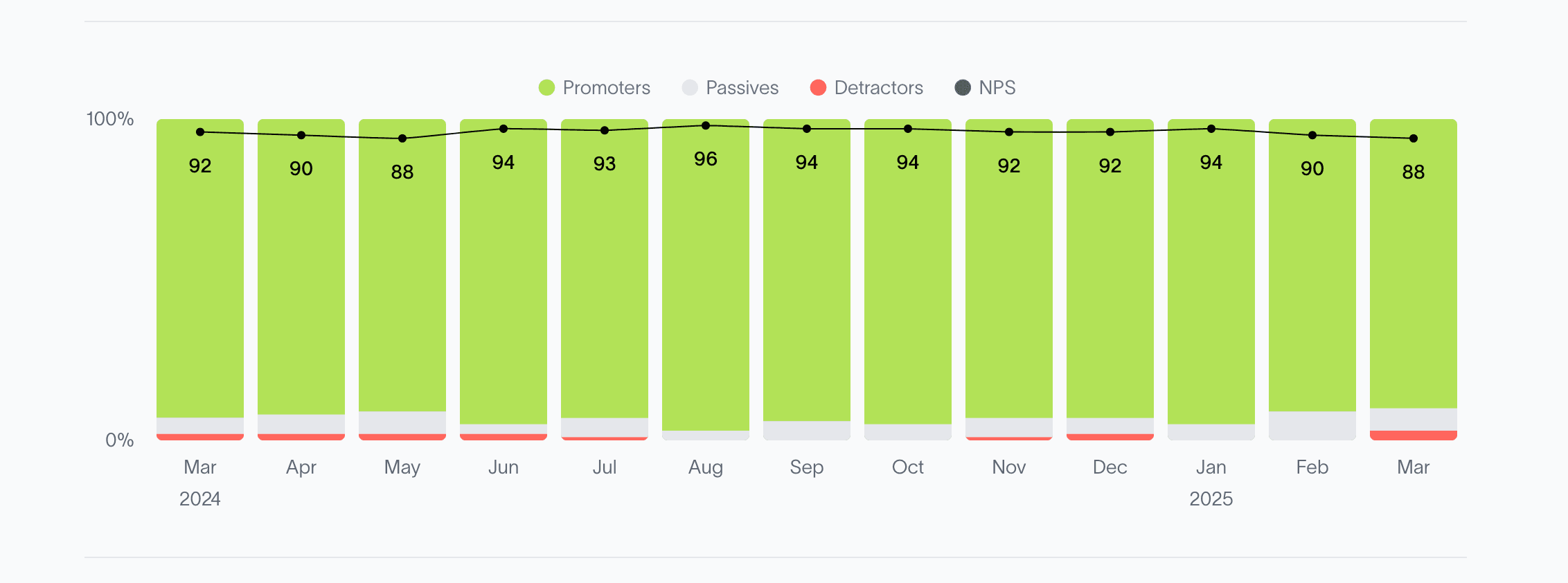

2024 Fair Square NPS Report

Mar 19, 2025

Does Medicare Cover Urodynamic Testing?

Dec 2, 2022

Does Medicare Cover Ilumya?

Dec 7, 2022

Should You Work With A Remote Medicare Agent?

Sep 20, 2023

Does Medicare Cover Light Therapy for Psoriasis?

Jan 17, 2023

Can Medicare Help with the Cost of Tyrvaya?

Jan 12, 2023

How to Apply for Medicare?

Jul 15, 2022

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Jul 15, 2025

Does Medicare Cover Tymlos?

Dec 5, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

20 Questions to Ask Your Medicare Agent

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need to Renew My Medicare?

Does Medicare Cover an FMT?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Flu Shots?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Oxybutynin?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Wart Removal?

Does Medicare Cover Zilretta?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Dental Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2025?

How Much Does Trelegy Cost with Medicare?

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Fair Square Medicare Legitimate?

Medicare Advantage Plans for Disabled People Under 65

Medicare Explained

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Moving? Here’s What Happens to Your Medicare Coverage

Saving Money with Alternative Pharmacies & Discount Programs

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What Is a Medicare Advantage POS Plan?

What is Plan J?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What to Do When Your Doctor Leaves Your Network

When to Choose Medicare Advantage over Medicare Supplement

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare