You Can Change Plans only During Specific Enrollment Periods

As you grow older, your healthcare needs may change, and it's not uncommon to find that your current Medicare plan no longer provides the coverage you require. It can be frustrating to realize that the plan that worked for you in the past no longer meets your needs.

Speak with a Medicare Advocate

Fortunately, Medicare understands this and allows you to change your plan if you're unsatisfied with it.

But can you change plans anytime?

While it's not always possible to change plans whenever you want, there are specific periods when you can make changes.

Let's explore the various enrollment periods to understand when you can join Medicare and make changes to your plan.

When Can I Enroll in Medicare?

Your Initial Enrollment Period (IEP), commonly known as your first opportunity to enroll in Medicare, typically occurs when you are approaching the age of 65. Nevertheless, if you have a disability, end-stage renal disease ( ESRD ALS

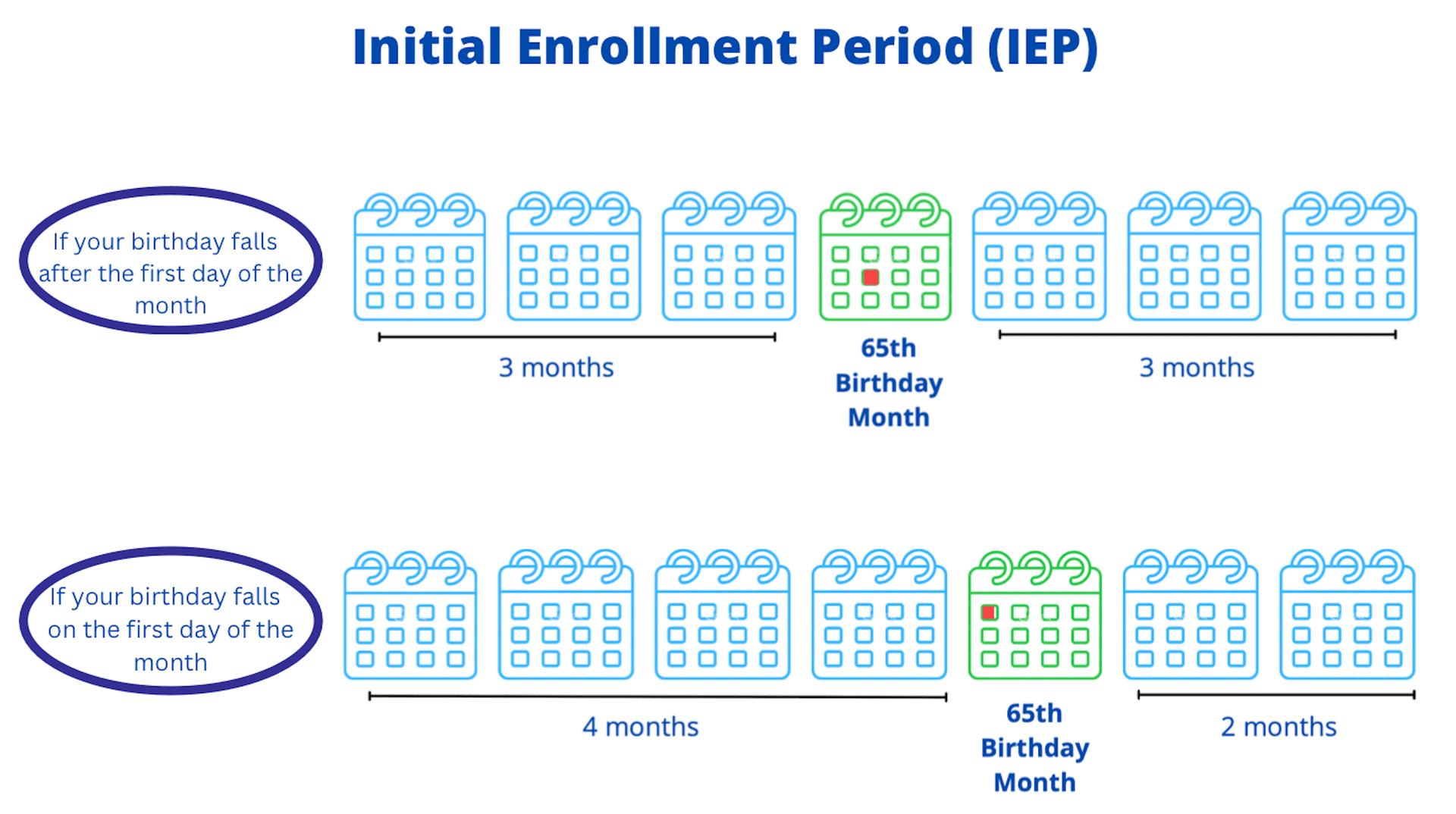

The Initial Enrollment period lasts for seven months, starting three months before your 65th birthday and ending three months after your birthday. But, if your birthday falls on the first of the month, it begins four months before your birth month and extends until two months after.

For example, if your birthday is in February, your IEP will start in November and end in May. But if your birthday is on the 1st of February, your IEP will begin in October and end in April.

Initial Enrollment Period

During your IEP, you can:

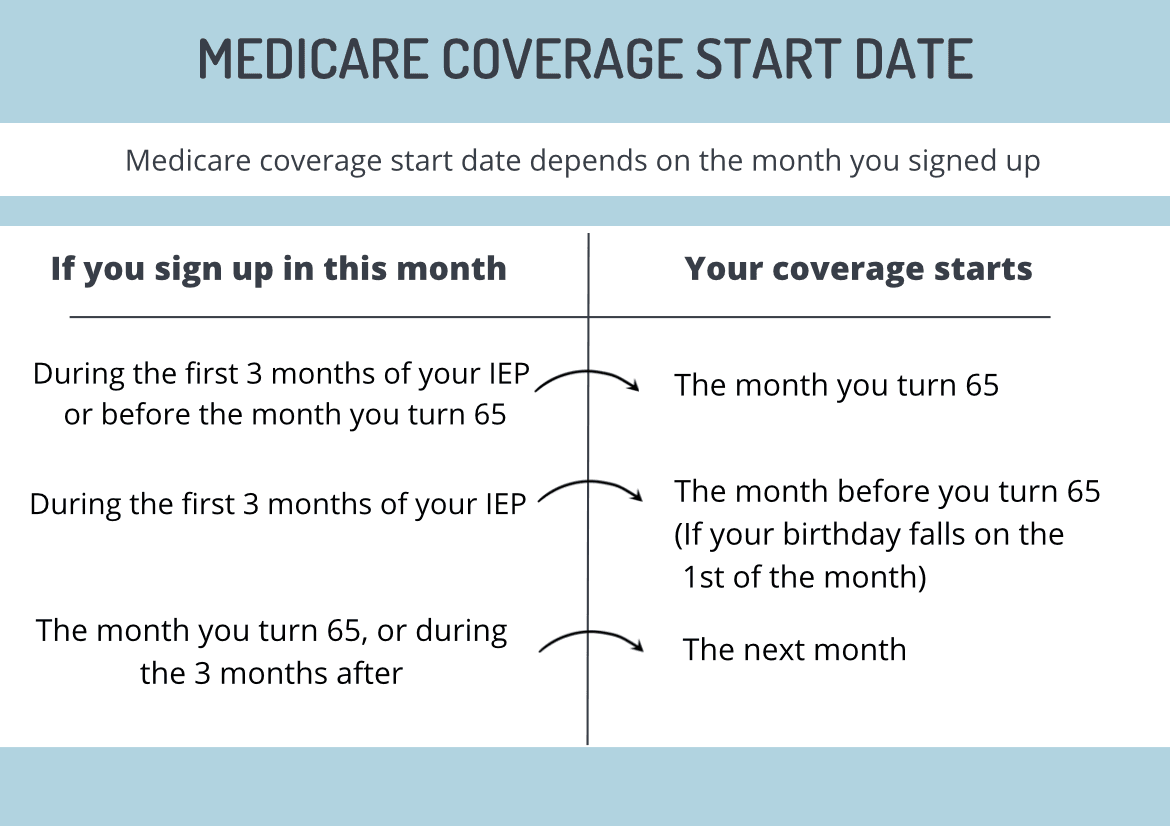

When Will My Medicare Coverage Start If I Enroll During My IEP?

Your Medicare coverage start date depends on when you sign-up for Medicare, as follows:

If you sign-up before the month of your 65th birthday, your Medicare coverage will begin the month you turn 65.

If your birthday falls on the first of the month and you sign-up during the first three months of your IEP, your coverage will begin the month before your 65th birthday.

If you sign-up the month you turn 65 or during the three months after, your coverage will start the following month after you sign-up.

Medicare Coverage Start Date

When Will My Medicare Coverage Start If I Have a Disability, ESRD or ALS?

If you have a disability, end-stage renal disease (ESRD) or ALS

1. For individuals with a disability

If you have a disability and have been collecting Social Security

2. For individuals with ESRD

If you have been diagnosed with ESRD and have enough work credits to qualify for retirement benefits, your Medicare coverage start date will depend on your specific circumstances.

If you are undergoing dialysis treatment, you will be eligible for Medicare coverage starting from the first day of the fourth month of dialysis treatment.

If you are starting a self-dialysis training program, you can immediately become eligible for Medicare coverage.

If you are undergoing a kidney transplant, your Medicare coverage will begin the month you are admitted to the hospital. Alternatively, if you have been admitted to the hospital for more than two months before your transplant, your Medicare coverage will begin two months before your transplant.

3. For individuals with ALS

If you have been diagnosed with ALS, your Medicare coverage will start as soon as you receive your disability benefits.

Can I Switch Medicare Plans Anytime?

No. You cannot switch Medicare Plans at any time.

If you're not satisfied with your current plan, you can make changes to your current plan during specific periods each year. Depending on your need, you can drop, switch, or join a new plan during these periods.

When Can I Switch Medicare Plans?

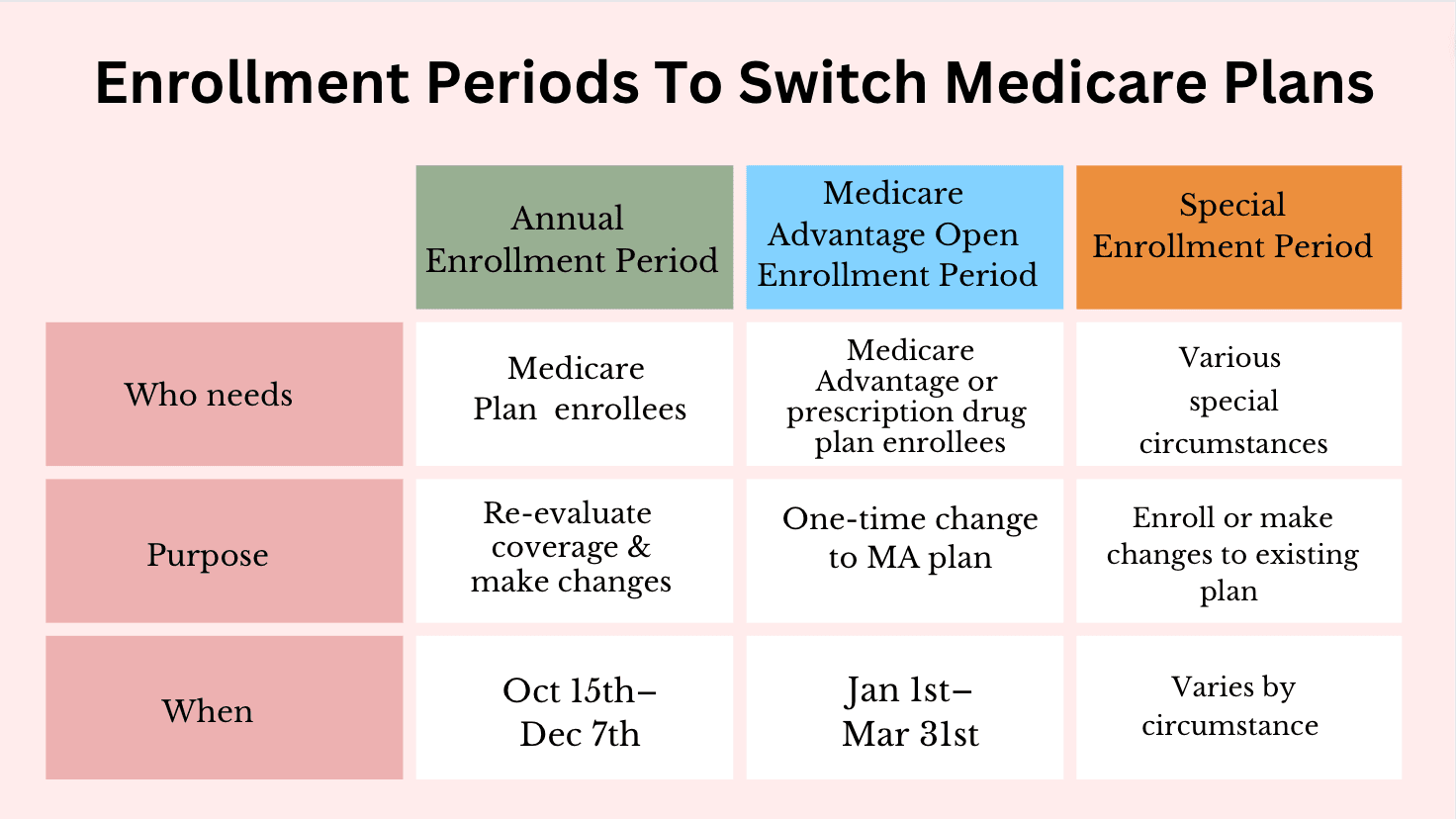

Finding the right Medicare plan can be daunting, and even after careful consideration, you may still find that it doesn't meet your healthcare needs or has high out-of-pocket costs. The good news is that Medicare understands that life circumstances can change, and they offer three enrollment periods for you to change your plan. These are:

Annual Enrollment Period

Medicare Advantage Open Enrollment Period

Special Enrollment Period

Let's learn more about these enrollment periods.

1. Annual Enrollment Period

The Medicare Annual Enrollment Period, also known as Fall Open Enrollment Period, extends from October 15th to December 7th every year.

During this period, you can:

Switch from Original Medicare to a

Medicare Advantage Plan

Join, drop, or switch to another Medicare Advantage Plan (or add or drop drug coverage)

Switch from one Prescription Drug Plan to another

Enroll in Medicare Part D

When Does My Coverage Begin?

Any changes you make during the AEP will take effect from January 1st of the following year.

However, if you're happy with your current plan, it will automatically renew on January 1st.

2. Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period is a one-time opportunity during which Medicare beneficiaries already enrolled in a Medicare Advantage Plan can switch to another Medicare Advantage Plan or return to Original Medicare.

Medicare Advantage Open Enrollment Period runs from:

January 1st to March 31st each year

Within the first three months you get Medicare — if you enrolled in a Medicare Advantage plan during your IEP

During this period, you can:

Switch from one Medicare Advantage Plan to another (with or without drug coverage)

Drop your Medicare Advantage Plan and return to Original Medicare

Join a Medicare drug plan

When Does My Coverage Begin?

Any changes made during the Medicare Advantage Open Enrollment Period will take effect on the first day of the following month.

3. Special Enrollment Period

The Medicare Special Enrollment Period (SEP) is when you can change your Medicare coverage due to certain life events.

During this period, you can:

Join a Medicare plan

Switch to another plan

When Does My Coverage Begin?

It may vary depending on specific situations, but generally, the first of the month after the plan gets your request.

You may be eligible for the Special Enrollment Period if:

You move to a different location

You lose your current coverage

You have a chance to get other coverage

Your plan changes its contract with Medicare

The state you live in grants SEPs

Other special situations

Let's examine some specific scenarios in more detail and explore the steps you can take.

Your Move to a New Place

If you move to a new address that falls outside of your current plan's service area, or if your original service provider introduces new plan options in your new location, you can:

Switch to a new Medicare Advantage plan or Medicare drug plan.

Return to Original Medicare (if you are outside your plan's service area.)

Note: If you do not enroll in a new Medicare Advantage plan, you will automatically be enrolled in Original Medicare when you disenroll from your old Medicare Advantage plan.

Your SEP depends on when you inform your service provider:

If you inform your provider before you move, your SEP starts the month before you move and continues for two months after you move.

If you inform your provider after you move, your SEP starts the month you notify your provider and ends after two months.

You Moved Into, Currently Live In or Moved Out of an Institution

If you recently moved into, currently live in or moved out of a skilled nursing facility or long-term care hospital, you have the following options:

Join a Medicare Advantage plan or Medicare drug plan.

Switch from your current plan to another Medicare Advantage plan or Medicare drug plan.

Return to Original Medicare.

Drop your Medicare drug coverage.

Your SEP lasts as long as you live in the institution and ends two months after you move out.

You're No Longer Eligible for Medicaid

If you are no longer eligible for Medicaid, you can:

Join a Medicare Advantage plan or Medicare drug plan.

Switch from your current plan to another Medicare Advantage plan or Medicare drug plan.

Return to Original Medicare.

Drop your Medicare drug coverage.

Your SEP lasts for three months from whichever date is later:

The date you are no longer eligible, or

The date you find out you are no longer eligible.

You Lose Coverage With Your Employer

If your employer or union COBRA coverage ends after 18 months, you can join a Medicare Advantage or Medicare drug plan.

Your SEP lasts two months after your coverage ends or two months after you are notified, whichever is later.

Your Plan Terminates Its Contract with Medicare

If your plan is no longer part of Medicare, you can switch from your Medicare Advantage plan or Medicare drug plan to another plan.

Your SEP begins two months before the contract ends and extends until one month after.

Other Situations

Some other special circumstances list

Medicare Enrollment Periods to Switch Plans

Is It Time to Switch Your Medicare Plan?

As your healthcare needs change, it's possible that your current plan may not provide the coverage you need. Review your plan periodically and make necessary changes to ensure you get the best possible care.

If you're enrolled in Original Medicare, review the following year's "Medicare & You" handbook to understand your Medicare benefits and costs clearly. For those with a Medicare Advantage Plan or a Part D plan, review the Annual Notice of Change (ANOC) and/or Evidence of Coverage (EOC) from your plan. These documents will detail any changes to your plan's costs, benefits, and regulations for the upcoming year.

Additionally, it's also recommended to research other Medicare options in your area, even if you are satisfied with your current coverage. There might be another plan that better meets your healthcare needs and is more affordable.

At Fair Square Medicare

Recommended Articles

How Can I Get a Replacement Medicare Card?

Aug 14, 2023

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

Does Medicare Cover Boniva?

Nov 29, 2022

Does Medicare Cover Hearing Aids?

Nov 9, 2022

Can I Change My Primary Care Provider with an Advantage Plan?

Aug 25, 2023

Does Medicare Cover Ofev?

Dec 2, 2022

Does Medicare Cover COVID Tests?

Dec 21, 2022

What People Don't Realize About Medicare

Mar 27, 2023

Does Medicare Cover Diabetic Eye Exams?

Jan 11, 2023

Does Medicare Cover Medical Marijuana?

Jan 6, 2023

Does Medicare Cover the Urolift Procedure?

Dec 6, 2022

Medicare Consulting Services

Apr 3, 2023

Can Medicare Help with the Cost of Tyrvaya?

Jan 12, 2023

13 Best Ways for Seniors to Stay Active in Columbus

Mar 8, 2023

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

Does Medicare Cover Fosamax?

Nov 30, 2022

Plan G vs. Plan N

Jan 28, 2022

Does Medicare Cover Breast Implant Removal?

Jan 5, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

2025 Medicare Price Changes

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inqovi?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nexavar?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Estimating Prescription Drug Costs

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Vision Plans for Seniors

How Do I Sign up for Medicare? A Simple How-To Guide For You

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does Medicare Cost?

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Fair Square Medicare Legitimate?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Saving Money with Alternative Pharmacies & Discount Programs

Seeing the Value in Fair Square

Should You Work With A Remote Medicare Agent?

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Supplement SELECT Plan?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

Which Medigap Policies Provide Coverage for Long-Term Care?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare