What's the difference between value and fee-based plans?

A Tale of Two Kids

Speak with a Medicare Advocate

Imagine you have two kids, one named "Fee", and the other named "Value". One weekend, you tell Fee and Value to each build identical treehouses, one on each of the two trees in your backyard. Your kids ask how you'll pay for them and you tell Fee that he can bring you receipts for materials and tools he purchases from the nearby hardware store and, if you think they're reasonable, you'll pay him back. Value get reimbursed differently. You give him $50 and tell him to spend it however he wants as long as he builds the treehouse. If he spends less than $50, he can keep the difference.

This example roughly illustrates the difference between fee-based and value based plans in health care. In the former, providers (such as doctors and hospitals) are reimbursed by Medicare for each service they perform. Medicare actually has a list of how much they'll reimburse for each medical procedure that could possibly be administered to you. This is how Original Medicare and Medigap coverage work.

Medicare Advantage (MA) plans are value-based. The government gives MA carriers a fixed amount of money per person they insure. This is called a capitation fee, after the word "capita", referring to "per head". The plans can spend this money however they want as long as their members have quality health outcomes. One way MA plans do this is by taking more control of what services you can use and when. For example, unlike Medigap plans or Original Medicare, MA plans require you to see in-network doctors rather than any doctor you like. Many also require your primary physician to refer you to a specialist. You can't go straight to one.

The value based nature of Medicare Advantage plans allows some of them to be zero premium. Some of them even pay part of your Part B premium. This can be appealing to folks looking to save money today, but remember that insurance is all about paying less today to decrease the chances of paying a lot more tomorrow.

Recommended Articles

What to Do When Your Doctor Doesn't Take Medicare

Feb 24, 2023

Is PAE Covered by Medicare?

Nov 23, 2022

What to Do When Your Doctor Leaves Your Network

Jul 15, 2025

2024 Cost of Living Adjustment

Nov 13, 2023

Can Doctors Choose Not to Accept Medicare?

Dec 8, 2022

Plan G vs. Plan N

Jan 28, 2022

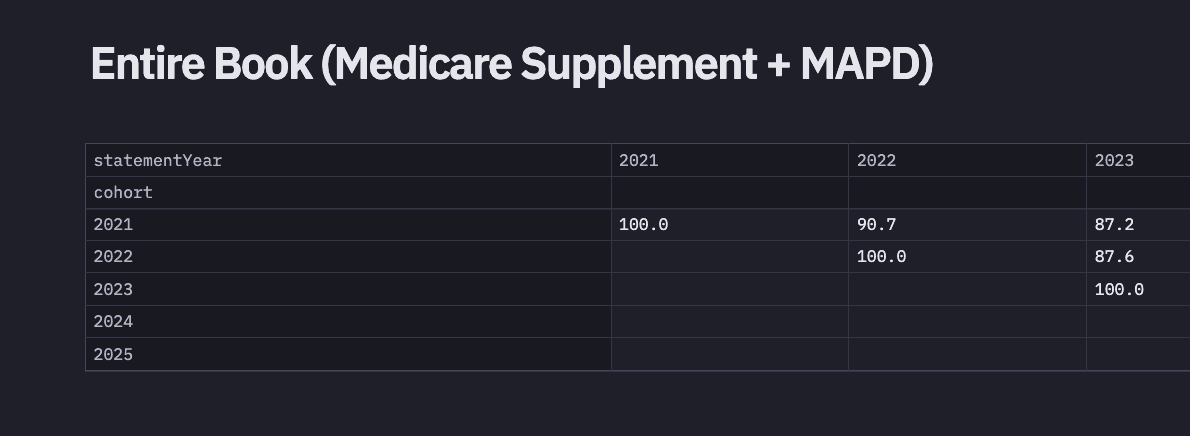

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Medicare & Ozempic

Jul 20, 2023

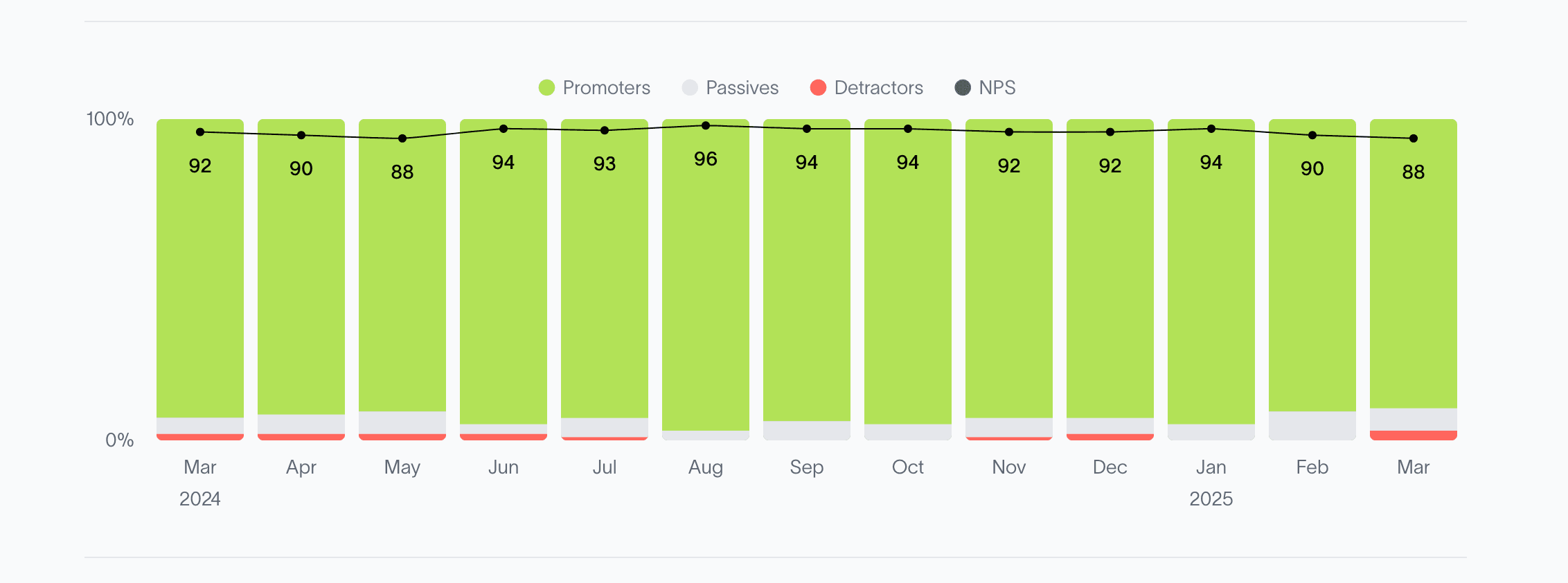

2024 Fair Square NPS Report

Mar 19, 2025

Does Medicare Cover Driving Evaluations?

Dec 1, 2022

How Much Does a Pacemaker Cost with Medicare?

Nov 21, 2022

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Is Vitrectomy Surgery Covered by Medicare?

Dec 2, 2022

How Do Medicare Agents Get Paid?

Apr 12, 2023

Does Medicare Cover Zilretta?

Nov 28, 2022

Does Medicare Cover Mental Health?

Oct 12, 2022

Does Medicare Cover Tymlos?

Dec 5, 2022

Does Medicare Cover TENS Units?

Nov 23, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Indianapolis

20 Questions to Ask Your Medicare Agent

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Comparing All Medigap Plans | Chart Updated for 2025

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Boniva?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Fosamax?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Nexavar?

Does Medicare Cover Ozempic?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Wart Removal?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Bunion Surgery?

Does Medicare Require a Referral for Audiology Exams?

Estimating Prescription Drug Costs

Explaining IRMAA on Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Does Medicare Cover Colonoscopies?

How Does Medicare Pay for Emergency Room Visits?

How Much Does a Medicare Coach Cost?

How Much Does Trelegy Cost with Medicare?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Botox Covered by Medicare?

Is Emsella Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare Consulting Services

Medicare Guaranteed Issue Rights by State

Medicare Supplement Plans for Low-Income Seniors

Moving? Here’s What Happens to Your Medicare Coverage

The Easiest Call You'll Ever Make

Top 10 Physical Therapy Clinics in San Diego

What Does Medicare Cover for Stroke Patients?

What Happens to Unused Medicare Set-Aside Funds?

What If I Don't Like My Plan?

What Is a Medicare Supplement SELECT Plan?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What People Don't Realize About Medicare

What You Need to Know About Creditable Coverage

When to Choose Medicare Advantage over Medicare Supplement

Which Medigap Policies Provide Coverage for Long-Term Care?

Why Is Medicare So Confusing?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare