Medicare has your back

Your sacroiliac joint, or SI Joint, is one of the more overlooked parts of the body that can cause unexpected pain. If you are experiencing pain, an SI joint fusion is one of the more popular new procedures in relieving this pain. The good news is you'll have Medicare coverage if you need it.

Speak with a Medicare Advocate

What is sacroiliac joint dysfunction?

Sacroiliac joint dysfunction is an issue caused by a misalignment of the sacroiliac joints in your lower back. These joints connect your spine and pelvis together, and when they become inflamed or irritated, it can cause pain, stiffness and limited mobility.

What is SI joint fusion surgery?

SI joint fusion is a surgery used to treat chronic pain caused by sacroiliac joint dysfunction. The aim of the surgery is to eliminate movement in the area and provide long-term pain relief. During SI joint fusion, the surgeon will remove damaged bone from the affected area and replace it with a grafting material, such as metal implants or donor bone. In some cases, screws and rods may be used to hold the bones in place.

What are the risks and benefits of SI joint fusion surgery?

SI joint fusion surgery carries some risks, including infection, nerve injury and blood clots. Patients should discuss the risks with their doctor before undergoing this procedure to make sure they understand what they are getting into.

The benefits of SI joint fusion surgery include long-term relief from chronic pain and improved mobility in the area. Many patients who undergo SI joint fusion report a marked improvement in their quality of life.

How does Medicare cover SI joint fusion surgery cost?

Medicare covers SI joint fusion in certain circumstances. Generally speaking, Medicare Part B will provide coverage for SI joint fusion if it is deemed medically necessary by your doctor and is performed by an approved healthcare provider. Medicare will pay 80% of the fee if it's done in an outpatient facility. On average, you can expect to pay $1,728 in out-of-pocket costs, according to Medicare.gov Medicare Supplement Plan G

How to know if you need SI joint fusion surgery?

The best way to know if you need SI joint fusion surgery is to consult with your doctor. Your doctor can help you determine whether or not this procedure is the right option for you and discuss any other treatment options that might be available.

What happens after surgery?

After SI joint fusion surgery, your doctor will likely recommend a period of rest and physical therapy. It may take some time for the area to heal fully; however, many patients report improved mobility and pain relief after undergoing this procedure.

Alternatives to SI joint fusion surgery

SI joint fusion surgery isn't the only option for treating sacroiliac joint dysfunction. Other treatment options may include physical therapy, medications, and lifestyle changes such as diet and exercise. In some cases, these non-surgical treatments can provide significant relief.

Takeaway

SI joint fusion is a surgery used to treat chronic pain caused by sacroiliac joint dysfunction. Medicare Part B typically covers this procedure when it is deemed medically necessary. Before undergoing SI joint fusion, you should talk to your doctor about the risks and benefits of the procedure to see if it's right for you. This content is for informational purposes only. If you have any questions about your Medicare plan, give us a call to speak with a Medicare expert today.

Recommended Articles

Does Medicare Cover Krystexxa?

Nov 18, 2022

How Much Does Xeljanz Cost with Medicare?

Jan 25, 2023

Is the Shingles Vaccine Covered by Medicare?

Nov 17, 2022

Does Medicare Cover Ofev?

Dec 2, 2022

Does Medicare cover Hyoscyamine?

Nov 30, 2022

Does Medicare Cover Cala Trio?

Nov 23, 2022

Does Medicare Cover PTNS?

Dec 9, 2022

Does Medicare Cover Nuedexta?

Nov 30, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

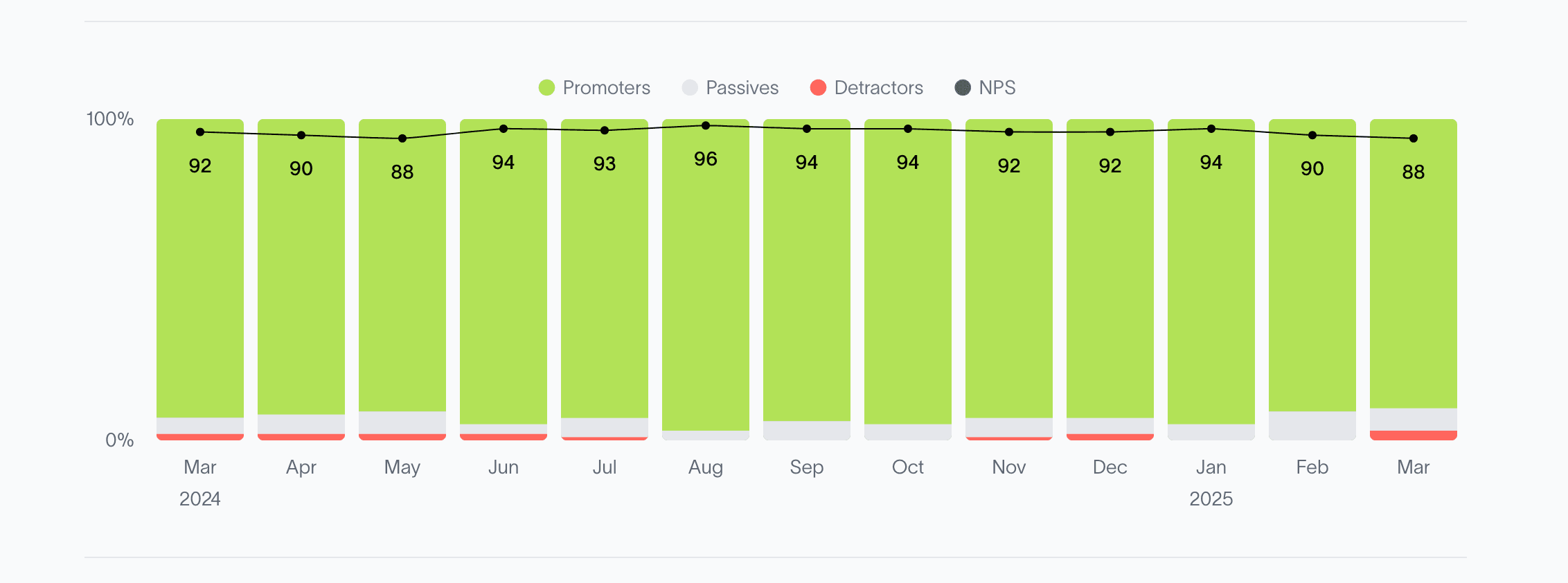

2024 Fair Square NPS Report

Mar 19, 2025

Are Medicare Advantage Plans Bad?

May 5, 2022

How Do Medicare Agents Get Paid?

Apr 12, 2023

What You Need to Know About Creditable Coverage

Jan 18, 2023

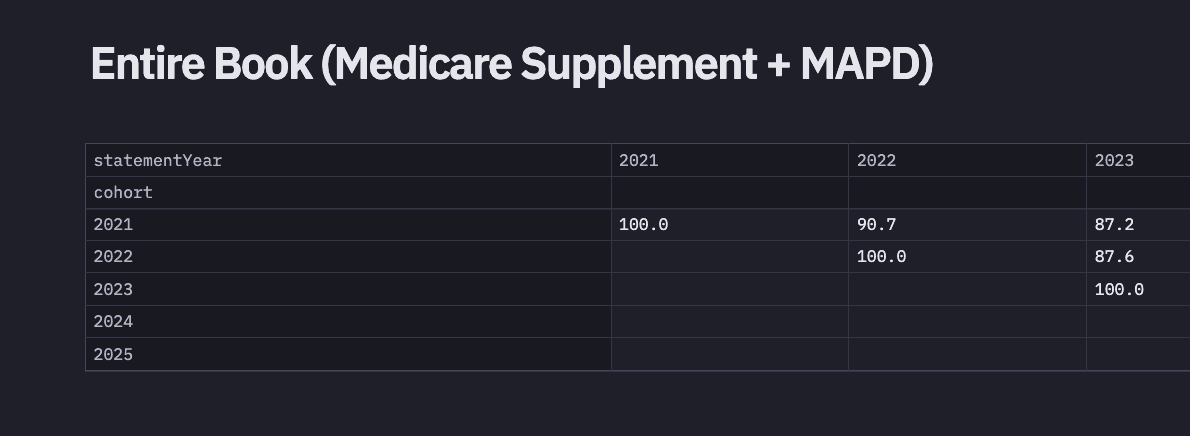

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Pay for Bunion Surgery?

Nov 29, 2022

Do I Need to Renew My Medicare?

Nov 29, 2022

What to Do When Your Doctor Doesn't Take Medicare

Feb 24, 2023

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2025 Medicare Price Changes

Can I Change My Primary Care Provider with an Advantage Plan?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Piqray?

Does Medicare Cover Service Animals?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Urodynamic Testing?

Does Medicare Have Limitations on Hospital Stays?

Explaining IRMAA on Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medigap Premiums Vary?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Apply for Medicare?

How to Compare Medigap Plans in 2025

How to Enroll in Social Security

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Gainswave Covered by Medicare?

Is PAE Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Moving? Here’s What Happens to Your Medicare Coverage

Top 10 Physical Therapy Clinics in San Diego

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Supplement SELECT Plan?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

Which Medigap Policies Provide Coverage for Long-Term Care?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare