Medicare Part B Premiums and Deductibles in 2023

Stay Up to Date on Medicare!

What Does Medicare Part B Cover?

Original Medicare

that covers your outpatient medical costs.- Essential medical services — medically necessary services and supplies required to diagnose or treat a medical condition

- Preventive services — designed to help prevent illness or detect it early

- Ambulance services

- Clinical research

- Diagnostic laboratory tests

- Doctor visits

- Durable medical equipment — hospital beds, blood sugar monitors, oxygen tanks, wheelchairs, walkers, etc.

- Therapy

- Screenings

- Vaccinations

- Transplants

- Limited outpatient prescription drugs

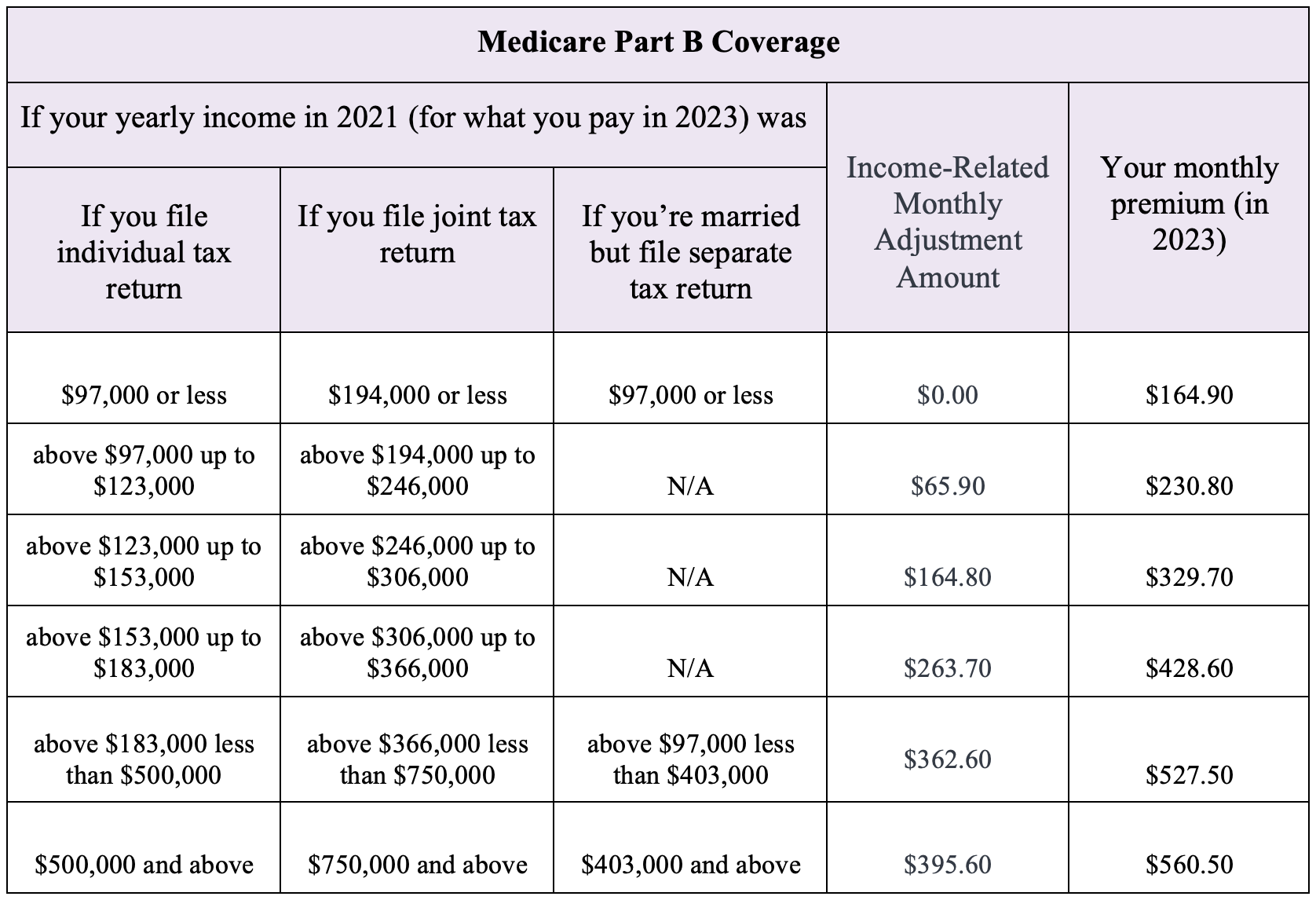

How Much Does Medicare Part B Cost In 2023?

- Monthly premium — $164.90

- Your premium may vary depending on your

MAGI

(modified adjusted gross income) - For example, if your MAGI exceeds a certain amount (as per your IRS tax return from 2 years ago), you may be subject to an

income-related monthly adjustment amount (IRMAA)

. You would pay the IRMAA in addition to the standard premium

- Annual deductible — $226

What Is Medicare Part B Immunosuppressant Drug Coverage?

ESRD

patients who need dialysis and/or a kidney transplant to survive.What Does Medicare Part B-ID Cover?

- Tacrolimus (Prograf®, Astagraf XL®, Envarsus XR®)

- Mycophenolate (Cellcept®, Myfortic®)

- Prednisone

- Cyclosporine (Neoral®, Gengraf®, Sandimmune®)

- Sirolimus (Rapamune®)

- Everolimus (Zortress®)

- Azathioprine (Imuran®)

- Belatacept (Nulojix®)

- Non-immunosuppressive medications

- Administration fees for IV immunosuppressant medications

- Compounded immunosuppressant medications

- Doctor visits, laboratory tests, and imaging

When Does the Medicare Part B-ID Benefit Begin?

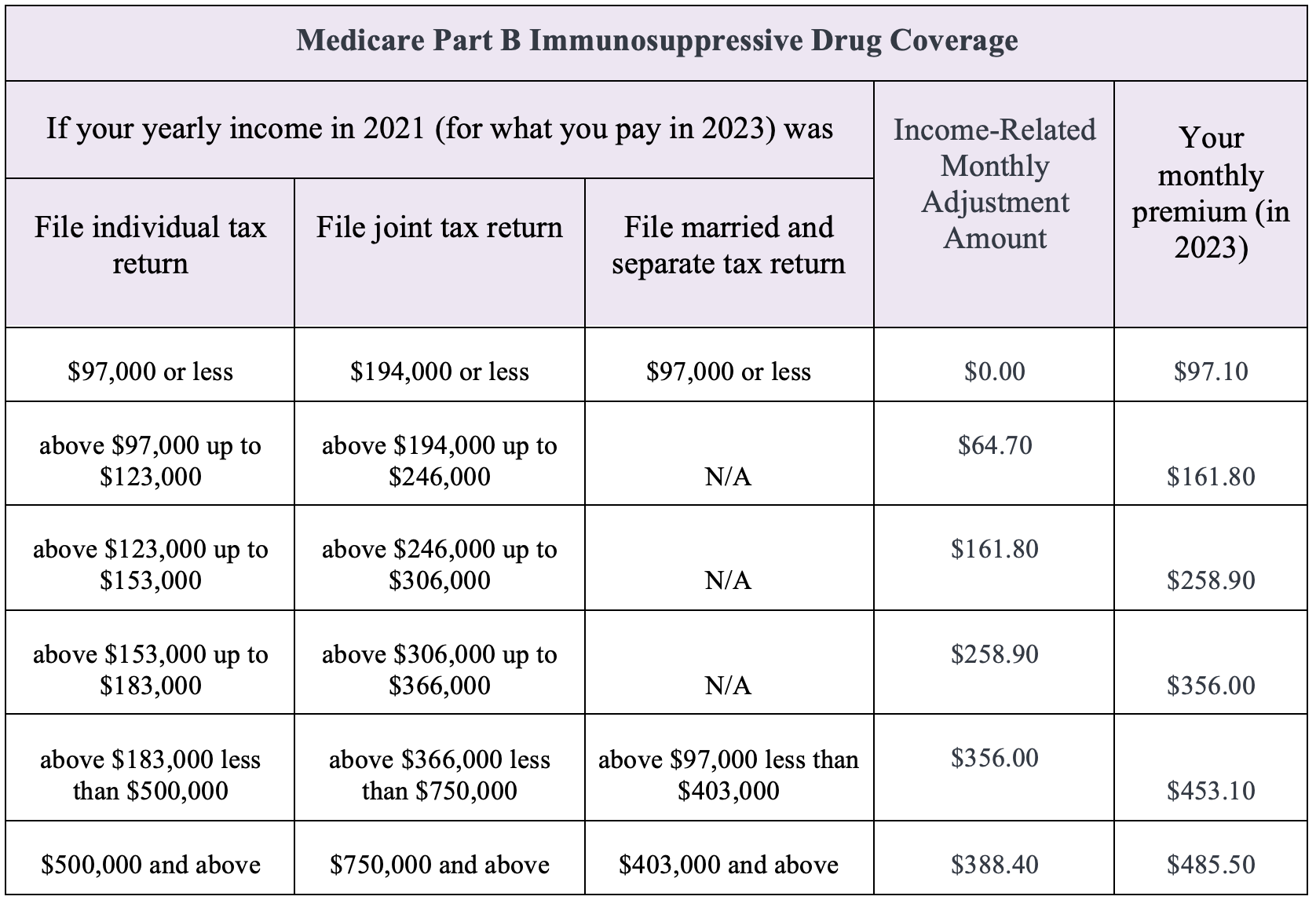

How Much Does Medicare Part B Immunosuppressant Drug Coverage Cost?

- Monthly premium — about $97.10 (exact amount varies depending on your income)

- Annual deductible — $226

- 20% of the Medicare-approved amount for your immunosuppressive drugs

Takeaway

- Lower monthly premiums

- Lower deductibles

- Affordable immunosuppressant drug coverage (if you have ESRD)

Fair Square Medicare

can help you understand your options and make informed decisions about your Medicare coverage.Stay Up to Date on Medicare!

Recommended Articles

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

2024 "Donut Hole" Updates

Are Medicare Advantage Plans Bad?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Comparing All Medigap Plans | Chart Updated for 2023

Do I Need Medicare If My Spouse Has Insurance?

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover PTNS?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Service Animals?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Plan Include A Free Gym Membership?

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

How Are Medicare Star Ratings Determined?

How Does Medicare Cover Colonoscopies?

How Does Medicare Pay for Emergency Room Visits?

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part A Cost in 2023?

How Often Can I Change Medicare Plans?

How to Choose a Medigap Plan

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is the Shingles Vaccine Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Deductibles Resetting in 2024

Medigap vs. Medicare Advantage

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: August 2023

The Fair Square Bulletin: February 2024

What Does Medicare Cover for Stroke Patients?

What Is a Medicare Advantage POS Plan?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What People Don't Realize About Medicare

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2025 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M