If you want to make an appeal or lodge a complaint, talk to your MBO

At Fair Square, we want to give you the tools to be your own best advocate. This advocacy starts when you pick your best-fit Medicare plan with a licensed Medicare advisor at Fair Square

Speak with a Medicare Advocate

If you need to file a complaint or grievance with Medicare, that is where the Ombudsman comes in. In this blog post, we will talk through the steps you need to take if you’re looking to file a complaint with your local Medicare office. Without knowing how to levy a complaint, you might find yourself missing out on coverage or adequate financial assistance.

What is a Medicare Ombudsman?

A Medicare Beneficiary Ombudsman, or MBO, is a person within the Centers for Medicare and Medicaid Services ( CMS

If you are interested in seeking an appeal for a Medicare decision related to services or coverage, then the MBO can help you file your grievance. While they are employed by the CMS, they work within specific localities and serve as an independent advocate. So you don’t need to be concerned about the MBO siding with Medicare over whatever issue you raise about your healthcare.

Some of the range of services your local MBO might offer include:

Helping Medicare beneficiaries navigate the system and respond to issues related to coverage, claims, and billing

Providing information about your Medicare benefits, rights, and protections

Helping beneficiaries file complaints and appeals related to their Medicare services and coverage

Educating Medicare beneficiaries about fraud and abuse in Medicare, including strategies about how to protect yourself

Your local MBO might also work to identify and address systemic issues that arise within Medicare

Why would I need to contact a Medicare Ombudsman?

If you are unsatisfied with your quality of care, you might contact your MBO. Original Medicare has a standard of care that needs to be upheld with each plan. Private insurance companies administer both Medicare Supplement and Medicare Advantage plans, but they need to maintain the government's standard of Medicare.

You might need to contact the Medicare Ombudsman if you have any issues or complaints about your Medicare coverage or services. Here are some situations where beneficiaries might need to contact Medicare Ombudsman:

You are having difficulty accessing the healthcare services or treatments you need.

You are experiencing delays or denials in getting Medicare coverage for a particular service or treatment.

You are dissatisfied with the quality of care you are receiving from a healthcare provider or facility.

You have concerns about the accuracy of your Medicare claims or bills.

You are having difficulty navigating the Medicare system and need assistance with enrollment or understanding your benefits.

Here are some common issues and complaints that the Medicare Ombudsman can help with:

Denials of coverage for medically necessary services or treatments

Delays or denials in receiving prescription drugs or durable medical equipment

Billing errors or disputes

Quality of care issues, such as hospital infections or medical errors

Issues related to Medicare Advantage or prescription drug plans

Complaints about Medicare marketing or enrollment practices

Difficulty navigating the Medicare system or understanding your benefits

The Medicare Ombudsman is available to help beneficiaries resolve these issues and can provide information, support, and advocacy. They can also guide the Medicare complaint and appeal process and help you understand your rights and protections under Medicare.

How to contact a Medicare Ombudsman

If you want to contact your Medicare Beneficiary Ombudsman, you can call 1-800-MEDICARE (1-800-633-4227), TTY users should call 1-877-486-2048. Once you reach the representative, ask them to send your inquiry to the MBO. According to the Medicare.gov website, you can also provide feedback to the Ombudsman to help improve your experiences.

You might also contact your Medicare Beneficiary Ombudsman locally through your state’s government website. Your local State Health Insurance Assistance Program (SHIP) can be viewed on this website.

The CMS website

If you want to email an Ombudsman directly, you can at the following email: Medicareombudsman@cms.hhs.gov

What to expect when contacting a Medicare Ombudsman

When contacting a Medicare Ombudsman, beneficiaries can expect to receive information, support, and assistance with their issues or complaints related to Medicare. Here is an overview of what beneficiaries can expect when contacting a Medicare Ombudsman:

Initial Contact: When you first contact the Medicare Ombudsman, you might speak with an intake specialist who will listen to your concerns and provide you with information and support. They may ask you questions to better understand your issue or complaint and gather any necessary information to help you.

Case Review: Once your case has been assigned to a Medicare Ombudsman, they will review your case and work with you to develop a plan for resolving your issue or complaint. They will explain the steps involved in the process and provide you with information about your rights and protections under Medicare.

Investigation and Advocacy: The Medicare Ombudsman will investigate your issue or complaint, gather any necessary information, and work with you to develop a plan for resolving the issue. They will advocate on your behalf and work with Medicare and healthcare providers to find a resolution that is fair and equitable.

Follow-Up: The Medicare Ombudsman will keep you informed of the progress of your case and any updates or developments. They will also follow up with you to ensure that the issue has been resolved to your satisfaction.

The process and timeline for resolving issues or complaints may vary depending on the nature of the issue and the complexity of the case. Some cases may be resolved quickly, while others may require more investigation and advocacy. The Medicare Ombudsman will work with you to set realistic expectations and keep you informed throughout the process. They will also provide you with information about the Medicare complaint and appeal process if necessary.

Tips for preparing to contact Medicare Ombudsman

Preparing to contact the Medicare Ombudsman can help ensure that you make the most of your interaction and get the support and assistance you need. Here are some tips for preparing to contact the Medicare Ombudsman:

Gather information: Before contacting the Medicare Ombudsman, gather relevant information about your issue, such as medical bills or correspondence from your healthcare providers. Having this information on hand can help the Ombudsman better understand your situation and advocate on your behalf.

Be proactive: The Medicare Ombudsman is there to assist you, but it's important to be proactive in your approach. No one will be a better advocate for you than yourself. If you have questions or concerns about the process or timeline, ask for clarification. If you think there may be additional information that could be helpful, offer to provide it. Being proactive can help ensure that your issue or complaint is resolved as quickly and efficiently as possible.

Take notes: Keep a record of all correspondence and interactions with the Medicare Ombudsman, including dates, times, and the names of the people you speak with. This can help you keep track of the progress of your case and provide a reference in case you need to follow up.

Follow up: After your interaction with the Medicare Ombudsman, follow up if necessary. If you have additional questions or concerns, don't hesitate to contact them again. Keep in mind that the Ombudsman is there to assist you, and they want to ensure that your issue or complaint is resolved to your satisfaction.

By preparing in advance and being proactive in your approach, you can make the most of your interaction with the Medicare Ombudsman and get the support and assistance you need.

Conclusion

A Medicare Beneficiary Ombudsman can be a valuable resource for Medicare beneficiaries who feel their rights have been violated or have issues with their Medicare coverage or services. The Ombudsman serves as an independent advocate and can assist with filing complaints and appeals related to Medicare services and coverage. If you need to contact your local Medicare Beneficiary Ombudsman, you can call 1-800-MEDICARE, TTY users should call 1-877-486-2048 or contact them through your state government website.

If you need assistance finding the right Medicare plan or have any questions, please call Fair Square

Recommended Articles

What's the Difference Between HMO and PPO Plans?

Dec 1, 2022

Can I Choose Marketplace Coverage Instead of Medicare?

May 2, 2023

What to Do When Your Doctor Doesn't Take Medicare

Feb 24, 2023

Does Medicare cover Deviated Septum Surgery?

Nov 18, 2022

Which Medigap Policies Provide Coverage for Long-Term Care?

Sep 16, 2022

13 Best Ways for Seniors to Stay Active in Phoenix

Mar 6, 2023

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

What is Plan J?

Jul 14, 2025

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

How to Enroll in Social Security

Apr 28, 2023

Does Medicare Cover Abortion Services?

Dec 13, 2022

Does Medicare Cover Chiropractic Visits?

Dec 22, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

Seeing the Value in Fair Square

May 15, 2023

Does Medicare Cover Cosmetic Surgery?

Nov 28, 2022

Denied Coverage? What to Do When Your Carrier Says No

Jul 15, 2025

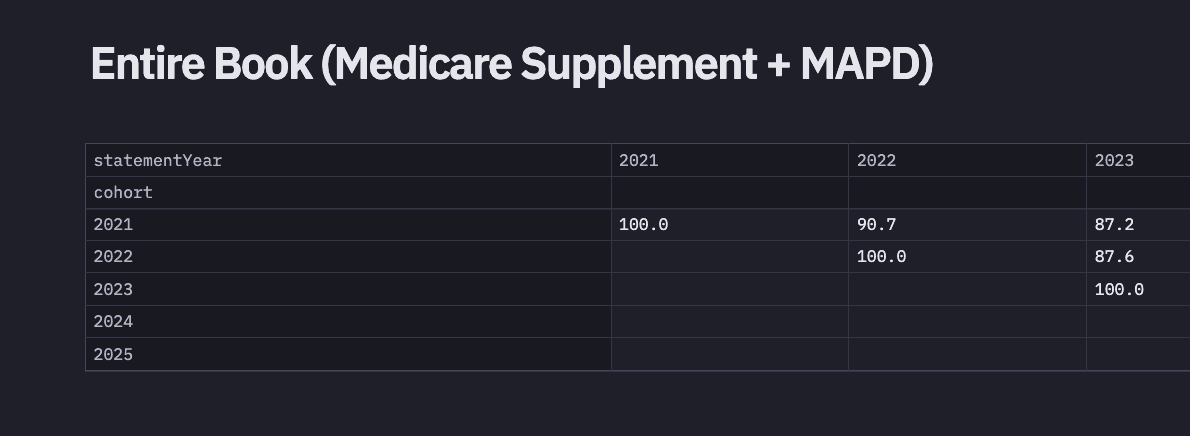

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Medicare Supplement Plans for Low-Income Seniors

Mar 23, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

15 Best Ways for Seniors to Stay Active in Denver

2024 Cost of Living Adjustment

Are Medicare Advantage Plans Bad?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Comparing All Medigap Plans | Chart Updated for 2025

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Ofev?

Does Medicare Cover Ozempic?

Does Medicare Cover Piqray?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Varicose Vein Treatment?

Does Your Plan Include A Free Gym Membership?

Estimating Prescription Drug Costs

Explaining IRMAA on Medicare

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How is Medicare Changing in 2025?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Balloon Sinuplasty Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Gainswave Covered by Medicare?

Medicare Savings Programs in Kansas

Plan G vs. Plan N

The Easiest Call You'll Ever Make

What is a Medicare Beneficiary Ombudsman?

What Is the Medicare Birthday Rule in Nevada?

What People Don't Realize About Medicare

What You Need to Know About Creditable Coverage

When Can You Change Medicare Supplement Plans?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare