By Daniel Petkevich

Jan 7, 2023

You may enroll in more than one plan, but you don't need all three. Here's why:

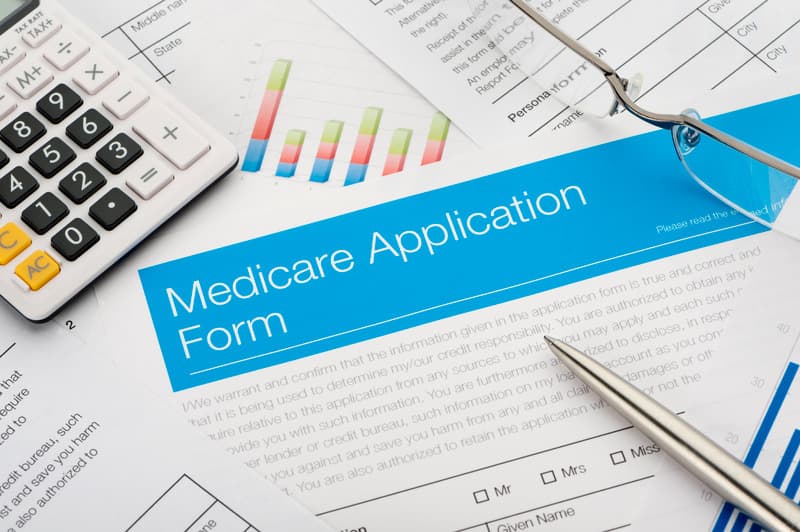

Medicare, Medicaid, and Medigap (also known as Medicare Supplement) often overlap; sometimes, people sign up for more than one plan. But is there ever a time when you should enroll in all three?

Speak with a Medicare Advocate

We want you to get the best benefits possible, so we'll walk you through everything you need to know.

Let's explore Medicare, Medicaid, and Medigap in more detail, get a sense of their differences, and discuss whether to enroll in more than one plan.

What's the Difference Between Medicare, Medicaid and Medigap?

Medicare, Medicaid and Medigap all assist in covering your healthcare expenses. But they help different populations and meet unique needs.

Let's take a look at each plan.

Medicare

Medicare

It provides coverage to people ages 65+ and those with disabilities or ESRD

There are four parts to Medicare:

Part A — part of Original Medicare; covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare

Part B — part of Original Medicare; covers medically necessary services and preventive care, such as doctor visits, lab tests, and durable medical equipment

Part C (Medicare Advantage) — alternative to Parts A and B offered by private insurance companies; combines all the benefits of Parts A and B and often includes additional benefits, such as prescription drug coverage

Part D — prescription drug benefit that can be added to Original Medicare (Parts A and B) or a Part C plan

Medicaid

Medicaid is a joint federal and state program that provides health insurance to low-income individuals and families — including the elderly, individuals with disabilities, children, and pregnant women.

Medicaid might cover a wide range of medical services, such as:

Doctor visits

Hospital stays

Prescription drugs

Long-term care

Immunizations

Screenings

Medicaid is administered by the states (rather than at a federal level). And each state has its own eligibility criteria and benefits. To be eligible for Medicaid, you must meet your state's income and asset requirements.

Medigap

Medigap is a supplemental insurance policy that supplements Original Medicare (Part A and Part B).

It helps cover certain out-of-pocket costs — like copayments, coinsurance, and deductibles. However, it doesn't cover long-term care

Medigap policies are offered by private insurance companies and are standardized by the federal government. You can choose from 10 Medigap plans Medicare Supplement Plan G

Can I Get Both Medicare and Medicaid Benefits Together?

Yes. You can benefit from Medicare and Medicaid if you're dually eligible. In other words, you have to meet the eligibility requirements for both Medicare and Medicaid.

To be dually eligible, you must meet the following conditions:

Be 65 years or older or have a disability (like ESRD)

Have a low income

How Do Medicare and Medicaid Work Together?

Medicare covers 80% of your healthcare expenses, while Medicaid helps cover the remaining out-of-pocket costs left by Medicare Parts A and B.

In other words, Medicare covers services that Medicaid doesn't and vice versa.

For example, Medicare may cover your hospital stays, doctor visits, and lab tests, while Medicaid covers your additional expenses like premiums, prescription drugs, eyeglasses, hearing aids

To better understand how these two programs work together, you need to be familiar with two terms: coordination of benefits and crossover claims.

What Is Coordination of Benefits?

When a person has multiple health insurance plans (like Medicare and Medicaid), providers must coordinate their benefits to avoid overpaying or duplicating coverage. Coordination of benefits determines which health insurance plan should pay for a medical service or claim first.

"Primary" payer — the insurance plan that pays first

"Secondary" payer — the plan that pays second

In general, Medicare is the primary payer, and Medicaid is the secondary payer. This means Medicare will pay for covered medical services first, and Medicaid will pay for any remaining expenses not covered by Medicare — like copayments, deductibles and coinsurance.

What's a Crossover Claim?

A crossover claim is a medical claim submitted to multiple insurance plans. They're used when an individual has two insurance plans that coordinate their benefits.

For example, if you’re enrolled in both Medicare and Medicaid, your provider will submit the claim to Medicare. Medicare will process the claim first and apply any deductibles, coinsurance, or copayments. The claim will then be automatically forwarded to Medicaid. (Note: Your provider doesn't have to bill Medicaid separately for the deductible, coinsurance, or copayments that Medicare applied).

Is Medigap Necessary If You Are Eligible for Both Medicare and Medicaid?

No. You don't need to enroll in a Medigap Plan if you're enrolled in Medicare and are eligible for full Medicaid benefits.

Here's why:

Most of your medical expenses are likely covered if you're dually eligible for Medicare and Medicaid

Insurance companies aren't permitted to sell Medigap policies to Medicare beneficiaries with full Medicaid coverage

I Don't Qualify for Medicaid. Can I Still Get a Medigap Plan?

Yes! Medigap plans are good for individuals who don't qualify for Medicaid. They're especially helpful if you have a high income or assets and need help with out-of-pocket costs not covered by Original Medicare (Parts A and B).

Takeaway

Medicare, Medicaid, and Medigap are all health insurance programs that cover your medical expenses. Medicaid is specifically designed to help low-income individuals pay for out-of-pocket costs. In contrast, Medigap plans often help high-income individuals — who aren't eligible for Medicaid — pay for their out-of-pocket costs.

You don't need to enroll in a Medigap Plan if you're eligible for both Medicare and Medicaid. Medicaid will likely cover most of your out-of-pocket expenses.

Having multiple health insurance plans can give you more comprehensive coverage. But it can also be confusing. At Fair Square Medicare

Recommended Articles

What is Plan J?

Jul 14, 2025

Medicare Explained

Jan 3, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

13 Best Ways for Seniors to Stay Active in Phoenix

Mar 6, 2023

How is Medicare Changing in 2025?

Dec 21, 2022

Saving Money with Alternative Pharmacies & Discount Programs

Feb 1, 2024

Does Medicare Cover the WATCHMAN Procedure?

Dec 1, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Does Medicare Cover Cardiac Ablation?

Dec 9, 2022

Does Medicare Cover Ozempic?

Mar 28, 2023

13 Best Ways for Seniors to Stay Active in Jacksonville

Mar 3, 2023

How to Apply for Medicare?

Jul 15, 2022

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

How Much Does a Medicare Coach Cost?

Mar 20, 2023

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Sep 19, 2022

What Happens to Unused Medicare Set-Aside Funds?

Jan 20, 2023

Medigap vs. Medicare Advantage

May 25, 2020

More of our articles

14 Best Ways for Seniors to Stay Active in Seattle

2025 Medicare Price Changes

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Comparing All Medigap Plans | Chart Updated for 2025

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Flu Shots?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Krystexxa?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Xiafaxan?

Does Medicare Cover Zilretta?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

Fair Square Client Newsletter: AEP Edition

How Are Medicare Star Ratings Determined?

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Medicare Costs Can Pile Up

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part A Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Often Can I Change Medicare Plans?

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is PAE Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare 101

Medicare Advantage Plans for Disabled People Under 65

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What Does Medicare Cover for Stroke Patients?

What If I Don't Like My Plan?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What People Don't Realize About Medicare

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Which Medigap Policies Provide Coverage for Long-Term Care?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare