By Daniel Petkevich

Mar 28, 2023

Read this if you have pre-existing conditions

Are you concerned about being denied coverage for pre-existing conditions under Medicare Advantage plans? You're not alone. Pre-existing conditions have been at the forefront of healthcare debates for many years now. Luckily, if you are interested in signing up for a Medicare Advantage plan, also known as Part C, you can join even if you have pre-existing conditions. But you should approach this decision with a degree of caution. Let’s talk through your options and why you might want to have some wariness when opting for Medicare Advantage plans with a pre-existing condition.

Speak with a Medicare Advocate

What Are Pre-Existing Conditions?

According to Medicare.gov

According to CMS.gov

Asthma

Diabetes

High blood pressure

Substance abuse and dependency

COPD

Organ failure

HIV

Arthritis

And many more

From the CMS article:

While insurers generally determine the presence of a pre-existing condition based on an applicant’s current health status, sometimes a healthy applicant can be deemed to have a pre-existing condition based on a past health problem or evidence of treatment for a particular condition.

Luckily in recent years, and especially with government-backed insurance programs like the ACA and Medicare, you should not face barriers when signing up due to your pre-existing conditions.

Pre-Existing Conditions and Signing Up for Medicare Advantage

First, it’s important to understand the distinction between Original Medicare and Medicare Advantage plans. Medicare Advantage plans include Original Medicare (Part A hospital insurance and Part B medical insurance), and usually include a prescription drug plan (Part D). Medicare Advantage plans are sold by private insurers that, by law, need to provide at least the same level of coverage as Original Medicare.

You will not be denied a Medicare Advantage plan because you have a pre-existing condition.

Medicare Advantage plans are not inherently bad

Network Restrictions for Pre-Existing Conditions on Medicare Advantage Plans

The insurance providers of Medicare Advantage plans might be restrictive in offering coverage when it comes to seeking specific care for your pre-existing condition. When choosing a Medicare Advantage plan, you will choose between HMO and PPO. For a deep dive into the difference between HMO and PPO, check out our article here

An HMO plan means that you can only seek care in your network. Otherwise, you will pay the entire cost out-of-pocket. A PPO plan means you can seek care outside of your network and receive some coverage, but you will pay more to go outside your network.

For example, if you are signing up for a Medicare Advantage plan with a pre-existing condition like cancer, they cannot prevent you from joining that plan. But if your cancer worsens and you are interested in seeking treatment or a second opinion at a hospital outside of that Medicare Advantage plans network, you could face higher bills or potentially pay for the entire procedure or consultation out-of-pocket.

In some instances, your Medicare Advantage plan might require prior authorization. That means that your coverage only kicks in if you get certain types of treatment approved by your insurance plan provider. If you want one form of treatment for your condition, and your provider would rather you get another form of treatment, you might have to pay for the preferred treatment out-of-pocket.

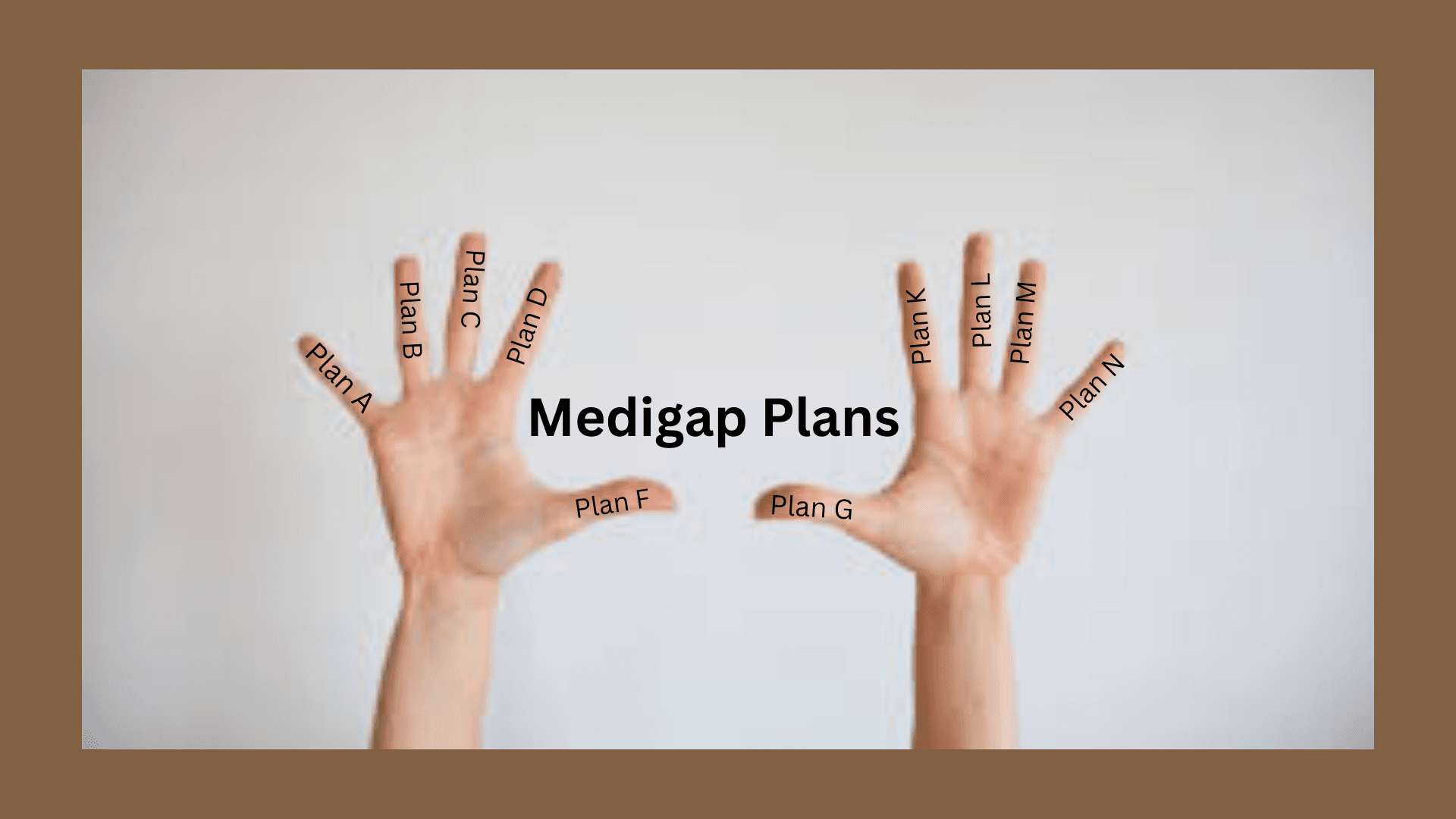

What About Medicare Supplement Plans?

Another way to add more coverage to your Original Medicare is through Medicare Supplement plans. These plans are sold by private insurance companies, but they are standardized by the government, so you might see different prices for the same levels of coverage. One of the key differences between Medicare Supplement and Medicare Advantage is that with a Supplement plan, you can seek treatment from any doctor who accepts Medicare, which includes over 90% of doctors nationwide. No fussing with HMO or PPO networks, just the Medicare network. However, if you’re trying to switch into a Medicare Supplement plan, it might get tricky.

Sometimes, insurance companies can dig through your medical history and increase your premium, delay your coverage, or sometimes even reject your application. While Original Medicare is not limited by pre-existing conditions, Medicare Supplement insurance plans have different rules.

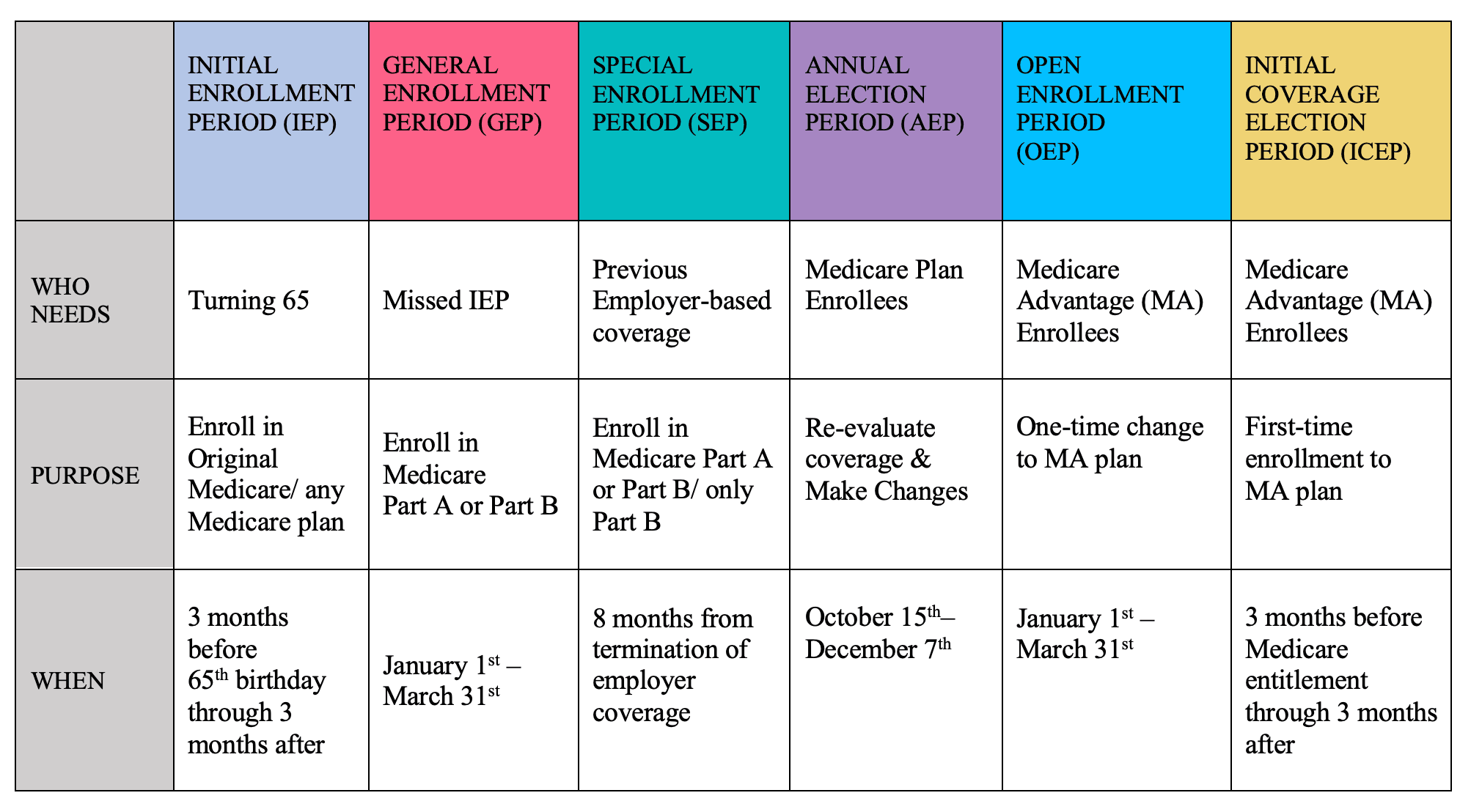

Unfortunately, when joining Medicare Supplement plans outside your Initial Enrollment Period (three months before you become eligible for Medicare until three months after you are eligible) and certain Guaranteed Issue periods, insurance companies have the ability to scrutinize your medical history and may increase premiums, impose waiting periods for coverage, or even reject your application in some cases.

This scrutiny is called Medical Underwriting. As a result—you might have a tougher time getting coverage due to your pre-existing conditions. Medical Underwriting doesn’t necessarily mean that you won’t be allowed to join a given Medicare Supplement plan, but you might have to pay much more for that plan than you would have without it.

We Recommend Choosing a Medicare Plan for Your Needs

Medicare Advantage plans will not deny you from joining their plan, but you might face much steeper out-of-pocket costs if you try to go outside your HMO or PPO network. Medicare Supplement plan providers won’t deny your treatment based on network restrictions or prior approval, but if you are trying to switch from an Advantage plan to a Supplement plan, you could face Medical Underwriting, which makes joining a plan harder or more expensive.

The best way to avoid these pitfalls is to speak with a Medicare expert at Fair Square

Conclusion

Pre-existing conditions cannot prevent you from joining a Medicare Advantage plan. If you enroll for a Medicare Supplement plan when you are first eligible for it, pre-existing conditions cannot prevent you from joining the plan, and you won’t face as many hurdles when you seek treatment due to your condition. We know Medicare can be complicated, and that’s why we’re working to make it easier for everyone. Please give us a call at 888-376-2028 if you have any questions or are ready to sign up for Medicare.

Recommended Articles

Does Medicare Cover Vitamins?

Dec 5, 2022

Does Medicare Cover Boniva?

Nov 29, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Does Medicare Cover Light Therapy for Psoriasis?

Jan 17, 2023

Does Medicare Cover Mouth Guards for Sleep Apnea?

Dec 8, 2022

Does Medicare Cover an FMT?

Dec 2, 2022

13 Best Ways for Seniors to Stay Active in Indianapolis

Mar 9, 2023

Is Gainswave Covered by Medicare?

Dec 6, 2022

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

Will Medicare Cover Dental Implants?

Jun 2, 2022

How Does Medicare Pay for Emergency Room Visits?

Nov 21, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

How Do Medigap Premiums Vary?

Apr 12, 2023

14 Best Ways to Stay Active in Charlotte

Mar 9, 2023

Does Medicare Cover Stair Lifts?

Nov 18, 2022

Is Emsella Covered by Medicare?

Nov 21, 2022

Does Medicare Require a Referral for Audiology Exams?

Nov 22, 2022

What People Don't Realize About Medicare

Mar 27, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Washington, D.C.

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

2024 Fair Square NPS Report

Can Doctors Choose Not to Accept Medicare?

Can I Laminate My Medicare Card?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Fosamax?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Home Heart Monitors?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Krystexxa?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Ofev?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover TENS Units?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Xiafaxan?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do Medicare Agents Get Paid?

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Apply for Medicare?

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Is Fair Square Medicare Legitimate?

Is HIFU Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare Deductibles Resetting in 2025

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

What If I Don't Like My Plan?

What Is Medical Underwriting for Medigap?

What To Do If Your Medicare Advantage Plan Is Discontinued

What's the Difference Between HMO and PPO Plans?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare