The right plan could save you thousands of dollars

Heart disease is often linked to risk factors such as high blood pressure, high cholesterol, and smoking — and nearly half of Americans have at least one of these risk factors.

Speak with a Medicare Advocate

Medical advancements have improved treatment options for heart problems, including medication and lifestyle education, but open heart surgery remains necessary for more complex cases, such as a bypass. It's expensive, however, ranging from $30,000 to $200,000, depending on the specifics.

Luckily for Medicare beneficiaries, heart surgery costs are taken care of. If you're enrolled in a Medicare Supplement Plan G, you could save thousands of dollars on open heart surgery. If you only have Original Medicare, you could receive up to 80% coverage but would be responsible for the remaining 20%.

This article will help you understand what's at stake financially when you're facing the possibility of open heart surgery — and how Medicare helps cover the costs.

What Is Open Heart Surgery?

Open heart surgery is performed to treat a variety of heart ailments. It involves making an incision in the chest to access the heart and its surrounding structures.

The surgery may be done to:

Repair or replace damaged or diseased heart valves

Repair or remove blockages in the coronary arteries

Repair or replace a damaged or diseased heart muscle

When Do You Need Open Heart Surgery

You may need open-heart surgery if you have a heart condition such as:

A congenital heart defect — problems with the heart that are present at birth, such as a hole in the heart (

atrial septal defect

)Coronary artery disease— a condition in which the coronary arteries become narrowed or blocked by plaque buildup

Heart failure — when the heart is unable to pump enough blood to meet the body's needs

Heart valve disease — when one or more of the heart's valves become narrowed, leaky, or otherwise damaged

Thoracic aortic aneurysm — ballooning or dilation of the aorta

How Much Does Open Heart Surgery Cost?

The cost of open heart surgery varies depending on the facility, the surgeon and the type of surgery involved.

The most common types of open heart surgery can range from about $30,000 to over $200,000.

Procedures like blockage removal tend to be on the lower end of the cost spectrum, while heart bypass surgery and heart valve replacement typically fall in the middle to higher range. But, a heart transplant is significantly more expensive, costing $800,000 or more.

Does Medicare Cover Open Heart Surgery?

Yes.

Medicare

Let's look at how different the Medicare parts cover open heart surgery.

Medicare Part A Coverage for Open Heart Surgery

Medicare Part A covers the cost of inpatient and hospital care, including heart surgeries.

After paying the Part A deductible of $1,600 (in 2023), Medicare will cover all expenses related to the surgery for the first 60 days of your hospital stay.

If your hospital stay exceeds 60 days, you will be responsible for additional costs as follows:

Days 61-90: $400 coinsurance each day

Days 91 and beyond: $800 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to a maximum of 60 reserve days over your lifetime)

Each day after the lifetime reserve days: All costs

Medicare Part B Coverage for Open Heart Surgery

Medicare Part B covers outpatient care, including preoperative care and follow-up appointments.

For open heart surgery, Medicare will cover 80% of the approved cost for outpatient care.

However, you’ll be responsible for paying:

The Part B annual deductible — $226 in 2023

20% of the Medicare-approved costs

Excess charges

(if any)

Medicare Part B may also cover immunosuppressant drugs.

Medicare Part D Coverage for Open Heart Surgery

Medicare Part D plans help cover prescription costs

Each plan only covers the drugs listed in its formulary, so check with your plan provider and doctor to determine whether your specific prescriptions are covered. If not, ask your doctor for alternative drugs that are covered by your plan.

Medicare Advantage Plan Coverage for Open Heart Surgery

Medicare Advantage Plans

Depending on your plan, you may have a fixed copay or a coinsurance amount that you'll pay until you reach your plan's out-of-pocket limit.

In case of a heart transplant, you may need to obtain prior authorization to get coverage.

Medigap Coverage for Open Heart Surgery

Medigap Medicare Supplement Plans

Since Original Medicare covers open heart surgery, Medigap plans can help pay for the remaining 20% of costs not covered by Original Medicare, potentially reducing or eliminating your out-of-pocket expenses and preventing a cost pile-up

Cardiac Rehabilitation

Cardiac rehabilitation is a medically supervised program that helps individuals recover from heart disease or heart-related surgery. The program typically includes exercise, education, and counseling to help improve cardiovascular fitness, reduce risk factors for heart disease, and improve overall health and quality of life.

Cardiac rehabilitation may include medication management, stress management techniques, and nutritional counseling.

The goal of cardiac rehabilitation is to help you return to an active and healthy lifestyle after a cardiac event or surgery.

How Long Does Medicare Pay for Cardiac Rehabilitation?

Medicare Part B covers 80% of the costs of a cardiac rehabilitation program if you’ve had at least one of these conditions:

A heart attack in the last 12 months

Coronary artery bypass surgery

Current stable angina (chest pain)

A heart valve repair or replacement

A coronary angioplasty (a medical procedure used to open a blocked artery) or coronary stent (a procedure used to keep an artery open)

A heart or heart-lung transplant

Stable chronic heart failure

Medicare Part B also covers intensive cardiac rehabilitation programs in a doctor's office or outpatient setting (including a critical access hospital).

You'll still be responsible for:

The Part B annual deductible — $226

20% of the Medicare-approved costs (if you receive these services in a doctor's office)

A copayment (if you receive these services in a hospital outpatient setting)

Medicare covers cardiac rehabilitation for a maximum of 36 sessions, and if deemed medically necessary, patients may be eligible for additional coverage of 72 sessions, referred to as intensive cardiac rehabilitation.

Medicare Coverage is Complicated, but You Can Get Help

Medicare helps alleviate the cost of open heart surgery by covering both the procedure and the preoperative and post-operative care.

Medicare Part A covers the entire cost of open heart surgery for the first 60 days after the deductible is met. Medicare Part B and Part C help cover the cost of outpatient care and prescription drugs. Medicare Part B also covers your cardiac surgery rehabilitation.

Talk to your insurance provider to learn more about your specific plan coverage and whether your prescriptions are listed in your plan's drug formulary.

If you have any questions about your surgery or Medicare coverage, you can also speak with one of Fair Square Medicare's advisors

Recommended Articles

Everything About Your Medicare Card + Medicare Number

May 12, 2022

How Much Does Xeljanz Cost with Medicare?

Jan 25, 2023

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

How Much Does Open Heart Surgery Cost with Medicare?

Jan 27, 2023

14 Best Ways to Stay Active in Charlotte

Mar 9, 2023

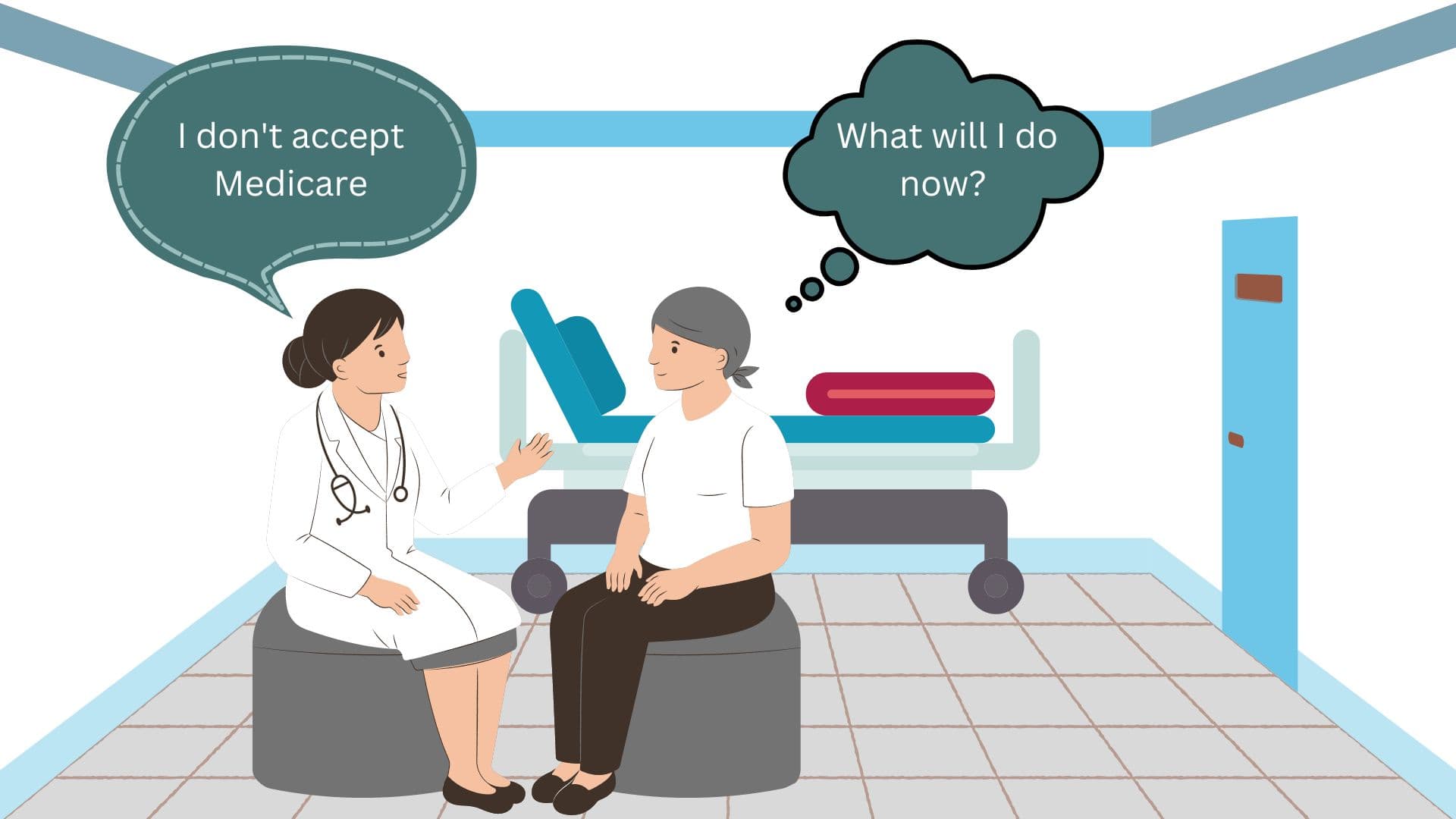

What to Do When Your Doctor Doesn't Take Medicare

Feb 24, 2023

Does Medicare Cover LVAD Surgery?

Nov 30, 2022

Does Medicare Cover Cervical Disc Replacement?

Jan 20, 2023

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Denied Coverage? What to Do When Your Carrier Says No

Jul 15, 2025

Medicare Savings Programs in Kansas

Mar 22, 2023

Are Medicare Advantage Plans Bad?

May 5, 2022

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Jul 15, 2025

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

The Easiest Call You'll Ever Make

Jun 28, 2023

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways for Seniors to Stay Active in Nashville

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Cost of Living Adjustment

2024 Fair Square NPS Report

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can Medicare Help with the Cost of Tyrvaya?

Costco Pharmacy Partners with Fair Square

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Fosamax?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Service Animals?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Antivenom?

Estimating Prescription Drug Costs

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Do Medigap Premiums Vary?

How Does Medicare Cover Colonoscopies?

How Medicare Costs Can Pile Up

How Much Does a Pacemaker Cost with Medicare?

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How to Choose a Medigap Plan

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Medicare Advantage Plans for Disabled People Under 65

Medicare Deductibles Resetting in 2025

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Top 10 Physical Therapy Clinics in San Diego

Welcome to Fair Square's First Newsletter

What Happens to Unused Medicare Set-Aside Funds?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

What You Need to Know About Creditable Coverage

What's the Deal with Flex Cards?

When Can You Change Medicare Supplement Plans?

Which Medigap Policies Provide Coverage for Long-Term Care?

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare