Read to see if you can expect to save money this year

The cost of Medicare can fluctuate every year. To get your 2025 budget ready, you will want to know how much your Medicare expenses will change. Some prices have gone up, others have gone down, and there might be potentially massive savings on the cost of insulin. Read on to find out how Medicare is changing in the new year.

Speak with a Medicare Advocate

Part A

We take an in-depth look at the changes to Part A in 2023 here

The Part A Deductible is now $1,676

The copayment for hospital days 61-90 is now $419 per day

For days 21-100 in a Skilled Nursing Facility (SNF), you will be responsible for $209.50 each day

Part B

The Part B Deductible is now $257. With Medicare Supplement Plan G

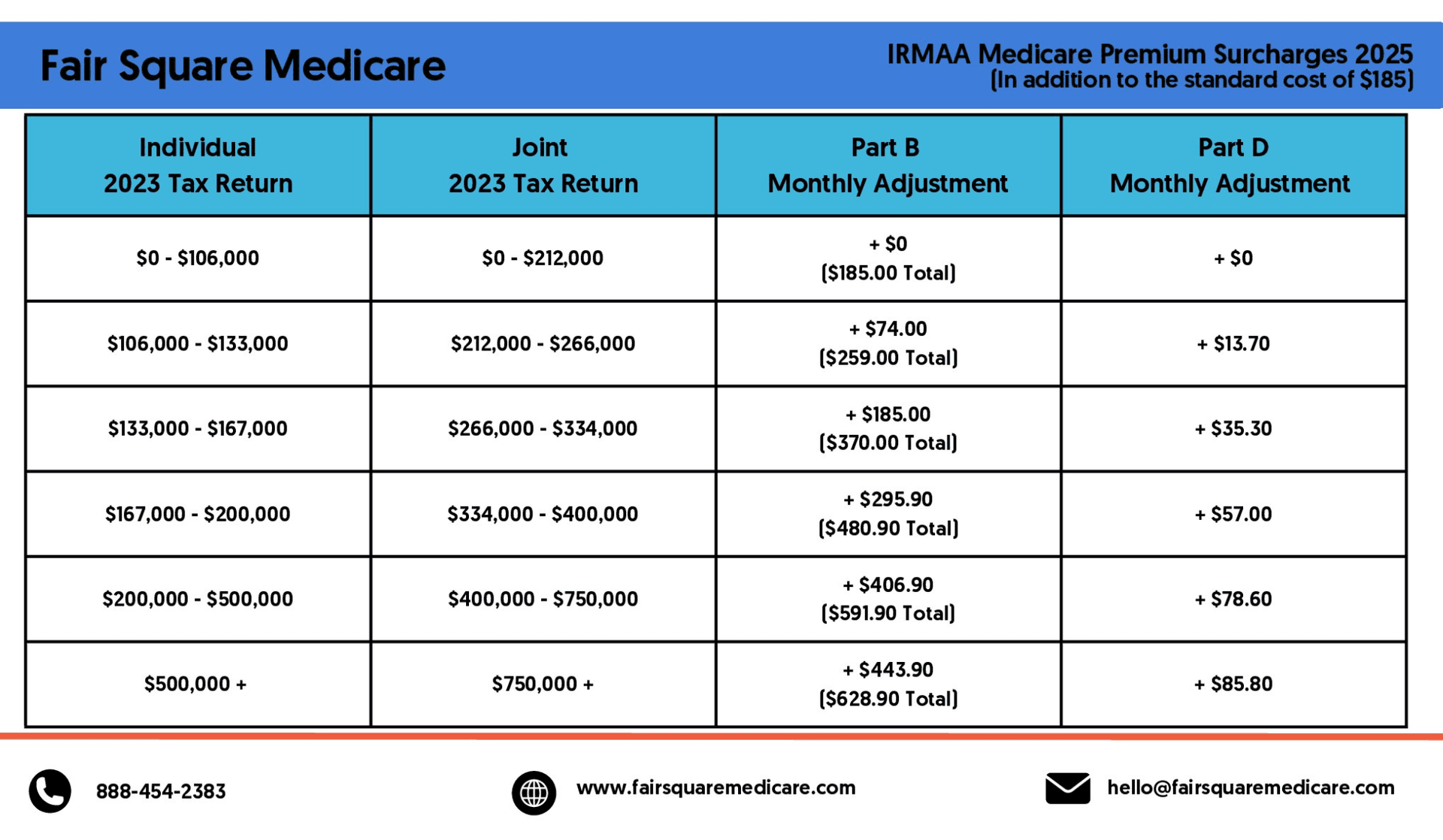

For many people, Medicare Part B typically costs $185 per month. You might be required to pay even more based on your MAGI

If your MAGI is above a certain amount (as per your IRS tax return from 2 years ago), you’ll have to pay the standard premium and an income-related monthly adjustment amount ( IRMAA

The table below shows the cost of Medicare Part B and Part D, depending on your income:

Many of the most significant changes to Part D Prescription Drug plans resulted from government legislation in 2022.

Inflation Reduction Act

Insulin is one of the most expensive life-saving medications available. But starting on January 1, the cost of a month's supply of insulin will be capped at $35.

Also, starting in 2025, there will be better access to vaccines that the Advisory Council on Immunization Practices recommends. That means no more out-of-pocket costs for the shingles vaccine

Conclusion

Medicare premiums and deductibles might change every year. If you are wondering how these changes might affect your budget, our team of experts is ready to help. Fair Square Medicare is here for you.

Recommended Articles

How Much Does Medicare Part A Cost in 2025?

Nov 18, 2022

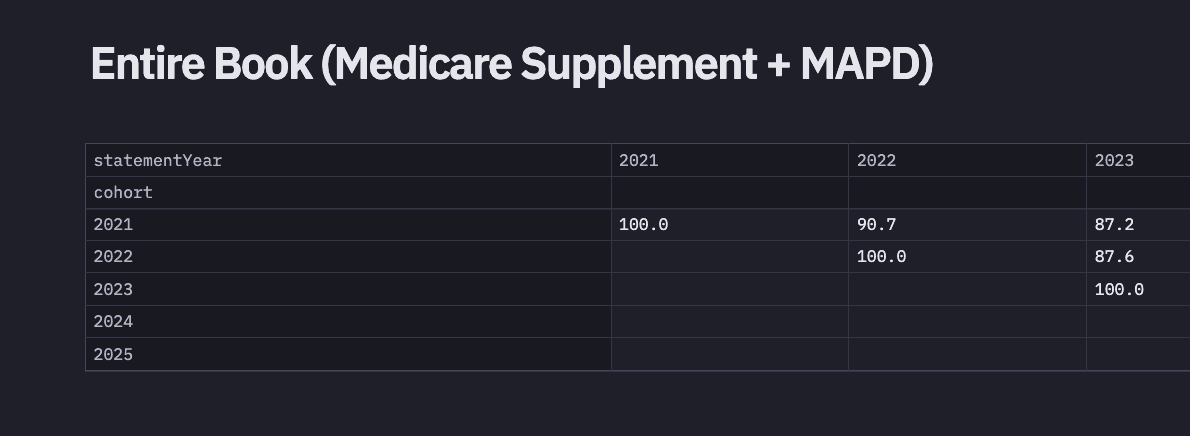

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

Does Medicare Cover Inqovi?

Jan 11, 2023

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Do You Need Books on Medicare?

Apr 6, 2023

Medicare Advantage MSA Plans

May 17, 2023

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

Does Medicare Cover Xiafaxan?

Jan 19, 2023

Does Retiring at Age 62 Make Me Eligible for Medicare?

Jun 16, 2022

Is Botox Covered by Medicare?

Jan 19, 2023

What is the Medicare ICEP?

Apr 7, 2023

How to Compare Medigap Plans in 2025

Jul 14, 2025

The Easiest Call You'll Ever Make

Jun 28, 2023

2024 Cost of Living Adjustment

Nov 13, 2023

Does Medicare Cover Cosmetic Surgery?

Nov 28, 2022

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2025 Medicare Price Changes

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Have Two Primary Care Physicians?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Does Medicare Cover Abortion Services?

Does Medicare Cover Cala Trio?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover COVID Tests?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Ilumya?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Service Animals?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Zilretta?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Does Your Plan Include A Free Gym Membership?

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Health Savings Accounts (HSAs) and Medicare

How Can I Get a Replacement Medicare Card?

How Do Medigap Premiums Vary?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Much Does a Medicare Coach Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Apply for Medicare?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is HIFU Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Deductibles Resetting in 2025

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Moving? Here’s What Happens to Your Medicare Coverage

Should You Work With A Remote Medicare Agent?

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What People Don't Realize About Medicare

What To Do If Your Medicare Advantage Plan Is Discontinued

What You Need to Know About Creditable Coverage

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare