The answer could save you money

Varicose veins, also known as spider veins, can appear as you age. In some instances, you might be able get Medicare coverage for the various forms of varicose vein treatment if your doctor deems them to be medically necessary.

Speak with a Medicare Advocate

Read more to find out how much money you could save by utilizing Medicare coverage to treat varicose veins.

What are varicose veins?

Varicose veins are swollen, twisted veins that you can see just under the surface of your skin. They might look blue or purple. They can vary in size and be found anywhere on the body but are often found on the legs. Varicose veins form when the valves in your veins don't work properly. This lets blood flow backward and puts pressure on the vein walls. Vein problems often run in families.

What are the treatment options for varicose veins?

When it comes to treating varicose veins, there are several options. Your doctor may recommend that you wear compression stockings or use a combination of lifestyle changes and medications. Surgery is another option for more severe cases. This includes procedures like sclerotherapy, micro sclerotherapy, Venaseal, endovenous laser therapy (EVLT), radiofrequency ablation (RFA), and ambulatory phlebectomy.

Does Medicare cover any of these treatments?

Medicare generally doesn’t pay for cosmetic procedures, including varicose vein treatment. If it's primarily for cosmetic purposes, you will have to pay the cost out-of-pocket. However, if your doctor determines the procedure is medically necessary, then Medicare may pay for it. It's important to note that Medicare requires pre-authorizations from your doctor before they will approve coverage for this type of treatment. In some cases, Medicare may also require you to get a second opinion from another doctor before coverage is approved.

If Medicare covers it, that means they will pay 80% of the cost. You will be responsible for the remaining 20%. If you have a Medicare Supplement plan, you may be able to get coverage for the 20% that Medicare doesn’t cover.

How much will the surgery cost?

The cost of varicose vein treatments varies widely, depending on the particular procedure and where you have it done. Generally speaking, sclerotherapy costs between $350-$600 per treatment. EVLT can range from $1,200 - $3,000 per session. Ambulatory phlebectomy typically starts at around $2,000 for a single leg. Speak with a medical professional and shop around your area for the best estimate of what you might expect to pay.

It's important to keep in mind that these costs don’t include any fees associated with doctor visits or pre-authorizations required by Medicare before they will approve coverage for the procedure. You should also factor in how much your Medicare Supplement plan may contribute towards covering the remaining 20% not paid for by Medicare.

What are the side effects associated with surgery?

The side effects associated with varicose vein treatments can vary depending on the type of surgery you have. Generally, they include bruising, tenderness and swelling in the area where the procedure was done. Other more serious side effects can occur such as infection or blood clots. It's important to talk to your doctor about any risks associated with the procedure before you decide to proceed.

How long will it take to recover from surgery?

Recovery time can also vary depending on the type of surgery you have and your individual health situation. Generally speaking, it takes a few weeks for the treated area to heal. During this time, you should avoid strenuous exercise or activities that may put a strain on the area. In some cases, it may take up to six months before you see full results from the treatment.

Are there any alternative treatments available?

In addition to surgery, there are some alternative treatments available for varicose veins. These include lifestyle changes such as wearing compression stockings, losing weight and exercising regularly. Other options include laser treatments or injections of special medications into the affected veins. These treatments may not be as effective as surgery, but they can often help reduce symptoms such as pain and swelling. It's important to talk to your doctor about what treatment is best for you before making a decision.

How can you prevent varicose veins from developing?

There are several things you can do to help prevent varicose veins from developing. Regular exercise, maintaining a healthy weight and avoiding standing or sitting for long periods of time can all help. Wearing compression stockings or elevating your legs can also reduce pressure in the affected area and make it less likely for new varicose veins to form. Eating a balanced diet rich in antioxidants like Vitamin C and E can also help improve circulation and strengthen your veins. It’s important to talk with your doctor about what steps you should take to prevent varicose veins from occurring or worsening.

Conclusion

If you think you need varicose vein treatment, talk to your doctor about the available options and how Medicare coverage works with them. This content is for informational purposes only. With your doctor, you can make an informed decision on your care. For questions about what Medicare plan is right for you, give us a call at 1-888-376-2028 to speak with a Medicare expert today.

Recommended Articles

Medicare 101

May 20, 2020

What is Plan J?

Jul 14, 2025

Medicare Explained

Jan 3, 2022

Does Medicare Cover TENS Units?

Nov 23, 2022

Is Fair Square Medicare Legitimate?

Jul 27, 2023

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Does Medicare Cover Boniva?

Nov 29, 2022

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

Does Medicare Require a Referral for Audiology Exams?

Nov 22, 2022

Does Medicare Cover Zilretta?

Nov 28, 2022

Do I Need to Renew My Medicare?

Nov 29, 2022

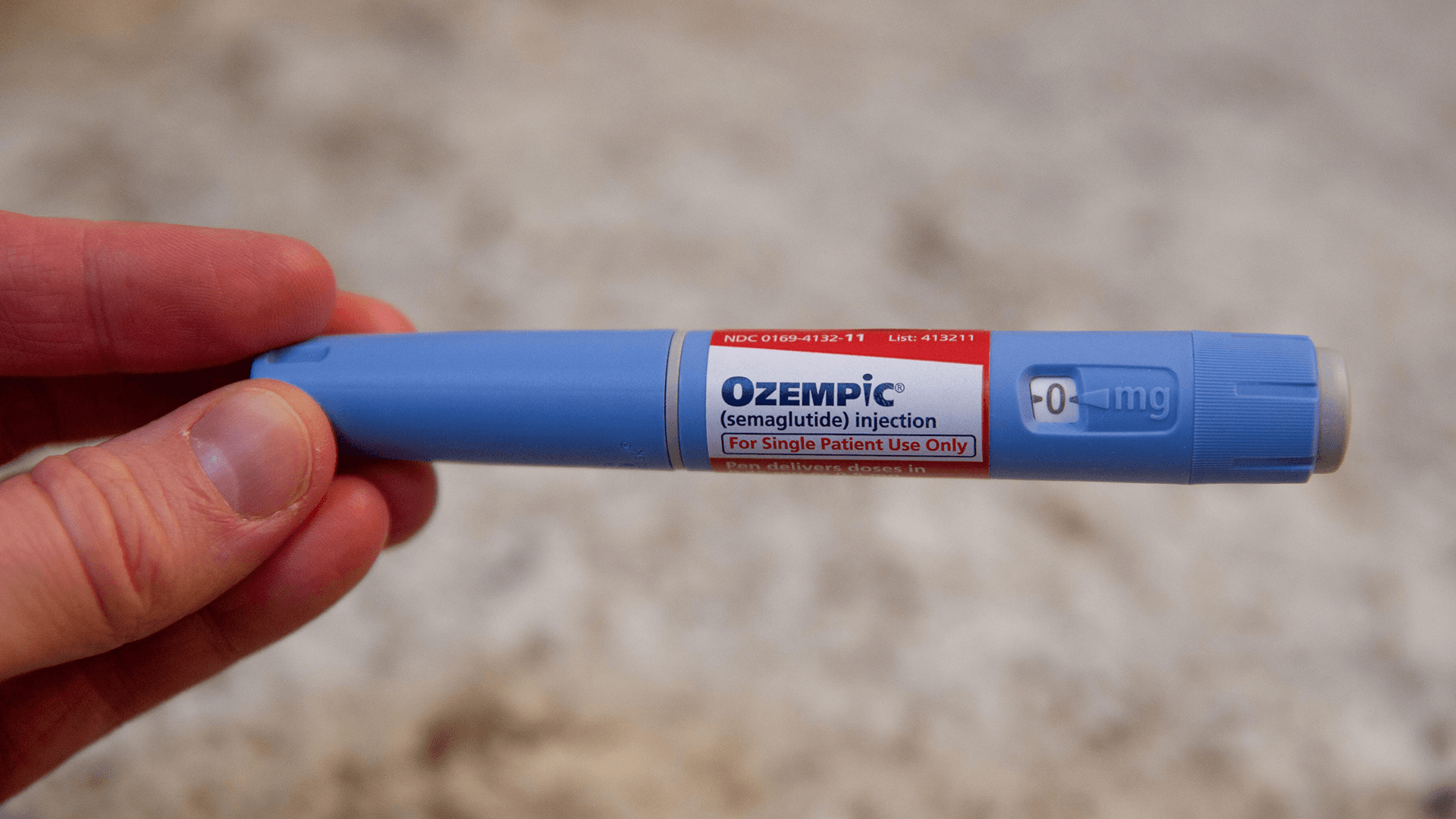

Does Medicare Cover Ozempic?

Mar 28, 2023

What Is Medical Underwriting for Medigap?

Apr 14, 2023

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

Does Medicare Cover Physicals & Blood Work?

Feb 1, 2024

14 Best Ways to Stay Active in Charlotte

Mar 9, 2023

Does Medicare Cover a Spinal Cord Stimulator?

Nov 19, 2022

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Seattle

2024 Fair Square Client Retention and Satisfaction Report

2025 Medicare Price Changes

Building the Future of Senior Healthcare

Can Medicare Advantage Plans be Used Out of State?

Comparing All Medigap Plans | Chart Updated for 2025

Costco Pharmacy Partners with Fair Square

Denied Coverage? What to Do When Your Carrier Says No

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Abortion Services?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Piqray?

Does Medicare Cover Qutenza?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Tymlos?

Does Medicare Pay for Varicose Vein Treatment?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How to Apply for Medicare?

How to Deduct Medicare Expenses from Your Taxes

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Gainswave Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

Plan G vs. Plan N

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Is a Medicare Supplement SELECT Plan?

What to Do When Your Doctor Doesn't Take Medicare

What's the Deal with Flex Cards?

When to Choose Medicare Advantage over Medicare Supplement

Which Medigap Policies Provide Coverage for Long-Term Care?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare