You've got coverage for one exam each year

Treating your diabetes can be overwhelming, especially considering the cost of insulin. While Medicare does not typically cover routine eye exams, there is an exception for screening diabetic retinopathy. You will have coverage for a one exam each year through Medicare Part B.

Speak with a Medicare Advocate

What is Medicare Part B (Medical Insurance)?

Medicare Part B (Medical Insurance) helps cover medically necessary services, like doctor's services and outpatient care. It also covers preventive services to help maintain your health and manage chronic conditions. This includes an annual eye exam for diabetic retinopathy if you have diabetes.

Your Medicare-approved eye doctor will check the back of your eyes (retina) to look for signs of damage from diabetes. This eye exam must be done by an eye doctor who is legally allowed to do the test in your state. Medicare Part B covers this eye exam annually for those with diabetes.

What services are covered by Medicare Part B for diabetic retinopathy exams?

Medicare Part B covers one eye exam for diabetic retinopathy each year if you have diabetes. The exam must be done by an eye doctor legally allowed to do the test in your state. This eye exam helps your doctor detect any signs of damage from diabetic retinopathy. Your doctor will check the back of your eyes (retina) for signs of diabetic retinopathy. If the doctor finds any damage, they'll recommend treatment to help prevent vision loss and other complications caused by diabetes.

Who can perform the exam and where?

The eye exam for diabetic retinopathy must be performed by an eye doctor who is legally allowed to do the test in your state. You should contact your Medicare-approved provider to find out if they offer this service and where it can be performed.

It's important to keep up with your recommended screenings, as early detection of diabetic retinopathy can help prevent vision loss. Knowing what is covered by your Medicare Part B plan can help you get the care you need to stay healthy.

How often should you get an eye exam for diabetic retinopathy?

If you have diabetes, you should get an eye exam for diabetic retinopathy once a year. This exam is vital to help detect any signs of damage from the disease and help keep your eyes healthy. Regular check-ups, prompt diagnosis, and treatment can reduce the risk of vision loss from diabetic retinopathy.

Tips to prepare for your appointment

Make sure to bring your Medicare card or other insurance cards and any paperwork needed for your appointment.

Don't forget to mention if you have diabetes when making the appointment so they can set aside enough time for the exam.

Bring a list of all current medications, including vitamins and supplements, that you are taking to the appointment.

Wear your corrective lenses, if needed, so that your doctor has an accurate view of your eyes.

Have a friend or family member come with you for support and help ask questions at the end of the exam.

Ask any questions you have about the exam process or what to expect.

Write down any instructions from your doctor about follow-up care or tests after the exam is completed.

By taking these steps, you can help ensure that your eye exam for diabetic retinopathy goes as smoothly as possible and helps maintain your eye health.

Know the risks

Risk factors associated with diabetes and vision loss include the duration and degree of glucose control, age, gender, ethnicity, and family history. Be sure to talk to your doctor about any risk factors you may have and how they can be managed. Early detection is critical in preventing vision loss due to diabetic retinopathy.

Symptoms of diabetic retinopathy

Diabetic retinopathy usually has no signs or symptoms in its early stages. That's why it's essential to have regular eye exams as your doctor recommends. Late-stage diabetic retinopathy can cause vision loss if not treated promptly. Some common symptoms of late-stage diabetic retinopathy include:

Blurry or distorted vision

Difficulty seeing at night

The presence of floaters in your vision field

Sudden vision loss

If you experience any of these symptoms, contact your doctor immediately to get the care you need.

Resources available to help manage diabetes-related vision issues

There are many resources available to help you manage diabetic retinopathy and other vision issues related to diabetes. Talk to your doctor about any questions or concerns you may have about managing your health and finding support. They can provide helpful information on organizations that specialize in providing assistance for those with diabetes-related vision problems. The American Diabetes Association (ADA)

Conclusion

This content is for informational purposes only and does not constitute medical advice. It is important to speak with your healthcare provider about any questions or concerns related to eye exams for diabetic retinopathy, risk factors, and resources available to help manage diabetes-related vision issues. Keeping up with recommended screenings can help detect signs of damage caused by diabetic retinopathy and reduce the risk of vision loss. Talk with an expert at Fair Square Medicare for all your Medicare questions.

Recommended Articles

Does Medicare Cover Air Purifiers?

Nov 18, 2022

How Does Medicare Pay for Emergency Room Visits?

Nov 21, 2022

Does Medicare Cover Hoarding Cleanup?

Jan 10, 2023

Does Medicare pay for Opdivo?

Nov 23, 2022

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

Mar 3, 2023

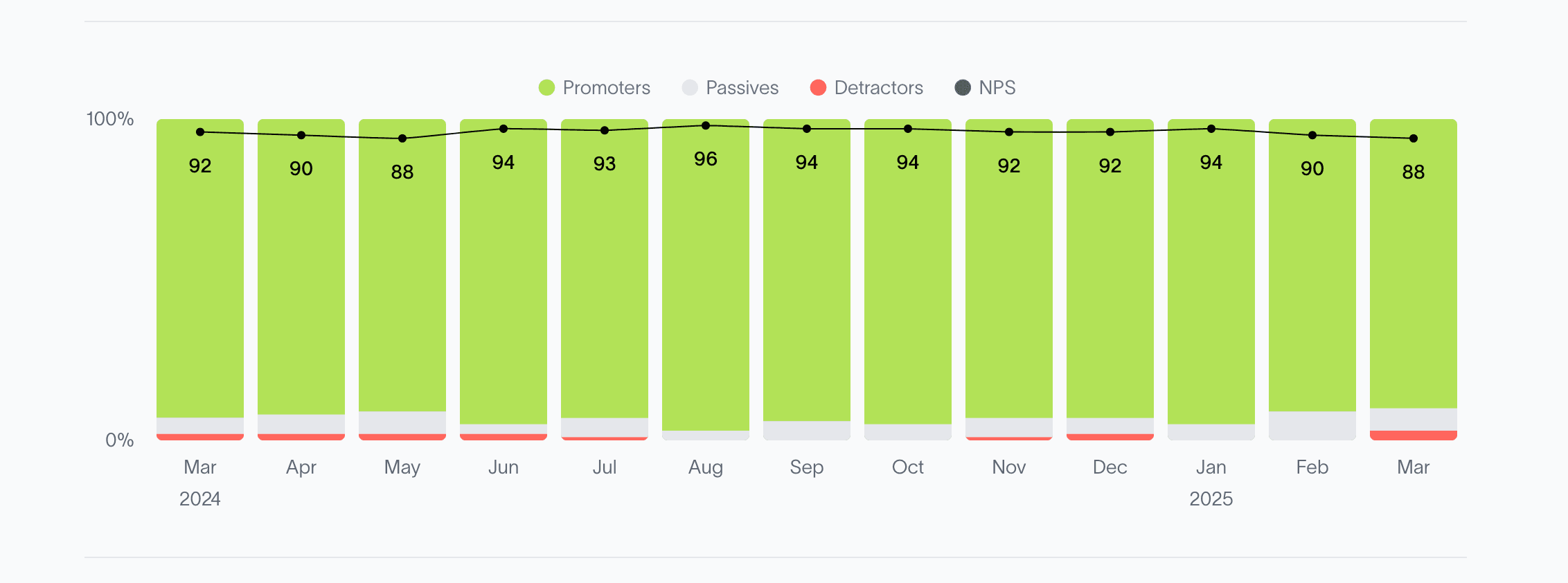

2024 Fair Square NPS Report

Mar 19, 2025

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Does Medicare Cover Hearing Aids?

Nov 9, 2022

Medicare Explained

Jan 3, 2022

20 Questions to Ask Your Medicare Agent

Mar 17, 2023

Does Medicare Cover Ofev?

Dec 2, 2022

Fair Square Client Newsletter: AEP Edition

Oct 2, 2023

When to Choose Medicare Advantage over Medicare Supplement

Jun 7, 2023

Is HIFU Covered by Medicare?

Nov 21, 2022

13 Best Ways for Seniors to Stay Active in Phoenix

Mar 6, 2023

Does Medicare cover Hyoscyamine?

Nov 30, 2022

Does Medicare Cover Kyphoplasty?

Dec 9, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover an FMT?

Does Medicare Cover Boniva?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ilumya?

Does Medicare Cover Jakafi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Piqray?

Does Medicare Cover PTNS?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the WATCHMAN Procedure?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

Finding the Best Dental Plans for Seniors

Finding the Best Vision Plans for Seniors

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How is Medicare Changing in 2025?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is PAE Covered by Medicare?

Medicare & Ozempic

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Moving? Here’s What Happens to Your Medicare Coverage

Saving Money with Alternative Pharmacies & Discount Programs

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What If I Don't Like My Plan?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What to Do When Your Doctor Leaves Your Network

What You Need to Know About Creditable Coverage

What's the Difference Between HMO and PPO Plans?

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare