You May Not Pay the Same Premium as Your Friend

Your friend informs you that they've enrolled in a Medigap plan for a premium of $150, piquing your interest as you are also considering enrolling in the same plan. However, upon checking, you realize the same plan will cost you $200. This discrepancy can lead to confusion and raise questions about the factors that contribute to the varying premiums of Medigap plans.

Speak with a Medicare Advocate

Let's find out whether Medigap premiums vary, identify the factors that influence its pricing, and understand how insurance companies arrive at the cost of your plan.

What's a Medigap Plan? Can Medigap Premium Amounts Vary?

A Medigap plan, also known as a Medicare Supplement plan

Medigap plans work alongside Original Medicare and are sold by private insurance companies. This means you need to have Medicare Parts A & B to be eligible to enroll in a Medigap plan.

These plans are standardized by the federal government and come in ten options (in most states), identified as Plans A, B, C, D, F, G, K, L, M, and N. Each plan offers a unique level of coverage to accommodate different healthcare needs.

It's important to note that some states, such as Wisconsin Massachusetts Minnesota

To enroll in a Medigap plan, you will typically have to pay the plan premium and the Part B premium, as well as any deductibles, copays, and coinsurances associated with your chosen plan. However, the Medigap plan premiums may differ from one person to another. For example, a friend in a different state may pay a different premium amount for your Medigap plan.

What Factors Impact the Cost of a Medigap Plan?

Medigap plans

Insurance Company — different companies may charge different premiums for the same Medigap plan.

Plan Type — plans that offer more comprehensive coverage may cost more than those that provide less coverage.

Age — premium amount may increase with age.

Gender — some insurance companies may charge different premiums based on gender.

Location — premiums can vary by state and even by region within a state.

Health Status —individuals with pre-existing medical conditions or those deemed at higher risk may be charged higher premiums.

Smoking Status — some insurance companies may also charge higher premiums to tobacco users.

How Do Insurance Companies Determine Their Medigap Premium Pricing?

We have seen the various factors that impact the cost of a Medigap plan. Now let's dive deeper to uncover how these factors influence your Medigap premium.

1. Your Insurance Company

The Medigap plan premium can vary depending on the insurance company. Various factors, such as administrative costs, underwriting expenses, and profit margins, can influence the premium for the same Medigap plan offered by different insurance companies.

Each insurance company has its own health questions and criteria to determine who they accept for a Medigap plan. Some insurers may loosen their underwriting process to attract more policyholders but may charge a higher premium. On the other hand, insurance companies with more stringent health questions may offer lower premiums.

Furthermore, some insurance companies offer discounts to policyholders who meet specific criteria, such as being a non-smoker. You may also be eligible for discounts if you pay your premiums yearly or use electronic funds transfer to make automatic payments from your checking account or credit card.

Additionally, you may receive a discount if you have multiple policies with the same insurance company.

2. Your Plan Type

The Medigap premiums generally increase as the level of coverage provided by the plan increases.

Plans with more comprehensive coverage typically have higher premiums compared to those with less coverage. For example, plans that offer less coverage, such as Plan K or Plan L, usually charge lower premiums than Plan G, which provides more coverage and charges more.

It's important to note that Medigap plans with high deductibles typically have lower premiums than their standard counterparts. However, you'll need to pay a higher deductible before your coverage starts.

Additionally, some insurance companies offer Medicare SELECT policies, which may have lower premiums, but have network restrictions to receive full coverage.

3. Your Age

Medigap plans can be priced or "rated" in 3 ways:

Community-rated (No Age-Rated)

With this type of Medigap policy, everyone pays the same premium, regardless of age. For example, Mr. Derek and Mrs. Paula both pay $160 for the same Medigap policy, even though Mrs. Paula is older.

Issue-age-rated (Entry Age-Rated)

Premiums are based on your age when you first buy the Medigap policy. Younger buyers typically pay less than older buyers. For example, Mr. Dan pays $145 because he bought the policy at age 65, while Mrs. Willey pays $175 because she bought the same policy at age 72.

Attained-age-rated

Premiums are based on your current age. They increase as you get older. At first, premiums for this type of policy may be lower, but they will increase over time. For example, Mrs. Henry's premium is $180 when she first buys the policy at age 65, but it increases each year. Mr. Bob, who buys the same policy at age 72, pays $265, and his premium also increases each year as he gets older.

It's important to note that in each of the above cases, the premium amount can increase due to inflation or other factors.

4. Your Gender

Did you know that your gender could affect your Medigap rates? Some insurance providers may offer reduced rates on Medicare Supplement plans for female policyholders.

As women tend to have better health and file fewer claims on average than men, female beneficiaries generally pay around $10-30 less in monthly premiums than their male counterparts.

5. Your Location

The cost of Medigap plans can vary depending on your location. Insurance companies use various factors to calculate Medigap premiums, such as local healthcare service costs, cost of living, and state-specific insurance regulations.

For example, in states like New York and Connecticut, Medigap premiums can be significantly higher compared to other states, often ranging between $300 to $500 per month. This is because these states have year-round open enrollment, allowing applicants to enroll in a Medigap plan without undergoing medical underwriting or answering health-related questions.

On the other hand, Medigap plans in Florida are known to be among the most expensive in the United States. This could be attributed to the state's large population of seniors, resulting in insurance carriers charging higher premiums to meet the increased demand for healthcare services.

Furthermore, there are some states like Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont where laws prohibit excess charges

6. Your Health Status

Medigap premiums are generally not impacted by your health status, provided you enroll during your initial enrollment period or have guaranteed issue rights

However, if you enroll in a Medigap policy after your initial enrollment period has ended, you may need to undergo medical underwriting. This means that the insurance company can consider your health status when determining your premium.

If you have pre-existing conditions or other health issues in this instance, you may be charged a higher premium or even denied coverage altogether.

7. Your Smoking Status

Due to the increased health risks associated with tobacco use, insurance carriers often charge tobacco users higher premiums. If you smoke, vape or use tobacco products, you can anticipate paying up to 10% more on your monthly Medigap premium than a non-tobacco user.

Compare Plans for Optimum Coverage at Minimum Cost

Medigap Plans are a valuable resource for covering the gaps left by Original Medicare. However, it is important to note that enrolling in a Medigap plan involves paying a plan premium, which can vary based on a variety of factors, including plan type, age, gender, location, health status, and the insurance company. By carefully considering these factors and comparing multiple plans, you can make an informed decision and find a Medigap plan

Comparing Medigap plans our Medicare advisors

Recommended Articles

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Does Medicare Cover Abortion Services?

Dec 13, 2022

Will Medicare Cover Dental Implants?

Jun 2, 2022

Can I Have Two Primary Care Physicians?

Oct 3, 2022

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Estimating Prescription Drug Costs

May 25, 2020

Does Medicare Cover PTNS?

Dec 9, 2022

Does Medicare Cover an FMT?

Dec 2, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

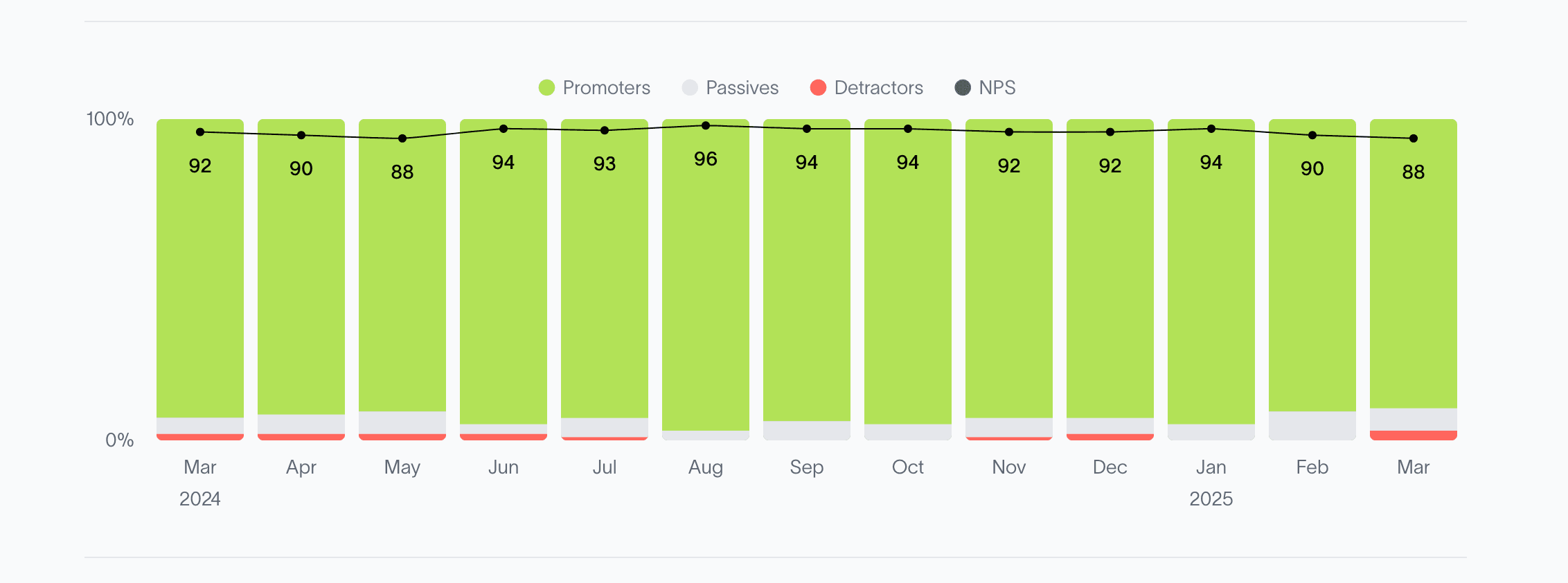

2024 Fair Square NPS Report

Mar 19, 2025

What Is the Medicare Birthday Rule in Nevada?

Mar 28, 2023

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

14 Best Ways to Stay Active in Charlotte

Mar 9, 2023

How Medicare Costs Can Pile Up

Oct 11, 2022

Does Medicare Cover Linx Surgery?

Dec 6, 2022

Does Medicare Cover Physicals & Blood Work?

Feb 1, 2024

Does Medicare Cover SI Joint Fusion?

Nov 28, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

14 Best Ways for Seniors to Stay Active in Nashville

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Cost of Living Adjustment

2024 Fair Square Client Retention and Satisfaction Report

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Use Medicare Part D at Any Pharmacy?

Costco Pharmacy Partners with Fair Square

Denied Coverage? What to Do When Your Carrier Says No

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Flu Shots?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mental Health?

Does Medicare Cover Nuedexta?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover TENS Units?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Funeral Expenses?

Fair Square Bulletin: We're Revolutionizing Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Enroll in Social Security

Is Gainswave Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Deductibles Resetting in 2025

Medicare Explained

Medicare Supplement Plans for Low-Income Seniors

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What If I Don't Like My Plan?

What Is a Medicare Advantage POS Plan?

What is a Medicare Beneficiary Ombudsman?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What People Don't Realize About Medicare

What You Need to Know About Creditable Coverage

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Which Medigap Policies Provide Coverage for Long-Term Care?

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare