If you need it, you've got coverage

Note: if you are experiencing a medical emergency, contact 911 immediately and seek medical attention.

Speak with a Medicare Advocate

One of the most rare but most costly expenses you could find yourself saddled with after an outdoor excursion is an antivenom to treat a poisonous bite. This potentially lifesaving treatment can cost tens of thousands of dollars. Will Medicare help pay for it? Yes, Medicare covers necessary healthcare expenses, and antivenom is no exception.

What is antivenom?

Antivenom is made of antibodies created from a poisonous animal's venom. It's an effective treatment for bites or stings from spiders, scorpions, snakes, and other potentially deadly creatures. As soon as possible after the bite or sting occurs, patients should seek medical attention right away to reduce symptoms and prevent further health complications.

How do you know if a venomous snake or insect has bitten you?

Many venomous creatures have distinct physical characteristics that can help you identify them. Snakes, for example, may have a triangular head and a patterned body or yellowish eyes. Scorpions may be identified by their long tail with a stinger on the end. Spiders may have an hourglass-shaped design on their back. However, not all venomous creatures are easy to identify, so if you feel pain or discomfort after a bite or sting, seek medical help immediately.

What are the costs associated with getting treatment for a snake bite?

The cost of antivenom treatment can vary depending on the type of venom and how much antivenom is needed. Generally, you can expect to pay thousands of dollars for a single dose, but some treatments may require multiple doses. Additionally, there are other costs associated with getting treated for snake bites, such as hospitalization fees, laboratory tests, and doctor visits.

Does Medicare cover the cost of antivenom?

Yes, Medicare Part A or B will cover the necessary costs of treating a venomous bite or sting, including antivenom. Specifically, Part A will be your source of coverage if you are admitted as an inpatient in an emergency room setting. If you are quickly released as an outpatient, Part B covers 80 percent of the costs associated with medically necessary treatments related to a venomous bite or sting. However, you may need to provide some out-of-pocket costs, such as co-pays and coinsurance.

It's important to remember that Medicare coverage for antivenom may vary depending on the type of venom you were exposed to and your overall health. Be sure to contact your local Medicare office for more information about specific coverage details.

How to get help if you're bitten by a snake while traveling in the United States:

If you're bitten by a venomous snake while traveling in the United States, contact 911 immediately and seek medical attention. Medicare will cover your necessary healthcare costs related to the bite or sting, including transportation to an emergency facility if needed. Additionally, Medicare also covers all medically necessary treatments related to the incident, including antivenom.

What to do if you're bitten by a snake while traveling abroad:

If you're bitten by a venomous snake while traveling abroad, contact the nearest medical facility right away. Medicare does not typically cover medically necessary treatments for injuries or illnesses that occur outside of the United States, except for medical emergency situations. You may also want to contact your travel insurance provider to see what kinds of coverage they may offer.

Conclusion

In conclusion, antivenom is a vital treatment for venomous bites and stings. Medicare covers the necessary costs associated with this treatment, but it's important to keep in mind that coverage details may vary depending on your situation. This content is for informational purposes only. If you have any questions about Medicare coverage, give us a call at Fair Square Medicare.

Recommended Articles

Does Medicare Cover Robotic Surgery?

Nov 28, 2022

Is Fair Square Medicare Legitimate?

Jul 27, 2023

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

Why You Should Keep Your Medigap Plan

Sep 21, 2023

13 Best Ways for Seniors to Stay Active in Jacksonville

Mar 3, 2023

What is the Medicare ICEP?

Apr 7, 2023

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

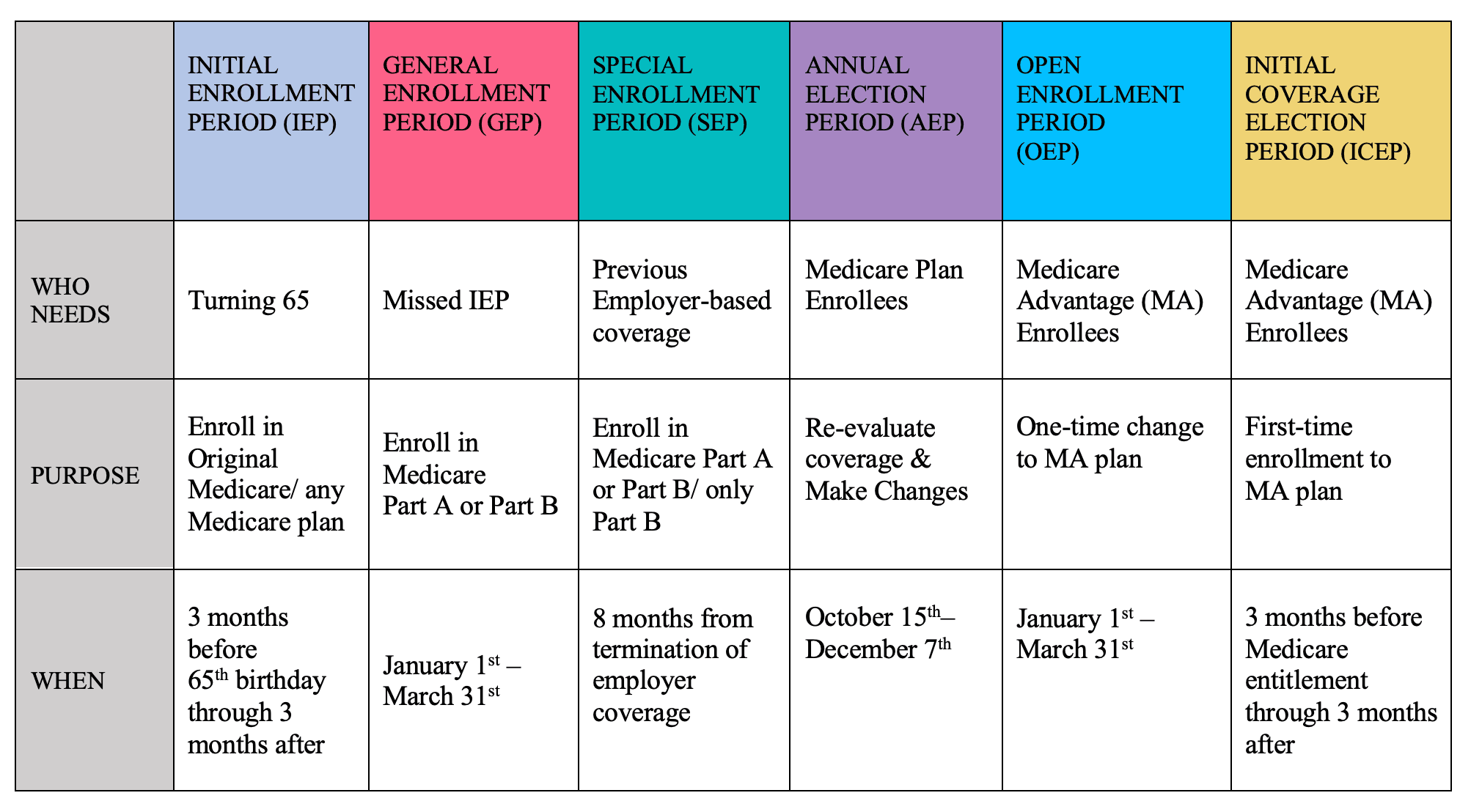

Explaining the Different Enrollment Periods for Medicare

Feb 3, 2023

Does Medicare Cover Breast Implant Removal?

Jan 5, 2023

What to Do When Your Doctor Leaves Your Network

Jul 15, 2025

Does Medicare Cover Cosmetic Surgery?

Nov 28, 2022

13 Best Ways for Seniors to Stay Active in Indianapolis

Mar 9, 2023

Medicare Advantage MSA Plans

May 17, 2023

Denied Coverage? What to Do When Your Carrier Says No

Jul 15, 2025

What People Don't Realize About Medicare

Mar 27, 2023

What You Need to Know About Creditable Coverage

Jan 18, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

2025 Medicare Price Changes

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Have Two Primary Care Physicians?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Ilumya?

Does Medicare Cover Inqovi?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Funeral Expenses?

Does Medicare Require a Referral for Audiology Exams?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Can I Get a Replacement Medicare Card?

How Does Medicare Pay for Emergency Room Visits?

How Medicare Costs Can Pile Up

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part A Cost in 2025?

How to Choose a Medigap Plan

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Balloon Sinuplasty Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is Gainswave Covered by Medicare?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Explained

Should You Work With A Remote Medicare Agent?

What If I Don't Like My Plan?

What Is a Medicare Supplement SELECT Plan?

What is the 8-Minute Rule on Medicare?

What To Do If Your Medicare Advantage Plan Is Discontinued

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare