Choose a Medigap Plan that's Right for You

It's always good to have options. Isn't it?

Speak with a Medicare Advocate

You like to have options getting a health insurance plan, right?

Even though Medicare Part A and Part B

Choosing the Medigap plan that suits you is a big decision, but there are a lot of options available, so it can seem a bit complicated.

We understand that.

To make it easier, we've put together a comparison of the benefits of all the Medigap plans, so you can compare one plan against another and select the one that's right for you.

What Is a Medigap Plan?

With Medicare, you might still have to pay a portion of your healthcare services as deductibles, copays, and coinsurance

Medigap is a health insurance policy sold by private insurance companies to fill the "gaps" in original Medicare coverage. You might need to pay a monthly premium for a Medigap policy in addition to your monthly Part B premium.

To sign up for a Medigap plan, you must have Medicare Parts A and B coverage. Once you've enrolled in Medicare Parts A and B, you can choose a Medigap plan that meets your needs and purchase it.

Medigap policies don't have networks, so you can go to any doctor or hospital that accepts Medicare. Moreover, some Medigap plans even offer extra benefits for emergency medical care while traveling outside the United States

How Do I Compare Different Medigap Plans?

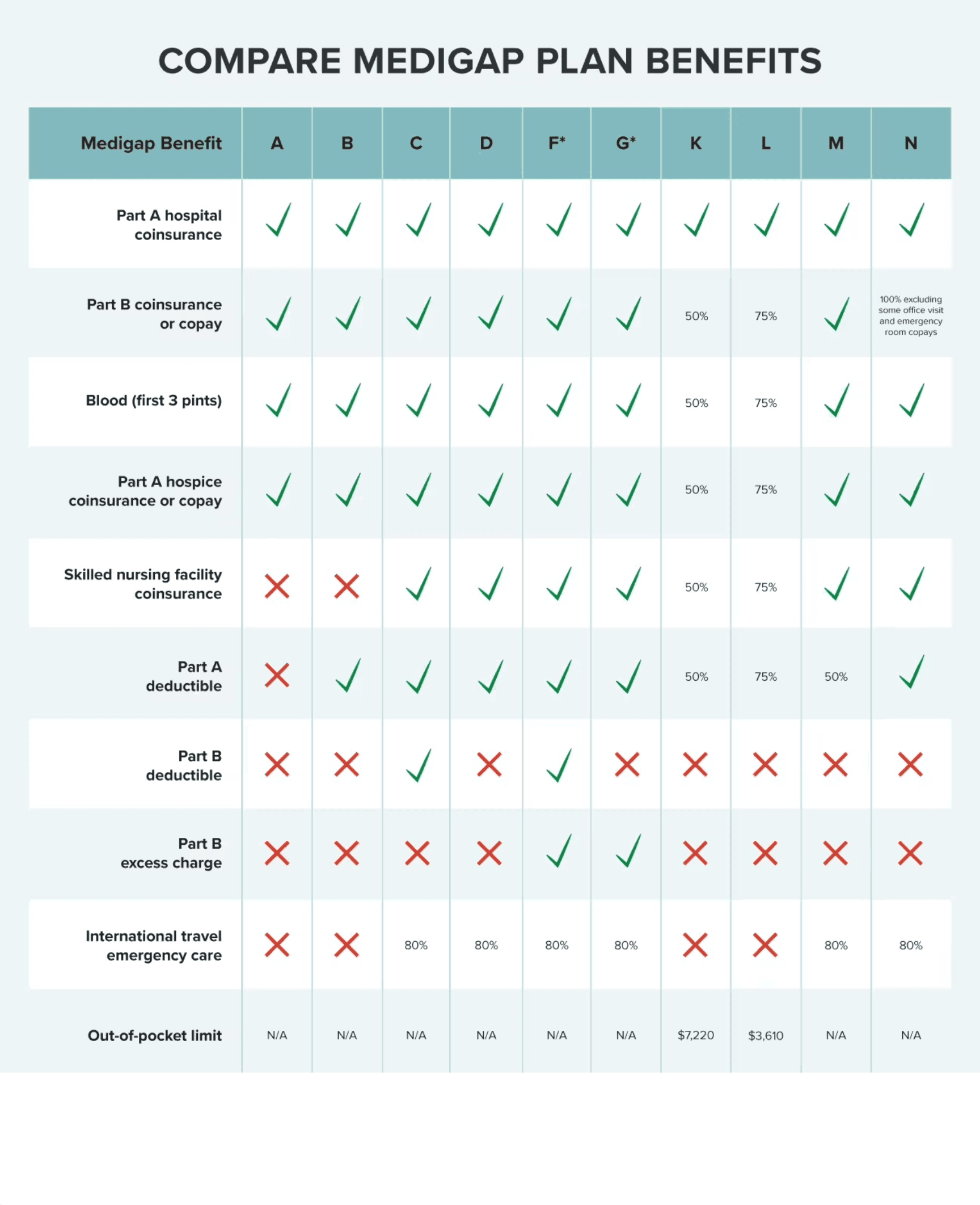

Medicare beneficiaries can choose from at least nine different Medicare Supplement (Medigap) plans in 2025, each identified by a letter. The federal government standardizes these plans, so each plan offers the same basic benefits regardless of where you purchase it.

Note: Medicare beneficiaries signing up for Medicare on or after January 1, 2020, can no longer purchase Medigap plans that cover the Part B deductible. So, Plans C and F are no longer available for them. However, if you were eligible for Medicare before January 1, 2020, but have not yet enrolled, you may be able to purchase Plan C or Plan F, which would cover your Part B deductible. You can keep your plan if you were covered by Plan C or F (or the Plan F high-deductible version) before January 1, 2020.

Most Medigap plans cover the same basic benefits, while some may provide additional benefits. You can compare plans in the chart below and choose the plan you like.

Medigap Plans — Comparison Chart 2025

Some states offer a Medigap plan called the Medicare SELECT plan

How Much Does a Medigap Plan Cost?

The total cost of Medigap plans the plan you choose

While some Medigap plans cover 100% of your service once you pay the required deductible amount, others may have copayments or coinsurance in addition to the premium. Different insurance companies may charge different premiums for the same plan, so it pays to compare when shopping for a plan.

The total cost of a Medigap plan depends on:

Part A/B premium

Medigap plan premium

Deductibles — The amount you pay before your insurance coverage begins

Copayments — The amount you pay as your share for services after paying any deductibles, usually a percentage

Coinsurance — The amount you pay as your share for a medical service

Do Medigap Plans Have Network Limitations?

No, standard Medigap plans are not restricted to specific networks. Healthcare providers who accept Medicare also accept Medigap.

Some Medigap plans even provide emergency healthcare services outside the U.S.

However, state-sponsored Medigap plans like Medicare SELECT have network limitations. Healthcare providers outside this network will not provide coverage except in an emergency.

Medigap plans in Massachusetts, Minnesota, and Wisconsin

Medigap plans are standardized across all states in the U.S. except in Massachusetts Minnesota Wisconsin

Even though the basic benefits are common across most of the Medigap plans, each of these states has a different way of handling Medigap, so you'll want to understand the differences before you purchase your plan.

However, beneficiaries in these states can use their policy nationwide with any doctor who accepts Medicare, just like the standard Medicare Supplement plans in other states.

When Do You Enroll in a Medigap Plan?

If you want to enroll in Medigap

Enrolling during your Initial Enrollment Period medical underwriting

Enrolling during any other time of the year may require medical underwriting, and providers may reject your application if you have a pre-existing condition.

Takeaway

Medigap plans can be an advantage for covering your out-of-pocket expenses. And since all Medicare-approved providers accept it, there are no network restrictions.

If you're looking for help selecting a Medigap plan that's right for you, we're here to make things easier. With an extensive knowledge of Medigap plans, our experts can provide an unbiased opinion

Call us at 1-888-376-2028 to get a better understanding of your Medigap options.

Recommended Articles

Does Medicare Cover SIBO Testing?

Dec 1, 2022

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Jul 14, 2025

Is Emsella Covered by Medicare?

Nov 21, 2022

How Much Does a Pacemaker Cost with Medicare?

Nov 21, 2022

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

Does Medicare Cover Medical Marijuana?

Jan 6, 2023

Does Medicare Cover Tymlos?

Dec 5, 2022

How to Enroll in Social Security

Apr 28, 2023

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

20 Questions to Ask Your Medicare Agent

Mar 17, 2023

Will Medicare Cover it?

Oct 3, 2023

Is the Shingles Vaccine Covered by Medicare?

Nov 17, 2022

Does Medicare Cover PTNS?

Dec 9, 2022

How Does Medicare Cover Colonoscopies?

Dec 27, 2022

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Jan 7, 2023

Does Medicare Cover a Spinal Cord Stimulator?

Nov 19, 2022

Are Medicare Advantage Plans Bad?

May 5, 2022

Last Day to Change Your Medicare Part D Plan

Jul 14, 2025

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways to Stay Active in Charlotte

2024 Fair Square Client Retention and Satisfaction Report

Building the Future of Senior Healthcare

Can I Have Two Primary Care Physicians?

Can I Laminate My Medicare Card?

Comparing All Medigap Plans | Chart Updated for 2025

Do I Need to Renew My Medicare?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover Abortion Services?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Boniva?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Ilumya?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Xiafaxan?

Does Medicare Cover Zilretta?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Medicare Costs Can Pile Up

How Much Does Medicare Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Become a Medicare Agent

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Explained

Medicare Savings Programs in Kansas

Moving? Here’s What Happens to Your Medicare Coverage

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Advantage POS Plan?

What is the 8-Minute Rule on Medicare?

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

When Can You Change Medicare Supplement Plans?

Which Medigap Policies Provide Coverage for Long-Term Care?

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare