Don't Miss Your Window: Your Guide to Medicare Enrollment Periods

The Medicare enrollment periods are complicated. But it's important to stay informed and up-to-date on the enrollment periods to avoid penalties or coverage gaps.

Speak with a Medicare Advocate

What are the Different Medicare Enrollment Periods?

Medicare End-Stage Renal Disease (ESRD).

If you’re eligible for Medicare, there are several enrollment periods when you can sign up for Medicare

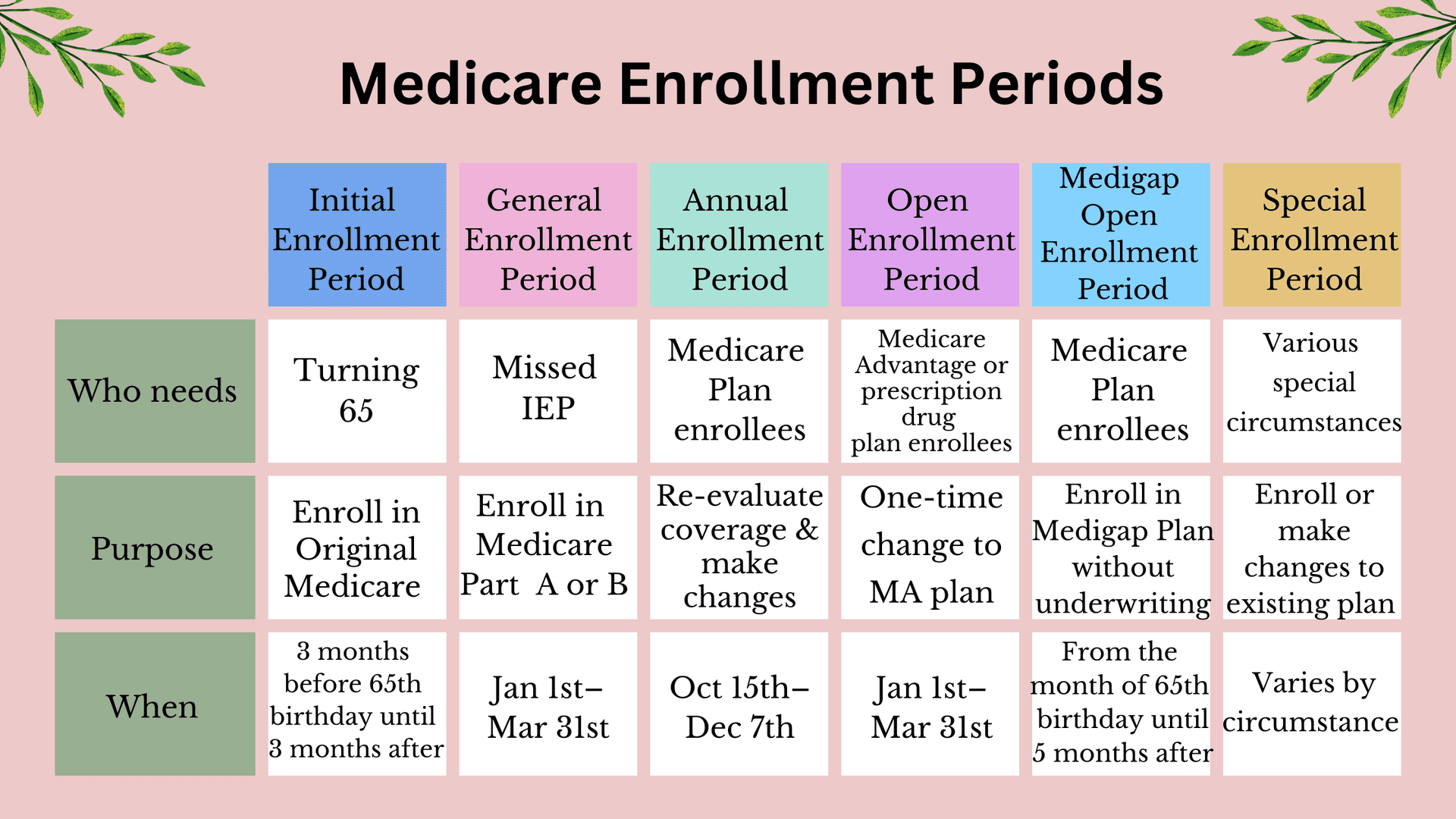

The six different Medicare enrollment periods include the following:

Initial Enrollment Period

General Enrollment Period

Annual Enrollment Period

Open Enrollment Period

Medigap Open Enrollment Period

Special Enrollment Period

Medicare Enrollment Periods

Let's look at each of the enrollment periods.

1. Initial Enrollment Period

If you're about to turn 65 and are newly eligible for Medicare, this is your gateway to start receiving your Medicare benefits. If you have a disability, end-stage renal disease (ESRD) or ALS

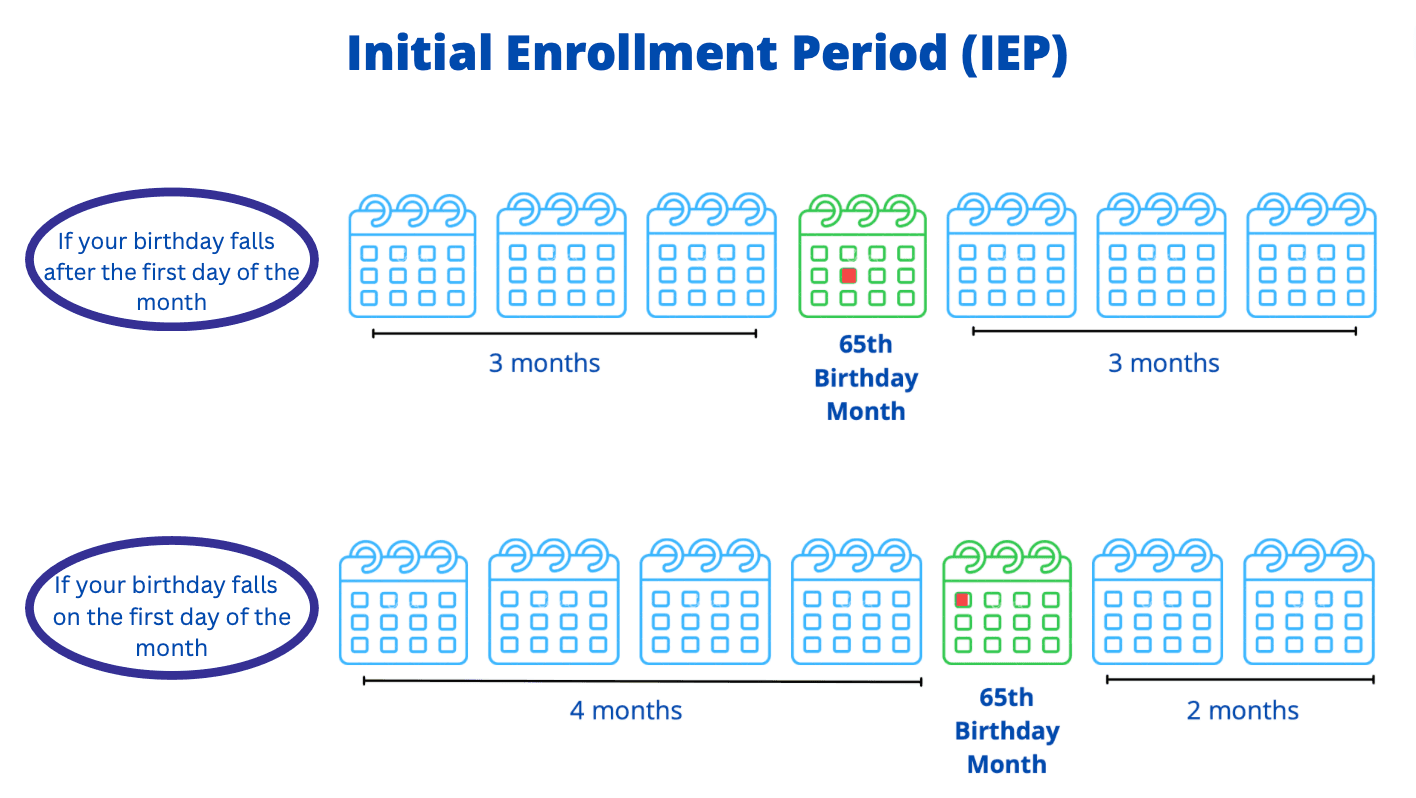

The Initial Enrollment Period (IEP) is a seven-month window that enables you to enroll in Medicare if you're about to turn 65, still working, and not yet getting social security or railroad benefits.

If you're already receiving social security or railroad benefits, you'll be automatically enrolled in Medicare Parts A and B.

The IEP depends on your date of birth

If your birthday falls on the first of the month, it begins 4 months before your birth month and extends until 2 months after your birth month; otherwise...

It begins 3 months before your birth month and extends until 3 months after your birth month

For example, if your birthday falls in February, your IEP starts in November and ends in May. But if your birthday is on the 1st of February, your IEP begins in October and ends in April.

During your IEP, you can:

Enroll in Original Medicare (Part A and Part B)

Enroll in Medicare Part D (Medicare prescription drug plan)

Enroll in Medicare Part C (Medicare Advantage Plan)

Failing to enroll during this 7-month Initial Enrollment Period may result in a monthly late enrollment penalty for as long as you have Part B coverage. In addition, you may incur a Part A penalty if you have to pay a Part A premium.

Initial Enrollment Period

2. General Enrollment Period

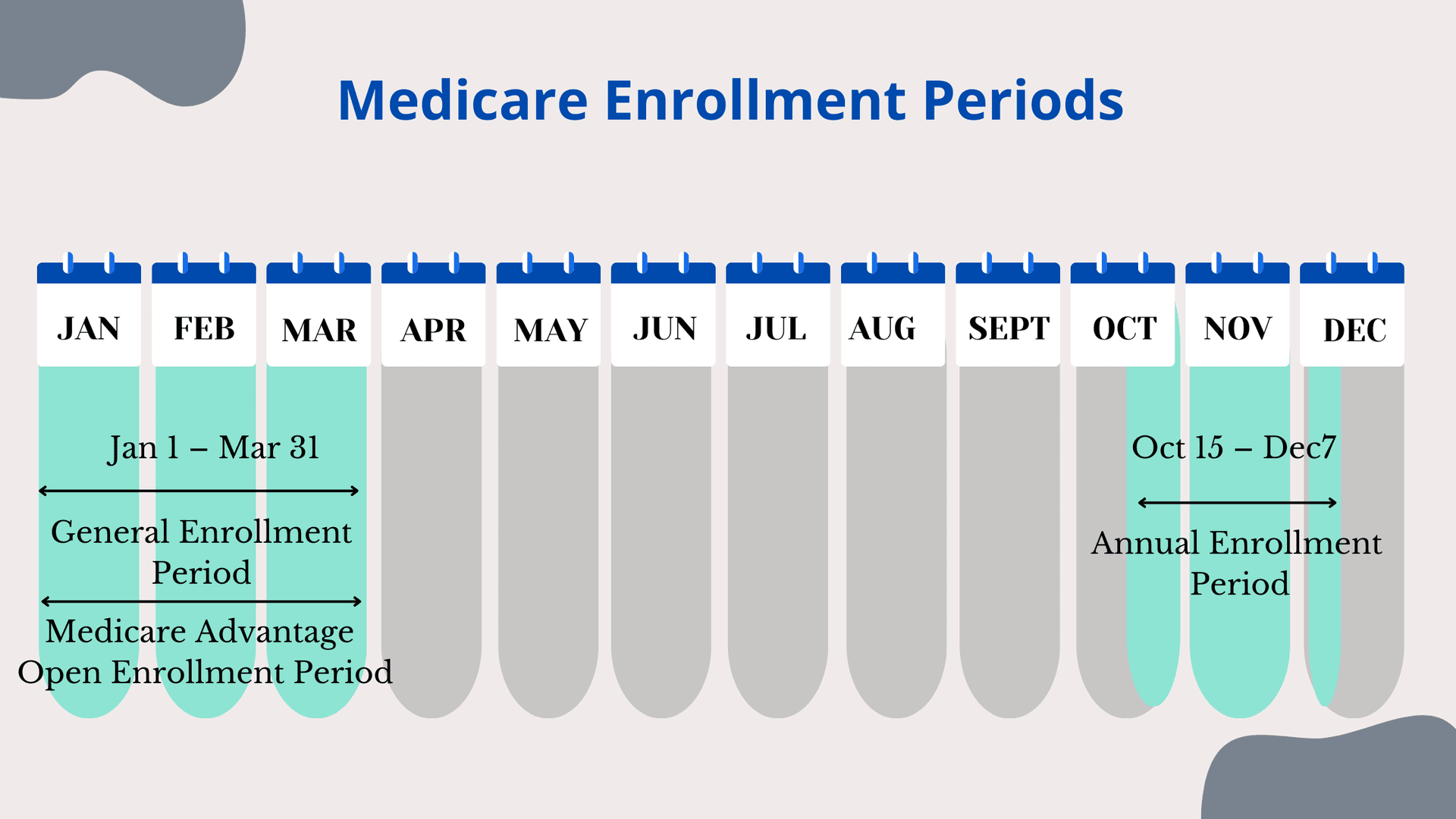

The General Enrollment Period runs from January 1st to March 31st and is the time you can enroll in Medicare Part A and B if:

You missed enrolling in Medicare during your IEP

You don't qualify for a Special Enrollment Period

If you're enrolling in Medicare during the General Enrollment Period, your coverage will begin the following month after you sign-up (Starting January 1, 2023).

You may incur late penalties for the duration of your enrollment in Medicare if you don't enroll in time. So, in addition to paying your regular premiums for Part B (and Part A, if applicable), you'll also have to pay a late penalty as long as you remain enrolled in Medicare.

3. Annual Enrollment Period

If you're unhappy with your current plan, you can change your existing Medicare coverage during the Annual Enrollment Period (AEP)

During this period, you can:

Switch from Original Medicare to a Medicare Advantage Plan — or vice versa

Switch from one Medicare Advantage Plan to another Medicare Advantage Plan

Switch from one Prescription Drug Plan to another

Enroll in Medicare Part D

Unenroll from a Prescription Drug Plan

If you switch your existing plan or enroll in a new plan during the AEP, your coverage will begin on January 1st.

If you're happy with your current plan, your plan will automatically renew on January 1st.

As a Fair Square Medicare client, you can rest assured that we will review your coverage and costs yearly during AEP to ensure you're not paying too much.

4. Open Enrollment Period

If you're currently enrolled in a Medicare Advantage Plan

During the OEP, you can:

Switch from one Medicare Advantage Plan to another (with or without drug coverage)

Unenroll from your Medicare Advantage Plan and return to Original Medicare

Enroll in a prescription drug or Medicare Part D plan if you're returning to Original Medicare

But, during this period, you can't:

Switch from Original Medicare to a Medicare Advantage Plan

Join a Medicare drug plan if you're in Original Medicare

Switch from one Medicare drug plan to another if you're in Original Medicare

If you make any changes to your Medicare coverage during the OEP, the new benefits will begin the following month.

Note: If you enrolled in a Medicare Advantage Plan during your IEP, you can switch to another Medicare Advantage Plan

General, Open and Annual Enrollment Periods

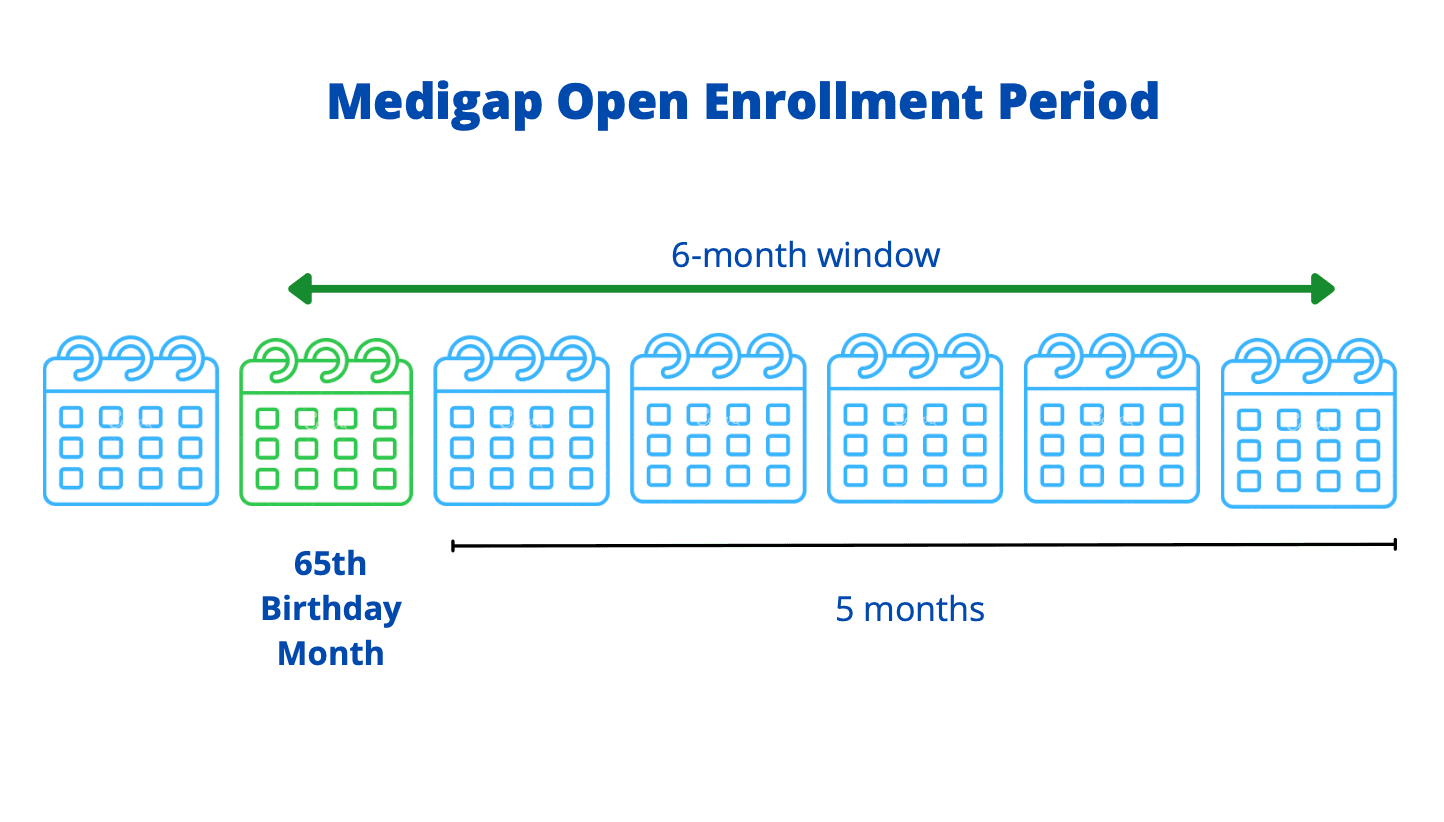

5. Medigap Open Enrollment Period

If you plan to supplement your Original Medicare coverage with a Supplemental Plan or a Medigap Plan

The Medigap Open Enrollment Period is a 6-month window that starts from the month you turn 65 and have Medicare Part B and ends 5 months after your birth month. For example, if your 65th birthday falls in February, your Medigap Open Enrollment Period begins in February and extends until July.

During the Medigap Open Enrollment Period, you'll typically get better pricing and a wider choice of Medigap plans, regardless of your health status. You can purchase any plan offered in your state without undergoing medical underwriting.

Note: if you choose to enroll in a Medigap plan outside your Medigap Open enrollment period, insurance companies may use medical underwriting to decide whether to accept your application (and how much to charge you for the plan) unless you have guaranteed issue rights

Medigap Open Enrollment Period

6. Special Enrollment Period

Medicare beneficiaries may be able to make changes to their existing Medicare health and drug coverage outside the regular enrollment periods if they qualify for the Special Enrollment Period.

You're eligible for the Special Enrollment Period if:

You move to a different location

You lose your current coverage

You have a chance to get other coverage

Your plan changes its contract with Medicare

The state you live in grants SEPs

During the Special Enrollment Period, you can join, switch or drop a Medicare Advantage Plan or a Prescription Drug Plan.

Medicare Enrollment Periods Are Complicated

Understanding different Medicare enrollment periods helps you make informed decisions about your healthcare coverage, so you have the peace of mind that comes with knowing you're covered. Taking advantage of your Medigap Open Enrollment Period allows you to choose any plan, even if you have pre-existing health conditions.

Failure to enroll in Original Medicare or a prescription drug plan at the right time can result in unnecessary penalties.

Fair Square Medicare

Recommended Articles

Does Medicare Cover Hearing Aids?

Nov 9, 2022

Does Medicare Cover Mental Health?

Oct 12, 2022

Medicare Consulting Services

Apr 3, 2023

The Easiest Call You'll Ever Make

Jun 28, 2023

Does Medicare Cover Orthodontic Care?

Nov 18, 2022

Does Medicare Cover Piqray?

Dec 2, 2022

How Often Can I Change Medicare Plans?

May 5, 2023

Does Medicare Cover Bladder Sling Surgery?

Jan 11, 2023

Does Medicare Cover Ozempic?

Mar 28, 2023

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Does Medicare Cover Physicals & Blood Work?

Feb 1, 2024

Does Medicare Have Limitations on Hospital Stays?

Mar 15, 2024

Does Medicare Cover Exercise Physiology?

Jan 11, 2023

Does Medicare Cover Home Heart Monitors?

Dec 1, 2022

Does Medicare Cover COVID Tests?

Dec 21, 2022

How Your Employer Insurance and Medicare Work Together

Sep 27, 2022

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

20 Questions to Ask Your Medicare Agent

2025 Medicare Price Changes

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Boniva?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Geri Chairs?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Funeral Expenses?

Estimating Prescription Drug Costs

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Does Medicare Pay for Emergency Room Visits?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does Medicare Part A Cost in 2025?

How Much Does Xeljanz Cost with Medicare?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Medicare Advantage Plans for Disabled People Under 65

Medicare Deductibles Resetting in 2025

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Supplement Plans for Low-Income Seniors

Plan G vs. Plan N

Should You Work With A Remote Medicare Agent?

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What is a Medicare Beneficiary Ombudsman?

What is Plan J?

What is the 8-Minute Rule on Medicare?

What is the Medicare ICEP?

What People Don't Realize About Medicare

What to Do When Your Doctor Doesn't Take Medicare

What to Do When Your Doctor Leaves Your Network

What's the Deal with Flex Cards?

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare