Blow out the candles and check out this unique opportunity

You don’t need an excuse to celebrate your birthday, but did you know that residents of the Silver State now have more reasons to celebrate? Since the beginning of 2022, Nevada has become one of the states that honor the Birthday Rule of Medicare. This rule gives residents more opportunities to change their Medicare Supplement plan around their birthday. How might this affect you? Let’s find out.

Speak with a Medicare Advocate

What is the Medicare Birthday Rule?

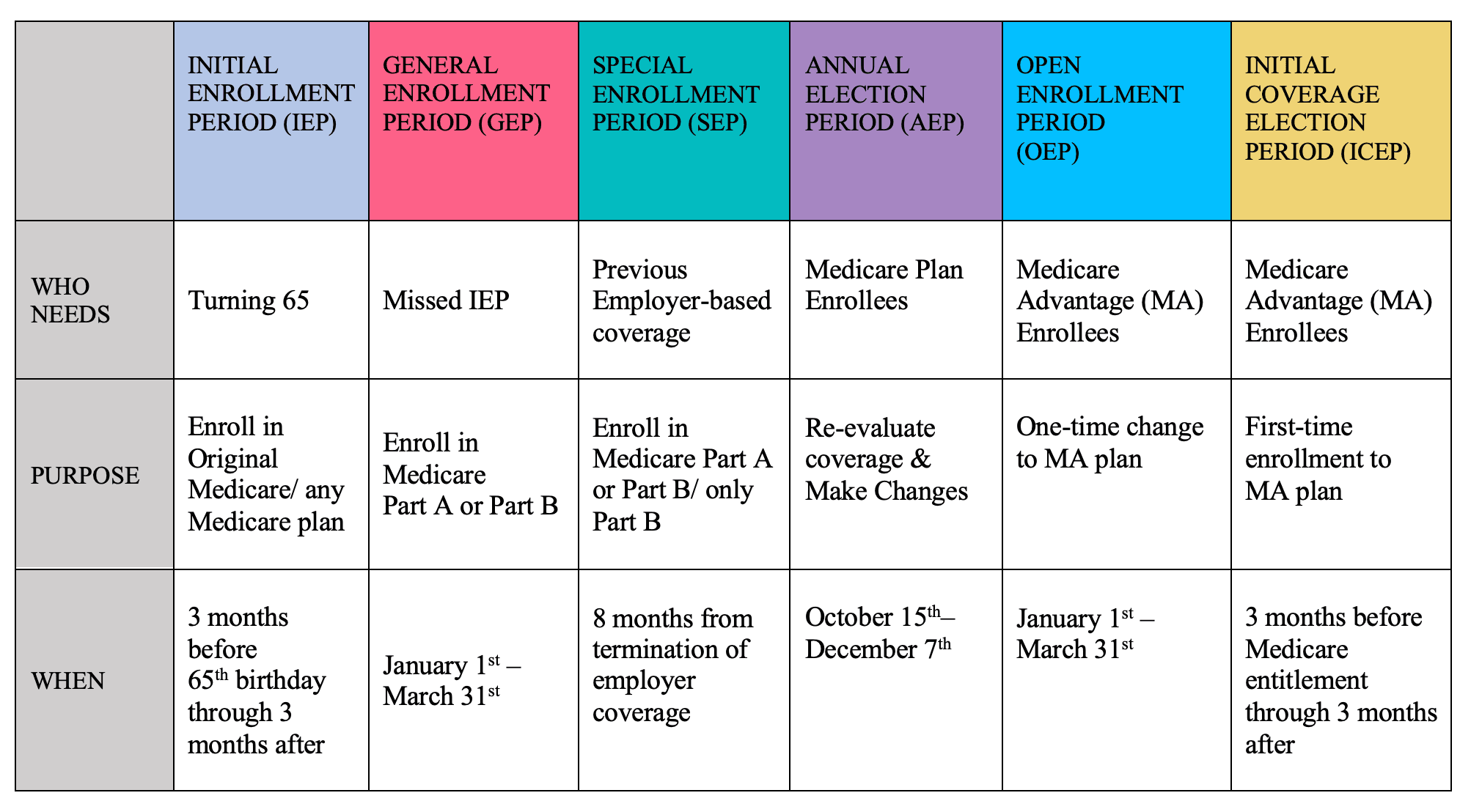

The Birthday Rule of Medicare is a pretty simple one. It allows you to change your Medicare plan around your birthday each year. You can switch between plans of equal or lesser coverage without going through Medical Underwriting. Medical Underwriting is when insurance companies scrutinize your health history, which could lead to increased rates and, in some cases, prohibit you from joining a specific plan.

Different states have slightly different variations of the Birthday Rule. California and Oregon were the first states to implement the Birthday Rule, but now residents of the following states have it: Nevada, Illinois, Idaho, and Louisiana.

This enrollment window

How does the Medicare Birthday Rule work in Nevada?

Nevada’s Medicare Supplement

Your current Medicare Supplement plan provider must notify you at least 30 days (but not more than 60 days) before the beginning of this enrollment period. This notification must let you know of your rights to enroll in the plan and your given timeframe to make a potential switch.

If you’re interested in reading more about the specific details of the Birthday Rule in Nevada, you can check it out here

The primary benefit of using the open enrollment window during your birthday is that you don’t have to go through Medical Underwriting, which offers a barrier to beneficiaries in other states. You can be more vigilant about finding the best deal for you. You should not feel trapped in one plan that you no longer want.

Steps to take advantage of the Medicare Birthday Rule in Nevada

Determine your eligibility: To use the Medicare Birthday Rule, you must be enrolled in a Medicare Supplement plan, and you must be within the enrollment period (beginning the first day of your birth month, lasting at least 60 days from there).

Review your current coverage: Before making any changes, review your current Medicare Supplement plan to assess whether it still meets your needs and fits in your budget.

Research your options:

Speak with a licensed insurance agent at Fair Square

to research available Medicare Advantage or Prescription Drug plans in your area.Compare plans: Compare the benefits, costs, and coverage of the available plans to determine which plan best fits your needs (we can help you with that, too).

Enroll in a new plan: During the enrollment period around your birthday, you can enroll in a new Medicare Supplement plan (of equal or lesser coverage). We can help you enroll in your new plan. You can also do research through the Medicare Plan Finder tool.

Cancel your old plan: Call your insurance company and ask to end your coverage. The insurance company can tell you how to submit a request to end your coverage.

Here are some tips from Medicare.gov

Be careful before you cancel your first Supplement plan. It might be wise to make sure you prefer your new policy. Otherwise, it could be a long year before you may switch. On the application for the new Medicare Supplement plan, you'll have to promise that you'll cancel your first policy.

Recap

As a quick recap of the Nevada Medicare Birthday Rule, you can switch Medicare Supplement plans around your birthday. Understanding this rule could help you save money on your Medicare premiums and find the best plan for you. If you are interested in switching or learning what might be your best-fit option, call a Medicare expert at Fair Square. Give us a call at 888-376-2028.

Recommended Articles

Do I Need Medicare If My Spouse Has Insurance?

Dec 19, 2022

Medicare Explained

Jan 3, 2022

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

How to Apply for Medicare?

Jul 15, 2022

Seeing the Value in Fair Square

May 15, 2023

2024 Cost of Living Adjustment

Nov 13, 2023

Does Medicare Cover Kidney Stone Removal?

Nov 23, 2022

Does Medicare Cover Air Purifiers?

Nov 18, 2022

Does Medicare Cover Compounded Medications?

Apr 4, 2023

Does Medicare Cover Cataract Surgery?

Dec 22, 2022

Medicare Supplement Plans for Low-Income Seniors

Mar 23, 2023

Does Medicare Cover Piqray?

Dec 2, 2022

Does Medicare pay for Opdivo?

Nov 23, 2022

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

Does Medicare Cover Cervical Disc Replacement?

Jan 20, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Do You Need Books on Medicare?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Hoarding Cleanup?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover PTNS?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Bunion Surgery?

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do Medicare Agents Get Paid?

How Does Medicare Pay for Emergency Room Visits?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Compare Medigap Plans in 2025

Is Balloon Sinuplasty Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare 101

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medigap vs. Medicare Advantage

Saving Money with Alternative Pharmacies & Discount Programs

What Happens to Unused Medicare Set-Aside Funds?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

What's the Difference Between HMO and PPO Plans?

When Can You Change Medicare Supplement Plans?

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare