See how Medicare can help with your ocular treatment

Knowing whether your eyesight can be solved with new glasses or something more serious can be tricky. If you are experiencing macular degeneration, treating it can be daunting. The good news is that Medicare has you covered. Let's talk through how you are covered.

Speak with a Medicare Advocate

What is Macular Degeneration?

Macular degeneration is an eye disorder that causes damage to the macula, a part of the retina located in the back of your eye. It affects your central vision, making it difficult to read or recognize faces. The condition can be caused by age-related changes or run in families.

What are the symptoms of Macular Degeneration?

The main symptom of macular degeneration is blurry or distorted central vision. You may also experience difficulty recognizing faces, reading small print, and distinguishing colors. Other symptoms can include dark spots, blind spots in the center of your vision, and straight lines appearing wavy or bent.

How is Macular Degeneration treated?

Wet macular degeneration injections are medications such as anti-VEGF agents and photodynamic therapy. These may be prescribed to slow the disease's progress. Vitrecurgery may also be an option for some patients.

Does Medicare cover Macular Degeneration?

Yes, Medicare Part B covers many of the treatments for macular degeneration, including doctor visits, medications, and surgery.

Medicare covers the following wet macular degeneration injections:

Beovu

Eylea

Lucentis

Avastin

In addition, Medicare covers photodynamic therapy and laser treatments for macular degeneration. Medicare also pays for diagnostic tests such as fluorescein angiography and optical coherence tomography scans to diagnose and monitor the progression of the disease.

Medicare also covers certain preventive care measures like annual eye exams. However, Original Medicare does not cover the cost of glasses or contact lenses related to macular degeneration. Some Medicare Advantage plans offer coverage for eyeglasses and contacts. In addition, Medicare plans do not cover alternative treatments such as acupuncture and herbal supplements. You should check with your plan provider for specific details on benefits and coverage for macular degeneration treatments.

Alternatives to Medicare for those with Macular Degeneration

Macular degeneration can be treated with lifestyle changes and medications. Your doctor may recommend eating a diet rich in dark leafy greens, omega-3 fatty acids, and antioxidants, quitting smoking, wearing sunglasses or protective eyeglasses when outdoors, and avoiding bright light from computers and other digital screens.

If you do not have Medicare or your plan does not cover the treatments for macular degeneration, there are other options available. Many health insurance plans offer coverage for macular degeneration treatments. You can also check with organizations such as The Macula Vision Research Foundation and Bright Focus Foundation to see if they offer any type of financial assistance.

Resources for those with Macular Degeneration

If you have been diagnosed with macular degeneration, there are many resources available to help you understand and manage the condition. The National Eye Institute provides educational materials on macular degeneration, including information about diagnosis and treatment options. There are also support groups for people living with macular degeneration that provide emotional and practical support.

Conclusion

Macular degeneration is a common eye condition that can cause vision loss. Fortunately, there are treatment options available for those with the condition, including medications and lifestyle changes. Medicare covers many of the treatments for macular degeneration, but remember to check with your doctor before pursuing any treatment options. This content is for informational purposes only. Talk with an expert at Fair Square Medicare for all your Medicare questions.

Recommended Articles

Does Medicare Cover Service Animals?

Nov 29, 2022

How Much Does Medicare Cost?

Jul 25, 2022

Does Medicare Cover Physicals & Blood Work?

Feb 1, 2024

Do I Need Medicare If My Spouse Has Insurance?

Dec 19, 2022

Does Medicare Cover Bariatric Surgery?

Dec 27, 2022

Is Fair Square Medicare Legitimate?

Jul 27, 2023

Does Medicare Cover Ofev?

Dec 2, 2022

Does Medicare Cover COVID Tests?

Dec 21, 2022

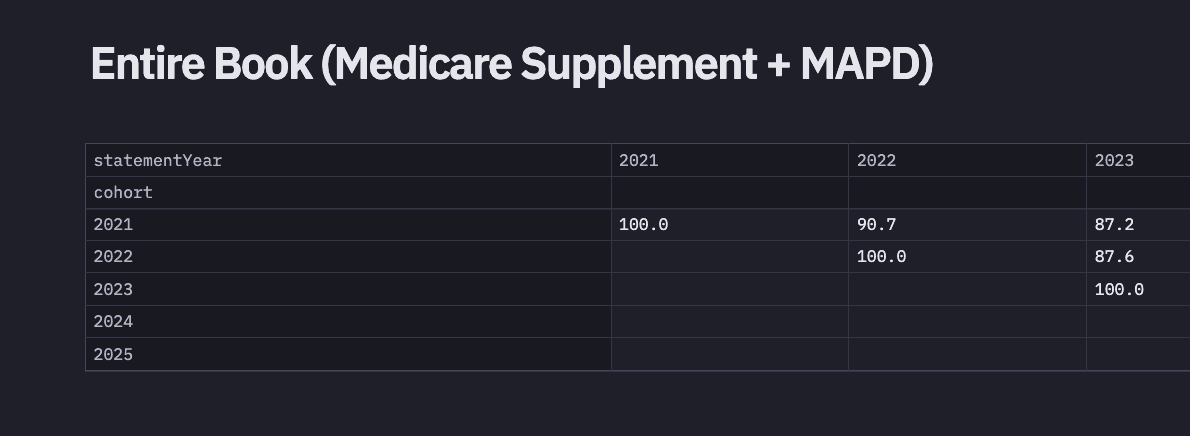

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Why You Should Keep Your Medigap Plan

Sep 21, 2023

Will Medicare Cover it?

Oct 3, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Does Medicare Cover Cala Trio?

Nov 23, 2022

Does Medicare Cover Mental Health?

Oct 12, 2022

How to Apply for Medicare?

Jul 15, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Top 10 Physical Therapy Clinics in San Diego

Nov 18, 2022

Does Medicare Cover Nexavar?

Nov 30, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Washington, D.C.

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Choose Marketplace Coverage Instead of Medicare?

Costco Pharmacy Partners with Fair Square

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Compounded Medications?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Krystexxa?

Does Medicare Cover Nuedexta?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Piqray?

Does Medicare Cover PTNS?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Everything About Your Medicare Card + Medicare Number

Fair Square Bulletin: We're Revolutionizing Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do Medicare Agents Get Paid?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Compare Medigap Plans in 2025

How Your Employer Insurance and Medicare Work Together

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Deductibles Resetting in 2025

Moving? Here’s What Happens to Your Medicare Coverage

Saving Money with Alternative Pharmacies & Discount Programs

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: October 2023

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What If I Don't Like My Plan?

What Is a Medicare Advantage POS Plan?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What is Plan J?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

When Can You Change Medicare Supplement Plans?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare