People over 60 do not have coverage

Searching for the right solution to your back problems can bring its own pain. If you are seeking Medicare coverage for a cervical disc replacement, Medicare is unlikely to cover it for most beneficiaries. No coverage could mean tens of thousands of dollars spent out-of-pocket for this procedure. Read on to see if you might qualify as one of the few eligible beneficiaries.

Speak with a Medicare Advocate

Overview of Medicare coverage for cervical disc replacement

Unfortunately, Medicare has a national noncoverage notice

How does the age limit affect eligibility for cervical disc replacement surgery?

The age limit does affect eligibility for cervical disc replacement surgery. Medicare

How much does a cervical disc replacement cost?

Many people opt for cervical disc replacement as a cheaper alternative to more intense back surgery. The cost of a cervical disc replacement procedure varies depending on factors such as the type of disc being replaced, the hospital or medical facility performing the surgery, and any other associated costs. You will see many estimates out there for the cost, but according to Spine.MD

Alternatives to traditional cervical disc replacements for those over the age of 60

If you are over the age of 60 and ineligible for cervical disc replacement surgery, there may be other options available to you. Your doctor can discuss alternative treatments that may provide relief from your condition. These could include physical therapy

Tips on how seniors can still access quality care despite the restrictions imposed by Medicare

Even if Medicare does not cover the procedure you need, there are still ways to access quality care. Requesting a referral from your primary care physician is one option; they may be able to recommend a specialist who is able to provide appropriate treatment for your condition. Additionally, you can look for programs or services that offer discounts on treatments or procedures that are not covered by Medicare.

Resources and support available to help seniors navigate their options

Navigating Medicare coverage and understanding your options can be confusing. Fortunately, there are resources available to help seniors make informed decisions about their health care. The Centers for Medicare & Medicaid Services (CMS) provides information on coverage options and financial assistance programs. Additionally, the National Institute on Aging offers resources and support for those aged 60 and older.

Questions to ask your doctor about your specific situation with regard to cervical disc replacement coverage

It is important to ask your doctor questions about your specific situation and the coverage options available to you. For instance, what criteria do I need to meet in order to be eligible for cervical disc replacement surgery? Are there any alternative treatments that may provide relief from my condition? What resources are available to help me access quality care? Knowing the answers to these questions can help you make an informed decision about your health care.

Takeaway

In conclusion, Medicare does not cover cervical disc replacement for beneficiaries over the age of 60. However, seniors may still be able to access quality care through referrals, discount programs and resources available. It is important to have a conversation with your doctor about the right treatment for you. This content is for informational purposes only. If you have questions about Medicare coverage or your plan, call an expert at Fair Square Medicare

Recommended Articles

Does Medicare Cover Kidney Stone Removal?

Nov 23, 2022

How to Become a Medicare Agent

Aug 30, 2023

Top 10 Physical Therapy Clinics in San Diego

Nov 18, 2022

Is Gainswave Covered by Medicare?

Dec 6, 2022

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

How Much Does Open Heart Surgery Cost with Medicare?

Jan 27, 2023

Do Medicare Supplement Plans Cover Dental and Vision?

Dec 8, 2022

Medicare Advantage MSA Plans

May 17, 2023

How Your Employer Insurance and Medicare Work Together

Sep 27, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

What is a Medicare Beneficiary Ombudsman?

Apr 11, 2023

Can I Choose Marketplace Coverage Instead of Medicare?

May 2, 2023

Can I Change My Primary Care Provider with an Advantage Plan?

Aug 25, 2023

Medicare Deductibles Resetting in 2025

Jan 18, 2024

What Is the Medicare Birthday Rule in Nevada?

Mar 28, 2023

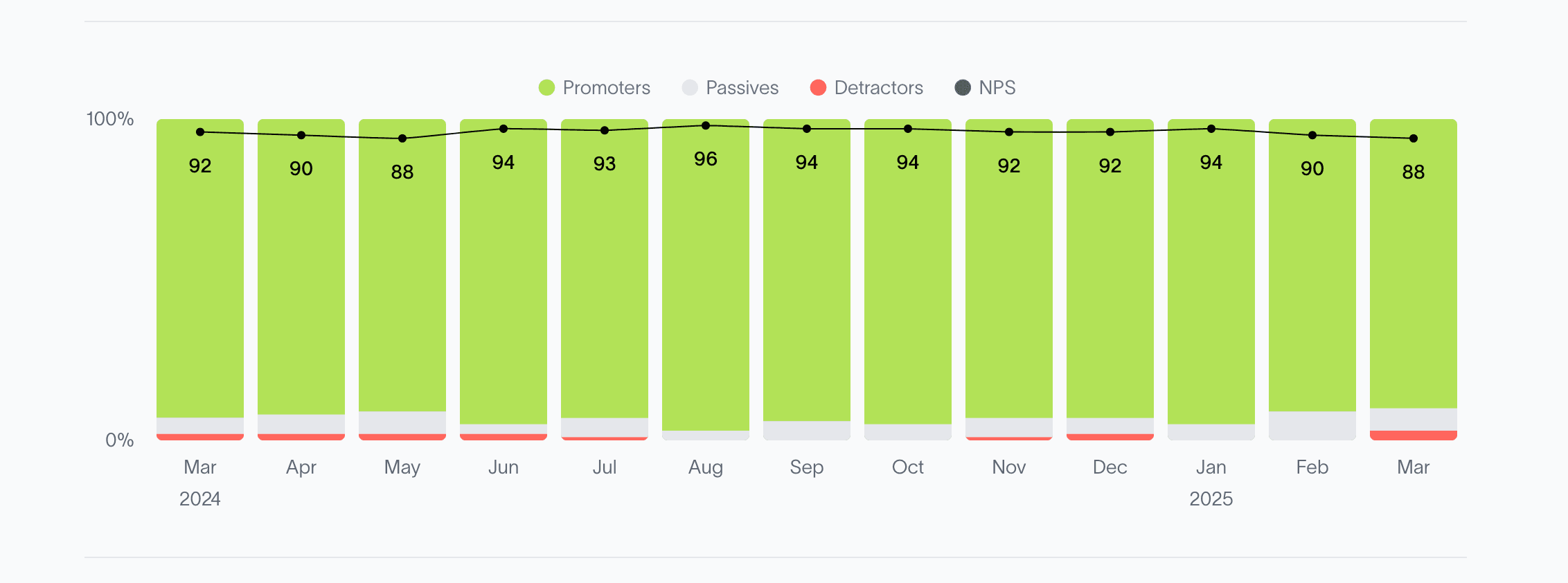

2024 Fair Square NPS Report

Mar 19, 2025

Does Medicare Have Limitations on Hospital Stays?

Mar 15, 2024

Are Medicare Advantage Plans Bad?

May 5, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

14 Best Ways for Seniors to Stay Active in Nashville

2024 Cost of Living Adjustment

Can Doctors Choose Not to Accept Medicare?

Comparing All Medigap Plans | Chart Updated for 2025

Denied Coverage? What to Do When Your Carrier Says No

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Abortion Services?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inqovi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Ozempic?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Funeral Expenses?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Does Medicare Cover Colonoscopies?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Cost?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Deduct Medicare Expenses from Your Taxes

Is Emsella Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Saving Money with Alternative Pharmacies & Discount Programs

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Is a Medicare Advantage POS Plan?

What To Do If Your Medicare Advantage Plan Is Discontinued

What You Need to Know About Creditable Coverage

When to Choose Medicare Advantage over Medicare Supplement

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare