If you get the right approval, you're covered

Medicare will cover almost any procedure that is deemed medically necessary. This includes robotic surgery. Let's dig deeper into robotic surgery to see if it could be right for you.

Speak with a Medicare Advocate

What is robotic surgery and how does it work?

Robotic surgery, also known as laparoscopic surgery, is a type of minimally invasive surgical procedure. It involves using robotic arms to perform various delicate and precise operations within the body. The benefits of robotic surgery include shorter hospital stays, less time under general anesthesia, fewer complications, reduced scarring, and quicker recovery times.

How common is robotic surgery and who can benefit from it?

Robotic surgery is becoming increasingly popular due to its accuracy and safety. It is often used in a variety of procedures such as hysterectomies, prostate surgeries, gallbladder removal, and many others. It can also be beneficial for patients with certain medical conditions or those who may not be able to tolerate traditional open surgery.

What are the risks and benefits of robotic surgery?

Robotic surgery is generally considered a safe and effective form of surgical treatment. However, it does carry some risks including the potential for infection, bleeding, or unintended damage to nearby organs. Additionally, robotic surgery may not be suitable for certain patients depending on their medical history or specific procedure being performed.

The benefits of robotic surgery include accuracy, precision, and a quicker recovery time. Additionally, it lessens the risk of infection as compared to traditional open surgery.

What are some different types of robotic surgery?

Robotic surgery can be used in a variety of different procedures, including cardiothoracic, colorectal, general, gynecologic, head and neck, pediatric, plastic and reconstructive, and urologic surgeries. It is also used in certain types of weight loss procedures, such as gastric bypass or sleeve gastrectomy.

Does Medicare cover robotic surgery?

Yes, Medicare will cover robotic surgery when it is deemed medically necessary. However, you may have to pay a portion of the cost in coinsurance or copayment, depending on your plan and the type of procedure being performed. It is important to check with your specific Medicare plan to understand what costs you are responsible for. Additionally, some facilities may charge extra for robotic surgery, so be sure to ask about this before your procedure.

What are the costs of robotic surgery?

The cost of robotic surgery will vary depending on the type of procedure and the facility performing it. Generally speaking, robotic surgery is usually more expensive than non-robotic procedures due to the additional cost associated with the technology. You may have to pay a portion of these costs out-of-pocket depending on your Medicare plan and if any extra charges were added. Ask your doctor and Medicare plan provider about these potential costs before undergoing robotic surgery.

How to find a doctor who performs robotic surgery?

If you are interested in receiving robotic surgery, you should talk to your doctor. They can provide a referral to a provider who is experienced in performing this type of procedure. Additionally, the American College of Surgeons can provide a list of accredited surgeons who specialize in robotic surgery.

Takeaway

In conclusion, Medicare covers robotic surgery when it is deemed medically necessary. However, you may have to pay a portion of the cost in coinsurance or copayment, depending on your plan and the type of procedure being performed. Speak with your doctor to see if robotic surgery is right for you. This content is for informational purposes only. For all of your Medicare questions, talk with an expert at Fair Square Medicare

Recommended Articles

Does Medicare Cover Xiafaxan?

Jan 19, 2023

How to Choose a Medigap Plan

Jan 10, 2023

Medicare Advantage MSA Plans

May 17, 2023

Does Medicare Cover the Urolift Procedure?

Dec 6, 2022

Does Medicare Cover Bladder Sling Surgery?

Jan 11, 2023

Does Medicare Cover Mental Health?

Oct 12, 2022

How Do Medicare Agents Get Paid?

Apr 12, 2023

Does Medicare Cover Piqray?

Dec 2, 2022

How Often Can I Change Medicare Plans?

May 5, 2023

Is Balloon Sinuplasty Covered by Medicare?

Dec 1, 2022

Does Medicare Cover ESRD Treatments?

Dec 8, 2022

Does Medicare Cover COVID Tests?

Dec 21, 2022

What Is the Medicare Birthday Rule in Nevada?

Mar 28, 2023

Is PAE Covered by Medicare?

Nov 23, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Is HIFU Covered by Medicare?

Nov 21, 2022

Do Medicare Supplement Plans Cover Dental and Vision?

Dec 8, 2022

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways for Seniors to Stay Active in Washington, D.C.

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Comparing All Medigap Plans | Chart Updated for 2025

Costco Pharmacy Partners with Fair Square

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Ofev?

Does Medicare Cover Ozempic?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Qutenza?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover TENS Units?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Vitamins?

Does Medicare Cover Wart Removal?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Does Your Plan Include A Free Gym Membership?

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

How Can I Get a Replacement Medicare Card?

How Does Medicare Cover Colonoscopies?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Cost?

How Much Does Medicare Part A Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Become a Medicare Agent

How to Enroll in Social Security

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medicare Supplement Plans for Low-Income Seniors

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Is a Medicare Advantage POS Plan?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is Plan J?

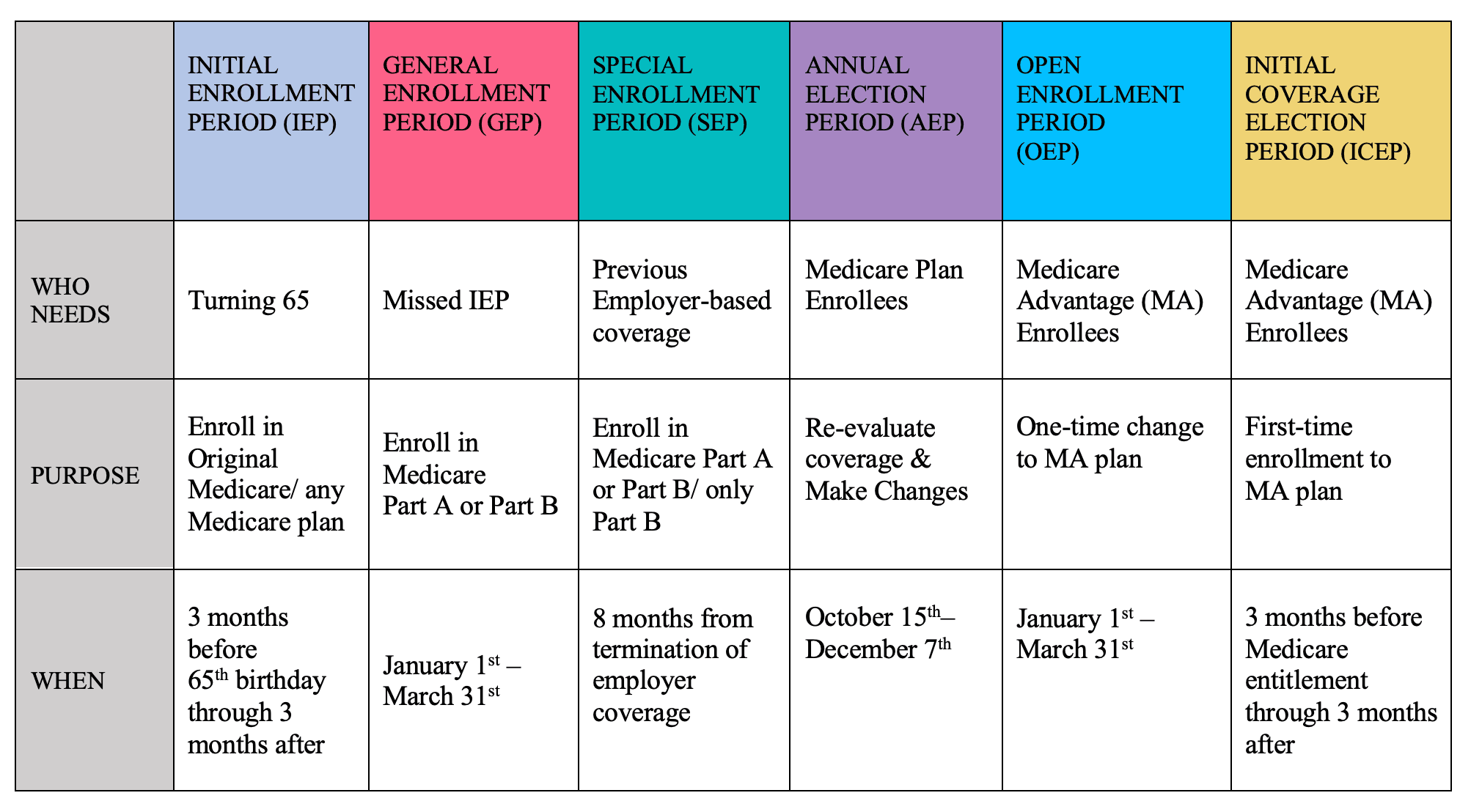

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What to Do When Your Doctor Leaves Your Network

What's the Difference Between HMO and PPO Plans?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare