Medicare in 2025: What You Need to Know

You might have believed that enrolling in Medicare meant no costs since you've been paying healthcare taxes for years.

Speak with a Medicare Advocate

Unfortunately, for most Americans, that's a misconception.

Although payroll taxes primarily fund Medicare

It’s important to understand your potential Medicare costs before enrolling so you can budget for them.

In this article, we'll mostly be exploring your expected Medicare costs if you only have coverage through "Original Medicare" (Parts A & B). Even if you have a Medicare Supplement or Medicare Advantage plan, you still have to pay your Parts A (if any) & B Premiums, but your actual costs for care & deductibles depend on your specific plan. If you choose to get additional coverage for some of the gaps discussed below, one of our agents (1-888-376-2028) or our online tool

What's the Cost of Medicare Part A in 2025?

If you or your spouse have worked for more than 10 years (40 quarters) and paid Medicare taxes, then your Medicare Part A premium is zero dollars. However, although you might get Medicare Part A with no premium, you'll still need to pay for the deductibles and coinsurance if you don't have a Medicare Supplement or Advantage Plan.

If you've worked for less than 10 years, Medicare Part A will probably cost you around $506/month. But, if you've worked between 30-39 quarters and paid Medicare taxes, you can get Medicare Part A at a reduced cost of $278/month.

In the case of a hospital stay, you'll have to pay up to $1,676 (your Part A deductible — 2025) for each benefit period

A benefit period begins the day you are admitted to the hospital (or skilled nursing facility) as an inpatient and ends the day you leave the hospital (or after 60 days).

So each time you're admitted to the hospital, you could have to pay $1,676 as your Part A deductible before Medicare starts to pay.

You might also need to pay the Medicare Part A coinsurance for your inpatient stay, which are as follows (for each benefit period in 2025):

Days 1-60: $0

Days 61-90: $419 per day

Days 91-150: $838 per day while using your 60

lifetime reserve days

.After 150 days: All costs

How Much Does Medicare Part B Cost in 2025?

Your Medicare Part B cost can vary depending on your income. Whether you're on Original Medicare, a Medicare Advantage plan, or have a Medicare Supplement, you'll likely have to pay your Part B premium depending on the factors below.

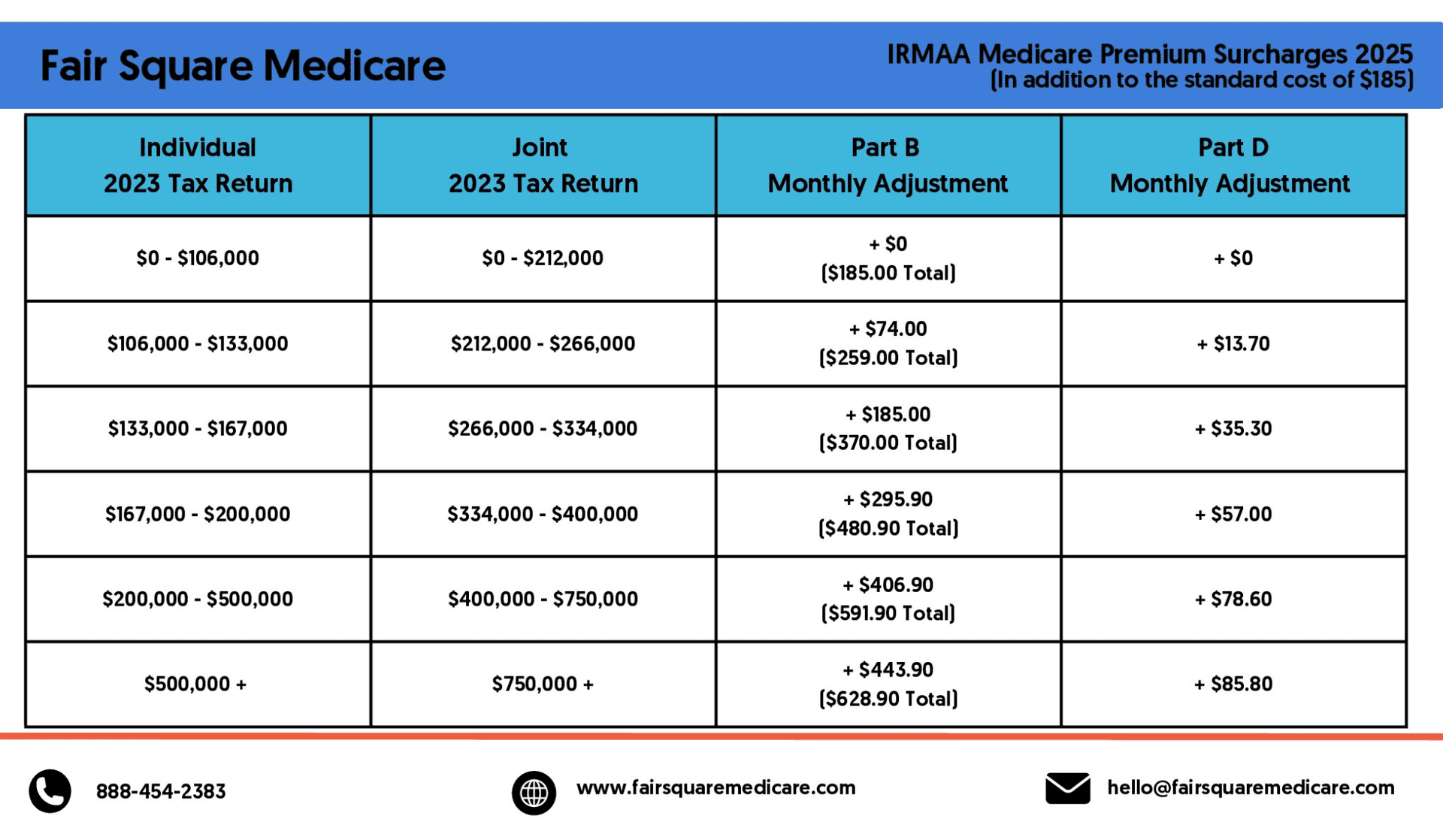

For many people, Medicare Part B typically costs $185 per month, but you might be required to pay even more based on your MAGI

If your MAGI is above a certain amount (as per your IRS tax return from 2 years ago), you’ll have to pay the standard premium and an income-related monthly adjustment amount ( IRMAA

Again, depending on your plan, you'll likely need to pay the Part B deductible each year before Medicare begins. In 2025, this amounts to $257. If you're only on Original Medicare, you'll also have to pay 20% of the bill for all Medicare-approved medical expenses you incur.

How Much Does Medicare Part D (Drug Coverage) Cost in 2025?

Medicare Part D's cost also depends on your income and your chosen plan.

You can choose from several Medicare Part D plans, some of which cost around $10-$15/month. Each Part D plan has a base premium. You might have to pay a little more if you fall in a higher-income bracket.

The table below shows the cost of Medicare Part B and Part D, depending on your income.

Medicare IRMAA Chart 2025

Your Part D deductibles, copays, and coinsurance also depend on the plan you choose.

How Much Will a Medicare Advantage Plan (Part C) Cost?

Medicare Advantage Plans

Any Medicare Advantage Plan or Part C premium depends on the plan you choose. Some Medicare Advantage plans might have a zero premium, but you still need to pay the Part B premium. Also, the Part C deductibles, copays and coinsurance vary with each plan.

Some plans have an out-of-pocket limit; once you've reached that limit for the year, your plan will cover 100% of your approved healthcare services for the rest of the year.

You can compare the cost of different Medicare Advantage Plans

How Much Will a Medicare Supplement Plan Cost?

Medicare Supplement Plan ( Medigap

The cost of Medigap

What's a Late Enrollment Penalty?

Medicare's initial enrollment period begins 3 months before your 65th birthday and extends until 3 months after your 65th birthday. The late enrollment penalty is a fee you may have to pay if you don't sign up for Medicare Part A and/or Part B when you're first eligible and don't have another form of "creditable" medical coverage.

The late enrollment penalty can increase your Part A and Part B premiums by 10%.

You may have to pay this higher monthly premium for Part A for twice the number of years you delayed getting your Part A.

If you delayed your Part B enrollment, you might also have to pay an extra 10% for each year you delayed signing up for Part B. Not to mention, you'll have to pay this high premium for as long as you have Part B.

Conclusion

Your Medicare Part A premium depends on the number of years you were in the workforce, while the cost of Medicare Part B and Part D primarily depends on your income bracket. To accurately evaluate the total cost of Medicare for you, you'll have to look at your income bracket, the number of quarters you've paid Medicare tax, the premium of the plan you choose (if any), and the deductibles and copayments of each plan.

The details of your Medicare cost can seem overwhelming and confusing, but that's what we're here for. Fair Square Medicare

Recommended Articles

Does Medicare Cover Geri Chairs?

Dec 7, 2022

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

Does Medicare Cover Hypnotherapy?

Nov 22, 2022

Does Medicare Cover Fosamax?

Nov 30, 2022

Can I Laminate My Medicare Card?

Dec 22, 2022

Are Medicare Advantage Plans Bad?

May 5, 2022

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Everything About Your Medicare Card + Medicare Number

May 12, 2022

How Does Medicare Pay for Emergency Room Visits?

Nov 21, 2022

Will Medicare Cover Dental Implants?

Jun 2, 2022

Does Medicare Cover Ilumya?

Dec 7, 2022

How Much Does a Medicare Coach Cost?

Mar 20, 2023

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Does Medicare Cover Urodynamic Testing?

Dec 2, 2022

14 Best Ways for Seniors to Stay Active in Nashville

Mar 10, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Plan G vs. Plan N

Jan 28, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

14 Best Ways to Stay Active in Charlotte

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Fair Square NPS Report

Can I Have Two Primary Care Physicians?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Costco Pharmacy Partners with Fair Square

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Compounded Medications?

Does Medicare Cover COVID Tests?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Inqovi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Ofev?

Does Medicare Cover Ozempic?

Does Medicare Cover Piqray?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Vitamins?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Estimating Prescription Drug Costs

Finding the Best Vision Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do Medigap Premiums Vary?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Much Does Medicare Cost?

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Enroll in Social Security

Is Botox Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare 101

Medicare Advantage Plans for Disabled People Under 65

Medicare Guaranteed Issue Rights by State

Medicare Supplement Plans for Low-Income Seniors

Medigap vs. Medicare Advantage

Moving? Here’s What Happens to Your Medicare Coverage

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Are Medicare Part B Excess Charges?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What is Plan J?

What to Do When Your Doctor Doesn't Take Medicare

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare