Typically not but there are exceptions

Typically, scleral lenses are not covered by Medicare. There might be some circumstances when your doctor deems them medically necessary, in which case you would get coverage. And there might be some Medicare plans that offer extra vision coverage. Read more to find out which plans might provide coverage.

Speak with a Medicare Advocate

What are Scleral Lenses?

Scleral lenses are large, custom-made contact lenses designed to rest on the white part of your eye (the sclera). They have a comfortable fit and are used to treat conditions such as dry eyes, keratoconus, and post-surgical complications.

How do Scleral Lenses work?

Scleral lenses are different from regular contact lenses. Instead of fitting on the cornea, they rest on the sclera, which helps provide a more comfortable fit and better vision stability for those with complex eye conditions. The back surface of these lenses is designed to vault over the entire corneal surface and provides a tear-filled space between the lens and the eye. This helps to keep the cornea well-hydrated and comfortable all day long.

What are the benefits of using Scleral Lenses?

The use of scleral lenses allows for better vision and comfort in people with certain eye conditions. They also provide superior protection against infections and irritations, as the vaulting over the corneal surface helps to protect it from dust and debris. Additionally, these lenses can help reduce or eliminate other symptoms like dryness and light sensitivity.

Does Medicare cover Scleral Lenses?

Medicare does not currently cover scleral lenses. However, you might get coverage if your doctor says that your scleral lenses are medically necessary. Some Medicare Advantage plans

If you have any questions about scleral lenses and whether or not your insurance will cover them, don’t hesitate to reach out to your eye care provider for more information. They can help you explore all your options to get the best possible vision care for your unique needs.

How to get a prescription for Scleral Lenses?

If you think scleral lenses are right for you, it’s important to start by getting a comprehensive eye exam from an optometrist or ophthalmologist. They will be able to assess your vision needs and provide you with a prescription for the appropriate type of lens.

Once the doctor has recommended scleral lenses, you’ll need to get a fitting with an experienced contact lens specialist. This is important since scleral lenses are custom made and require a precise fit for the best vision and comfort. During the fitting process, your eye care professional will measure your eyes, evaluate your vision needs, and make necessary adjustments to ensure that the lenses fit properly.

Where to find affordable Scleral Lenses?

If you’re looking for more affordable scleral lenses, there are a few options available. Many eye care centers offer discounts and payment plans that can help make these lenses more accessible and affordable. You can also ask your provider if they accept any insurance or discount programs that could help reduce the cost of your lenses. Finally, you may be able to find scleral lenses online from certain retailers. However, it’s important to make sure that the lenses you purchase are of good quality and are properly fitted by a qualified eye care professional.

Takeaway

Medicare does not currently cover scleral lenses; however, some Medicare Advantage plans may provide coverage. To see if scleral lenses are right for you, have a conversation with your doctor or optometrist. This content is for informational purposes only. For questions about your Medicare plan, give us a call at Fair Square Medicare.

Recommended Articles

Does Medicare Cover Orthodontic Care?

Nov 18, 2022

What Happens to Unused Medicare Set-Aside Funds?

Jan 20, 2023

Does Medicare Cover Hepatitis C Treatment?

Nov 22, 2022

Does Medicare Cover Robotic Surgery?

Nov 28, 2022

Is Botox Covered by Medicare?

Jan 19, 2023

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

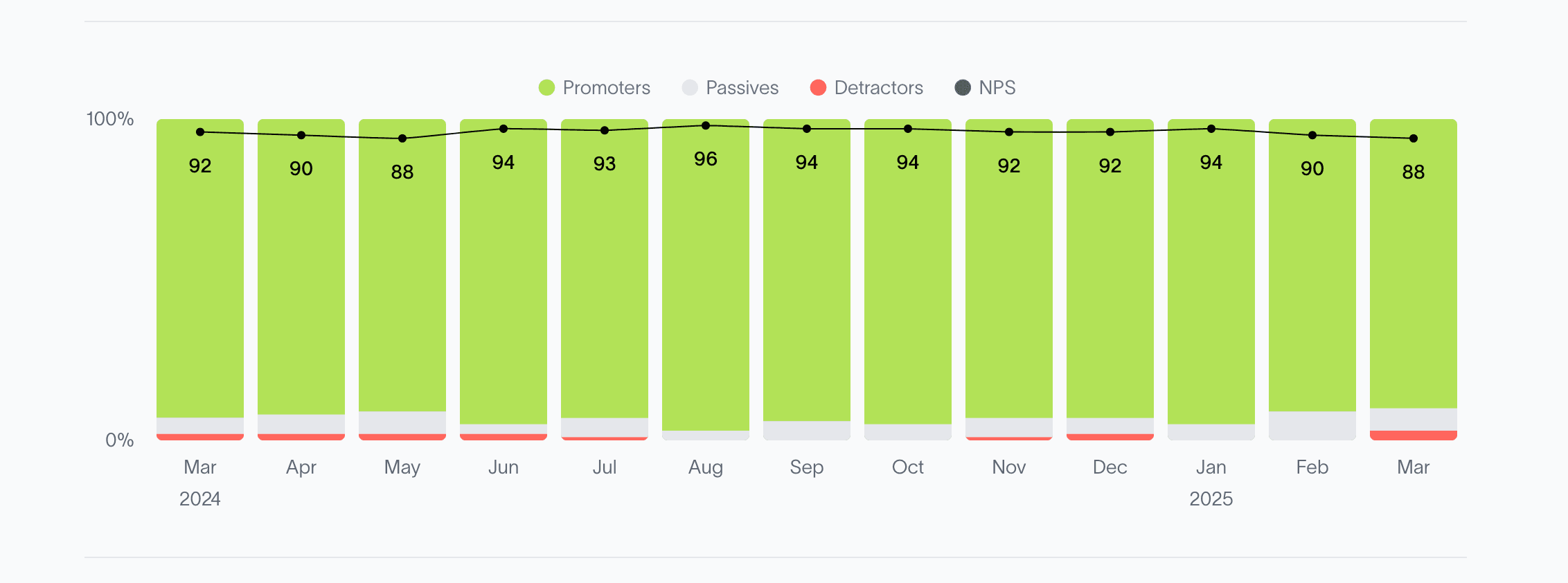

2024 Fair Square NPS Report

Mar 19, 2025

How Much Does Open Heart Surgery Cost with Medicare?

Jan 27, 2023

Does Medicare Cover Kyphoplasty?

Dec 9, 2022

Explaining the Different Enrollment Periods for Medicare

Feb 3, 2023

Does Medicare cover Deviated Septum Surgery?

Nov 18, 2022

Medicare Explained

Jan 3, 2022

Finding the Best Vision Plans for Seniors

Jan 6, 2023

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

What You Need to Know About Creditable Coverage

Jan 18, 2023

Finding the Best Dental Plans for Seniors

Jan 4, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

Mar 3, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Washington, D.C.

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

2025 Medicare Price Changes

Can Doctors Choose Not to Accept Medicare?

Can I Have Two Primary Care Physicians?

Can I switch From Medicare Advantage to Medigap?

Do You Need Books on Medicare?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Piqray?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Service Animals?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Plan Include A Free Gym Membership?

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medigap Premiums Vary?

How Much Does Medicare Cost?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How to Become a Medicare Agent

How Your Employer Insurance and Medicare Work Together

Is PAE Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare 101

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Saving Money with Alternative Pharmacies & Discount Programs

The Easiest Call You'll Ever Make

What is a Medicare Beneficiary Ombudsman?

What Is Medical Underwriting for Medigap?

What is Plan J?

What to Do When Your Doctor Leaves Your Network

When Can You Change Medicare Supplement Plans?

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare