Medical Marijuana: Usage, Costs, and Coverage Options

Medical marijuana is increasingly popular as a treatment option for various medical conditions and is now legal in many states.

Speak with a Medicare Advocate

However, medical marijuana remains illegal at the federal level. This might leave you wondering whether Medicare covers it as a treatment option.

This article will answer all your questions about medical marijuana: why it's used, how much it costs, and whether Medicare offers coverage.

What Is Medical Marijuana?

Medical marijuana is a medical treatment derived from marijuana plants. These plants contain over 100 different chemical compounds called cannabinoids, which are believed to have potential therapeutic properties.

The two main cannabinoid compounds in the marijuana plant include:

Cannabidiol (CBD)

Tetrahydrocannabinol (THC)

Both compounds have unique benefits. CBD does not have the same psychoactive effects as THC, which is the compound more associated with feeling high on marijuana.

What Is Medical Marijuana Used For?

Medical marijuana is used to treat the following medical conditions:

Chronic pain — relieves neuropathic pain and pain caused by cancer

Multiple sclerosis — improves muscle spasms and spasticity

Epilepsy — reduces the frequency and severity of seizures in some people

Crohn's disease — reduces inflammation and improves symptoms

HIV/AIDS — relieves specific symptoms, including severe nausea, vomiting, and loss of appetite

Inflammation

Anxiety

The use of medical marijuana continues to be a topic of debate. Prior to FDA approval, there have not been largescale research studies to help fully understand its benefits and risks.

Is Medical Marijuana FDA-Approved?

No. The Food and Drug Administration (FDA) does not yet recognize marijuana as a medication for any specific medical condition.

However, the FDA has approved certain prescription cannabinoids — products containing at least one plant-derived or synthetically manufactured cannabinoid. (These are available by prescription only).

The FDA-approved cannabinoid-based medications include:

Epidiolex (cannabidiol) — treats seizures associated with

Lennox-Gastaut syndrome

orDravet syndrome

, two rare and severe forms of epilepsyMarinol (dronabinol) — treats nausea and vomiting in cancer patients; treats anorexia associated with HIV/AIDS

Syndros (dronabinol) — treats nausea and vomiting in cancer patients; treats anorexia associated with HIV/AIDS

Cesamet (nabilone) — treats nausea caused by chemotherapy

Does Medicare Cover Medical Marijuana?

No, Medicare

However, if you have Medicare Part D or a Medicare Advantage plan prescription drug coverage

In other words, if your prescription drug plan covers FDA-approved cannabinoid-based medications and your medication is listed in its drug formulary, you might get coverage.

Contact your insurance provider to find out whether cannabinoid-based medications are included in your plan's drug formulary.

Why Doesn't Medicare Cover Medical Marijuana?

Despite being legal in many states

Will Medicare Cover Medical Marijuana in the Future?

Maybe! Marijuana legalization has passed in several states and has been up for debate at the federal level. So, there might be a day when it's federally legal, which could open the door to Medicare coverage of medical marijuana. We will be sure to keep an eye on this and update our blog accordingly.

How Much Does Medical Marijuana Cost?

The cost of medical marijuana depends on the following:

The product's quality

Medium-grade cannabis costs about $266 per ounce (in the U.S.)

High-quality cannabis costs about $326 per ounce (in the U.S)

The product's form

Inhalable, edible, topical, etc.

The location of purchase

States with stricter medical cannabis laws tend to have higher prices, while states with more liberal laws and higher production rates tend to have cheaper cannabis

The total expenses also include the following:

A healthcare provider's fee for determining your eligibility

A fee for the medical marijuana card — around $50–$200

A charge for using your medical marijuana card at a dispensary or other licensed establishment

Can I Use My HSA To Pay For Medical Marijuana?

No, you can't use your health savings account (HSA) to pay for medical marijuana.

Because marijuana is illegal under federal law, the Internal Revenue Service (IRS) considers marijuana an ineligible expense for health savings accounts (HSAs).

Since the federal government regulates HSAs, they must adhere to federal law. This means HSA funds can't be used to pay for marijuana, regardless of whether it's used for medical or recreational purposes.

What's a Medical Marijuana Card? How Do I Get One?

A medical marijuana card (AKA a cannabis card or a marijuana card) is an identification card that shows you've been approved to use medical marijuana for medical purposes and allows you to buy and possess marijuana for medicinal use following state laws.

To obtain a medical marijuana card, you must:

Be a resident of the state where the card is issued

Have a diagnosed qualifying medical condition

Obtain a recommendation from a licensed healthcare provider

The healthcare provider must be registered with the state's medical marijuana program and certify that you would benefit from the use of medical marijuana

Once certified, you can apply for a medical marijuana card through the state's medical marijuana program.

Do I Need To Tell My Healthcare Provider If I'm Using Medical Marijuana?

Yes, it's generally a good idea to tell your healthcare provider if you're using medical marijuana, as it can affect how your body processes other medications and treatments.

Additionally, your healthcare provider can help you monitor any side effects or interactions with other medications.

It's important to have open and honest communication with your healthcare provider about all aspects of your healthcare, including any complementary or alternative treatments you may be using. This will help them provide you with the best possible care.

Takeaway

Although it's legal in many states, medical marijuana is not yet FDA-approved or covered by Medicare.

However, Medicare may cover FDA-approved cannabinoid-based medications if they're included in your prescription drug plan. Talk to your insurance provider to determine whether they cover specific prescription cannabinoids. You can also talk to your healthcare provider about a medical marijuana card.

If you have any questions, Fair Square Medicare

Recommended Articles

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

Why You Should Keep Your Medigap Plan

Sep 21, 2023

Does Medicare Cover Compounded Medications?

Apr 4, 2023

What Is a Medicare Advantage POS Plan?

May 10, 2023

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

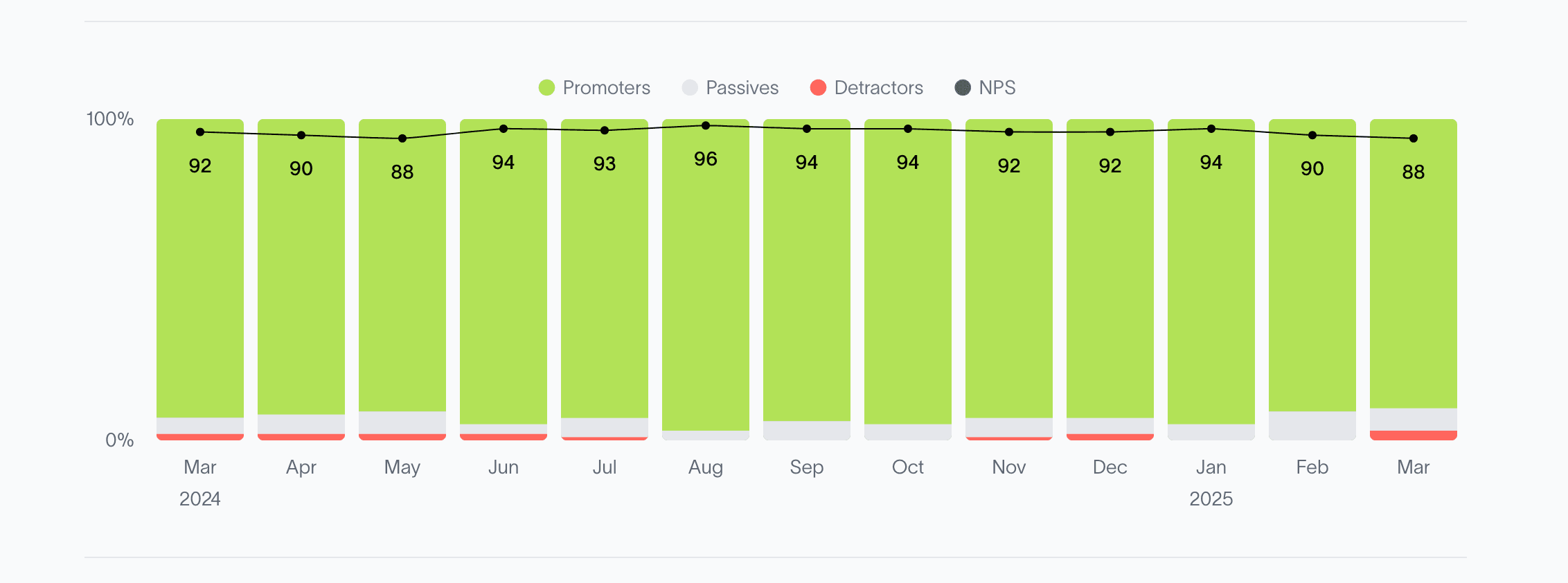

2024 Fair Square NPS Report

Mar 19, 2025

Will Medicare Cover Dental Implants?

Jun 2, 2022

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Costco Pharmacy Partners with Fair Square

Jan 13, 2023

What To Do If Your Medicare Advantage Plan Is Discontinued

Feb 26, 2024

How Often Can I Change Medicare Plans?

May 5, 2023

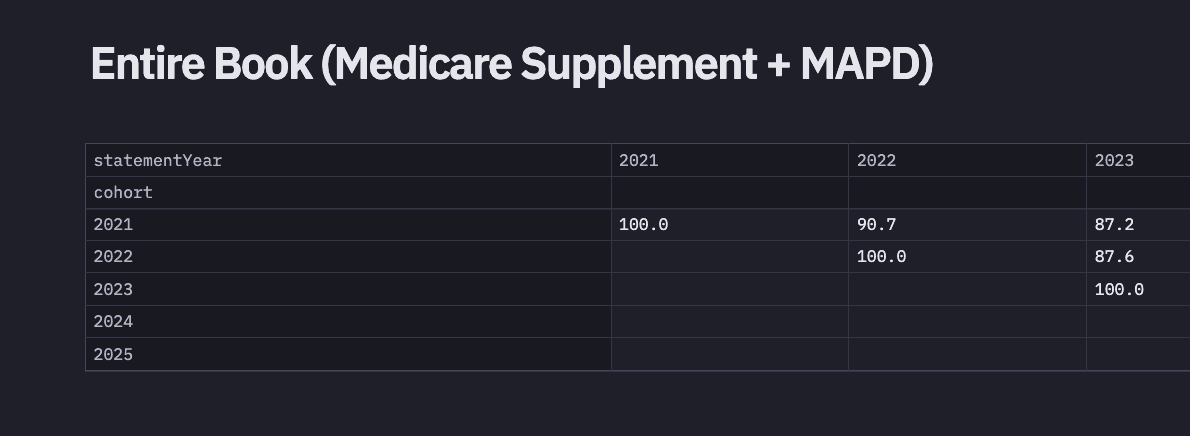

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Flu Shots?

Dec 9, 2022

What Does Medicare Cover for Stroke Patients?

Jan 20, 2023

Medicare Deductibles Resetting in 2025

Jan 18, 2024

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Washington, D.C.

2025 Medicare Price Changes

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Have Two Primary Care Physicians?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Help with the Cost of Tyrvaya?

Do I Need Medicare If My Spouse Has Insurance?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover SIBO Testing?

Does Medicare Cover TENS Units?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Vitamins?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do Medigap Premiums Vary?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare 101

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Plan G vs. Plan N

The Easiest Call You'll Ever Make

What Happens to Unused Medicare Set-Aside Funds?

What Is Medical Underwriting for Medigap?

What Is the Medicare Birthday Rule in Nevada?

What People Don't Realize About Medicare

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare