Read to see how Medigap plans fit with your budget

Retirement is something that all seniors should look forward to. However, there is also the sense that their budget is already stretched thin enough before considering the added burden of paying for health insurance. Medicare Supplement Plans, especially Plan G

Speak with a Medicare Advocate

Just because you might be low-income does not mean you can’t afford to have the Medicare Supplement plan with the most comprehensive coverage. Our team of experts at Fair Square can assess your financial situation and find the best plan for your needs. Let’s talk about how low-income seniors can find Medicare Supplement plans.

Medicaid and Medicare Savings Programs

You have options when it comes to saving on your healthcare expenses in retirement. Both options can help save you money on your out-of-pocket costs, including premiums, deductibles, copays and coinsurance.

One option that you’re likely already familiar with is Medicaid. Medicaid

Medicare Part B

premiums.Deductibles, coinsurance, and copayments.

Part A premiums

(for those who have to pay)Additional prescription drugs and services that Medicare doesn't cover.

You might also be enrolled in Extra Help, which offers savings on your Part D Prescription Drug plan. Learn more about Extra Help here

If you want to apply for Medicaid, you can begin the process at the link here

Medicare Savings Programs are state-based programs to help ease some of the burdens of out-of-pocket costs associated with Medicare. In addition to helping with premiums, deductibles, copays, and more, depending on your state. Your options vary based on your state, but according to the Medicare.gov website, there are four different MSPs:

Qualified Medicare Beneficiary (QMB) program

Specified Low-Income Medicare Beneficiary (SLMB) Program

Qualifying Individual (QI) Program

Qualified Disabled Working Individual (QDWI) Program

There are some broad income and resource limits listed on the Medicare website. However, the numbers listed have yet to be updated for 2025, and the limits might vary depending on your state and your situation. It’s worth it to apply even if you’re above the limit because these programs are state-specific, so you might still qualify. You will need to apply through your state’s Medicaid portal. You can begin the application here

Medicare Supplement Plans for Low-Income Seniors

Medicare Supplement plans, also known as Medigap plans, are used to fill in the gaps in Original Medicare. When Medicare was first introduced in 1965, it was considered great as far as health insurance plans of the day. However, as healthcare costs have skyrocketed over the last 50-plus years, leaving 20% of healthcare costs in the hands of beneficiaries is simply not enough coverage. Medicare Supplement plans are recommended by our agents for many seniors joining Medicare for the first time because they offer the most comprehensive coverage against out-of-pocket costs, and because you have every doctor and facility covered by Medicare at your disposal.

If you can apply to a Medicare Supplement plan during your initial enrollment period, that is the best time. The availability window of Medicare Supplement plans can close if you enroll in a Medicare Advantage plan first, then try to switch. Before switching, beneficiaries might have to go through medical underwriting, a process that could make joining a Medicare Supplement plan prohibitively expensive. Plus, if you are eligible for Medicare and are without coverage, you could be subject to Late Enrollment Penalties. Call one of our licensed Medicare advisors today at (888)-376-2028 to see if a Medicare Supplement plan is your best choice.

Comparing Medicare Supplement Plans

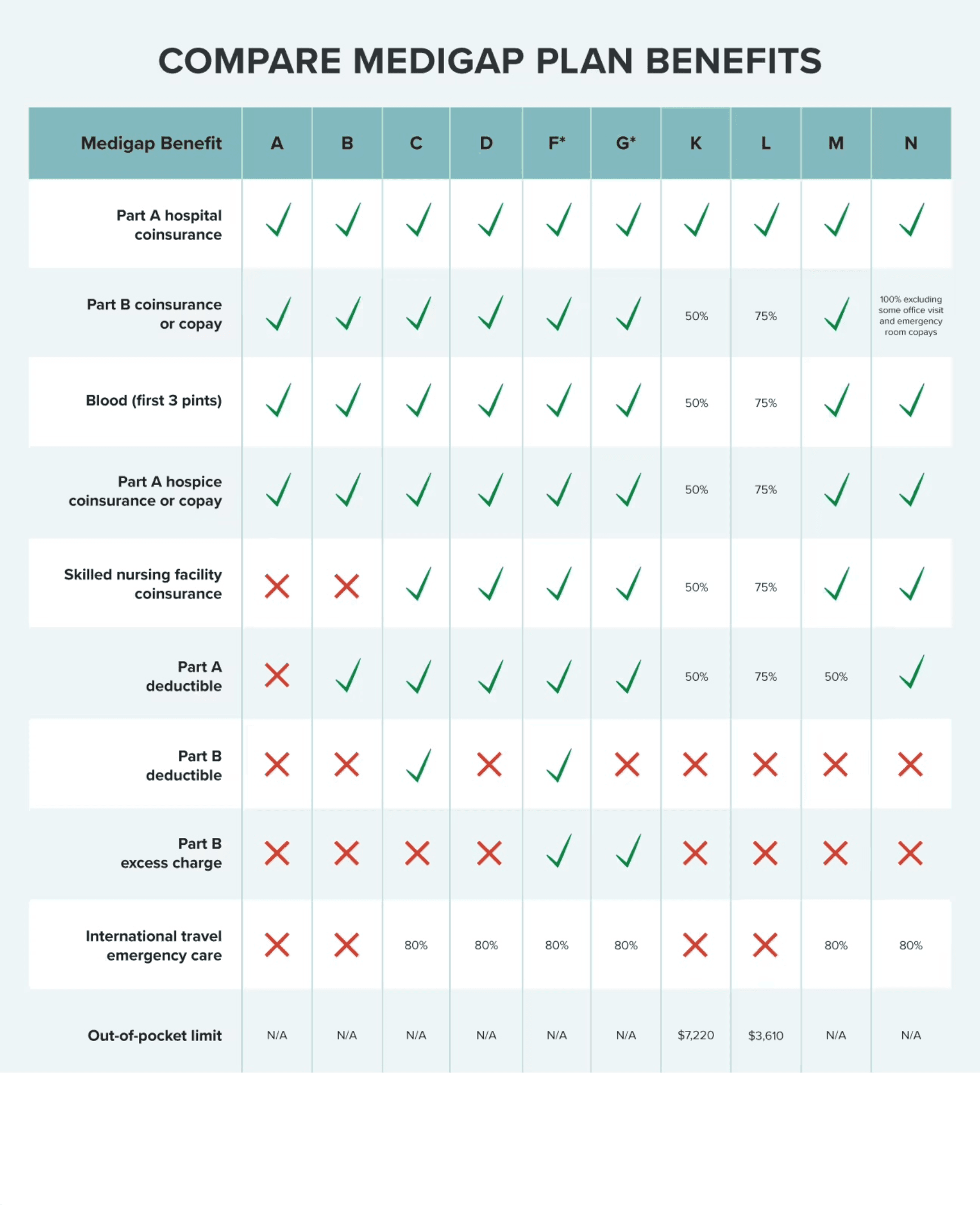

For the sake of completeness of information, we’ve made a handy chart to compare the different plan letters associated with Medicare Supplement.

As you can see, the Medigap plan that offers the most comprehensive coverage is Plan F. However, Plan F is only available to those who were eligible for Medicare before 2020. And since the available pool of Plan F recipients is shrinking, that means the monthly premium is likely to increase in the future. Check out this excerpt for another reason to think twice about Plan F, from our article about comparing Medigap plans

The only difference between Plan F and G is that the former covers the $257 Medicare Part B deductible. However, Plan F costs, on average, about $50 more per month than Plan G. No point in paying an extra $600 a year for $257 in savings.

That is why for many of our clients, our recommendation is generally for Plan G. As it stands, Plan G offers the most coverage for new-to-Medicare seniors. If you live in a state that has excess charges outlawed (including Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont), then Plan N is also a solid choice.

For all seniors, but especially those with limited income, the cost can be the determining factor for choosing a Medicare Supplement plan. For Medicare Advantage plans, the quality of care and the network may vary depending on your insurance plan provider. Medigap plans, however, have benefits determined by the government. You will receive the same standard across different insurance plan providers. And you don’t need to worry about networks since you can visit any doctor in the country that accepts Medicare (which constitutes over 90% of doctors nationwide).

Tips for Choosing the Right Plan

The short answer is that different people have different situations, and the easiest way to choose the right plan for you is to speak with a licensed Medicare advisor at Fair Square

As mentioned above, Plan G offers the most comprehensive coverage. It might not be the cheapest Medigap plan available in terms of your monthly premium.

However, a monthly premium is not the only factor when choosing a plan. You want to think about how frequently you go to the doctor, any major procedures coming up, and whether your family has a history of serious medical issues. A common mistake for many when choosing a Medicare plan is making the assumption that they will be spending the same on healthcare when they turn 85 as they currently do when they’re 65. Healthcare expenditures typically increase as you age, so you should consider that when choosing a Medicare Supplement plan.

Conclusion

If you are a low-income senior looking for a Medicare Supplement plan, don’t worry. You’ve got options when it comes to choosing a plan letter, not to mention the availability of Medicaid and Medicare Savings Programs. It’s important to get the process started early so you know your options and avoid any potential penalties. Give us a call at (888)-376-2028 to start shopping for a Medicare Supplement plan today.

Recommended Articles

How Much Does Medicare Cost?

Jul 25, 2022

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Is Emsella Covered by Medicare?

Nov 21, 2022

Is Vitrectomy Surgery Covered by Medicare?

Dec 2, 2022

Everything About Your Medicare Card + Medicare Number

May 12, 2022

Are Medicare Advantage Plans Bad?

May 5, 2022

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Is Fair Square Medicare Legitimate?

Jul 27, 2023

What's the Deal with Flex Cards?

Dec 15, 2022

Does Medicare Cover Ofev?

Dec 2, 2022

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

Does Medicare Cover Mental Health?

Oct 12, 2022

Does Medicare Cover Driving Evaluations?

Dec 1, 2022

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Is Balloon Sinuplasty Covered by Medicare?

Dec 1, 2022

Does Medicare Cover Tymlos?

Dec 5, 2022

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Laminate My Medicare Card?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ilumya?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inqovi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nuedexta?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Cover Zilretta?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Dental Plans for Seniors

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Does Medicare Cover Colonoscopies?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2025?

How Much Does Xeljanz Cost with Medicare?

How to Compare Medigap Plans in 2025

Is Botox Covered by Medicare?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

Top 10 Physical Therapy Clinics in San Diego

Welcome to Fair Square's First Newsletter

What Is a Medicare Advantage POS Plan?

What People Don't Realize About Medicare

What To Do If Your Medicare Advantage Plan Is Discontinued

What's the Difference Between HMO and PPO Plans?

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare