Paying more than you expected? Let's talk it through

When signing up for Medicare, you might see a higher monthly bill than expected. Depending on your income, you could pay a higher share of Medicare. This surcharge is known as IRMAA, and we are here to answer any questions you have on what it means for your budget.

Speak with a Medicare Advocate

Introducing IRMAA and its purpose

Medicare Part B and Part D provide important coverage for many beneficiaries, but higher-income individuals may be required to pay an additional premium known as the Income-Related Monthly Adjustment Amount (IRMAA). The purpose of IRMAA is to ensure that those with higher incomes pay a larger share of their Medicare costs.

Who is affected by IRMAA and how is it calculated?

IRMAA is based on a beneficiary's modified adjusted gross income (MAGI), which includes any taxable Social Security, Railroad Retirement benefits, and other types of income. It is determined by the Centers for Medicare & Medicaid Services (CMS) each year and typically applies to individuals with incomes above certain thresholds.

How is IRMAA applied?

IRMAA is typically deducted from a beneficiary's Social Security benefits. However, suppose a beneficiary does not receive Social Security benefits, or their income exceeds the threshold set by CMS. In that case, they may be required to make an additional payment to cover the IRMAA. This amount is then applied to their Medicare Part B and/or Part D premiums.

How does the Social Security Administration determine if someone needs to pay an additional premium for Medicare Part B or Part D coverage?

The Social Security Administration uses the individual's modified adjusted gross income (MAGI) to determine if they must pay an additional premium for Medicare Part B or Part D coverage. MAGI includes any taxable Social Security, Railroad Retirement benefits, and other types of income reported on tax returns.

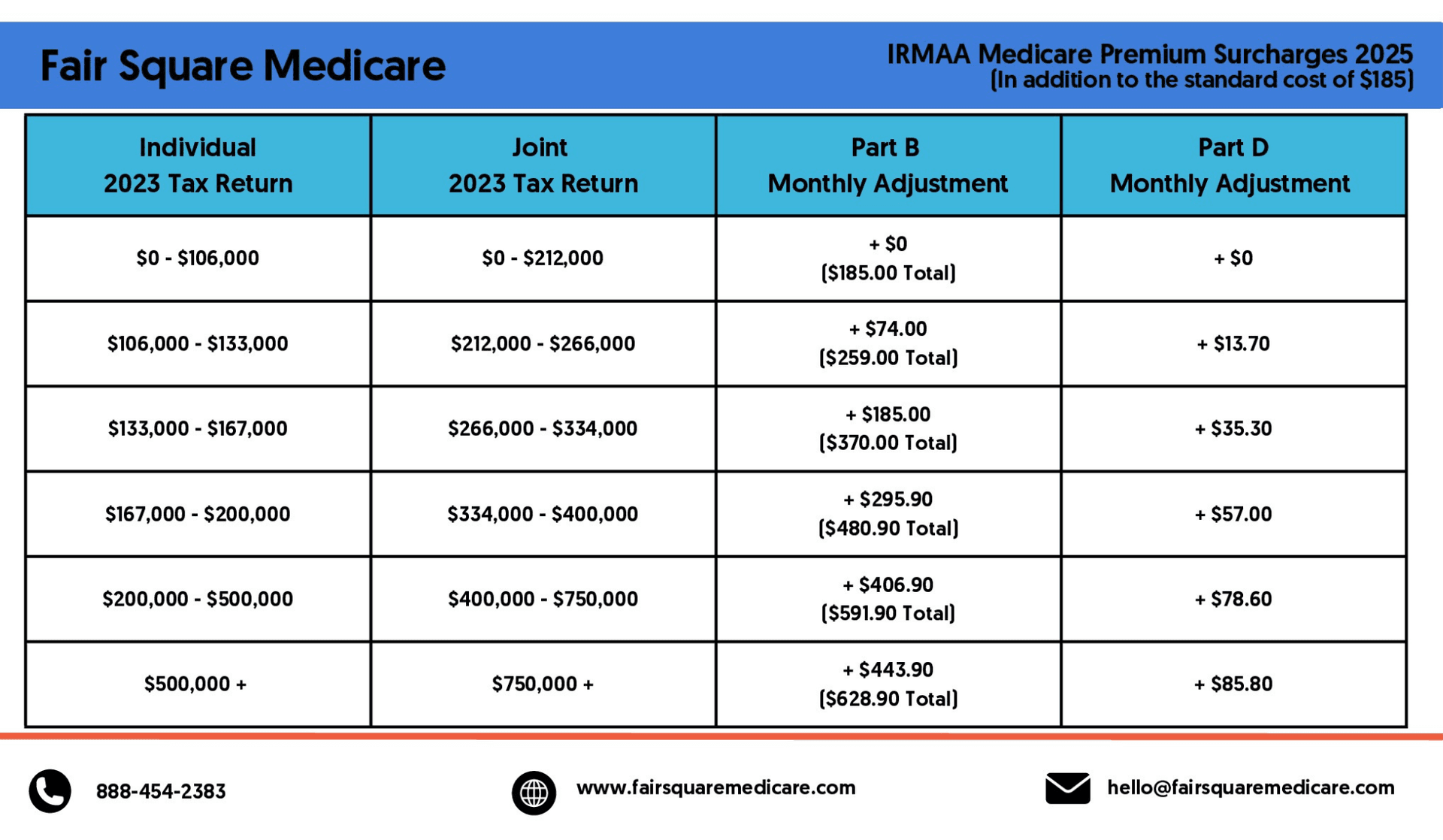

What are the income thresholds that trigger IRMAA payments?

The MAGI used to calculate IRMAA is based on prior-prior year taxes. See the charts below for the income thresholds in 2025, based on your 2023 taxes.

Here's the Part B and Part D breakdown:

How can beneficiaries appeal their IRMAA determination?

If a beneficiary disagrees with their IRMAA determination, they can file an appeal. The process involves submitting documents to support lower income or filing status and/or providing proof of certain financial exemptions such as institutionalization or disability. It is important to note that the appeal must be filed within 60 days from the date on the letter received from the Social Security Administration. For more information on the appeals process, please visit the Medicare website

Tips on reducing your Medicare premiums with IRMAA in mind

If your income is above the threshold for IRMAA and you want to minimize your out-of-pocket expenses, there are a few tips that may help reduce your Medicare premiums. First, consider switching to an Advantage plan if available in your area. These plans typically offer lower premiums and may be more cost-effective than Original Medicare. Additionally, consider speaking to a tax professional about ways to lower your taxable income so you can avoid or reduce IRMAA payments. Finally, if you are enrolled in Medicare Part D coverage, compare prices among plans to find the one with the lowest premium and best drug coverage.

Questions to ask when considering a Medicare plan with higher premiums due to IRMAA

If your income is above the IRMAA threshold and you are considering a Medicare plan with higher premiums due to IRMAA, here are some important questions to ask:

What additional coverage or services does this plan offer that would be beneficial?

Will my out-of-pocket costs be lower if I switch to this plan?

Are there any additional costs associated with the plan that I should be aware of?

Is it possible to switch plans if I decide this one is not right for me?

By asking these questions, you will be better informed when making your decision, so you can find a Medicare plan that meets your needs.

Conclusion

IRMAA is an additional premium that some Medicare beneficiaries are required to pay for their Part B and/or Part D plans to ensure those with higher incomes are paying a larger portion of their healthcare costs. If you are concerned about paying beyond your budget for your Medicare plan, talk to an expert at Fair Square Medicare. Our team of experts can help you find the best plan for your unique situation.

Recommended Articles

Do You Need Books on Medicare?

Apr 6, 2023

Explaining the Different Enrollment Periods for Medicare

Feb 3, 2023

Does Medicare Cover LVAD Surgery?

Nov 30, 2022

How Much Does a Pacemaker Cost with Medicare?

Nov 21, 2022

Does Medicare Cover Fosamax?

Nov 30, 2022

Does Medicare Cover Boniva?

Nov 29, 2022

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Health Savings Accounts (HSAs) and Medicare

Jan 24, 2024

Does Medicare Pay for Bunion Surgery?

Nov 29, 2022

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

Does Medicare Cover Geri Chairs?

Dec 7, 2022

Is the Shingles Vaccine Covered by Medicare?

Nov 17, 2022

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Does Medicare Cover Home Heart Monitors?

Dec 1, 2022

What's the Difference Between HMO and PPO Plans?

Dec 1, 2022

Does Medicare Cover Medical Marijuana?

Jan 6, 2023

Medicare Advantage Plans for Disabled People Under 65

Mar 24, 2023

Does Medicare Cover Jakafi?

Dec 12, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Have Two Primary Care Physicians?

Can I switch From Medicare Advantage to Medigap?

Do All Hospitals Accept Medicare Advantage Plans?

Does Medicare Cover Abortion Services?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover Inqovi?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Nuedexta?

Does Medicare Cover PTNS?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Wart Removal?

Does Medicare Pay for Antivenom?

Does Your Plan Include A Free Gym Membership?

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Does Medicare Cover Colonoscopies?

How Much Does Medicare Cost?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is PAE Covered by Medicare?

Medicare & Ozempic

Medicare Advantage MSA Plans

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Plan G vs. Plan N

Saving Money with Alternative Pharmacies & Discount Programs

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What Is the Medicare Birthday Rule in Nevada?

What To Do If Your Medicare Advantage Plan Is Discontinued

What You Need to Know About Creditable Coverage

What's the Deal with Flex Cards?

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare