Guaranteed Issue Rights in some States Are More Favorable than Others

If you have any pre-existing medical conditions, changes to your Medigap Plan made outside the Open Enrollment Period may limit your plan choices.

Speak with a Medicare Advocate

Fortunately, Guaranteed Issue rights offer relief if your coverage is lost due to a qualifying event, allowing you to choose a plan even if you have a pre-existing condition. But, these rights may differ across states based on your situation.

Let's look at Guaranteed Issue rights and how they vary from state to state.

What Are Guaranteed Issue Rights?

Guaranteed Issue Rights, also called Medigap Protections, are your rights in specific situations that permit you to choose any Medicare Supplement ( Medigap

In medical underwriting, insurance companies examine your medical history, including your medical records and prescription history, to determine whether to offer insurance and at what cost.

If you have guaranteed issue rights, insurance companies:

Are legally obligated to sell you a Medicare Supplement (Medigap) policy

Cannot reject your application

Must cover all your pre-existing conditions

Cannot overcharge you due to a pre-existing condition

When Do You Have Guaranteed Issue Rights?

Guaranteed Issue Rights are only available under specific conditions, so it's good to enroll in a Medigap or Medicare Supplement plan during your Medigap Open Enrollment Period

You're eligible for guaranteed issue rights under the following situations:

If you're enrolled in a

Medicare Advantage plan

and:It will no longer be part of Medicare

It's discontinuing its service in your region, or

You move outside of your plan's service area

When your employer group health plan or union coverage that supplements Original Medicare is ending

If you have a

Medicare SELECT

plan and you decide to move out of its service areaWhen your Medigap Insurance company goes bankrupt, or your plan coverage ends through no fault of your own

If you leave a Medicare Advantage Plan or a Medigap plan because your insurance company didn't follow the rules or misled you

In a similar vein, you have Trial Rights 1 and 2:

If you enrolled in a Medicare Advantage plan or

PACE (Program of All-inclusive Care for the Elderly)

during yourInitial Enrollment Period

and within the first year decide to return to Original MedicareIf you dropped a Medigap plan to enroll in a Medicare Advantage plan (or Medicare SELECT plan) for the first time and, within the first year and decide to switch back

Note: There may be times when more than one of the situations above applies to you. When this happens, you can choose the guaranteed issue right that gives you the best choice.

What Happens if Your Medicare Supplement Plan Discontinues Your Coverage?

If your insurance provider moves out of your service area, goes bankrupt, or discontinues your coverage for reasons that don't involve you, then:

You can choose a Medigap plan* sold by any insurance provider in your state

You can apply for a Medicare Supplement (Medigap) plan starting 60 days before your coverage ends until 63 days after your coverage has expired

To apply for a plan change with guaranteed issue rights, you must have the following information:

A disenrollment letter from your insurance company

The date your coverage ends

Your name (or the applicant's name) on the documentation

*Note: If you're eligible for Medicare after January 1, 2020, you cannot use guaranteed issue rights to enroll in Medicare Supplement Plan F.

What Happens if Your Employer Plan Ends?

If your employer group health plan or union coverage is ending, you can choose most Medigap plans* sold by any insurance provider in your state. Don't bank on your retirement plan or COBRA creditable coverage

The latest you may apply for a Medigap policy is 63 calendar days after one of the following three events:

The end of your coverage

The date of the notification informing you of the coverage termination (if received)

The date of a denied claim, if it was the only way to determine coverage termination

Note: Under certain conditions, your rights may be extended for 12 months (To learn more about this, talk with one of our advisors

When applying for a Medigap plan, keep a record of the following items:

Copies of any letters, notices, emails, or claim denials that include your name as evidence of your coverage termination

The postmarked envelope these documents came in as proof of the mailing date

You may need to submit some or all of these documents with your Medigap application to prove your guaranteed issue right.

If You Voluntarily Lose Your Group Coverage

If you lose your insurance coverage without canceling it or due to non-payment, it's considered involuntary, and you may be eligible for guaranteed issued rights.

However, if you choose to leave your group coverage voluntarily, keep the following information handy while applying for a Medigap plan:

The date the coverage ends

Documentation from your employer or carrier on their letterhead

Information about whether the coverage was primary or secondary

What Happens if Your Insurance Provider Misleads You?

If an insurance provider misleads you or violates the regulations for Medicare Supplement plans, you may be eligible for guaranteed issue rights to enroll in a new plan.

To claim this, you may have to file a complaint with Medicare, and if your appeal is approved, you'll receive a guaranteed right to enroll in a new plan.

However, you must apply for your new Medigap plan within 63 days of your coverage ending.

How Do Medicare Guaranteed Issue Rights Differ by State?

As a federal program, Medicare allows states to impose additional rules as long as they adhere to the fundamental Medicare standards. Some states have implemented favorable regulations to assist seniors in adjusting their Medigap plans.

Here's a brief on different state-specific guaranteed issue rights.

1. Annual or Continuous Guaranteed Issue Rights

Missouri — Once a year, during your policy anniversary, you can switch to a Medigap plan with similar or lesser benefits. This window of opportunity starts 30 days before your policy anniversary and ends 30 days after.

Washington — Has year-round guaranteed issue rights. You can switch to a similar or lower-benefit plan at any time.

California and Oregon — These states follow the Birthday Rule, which means that you can change your plan up to 30 days before and 30 days after your birthday each year.

Massachusetts — Has a state-specific Medigap Open Enrollment Window from February 1 to March 31 each year.

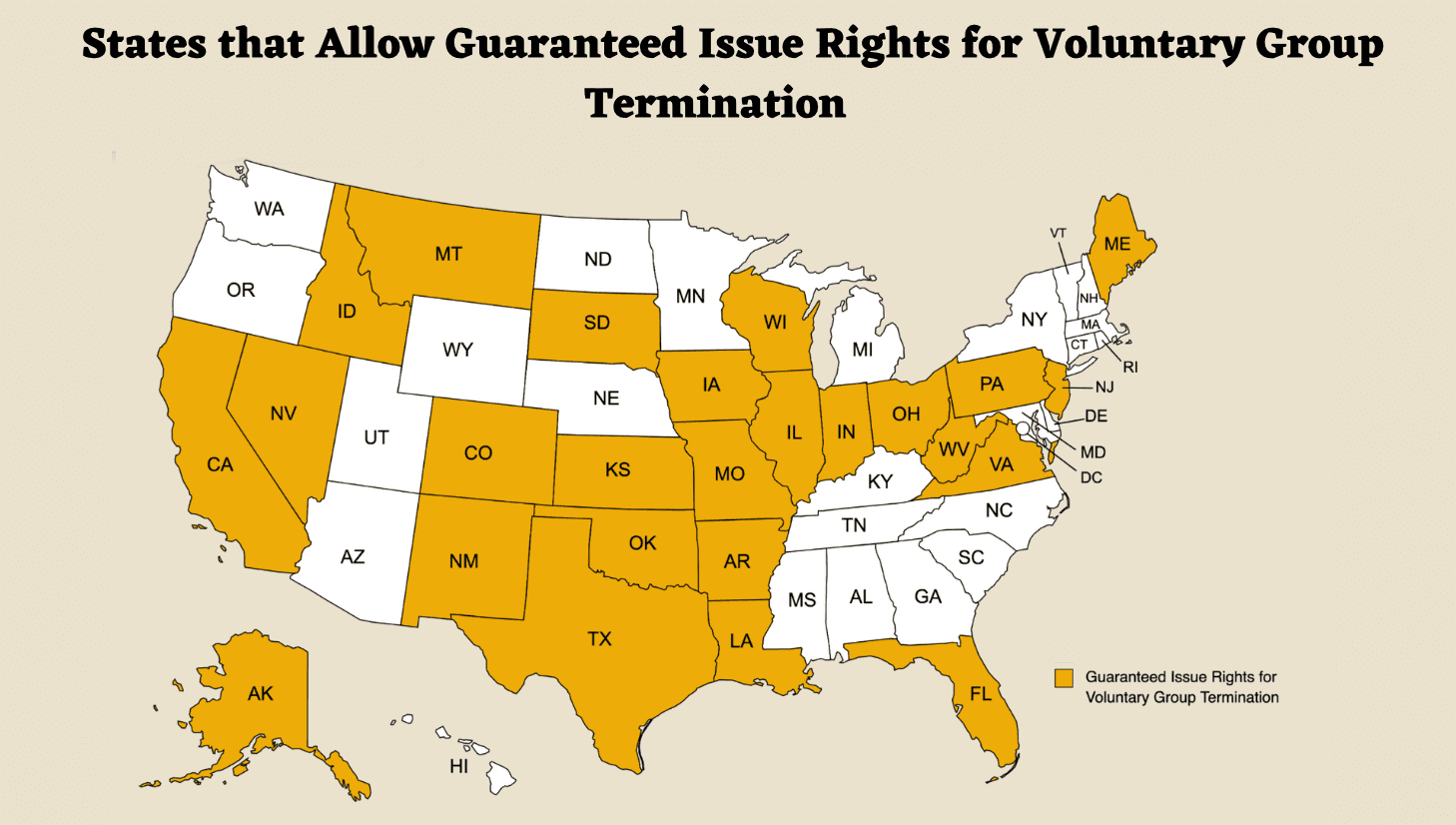

2. Voluntary group termination

In some states, voluntarily terminating a group health plan does not grant guaranteed issue rights. But, some states allow the transition from employer coverage to Medigap using guaranteed issue rights. These states are:

Alaska

Arkansas

California

Colorado

Florida

Idaho

Illinois

Indiana

Iowa

Kansas

Louisiana

Maine

Missouri

Montana

Nevada

New Jersey

New Mexico

Ohio

Oklahoma

Pennsylvania

South Dakota

Texas

Virginia

West Virginia

Wisconsin

State-Specific Medicare Guaranteed Issue Rights for Group Termination

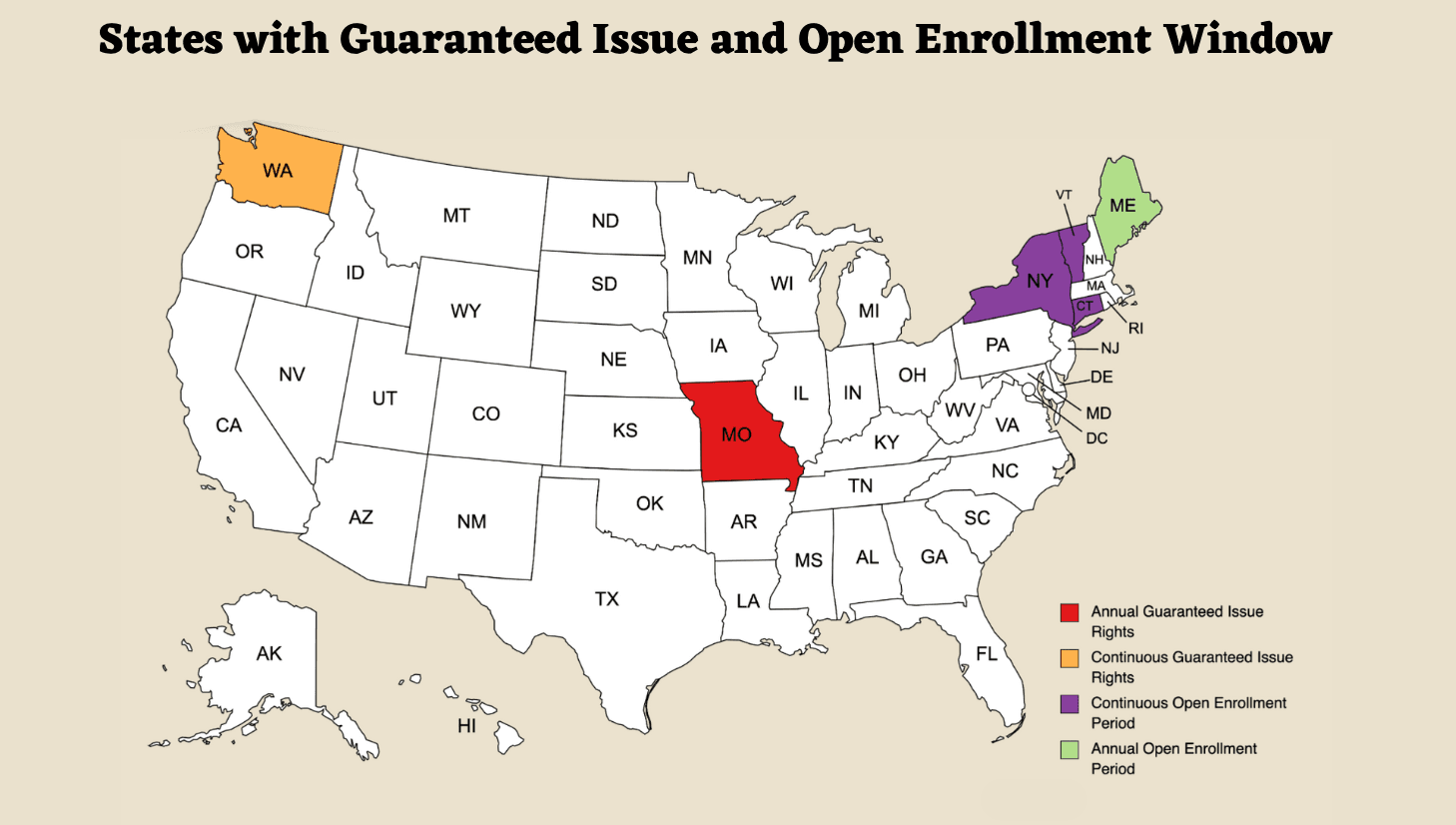

In addition to state-specific guaranteed issue rights, some states also provide continuous or annual open enrollment periods to help Medicare beneficiaries change their plans.

3. Annual or Continuous Open Enrollment Period

Some states allow you to change Medigap plans at any time or at specific times without undergoing medical underwriting. These states are:

Connecticut

New York

Vermont — only for Mutual of Omaha and UnitedHealthcare plans

Maine — Offers Open Enrollment annually in June. You can switch to a similar or lower-benefit plan without medical underwriting during this period

Guaranteed Issue Rights and Open Enrollment Window

What Documents Do You Need When Using Your Guaranteed Issue Rights?

If you're eligible for guaranteed issue rights, you'll need to provide documentation before switching plans.

For a Medigap-to-Medigap policy change, you'll need the following:

A copy of your current Medicare Supplement ID card with your current plan letter and your name

Proof of payment for the last three months that includes your full name

For a Medicare Advantage-to-Supplement policy change, you'll need the following:

Proof of disenrollment

The policy end date

Stay up-to-date with Your State Regulations to Optimize Your Medicare Benefits

Guaranteed Issue rights are important to the Medicare program, allowing you to access essential medical coverage during life events or circumstances that result in the loss of your existing plan.

However, Guaranteed Issue Rights vary among states, with some offering more favorable regulations for seniors and those with disabilities. Learn your state's regulations to make the most of the benefits provided by Medicare.

If you have any questions or need assistance in understanding your guaranteed issue rights, call us at 1-888-376-2028. Our team of experts

Recommended Articles

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

Does Medicare Cover Ketamine Infusion for Depression?

Nov 23, 2022

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Does Medicare Cover Wart Removal?

Jan 17, 2023

What Is Medical Underwriting for Medigap?

Apr 14, 2023

Does Medicare Cover Cardiac Ablation?

Dec 9, 2022

Explaining the Different Enrollment Periods for Medicare

Feb 3, 2023

How Often Can I Change Medicare Plans?

May 5, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Seeing the Value in Fair Square

May 15, 2023

Estimating Prescription Drug Costs

May 25, 2020

Is HIFU Covered by Medicare?

Nov 21, 2022

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

Does Medicare Cover LVAD Surgery?

Nov 30, 2022

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

14 Best Ways to Stay Active in Charlotte

2024 Cost of Living Adjustment

Can Doctors Choose Not to Accept Medicare?

Can I Laminate My Medicare Card?

Costco Pharmacy Partners with Fair Square

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Compounded Medications?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inqovi?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Nexavar?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Allergy Shots?

Does Medicare Require a Referral for Audiology Exams?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Explaining IRMAA on Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Cost?

How to Compare Medigap Plans in 2025

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is the Shingles Vaccine Covered by Medicare?

Medicare & Ozempic

Medicare Consulting Services

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What If I Don't Like My Plan?

What Is a Medicare Advantage POS Plan?

What Is the Medicare Birthday Rule in Nevada?

What You Need to Know About Creditable Coverage

What's the Difference Between HMO and PPO Plans?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare