Marketplace Coverage Might Not Be a Good Alternative to Medicare

Throughout our lives, we experience many significant milestones. From our first steps to our first job, each event marks a turning point that shapes our journey. As you approach your 65th birthday, one such milestone is enrolling in Medicare

Speak with a Medicare Advocate

For many, it marks the transition from employer/individual-sponsored health insurance to government-funded coverage and can bring both relief and confusion.

You may be faced with choosing a healthcare plan that can impact your health and finances for years to come. Understanding the ins and outs of Medicare enrollment

Let's discuss ACA plans and whether you should choose them over Medicare.

What Are ACA Plans? What Are Its Limitations?

The ACA (Affordable Care Act), also known as Obamacare, is a healthcare reform law passed in the United States in 2010. ACA plans refer to health insurance plans that comply with the regulations outlined in the ACA.

These plans are offered through the Health Insurance Marketplace and provide coverage for essential health benefits, such as hospitalization, prescription drugs, preventive care, and maternity care.

The ACA plans also offer premium subsidies to individuals who meet specific income criteria, lowering their health care coverage cost.

However, these plans can be more expensive than other insurance plans since they cover preexisting conditions — particularly for individuals who earn beyond the subsidy threshold. Additionally, some individuals may be unable to find an ACA plan that includes their preferred healthcare provider or medications.

When Can I Enroll in Medicare?

Medicare eligibility typically begins at age 65, although people with special circumstances may be eligible for Medicare at an earlier age.

You can sign up for Medicare

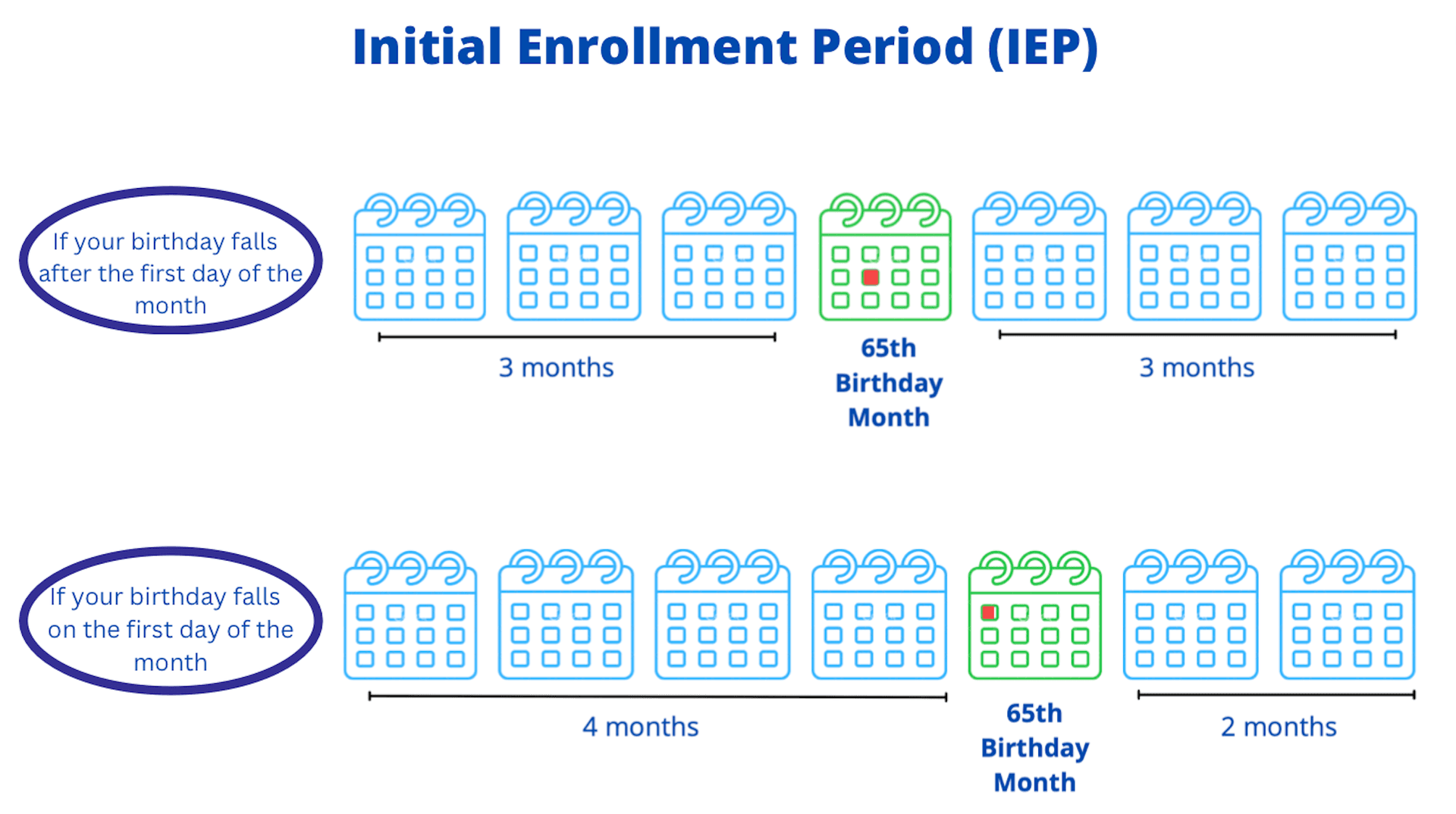

Medicare Initial Enrollment Period

If you miss your IEP, you can enroll during the General Enrollment Period (GEP) from January 1 to March 31 each year, but you may be subject to a late enrollment penalty.

Is It Possible to Get a Marketplace Plan Alongside Medicare?

Once you enroll in Medicare you cannot join a Marketplace plan. Moreover, it's illegal for anyone aware that you're enrolled in Medicare to offer or sell you a Marketplace plan.

However, if you already have a Marketplace Plan and you're eligible for Medicare, you can continue to keep your Marketplace plan after enrolling in Medicare. But, you may lose any premium tax credits and cost-sharing reductions you received before enrolling in Medicare.

For example, Joana has a Marketplace Plan and will be eligible for Medicare in 7 months. She can keep the Marketplace plan until Medicare coverage starts, but once Medicare coverage begins, Joana will lose any financial assistance she received to pay for her Marketplace premiums.

Can I Select Marketplace Coverage over Medicare?

Generally, no, but you can select a Marketplace Plan instead of Medicare in the following scenarios:

If you're paying a premium for Medicare Part A because you haven't worked long enough to qualify for a premium-free Part A, you can drop both Part A and

Part B

coverage and enroll in a Marketplace plan instead. For example, Jim is not eligible for premium-free Part A as he has worked for less than 40 calendar quarters. He can drop or delay Medicare Parts A and B until he completes 40 calendar quarters and enrolls in a Marketplace Plan.If you're eligible for Medicare but have not yet enrolled due to any of the following reasons:

You'd need to pay a premium for Medicare.

You have a medical condition that qualifies you for Medicare — such as end-stage renal disease (

ESRD

) — but have not yet applied for Medicare coverage.You are not collecting Social Security retirement or disability benefits before being eligible for Medicare.

Nevertheless, here are a few key factors to consider before you decide to select a Marketplace Plan over Medicare:

Suppose you choose to drop your premium-free

Medicare Part A

. You'll also lose your retiree or disability benefits (from Social Security or Railroad Retirement Board) and will not be eligible for any financial assistance to pay your Marketplace plan premiums. Moreover, you'll need to reimburse all retirement or disability benefits you received to date, along with the costs that Medicare paid for your healthcare claims.If you enroll in Medicare after your Initial Enrollment Period, you may have to pay a late enrollment penalty for as long as you have Medicare.

If you miss your Initial Enrollment Period, you can only enroll in Medicare during the Medicare General Enrollment Period (January 1 - March 31). Your coverage will start on the first day of the month following your enrollment.

If you're considering dropping your Medicare due to the Part A premium, evaluate whether your Marketplace plan can fulfill your requirements and is affordable. In some situations, your Part A premium might be less expensive than a Marketplace plan that does not provide financial assistance.

If I Become Eligible for Medicare After Enrolling In a Marketplace Plan, What Should I Do?

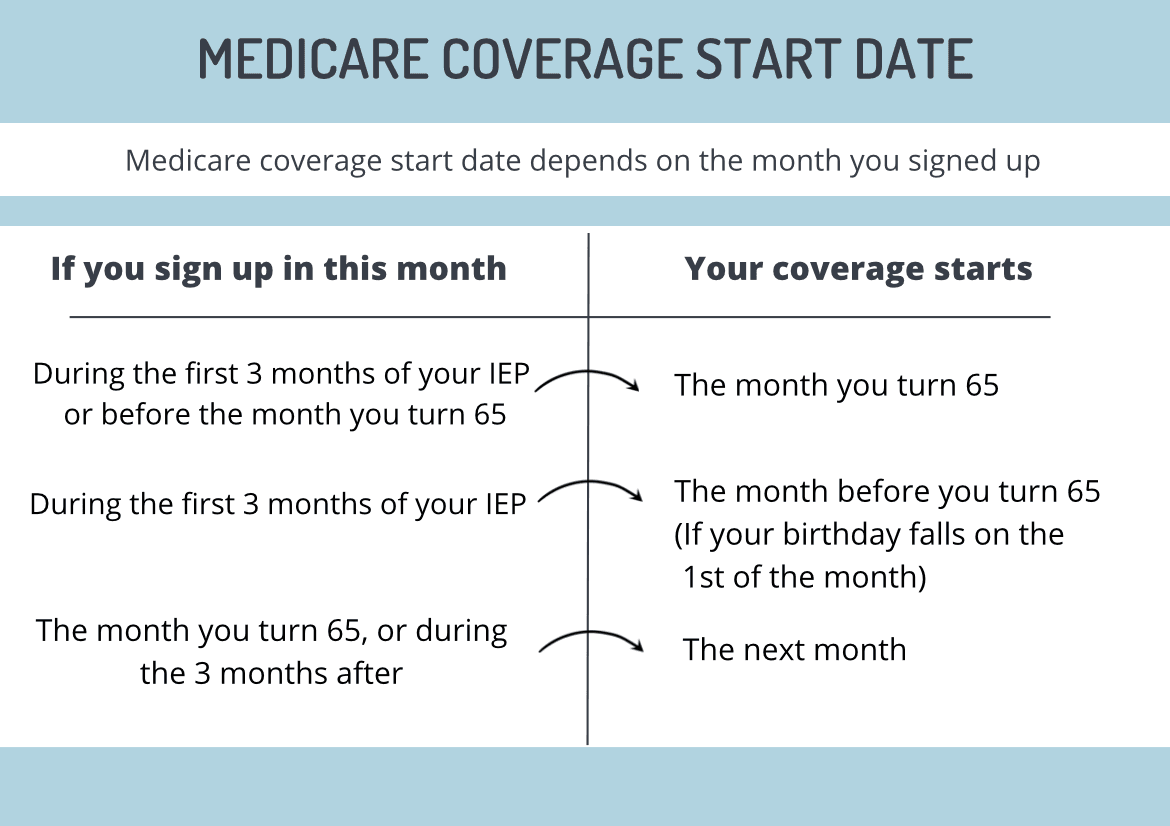

Generally, if you have a Marketplace plan when you become eligible for Medicare, it is recommended to terminate your Marketplace coverage. However, ensure that you end your Marketplace plan only the day before your Medicare coverage starts to avoid any gaps in your coverage. The following chart displays when your Medicare coverage begins based on the month you enroll.

Medicare Coverage Start Date

Suppose you are the sole eligible recipient of Medicare while other individuals are included in your Marketplace application. In that case, you can choose to cancel only your coverage while keeping the coverage for the others.

To terminate your Marketplace coverage, you can either log in to your account at HealthCare.gov

Note that if you receive financial assistance to pay for your Marketplace plan premiums after you enroll in Medicare, you'll need to reimburse some or all of the assistance you received when you file your federal income taxes.

Additionally, if your plan knows you're eligible for Medicare, they will not automatically renew your Marketplace coverage. As a result, this will terminate coverage for everyone listed on your Marketplace plan, including individuals not yet eligible for Medicare. So, it's necessary to cancel your marketplace coverage on time.

ACA Plans or Medicare: Which Is Right for Me?

As you approach age 65, choosing between a Marketplace plan and Medicare can be confusing. Once you enroll in Medicare, you cannot enroll in a Marketplace plan.

If you are eligible for premium-free Medicare Part A, delaying enrollment in Medicare might not be a good option. You may be subject to late penalties for as long as you have Medicare and lose any financial assistance to cover your Marketplace plan premiums. On the other hand, delaying enrollment in Medicare due to the Part A premium should be carefully considered because some Marketplace plans may actually be more expensive than the Part A premium.

It's important to seek expert advice when choosing between a Marketplace plan and Medicare. Our advisors

Recommended Articles

Can I Have Two Primary Care Physicians?

Oct 3, 2022

How Can I Get a Replacement Medicare Card?

Aug 14, 2023

Does Medicare Cover Ilumya?

Dec 7, 2022

Medicare & Ozempic

Jul 20, 2023

Is HIFU Covered by Medicare?

Nov 21, 2022

Will Medicare Cover Dental Implants?

Jun 2, 2022

Does Medicare Require a Referral for Audiology Exams?

Nov 22, 2022

Does Medicare Cover COVID Tests?

Dec 21, 2022

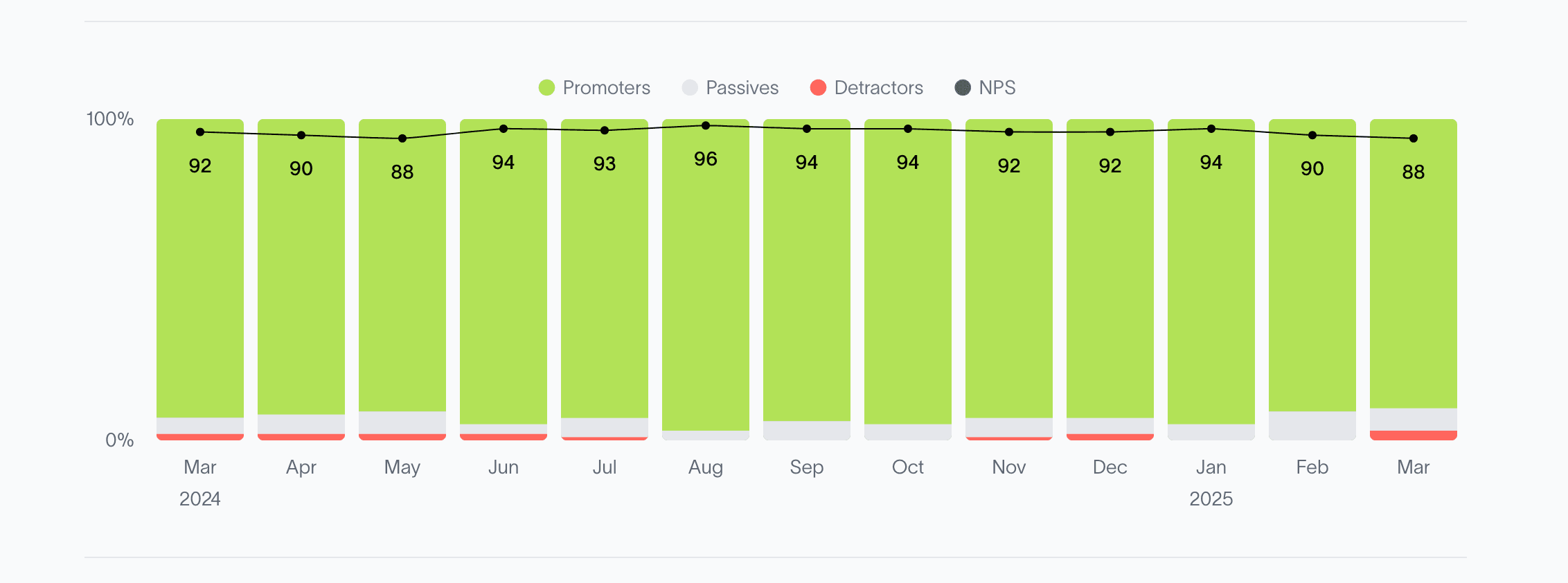

2024 Fair Square NPS Report

Mar 19, 2025

Does Medicare Cover Macular Degeneration?

Nov 30, 2022

Is the Shingles Vaccine Covered by Medicare?

Nov 17, 2022

Does Medicare Cover Cataract Surgery?

Dec 22, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Does Medicare cover Hyoscyamine?

Nov 30, 2022

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

What is the 8-Minute Rule on Medicare?

Dec 21, 2022

Is Emsella Covered by Medicare?

Nov 21, 2022

Does Medicare Pay for Allergy Shots?

Nov 29, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

2024 Fair Square Client Retention and Satisfaction Report

2025 Medicare Price Changes

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Costco Pharmacy Partners with Fair Square

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Flu Shots?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Nuedexta?

Does Medicare Cover Ofev?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover Zilretta?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Vision Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

Is Balloon Sinuplasty Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Fair Square Medicare Legitimate?

Medicare Advantage Plans for Disabled People Under 65

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Medigap vs. Medicare Advantage

Saving Money with Alternative Pharmacies & Discount Programs

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What is a Medicare Beneficiary Ombudsman?

What Is Medical Underwriting for Medigap?

What to Do When Your Doctor Doesn't Take Medicare

What to Do When Your Doctor Leaves Your Network

What You Need to Know About Creditable Coverage

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare