The Pros and Cons of Medicare Advantage Plans

Are you unsure about whether you should consider a Medicare Advantage plan?

Speak with a Medicare Advocate

You may have heard "bad" things about Medicare Advantage (MA) Plans from your providers or friends. At the same time, you may be attracted by their marketing pitches, like low premiums, extra benefits, and more.

Are Medicare Advantage Plans truly bad?

Medicare Advantage Plans are not as bad as some people might have you believe, but they're often misunderstood.

Many enrollees don’t read their plan details upfront, so they're unhappy when caught off guard by additional payments like deductibles or copays.

As with any insurance product, there are pros and cons to Medicare Advantage Plans. We'll discuss these to help you decide what suits you.

What's a Medicare Advantage Plan?

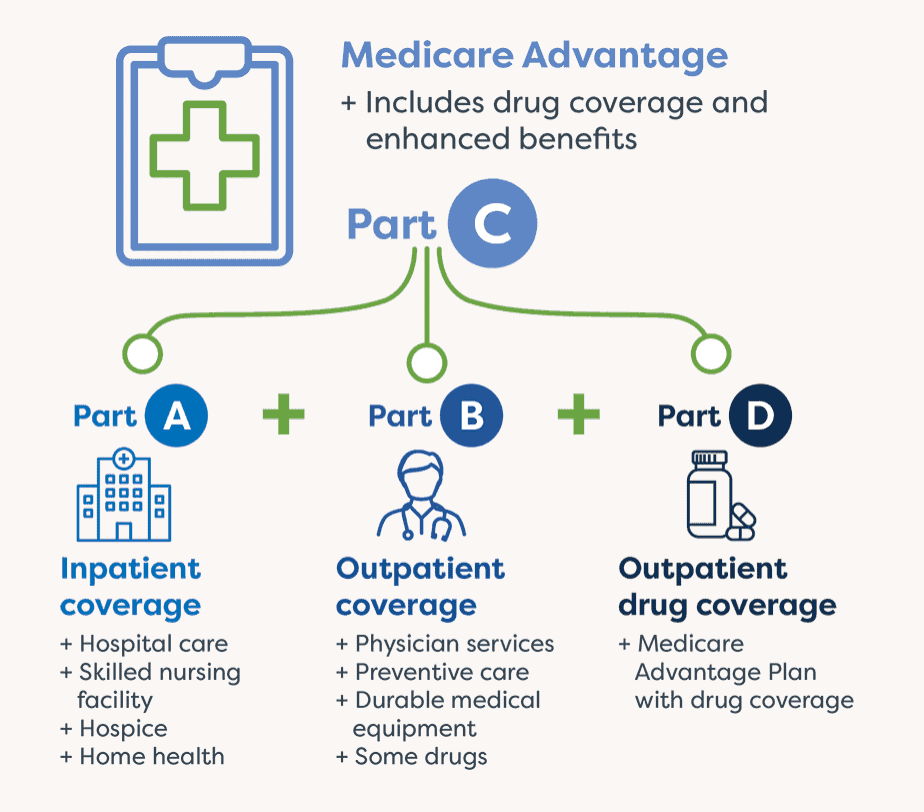

Medicare Advantage is also known as Medicare Part C

Medicare Advantage | Source: NascentiaHealth

Medicare Advantage Plans are available throughout the United States, and about one-third of Medicare beneficiaries are enrolled in such plans. However, these plans are only approved in specific regions across the country, and only a limited number of insurers can offer these plans.

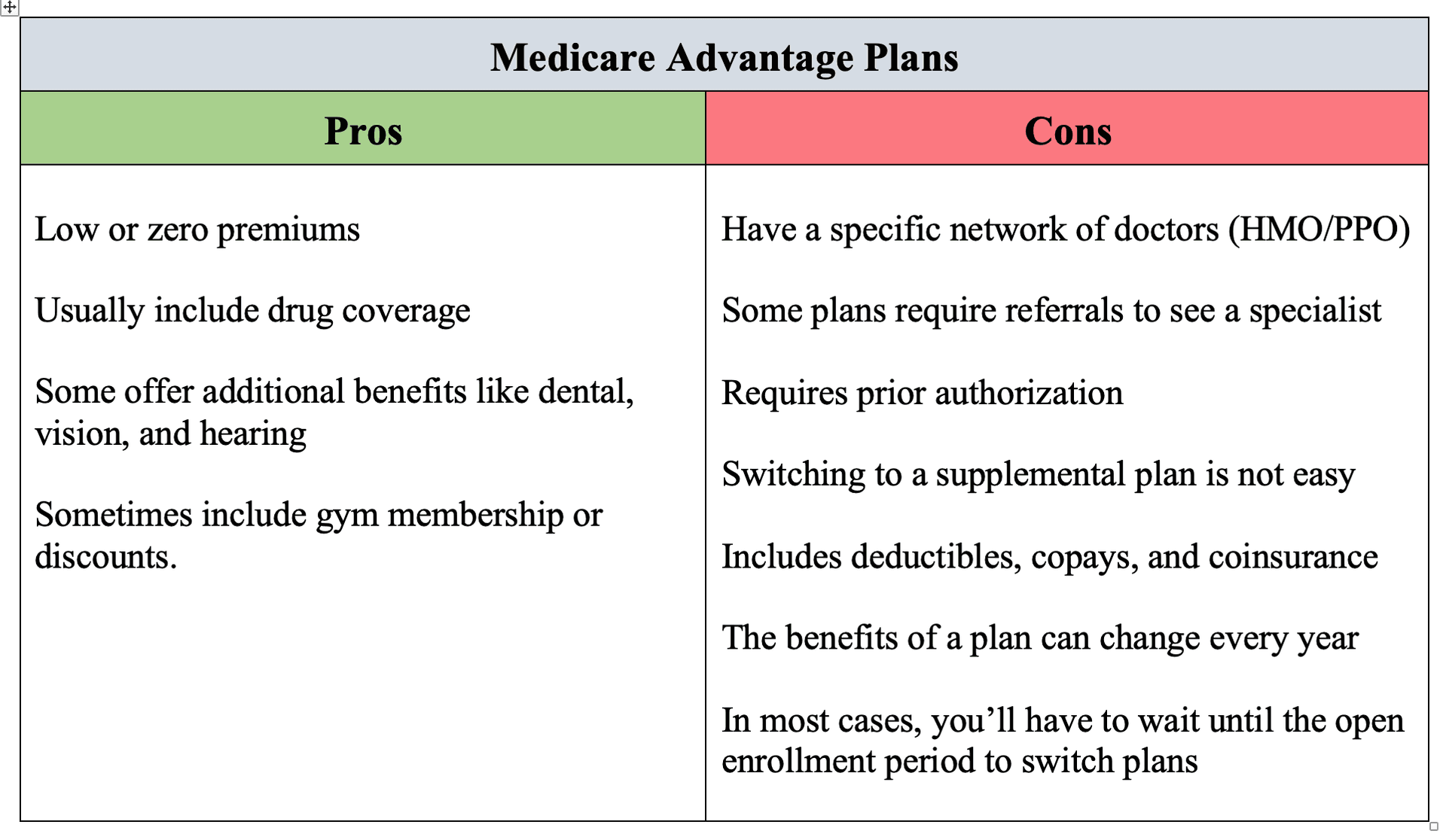

Pros and Cons of Medicare Advantage Plans

Pros and Cons of Medicare Advantage Plans

Let's go deeper on this chart.

The Pros of Medicare Advantage

Many Plans have Low Monthly Premiums

Medicare Advantage plans typically have low premiums, especially when you consider that a Medicare Supplement Plan G can cost $150 or more per month.

Like a Medicare Supplement plan, you will likely still need to pay the monthly Part B premium with a Medicare Advantage plan.

Plans Usually Include Drug Coverage

Most MA plans have prescription drug coverage. You get the benefits of Medicare Parts A, B, and D benefits at no extra cost.

It Typically Offers Additional Benefits Like Dental, Vision, and Hearing

MA covers your Medicare Part A and Part B—and it usually covers prescription drugs. Some plans also provide additional dental, vision, and hearing coverage, not included in Original Medicare.

Plans Sometimes Include Free or Discounted Gym Memberships (in Addition to Other Potential Benefits!)

Some MA plans also provide extra coverage, like gym membership or fitness program benefits.

The Cons of Medicare Advantage

It Has a Limited Network of Doctors (HMO/PPO)

You can use the benefits of most Medicare advantage plans only within a limited network of doctors. These networks can be local or regional and contain only a few thousand providers.

However, Original Medicare and Medicare Supplements give you the freedom to visit any doctor or facility that accepts Medicare in the country.

Sometimes your preferred doctors might not be present in your specified network, or they may participate in an HMO plan but not a PPO plan. With some plans, you can't use the benefits of a particular MA plan outside your network.

In Most Cases, You May Only Switch Plans During Open Enrollment

Medicare Advantage Plans follow a specific calendar of enrollment periods, so you may run into trouble changing your plan if you're in between these periods. In most cases, you can only switch plans during the Annual Enrollment Period (AEP)—from October 15th to December 7th every year.

If you aren't satisfied with your plan, you likely have to wait until the annual enrollment period to change it.

You May Need a Referral to See a Specialist

Many Medicare Advantage Plans, particularly HMO plans, require a referral from a primary doctor to see a specialist.

If you want to see a specialist while on an HMO, you are usually obligated to visit your primary care provider first, which adds an extra step (and time) to the process.

Prior Authorization can Affect Coverage

One major disadvantage of the MA plan is that it may require prior authorization to conduct some tests and procedures. You might also need pre-approval for specific prescription drugs.

For instance, if your doctor requests certain tests, some MA plans will need them to be pre-approved by the insurance provider to receive coverage. Similarly, certain drugs get coverage only if they have received prior authorization. This may add a few extra steps and considerable time to some tests, procedures, and prescriptions.

Switching to a Medicare Supplement Plan Is Not Easy

Generally, Medicare Advantage plans don't require medical underwriting enrolling in Parts A & B

Technically, you can easily switch from a Supplement plan to an Advantage plan during the annual enrollment period, but not vice versa. It's worth noting that your initial enrollment period

Advantage Plans have Deductibles, Copays and Coinsurance

Although Medicare Advantage Plans have low premiums, there are usually on-the-go expenses for the services you use. These typically come in the form of deductibles, copays, and coinsurance.

Deductibles—The amount you pay before your insurance coverage begins.

Coinsurance— The amount you pay as your share of the cost for services after you pay any deductibles, usually a percentage.

Copays—The amount you pay as your share of the cost for a medical service you use.

For instance, you will likely pay copays for your doctor visits and blood tests. These copays are usually a set amount, say somewhere between a medium and a large pizza.

The deductibles, copays, and coinsurance can add up.

Advantage Plans Usually have Steep Out of Pocket Maximums

The aforementioned Deductibles, Copays, and Coinsurance should not exceed your Maximum Out of Pocket (MOOP) in a given year. Most Medicare Advantage plans cap this spend somewhere around the cost of a used car.

However, with Plan G (a Medicare Supplement), your worst-case scenario for Medicare covered medical services in a year is $233 ($226 starting in 2023).

The Drug and Medical Benefits Can Change Every Year

Medicare Advantage Plans change their benefits, premiums, prescription drugs, and additional benefits every year. They can also change their network providers and pharmacy providers.

So, if you opted for a Medicare Advantage plan due to certain benefits, check each year to see if there are any changes in your plan.

So, is Medicare Advantage Good or Bad?

Medicare Advantage is a sort of all-in-one plan. Enrollees in Medicare Advantage plans may receive more preventive care than those in Original Medicare. While it can benefit some people, it might not be ideal for others.

Let's look at some possible scenarios.

If you have a chronic condition or severe health needs, the MA plan might not be a good choice. Staying in-network and getting prior authorizations for visiting a specialist may be challenging. Also, due to your frequent hospital visits, you'll probably pay high additional costs such as copays and coinsurance.

In addition, getting approvals for some drugs can be frustrating.

Now suppose you're healthy when you're 65, but can't afford the premiums of Medicare Supplement Plans. Then, Medicare Advantage plans may benefit you.

A counterpoint to this is whether you think getting prior authorization for treatment is a hindrance. Then, an MA plan may not be the best fit. Prior authorization gets in the way when you and your doctor have agreed to a particular mode of treatment, but your Medicare Advantage carriers don't agree to it.

Although Medicare Advantage Plans have an out-of-pocket limit that protects you against massive hospital expenses, some plans can set this limit very high.

If you enroll in a Medicare Advantage Plan for the additional dental, vision, and hearing benefits, make sure you know the plan. Others might only offer basic services, which might not be worth it.

Finally, your Medicare Advantage plan can change every year. You need to study the changes in your plan closely each year and possibly switch plans accordingly. Of course, we can help you understand your plan benefits and how they change year to year. If you prefer to avoid this kind of red tape, it may be better not to enroll in a Medicare Advantage plan.

Conclusion

Medicare Advantage plans are not inherently "bad". It's just that some people don't get into the details

If you would like assistance determining which Medicare plan is right for you, you can speak to one of our licensed advisors by calling us at (888)-376-2028. We're here to help you find the plan that works best for you

Recommended Articles

Does Medicare Cover Cala Trio?

Nov 23, 2022

Medicare Supplement Plans for Low-Income Seniors

Mar 23, 2023

14 Best Ways for Seniors to Stay Active in Seattle

Mar 10, 2023

How Much Does a Medicare Coach Cost?

Mar 20, 2023

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Jan 7, 2023

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Jul 15, 2025

Explaining IRMAA on Medicare

Dec 21, 2022

Does Your Plan Include A Free Gym Membership?

Jul 12, 2023

20 Questions to Ask Your Medicare Agent

Mar 17, 2023

Fair Square Client Newsletter: AEP Edition

Oct 2, 2023

How to Choose a Medigap Plan

Jan 10, 2023

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Does Medicare Cover Cardiac Ablation?

Dec 9, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

Does Medicare Pay for Antivenom?

Dec 6, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

2024 Fair Square NPS Report

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Change My Primary Care Provider with an Advantage Plan?

Can I switch From Medicare Advantage to Medigap?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Do You Need Books on Medicare?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Cover Wart Removal?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do Medigap Premiums Vary?

How Does Medicare Pay for Emergency Room Visits?

How Medicare Costs Can Pile Up

How Much Does Open Heart Surgery Cost with Medicare?

How to Become a Medicare Agent

Is Balloon Sinuplasty Covered by Medicare?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is PAE Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare 101

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

Plan G vs. Plan N

Welcome to Fair Square's First Newsletter

What Is Medical Underwriting for Medigap?

What is Plan J?

What is the 8-Minute Rule on Medicare?

What People Don't Realize About Medicare

What to Do When Your Doctor Doesn't Take Medicare

What's the Difference Between HMO and PPO Plans?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare