Let's discuss how this challenging question can have a few simple answers

One of the most significant decisions you can make regarding your Medicare plan is the choice between Medicare Advantage and Medicare Supplement. We understand that the decision is a complex one. There are many different plans to choose from, not to mention deciphering each unique plan’s pros and cons.

Speak with a Medicare Advocate

Sometimes, the decision between Advantage and Supplement is made simple. In this blog post, we're going to take you through real examples from real Fair Square clients that showcase unique scenarios when Medicare Advantage might be the right choice over Medicare Supplement. Your options can differ based on where you live. Whether you're soaking up the sun in California, bustling through the busy streets of the New York Metro Area, or enjoying the peaceful serenity of Connecticut, we've got some crucial insights tailored just for you. We'll even delve into specific considerations for our Tricare for Life clients. Let’s talk through these scenarios and get you closer to your ideal Medicare plan.

Financial Comparison of Medicare Advantage and Medicare Supplement

Before we talk about specific instances when Medicare Advantage might be preferable to Medigap plans, let’s have a quick refresher on the main differences between the two types of plans.

Medicare Advantage and Medicare Supplement are two distinctly different healthcare options. Medicare Advantage plans, also known as Part C, often have lower monthly premiums, sometimes even $0, but include out-of-pocket costs such as copayments, deductibles, and coinsurance. They are often referred to as the “pay-as-you-go” option because you generally have lower upfront costs with the monthly premium, but you might have to pay more as you visit the doctor more frequently.

Conversely, Medicare Supplement plans, also known as Medigap, usually feature higher monthly premiums upfront but cover most, if not all, out-of-pocket costs from Medicare Parts A and B, depending on your plan letter of choice. Check out this chart below which compares the different plan letters of Medicare Supplement. As you can tell, the most comprehensive of these plan letters that are still available to new-to-Medicare beneficiaries is Plan G.

One major difference in Medicare Advantage plans is the concept of the Maximum Out of Pocket (MOOP) in a given year. This is a safety feature that sets a limit on how much beneficiaries have to spend on covered medical services in a given year, after which the plan pays for 100% of covered expenses. While you may have more out-of-pocket costs under a Medicare Advantage plan, your total cost risk is capped.

In contrast, Medicare Supplement plans, which provide broader coverage, might quote significantly higher premiums compared to Medicare Advantage. Budgeting with a Medicare Supplement plan can be more predictable, as they provide extensive coverage with minimal unexpected out-of-pocket costs.

Looking Beyond the Finances

Since we’ve gone through the financial comparisons between the two, before we move to the specific scenarios, let’s talk about a few more factors in the decision between Medicare Advantage and Medicare Supplement.

With Medicare Supplement, you have the advantage of seeing every medical provider in the country that accepts Medicare (over 90% nationwide). With Medicare Advantage, you are restricted to an HMO or PPO network. HMO means that you have to stay within your network or pay the total medical cost out-of-pocket. PPO means that you can go outside the network and pay a higher share than you would normally but still receive some coverage from your Medicare plan.

On the plus side for Medicare Advantage, many of these plans offer extra benefits that you will not get with your Medicare Supplement or Original Medicare. Most Advantage plans come with a Part D prescription drug plan attached, in addition to dental, vision, and hearing benefits. Plan-specific details may vary, so you can do your own research to see what might be included or speak with a Fair Square expert

Finally, when choosing between Advantage and Supplement, you should be aware of Medical Underwriting. Medical underwriting is when insurance companies scrutinize your health history, which could lead to increased rates and, in some cases, prohibit you from joining a specific plan. You might go through underwriting when you try to enroll in a Medicare Supplement plan outside your initial enrollment period (although, as we’ll discuss below, some states have no Underwriting).

Region-Specific Considerations

California

For California residents, it's important to understand the nuances of your options. Not all plans are created equal, and quotes might be different based on your gender, age, and medical history.

In California, Medicare Advantage plans

In contrast, the cheapest Medicare Supplement Plan G for this client was $200. A Medicare Supplement Plan in California

However, cost isn't the only factor when choosing between Medicare Advantage and Medicare Supplement. It's crucial to understand the "guaranteed issue rights." This refers to the situations when insurance companies are legally required to sell or offer you a Medigap policy without going through Medical Underwriting. In California, you can switch from an Advantage Plan to a Supplement Plan when these rights are present. Understanding your rights can make this transition smoother and more timely.

In California, the Advantage plans may be more HMO-oriented, so you'll need to select a primary care physician and stick to a specified network for care. PPOs offer a bit more flexibility, allowing you to see doctors and specialists outside of your network, though this might come at a higher cost. Consider your personal health needs and lifestyle when choosing between HMOs and PPOs. For example, if you travel with any frequency, HMOs might mean more healthcare spending totally out-of-pocket.

In California, you also have a "trial right" for a year with Medicare Advantage. This means that if you're not satisfied with your Advantage Plan, you can switch to a Medicare Supplement policy within the first 12 months of enrollment. For more information about trial right in California, check out this article

In summary, California offers some attractive options for those considering Medicare Advantage, thanks to its cost-effectiveness and certain legal protections. However, the choice between Medicare Advantage and Medicare Supplement should always be based on your unique health needs and financial situation. Take advantage of your trial rights, assess your options, and make the choice that suits you best.

New York

There are two major contributing factors to Medicare Advantage plans in New York Medigap plans in the Empire State

Now, let's discuss another essential aspect of New York's Medicare landscape: the presence of year-round guaranteed issue rights to switch to Medigap. This feature helps to avoid one of the most significant red flags associated with Advantage plans — the difficulty of switching to a Supplement plan without facing underwriting or denials based on pre-existing conditions. So, a very common situation that we see is that many new-to-Medicare beneficiaries who recently turned 65 are still in great health. They don’t need a Supplement plan’s level of coverage when they only see the doctor once or twice a year, but if their health worsens in a decade or so, they don’t want to face Medical Underwriting that could lock them into their Medicare Advantage plan. In New York, when you choose a Medicare Advantage plan and later decide it's not the right fit, you have the flexibility to change your plan.

However, it's crucial to time this switch strategically. We recommend aligning this change with the Annual Enrollment Period. Doing so allows you to also obtain a Part D plan, ensuring your prescription medications are covered when you make the transition. The AEP happens each year from October 15th through December 7th every year. One of Fair Square’s licensed Medicare advisors can help you make the switch when the time is right.

Connecticut

Like in New York, Connecticut also offers you the flexibility to switch to a Medigap plan annually, thanks to guaranteed issue rights. This allows you the freedom to transition between plans based on your evolving healthcare needs and circumstances.

Moreover, the switching period isn't just about moving to Medigap. You'll also find that several enticing Medicare Advantage offers become available during this period. This can present a golden opportunity to evaluate your current plan and consider whether a different plan might offer better value or more suitable coverage.

Remember, your choice should always prioritize your unique health needs and financial situation. Keep a keen eye on these switching periods, and take full advantage of Connecticut's flexibility in Medicare offerings.

While these benefits make a compelling case for Medicare Advantage, it's worth noting that these plans do come with certain limitations. One key drawback is the network restrictions. With an Advantage plan, you're typically required to use healthcare providers within a specific network. This can be restrictive if your preferred doctors or specialists aren't in your plan's network.

A Closer Look at Tricare for Life Clients

Tricare for Life clients are in a unique position when it comes to navigating the world of Medicare, and we're here to help clarify your options.

A Supplement plan might not be your best bet. Tricare for Life already fills in many of the gaps that a Medigap plan would cover. That means opting for a Supplement plan could lead to unnecessary overlap and potential waste of your hard-earned money.

Instead, you might want to consider the benefits of choosing an Advantage plan with dental, vision, and/or hearing coverage. These plans can provide additional coverage that complements your Tricare for Life benefits. An MA plan that offers these benefits with a $0 premium is a win-win situation.

Let's illustrate this with an example. Consider a recent client of ours near Atlanta who is already covered by Parts A & B due to enrolling in Social Security and has Part D coverage through Express Scripts. Adding an Advantage plan would give the client coverage for dental cleanings, exams, X-rays, and a limited coverage amount (usually around $1,000 to $1,500) towards comprehensive dental care, which can include fillings or root canals.

You've been contributing your tax dollars to Medicare throughout your working life, so why not take full advantage of what it has to offer? With the right MA plan, you can enhance your coverage and ensure you're getting the most value possible without being wasteful. As always, be sure to consider your unique health needs and financial situation when choosing your plan.

Conclusion

One of the most important takeaways for people making a decision about their Medicare plan is to research what fits best to their unique circumstances. Medicare is not a one-size-fits-all program, so use all your resources wisely to find your best-fit plan. The above situations are not the only instances where Medicare Advantage plans are a better option than Medicare Supplement, and there still might be someone in these three states that should have a Supplement plan.

If you are interested in talking through your options, give us a call at 888-376-2028. We can give you personalized advice on choosing between Advantage and Supplement plans. If you know someone who might benefit from reading this article, share it with them!

Recommended Articles

Does Medicare Cover Service Animals?

Nov 29, 2022

Does Medicare Cover Chiropractic Visits?

Dec 22, 2022

Does Medicare Cover TENS Units?

Nov 23, 2022

Does Medicare Cover Driving Evaluations?

Dec 1, 2022

Does Medicare Cover Medical Marijuana?

Jan 6, 2023

What's the Deal with Flex Cards?

Dec 15, 2022

What Are Medicare Part B Excess Charges?

Jan 6, 2023

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Nov 30, 2022

Is Fair Square Medicare Legitimate?

Jul 27, 2023

When to Choose Medicare Advantage over Medicare Supplement

Jun 7, 2023

Medicare Advantage MSA Plans

May 17, 2023

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

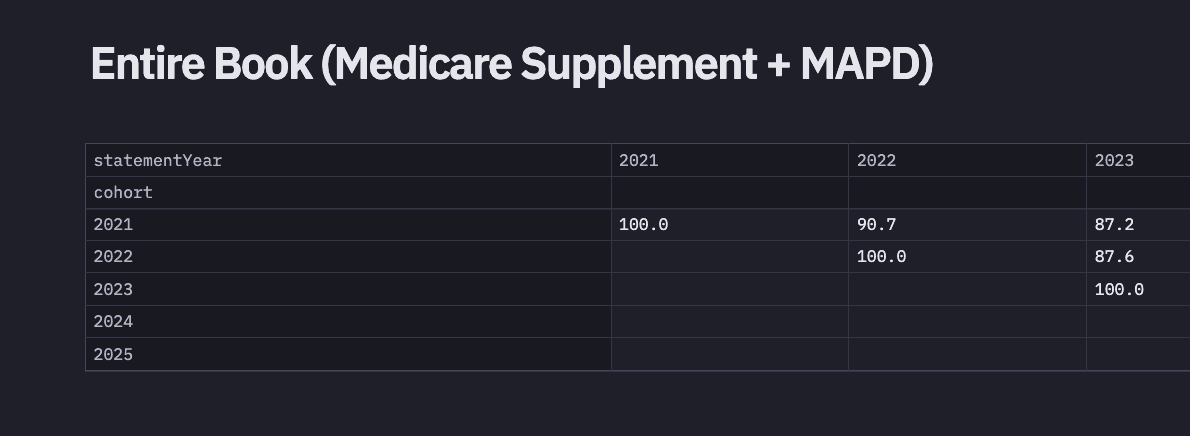

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Breast Implant Removal?

Jan 5, 2023

Does Medicare Cover Piqray?

Dec 2, 2022

Does Medicare Cover LVAD Surgery?

Nov 30, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

Do You Need Books on Medicare?

Apr 6, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Nashville

2024 Cost of Living Adjustment

2025 Medicare Price Changes

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Laminate My Medicare Card?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Costco Pharmacy Partners with Fair Square

Denied Coverage? What to Do When Your Carrier Says No

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Disposable Underwear?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inqovi?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Nexavar?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Wart Removal?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Bunion Surgery?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Everything About Your Medicare Card + Medicare Number

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Dental Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Does Medicare Cover Colonoscopies?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does Medicare Part A Cost in 2025?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Medicare 101

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Saving Money with Alternative Pharmacies & Discount Programs

Seeing the Value in Fair Square

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Is Medical Underwriting for Medigap?

What is Plan J?

What People Don't Realize About Medicare

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

When Can You Change Medicare Supplement Plans?

Which Medigap Policies Provide Coverage for Long-Term Care?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare