Is a Medicare Supplement SELECT Plan Right For You?

Enrolling in Medicare

Speak with a Medicare Advocate

Fortunately, Medicare Supplement plans, as the name suggests, are designed to supplement Original Medicare and help cover those additional expenses.

But what is a Medicare Supplement SELECT plan?

Let's find out and help you determine whether it's the right choice for your healthcare needs.

What Is a Medicare Supplement Plan?

A Medicare Supplement Plan Medigap plan

Medicare Supplement Plans are sold by private insurance companies and help fill the "gaps" in Original Medicare. They help cover costs such as:

Part A deductible

Part A coinsurance or copayment

Part B coinsurance or copayment

Blood transfusion (first 3 pints)

Hospital costs for up to 365 days after Original Medicare coverage

Foreign Travel Insurance

SNF coinsurance

Medicare Supplement Plans only work alongside Original Medicare (Parts A and B). They cannot be used with Medicare Advantage Plans

Additionally, you must already be enrolled in Medicare Parts A and B to be eligible for a Medicare Supplement Plan.

One of the benefits of Medigap plans is that they do not have network restrictions, allowing you to receive care from any healthcare provider or hospital that accepts Medicare.

There are ten standardized Medicare Supplement Plans, identified as Plans A, B, C, D, F, G, K, L, M, and N. Each plan offers varying levels of coverage to suit different healthcare needs. Some Medigap plans may also provide added benefits for emergency medical care while traveling outside the United States.

What Is a Medicare Supplement SELECT Plan? How Does It Work?

A Medicare Supplement SELECT Plan, or Medicare SELECT plan, is a type of Medicare Supplement Plan

However, it has network limitations, so you must use specific doctors, hospitals, and other healthcare providers in the plan's network to receive full coverage benefits (except in an emergency). You may be responsible for some or all associated costs if you receive care from a healthcare provider outside the network.

In addition, you may also need a referral from your primary care physician

For example, Medicare Supplement SELECT Plan G covers the same out-of-pocket costs as Medicare Supplement Plan G but comes with network restrictions and may require referrals.

Are Medicare Supplement SELECT Plans Available Everywhere?

The Medicare SELECT option can be available in any of the ten standardized Medigap plans. However, not all insurance companies offer all these SELECT plans. In addition, their availability may also vary depending on the region you reside in.

Suppose you're interested in a Medicare SELECT plan. In that case, you'll need to check if it's available in your state and if the insurance company offering it has a network of healthcare providers you are comfortable using. You can use Medicare's online tool ( Find a Medigap Policy

Which Is Better: Supplement Plan or Supplement SELECT Plan?

When it comes to insurance, whether it's health insurance or any other type of insurance, it's important to recognize that there is no single policy that can meet the needs of every individual.

If you're looking to reduce your out-of-pocket expenses, both Medicare Supplement Plans and Medicare Supplement SELECT plans offer the same degree of coverage (when you compare the same type of plan).

For example, as discussed earlier, Medicare Supplement Plan G and Medicare Supplement SELECT Plan G offer the same coverage for out-of-pocket expenses.

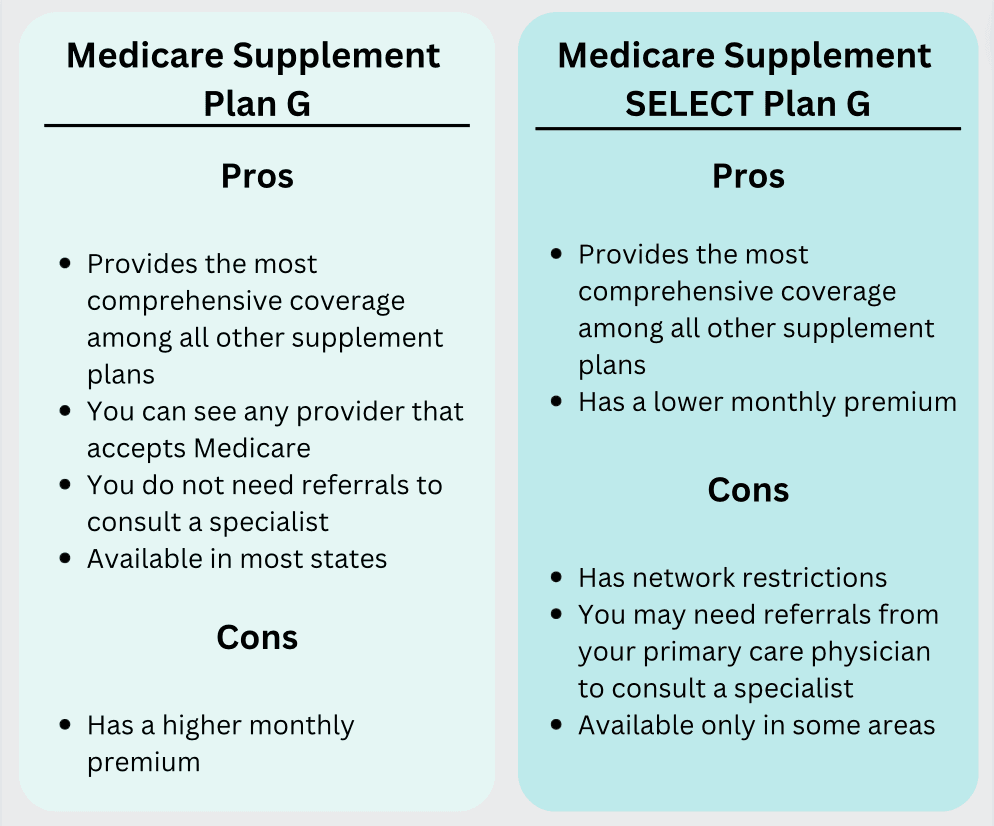

However, when choosing between these plans, it's important to consider the pros and cons of each one. Each plan has its own advantages and disadvantages, and what works for one person may not work for another.

Let's compare the pros and cons of these plans so that you can choose the plan that best fits your specific needs and preferences.

Pros and Cons of Medicare Supplement Plan G and Medicare Supplement SELECT Plan G

Medicare Supplement Plan VS Medicare Supplement SELECT plan

Are Medicare Supplement SELECT and Medicare Advantage Plans the Same?

Many Medicare beneficiaries often get confused between a Medicare Supplement SELECT plan and a Medicare Advantage Plan

Medicare Supplement SELECT plans differ from a Medicare Advantage Plan in the following ways**:**

Medicare SELECT Plans work together with Original Medicare and help cover your out-of-pocket costs left after Medicare coverage. On the other hand, Medicare Advantage Plans are an alternative to Original Medicare.

Some Medicare Advantage Plans may cover your Part D prescription drugs, but Medicare Supplement SELECT plans don't cover prescription drugs. If you're enrolled in a Medicare Supplement SELECT plan, you must enroll in a separate Part D plan to cover your prescription drugs.

Medicare Supplement SELECT plans do not cover

dental

,vision

orhearing

, while some Medicare Advantage Plans may cover these additional services. However, depending on the Medigap company, you may get additional wellness coverage, such as fitness/gym membership benefits.Medicare Supplement SELECT plans help cover your deductibles, copays and coinsurance. On the other hand, Medicare Advantage plans can require you to pay deductibles, copays and coinsurances.

Do You Need a Medicare SELECT Plan?

Medicare Supplement SELECT or Medicare SELECT Plans help cover the coverage gaps of Original Medicare, just like a Medicare Supplement Plan.

If you're struggling to find a Medicare plan that is right for you, our advisors at Fair Square Medicare

Recommended Articles

Does Medicare Cover Breast Implant Removal?

Jan 5, 2023

What's the Difference Between HMO and PPO Plans?

Dec 1, 2022

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

Do Medicare Supplement Plans Cover Dental and Vision?

Dec 8, 2022

Does Medicare Cover Ilumya?

Dec 7, 2022

Medicare Explained

Jan 3, 2022

How Often Can I Change Medicare Plans?

May 5, 2023

Medicare Supplement Plans for Low-Income Seniors

Mar 23, 2023

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

How to Deduct Medicare Expenses from Your Taxes

Dec 28, 2022

Medicare Consulting Services

Apr 3, 2023

Does Medicare pay for Opdivo?

Nov 23, 2022

14 Best Ways for Seniors to Stay Active in Nashville

Mar 10, 2023

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

Why Is Medicare So Confusing?

Apr 19, 2023

Does Medicare Cover Nuedexta?

Nov 30, 2022

Does Medicare Cover Piqray?

Dec 2, 2022

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Washington, D.C.

15 Best Ways for Seniors to Stay Active in Denver

2024 Fair Square NPS Report

2025 Medicare Price Changes

Are Medicare Advantage Plans Bad?

Can I Laminate My Medicare Card?

Can I Use Medicare Part D at Any Pharmacy?

Comparing All Medigap Plans | Chart Updated for 2025

Denied Coverage? What to Do When Your Carrier Says No

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Qutenza?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Funeral Expenses?

Does Your Plan Include A Free Gym Membership?

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part A Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How to Become a Medicare Agent

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is HIFU Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare 101

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Guaranteed Issue Rights by State

Moving? Here’s What Happens to Your Medicare Coverage

Saving Money with Alternative Pharmacies & Discount Programs

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Does Medicare Cover for Stroke Patients?

What Is Medical Underwriting for Medigap?

What is Plan J?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What To Do If Your Medicare Advantage Plan Is Discontinued

What You Need to Know About Creditable Coverage

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare