Making Sense Out of the Medigap Alphabet Soup

Ever heard folks talking about Plan F or Plan G? Those are Medigap plans. Here, we'll explain what they are and why we think Plan G is a good fit for folks who want the most coverage.

Speak with a Medicare Advocate

Medigap plans exist to - you guessed it - fill the gaps in Part A (In-Patient Coverage) and Part B (Out-Patient) coverage. They are plans that are subsidized and defined by Medicare but offered by private insurance carriers. What that means is you'll purchase a Medigap plan from a private carrier, like Cigna or Anthem, and that the benefits of the same plan are the same across carriers. Plan G from Cigna is the same as Plan G from Anthem. If you buy a Medigap plan, you'll pay a premium for it on top of the Part B premium you're already paying.

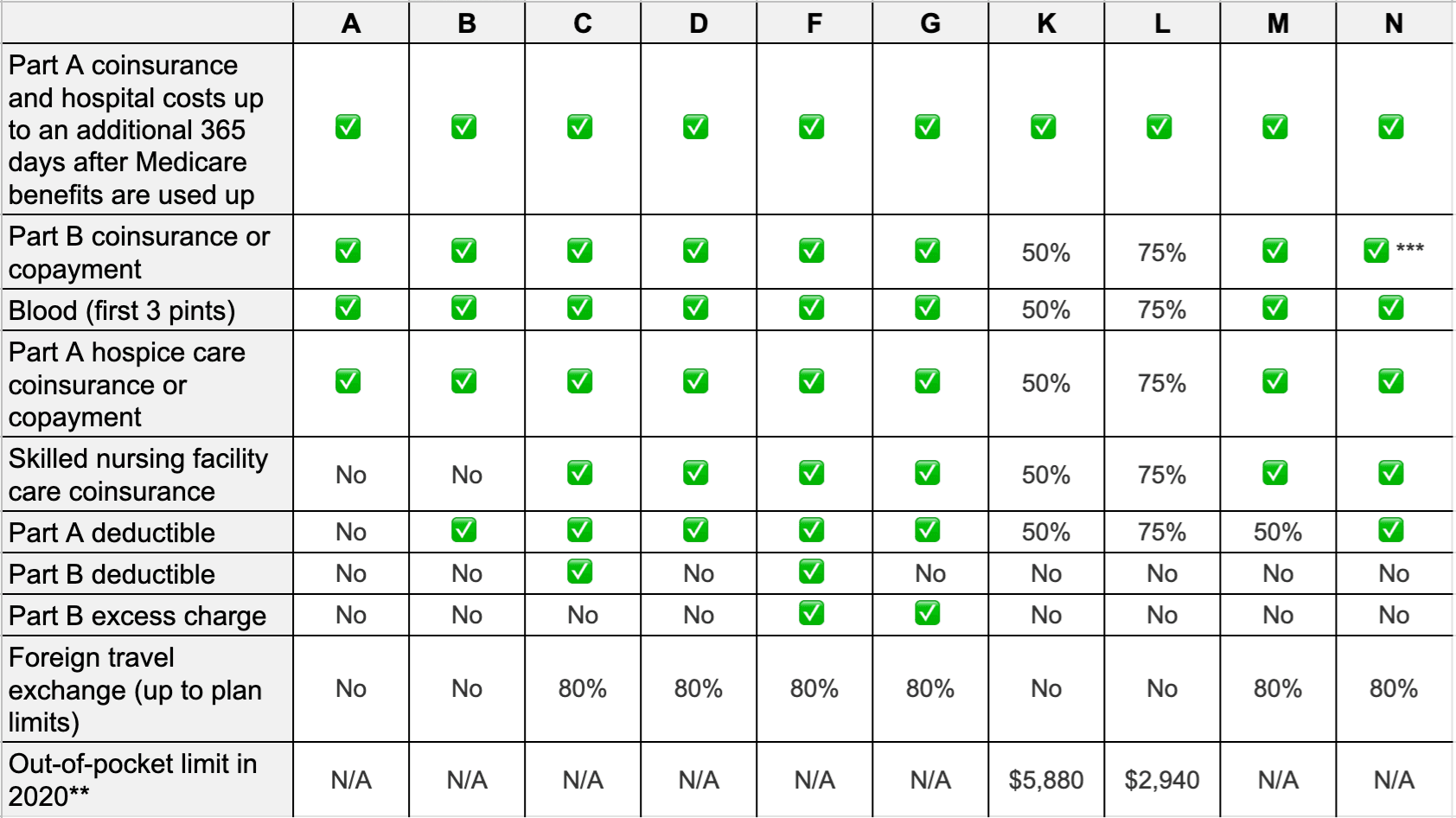

At first, choosing a Medigap plan can be daunting because there's a literal alphabet soup of options. There's Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan M, and Plan N. Here's a description of their benefits:

Whew! That's a lot of information. Let's go through this table by choosing one of the plans with the most checkmarks: Plan G. With Plan G, you get:

Coverage for Part A Coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up - With just Part A, you have to pay $400 per day in 2023 or more after the 61st day you're in the hospital. Plan G covers this and gives you an extra year of covered days.

Part B Coinsurance - With Part B, you're on the hook for 20% of medical expenses after you meet your deductible. Plan G covers all qualifying medical expenses after you meet your deductible.

Blood - Should you need blood, Plan G covers the first three pints, which Part A does not.

Part A Hospice & Skilled Nursing Facility Care - Should you go to a hospice or skilled nursing facility, Plan G covers your coinsurance.

Part A deductible - Plan G covers your Part A deductible, $1,600 in 2023.

Part B deductible - Plan G does not cover this.

Part B Excess Charge - Doctors who accept Medicare will sometimes bill more than what Medicare will reimburse. Usually, you are on the hook for this "excess charge" but Plan G will cover it.

Foreign Travel - Plan G will pay for 80% of your medical expenses abroad up to $50,000.

Out of Pocket Limit - There is no out-of-pocket limit

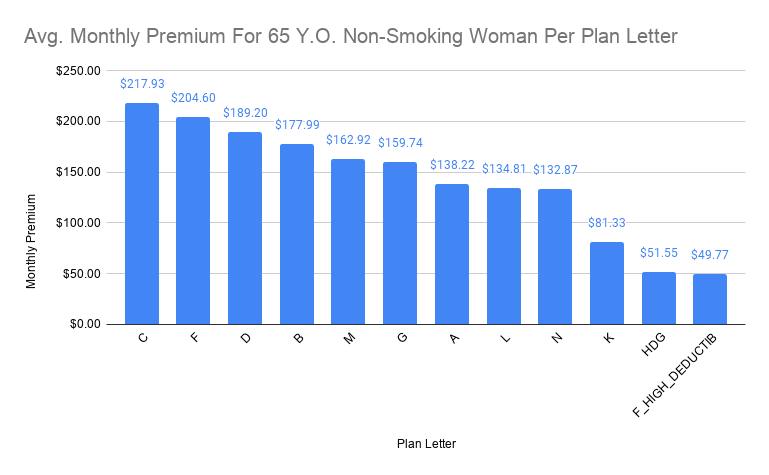

Now let's get to choosing a plan. In the world of insurance, paying more doesn't always get you better coverage. A plan's premium is dictated by a number of factors, one of which is how many people are enrolled in it. Generally, the more people enrolled in a plan the lower its premium.

This relationship between coverage and premium is important to remember because around two-thirds of the people enrolled in Medigap plans are enrolled in Plans F or G. They offer the most coverage of all the Medigap plans but aren't the most expensive. As an example, consider the average prices of Medigap plans in California for a 65-year-old non-smoking female from carriers with at least an AM Best rating of "A-".

Looking at this data, we can immediately rule out five of the 12 Medigap plans available. Here's how:

Five plans are more expensive than Plan G, but only one, Plan F, has stronger benefits. This lets us rule out Plans C, D, B, and M. No point in paying more for less coverage.

The only difference between Plan F and G is that the former covers the $226 Medicare Part B deductible. However, looking closely at the chart we see that Plan F costs, on average, about $50 more per month than Plan G. No point in paying an extra $600 a year for $226 in savings.

So we've whittled down our options to G, A, L, N, K and the high deductible versions of Plans F and G. Which one you choose depends on the prices unique to you (we used averages) and how much coverage you want. For folks who want maximum coverage, Plan G is usually the best fit. Go to www.fairsquaremedicare.com

Recommended Articles

Does Medicare Cover Jakafi?

Dec 12, 2022

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

Is Balloon Sinuplasty Covered by Medicare?

Dec 1, 2022

Does Medicare Cover Hepatitis C Treatment?

Nov 22, 2022

How Much Does Medicare Part A Cost in 2025?

Nov 18, 2022

Does Medicare Cover Air Purifiers?

Nov 18, 2022

2025 Medicare Price Changes

Oct 30, 2023

Does Medicare Cover Krystexxa?

Nov 18, 2022

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

Does Medicare Cover Abortion Services?

Dec 13, 2022

Can I Have Two Primary Care Physicians?

Oct 3, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

Does Medicare Cover Ketamine Infusion for Depression?

Nov 23, 2022

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

Welcome to Fair Square's First Newsletter

Feb 28, 2023

Medicare Advantage MSA Plans

May 17, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

2024 Fair Square NPS Report

Are Medicare Advantage Plans Bad?

Can I Choose Marketplace Coverage Instead of Medicare?

Can Medicare Help with the Cost of Tyrvaya?

Costco Pharmacy Partners with Fair Square

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ilumya?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Piqray?

Does Medicare Cover PTNS?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Funeral Expenses?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Fair Square Client Newsletter: AEP Edition

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Much Does Xeljanz Cost with Medicare?

How to Choose a Medigap Plan

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare 101

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Medicare Supplement Plans for Low-Income Seniors

Seeing the Value in Fair Square

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What is a Medicare Beneficiary Ombudsman?

What is Plan J?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What People Don't Realize About Medicare

What's the Difference Between HMO and PPO Plans?

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare