By Daniel Petkevich

Jul 15, 2025

What to know about turning 65 and your COBRA coverage.

1. Medicare Becomes Primary, COBRA Drops to Secondary

Speak with a Medicare Advocate

The moment you turn 65, Medicare is expected to pay first. If you stick with COBRA but don’t enroll in Parts A and B, your COBRA plan can refuse most of the bill—leaving you on the hook for what Medicare would’ve paid.

2. COBRA Doesn’t Protect You From the Part B Late-Enrollment Penalty

COBRA isn’t “active-employment” coverage, so it doesn’t stop the penalty clock. You have an 8-month Special Enrollment Period that starts the month after employment—or the group plan—ends to sign up for Part B. Miss it and you’ll owe an extra 10 % on your Part B premium for every 12 months you delayed, for life.

3. Enrolling in Medicare Can Cancel Your COBRA

If COBRA started before you became Medicare-eligible, the employer can end your COBRA as soon as you sign up for Part A and B. Your spouse and dependents may stay on COBRA (up to 36 months), but your own coverage usually terminates.

4. Drug Coverage? Check the Fine Print

Some COBRA plans offer “creditable” prescription coverage—others don’t. Go more than 63 days without creditable drug coverage after becoming Medicare-eligible and you’ll face a Part D penalty (1 % of the national base premium for every month you delayed). Always ask the plan for its annual “creditable-coverage” notice.

5. You Could Lose Easy Access to Medigap Later

Your six-month, one-time Medigap Open Enrollment Period starts when you take Part B. If you delay Part B while lounging on COBRA and your health changes, you may be denied a Medigap policy—or charged more—when you finally apply.

6. COBRA Is Usually Pricier Than Medicare

Most people pay the full employer premium—often $600-plus per month—while Medicare Part B runs about $185/month in 2025, and many Medigap Plan G quotes fall below $250. The math rarely favors staying on COBRA once Medicare is available. (Compare your exact numbers to be sure.)

Bottom Line

COBRA is great as a short bridge before 65, but once Medicare calls, hanging on to COBRA can leave you with denied claims, lifelong penalties, and higher premiums. Enroll in Medicare on time and consider Medigap or a Medicare Advantage plan for complete, penalty-free coverage.

Need a Penalty-Free Exit Plan?

Our licensed Medicare advocates can walk you through the timelines and run side-by-side cost comparisons—no cost, no pressure. Call 888-376-2028 today.

Recommended Articles

Does Medicare Cover Ketamine Infusion for Depression?

Nov 23, 2022

Does Medicare Cover Linx Surgery?

Dec 6, 2022

Does Medicare Cover Cartiva Implants?

Nov 29, 2022

How Medicare Costs Can Pile Up

Oct 11, 2022

Does Medicare Cover Ofev?

Dec 2, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

Does Medicare Cover Air Purifiers?

Nov 18, 2022

Medicare Advantage Plans for Disabled People Under 65

Mar 24, 2023

Do Medicare Supplement Plans Cover Dental and Vision?

Dec 8, 2022

Do All Hospitals Accept Medicare Advantage Plans?

Apr 11, 2023

How to Choose a Medigap Plan

Jan 10, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

What's the Deal with Flex Cards?

Dec 15, 2022

Saving Money with Alternative Pharmacies & Discount Programs

Feb 1, 2024

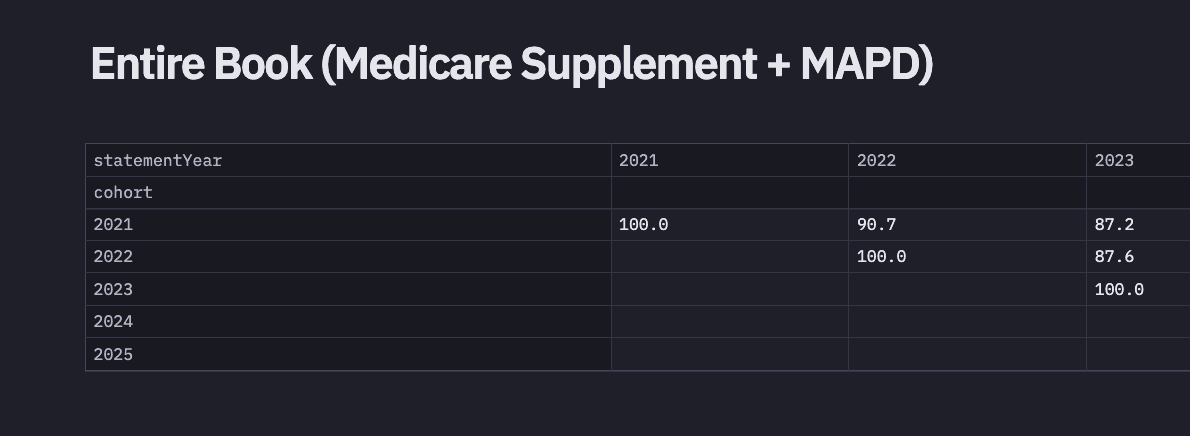

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Ilumya?

Dec 7, 2022

Last Day to Change Your Medicare Part D Plan

Jul 14, 2025

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

More of our articles

14 Best Ways for Seniors to Stay Active in Nashville

2024 Fair Square NPS Report

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Can Medicare Help with the Cost of Tyrvaya?

Comparing All Medigap Plans | Chart Updated for 2025

Denied Coverage? What to Do When Your Carrier Says No

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Books on Medicare?

Does Medicare Cover an FMT?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Jakafi?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mental Health?

Does Medicare Cover Nuedexta?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Service Animals?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Bunion Surgery?

Does Your Plan Include A Free Gym Membership?

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

Explaining the Different Enrollment Periods for Medicare

Finding the Best Dental Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Are Medicare Star Ratings Determined?

How Does Medicare Cover Colonoscopies?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare 101

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medicare Supplement Plans for Low-Income Seniors

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Supplement SELECT Plan?

What is the 8-Minute Rule on Medicare?

What Is the Medicare Birthday Rule in Nevada?

What People Don't Realize About Medicare

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Leaves Your Network

What You Need to Know About Creditable Coverage

Which Medigap Policies Provide Coverage for Long-Term Care?

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare