Read this before going to the doctor

Over 90% of doctors nationwide accept Medicare, to match with the 96% of age-eligible Americans receiving Medicare benefits. However, that leaves over 9,000 physicians who have decided to opt out of Medicare, according to KFF

Speak with a Medicare Advocate

How do doctors become certified to accept Medicare patients?

Doctors must enroll in Medicare's program to receive reimbursement for services they provide to Medicare beneficiaries. To do this, doctors must apply with a signed agreement stating that they accept the conditions and fees set by Medicare. Once certified, most doctors are obligated to accept all patients with Medicare insurance coverage.

Why do some doctors choose not to accept Medicare patients?

There are several reasons why some doctors choose not to accept Medicare patients. One of the most common reasons is that they do not feel that the reimbursements provided by Medicare cover the costs associated with providing care for these patients. Additionally, some doctors may have concerns about the paperwork or bureaucracy that comes along with treating Medicare patients. Other doctors may simply be overwhelmed with the number of patients they already have and don’t want to take on additional Medicare beneficiaries.

Some of the highest opt-out rates are among psychiatrists. According to KFF, over 40% of the Medicare opt-outs are from the field of psychiatry. This could prove challenging if you are among the growing number of seniors seeking mental health

There are some doctors that refuse insurance altogether, preferring to be on-call for private citizens willing to pay a hefty fee. These are known as concierge doctors

What are the consequences of doctors refusing to accept Medicare patients?

If a doctor decides not to accept Medicare, then they will no longer be eligible for reimbursements from the program. However, this does not mean that these doctors cannot see Medicare patients. It simply means that the patient will need to pay out-of-pocket for any services they receive from this doctor and then submit a claim to Medicare for reimbursement. In some cases, doctors may also be fined or penalized for refusing to accept Medicare patients.

How can people find a doctor who accepts Medicare patients?

The best way to find a doctor who accepts Medicare is to use the "Find a Doctor" tool on Medicare's website. This tool allows you to search for doctors in your area who accept Medicare and meets other criteria, such as their specialty and language spoken. Additionally, many hospitals and healthcare facilities have lists of doctors who are participating providers with Medicare. You can also call your local Medicare office to get more information about finding a doctor who accepts Medicare.

What if your doctor doesn't accept Medicare?

If your doctor doesn't accept Medicare, you should ask them why they are not participating in the program. Your doctor may be able to offer alternative solutions that would make it possible for you to receive care from them while still receiving reimbursement from Medicare. If you receive care and they have opted-out of Medicare, you could be responsible for the full cost of the treatment out-of-pocket.

You can use the "Find a Doctor" tool on Medicare's website to search for doctors in your area who accept Medicare. You can also contact your local medical society or hospital to find a list of doctors who are participating providers with Medicare. Finally, you can call 1-800-MEDICARE (1-800-633-4227) to speak with a representative and get more information on how to find doctors who accept Medicare.

Conclusion

A growing number of doctors may choose to opt-out of Medicare. For Medicare beneficiaries, it's important to make sure your doctor accepts Medicare. Otherwise, you could pay for your treatment out-of-pocket. For all your Medicare-related questions, talk with an expert at Fair Square Medicare

Recommended Articles

Is Balloon Sinuplasty Covered by Medicare?

Dec 1, 2022

Does Medicare Cover Ilumya?

Dec 7, 2022

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

Does Medicare Cover the Urolift Procedure?

Dec 6, 2022

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

What is Plan J?

Jul 14, 2025

Does Medicare Cover Wart Removal?

Jan 17, 2023

How is Medicare Changing in 2025?

Dec 21, 2022

How Your Employer Insurance and Medicare Work Together

Sep 27, 2022

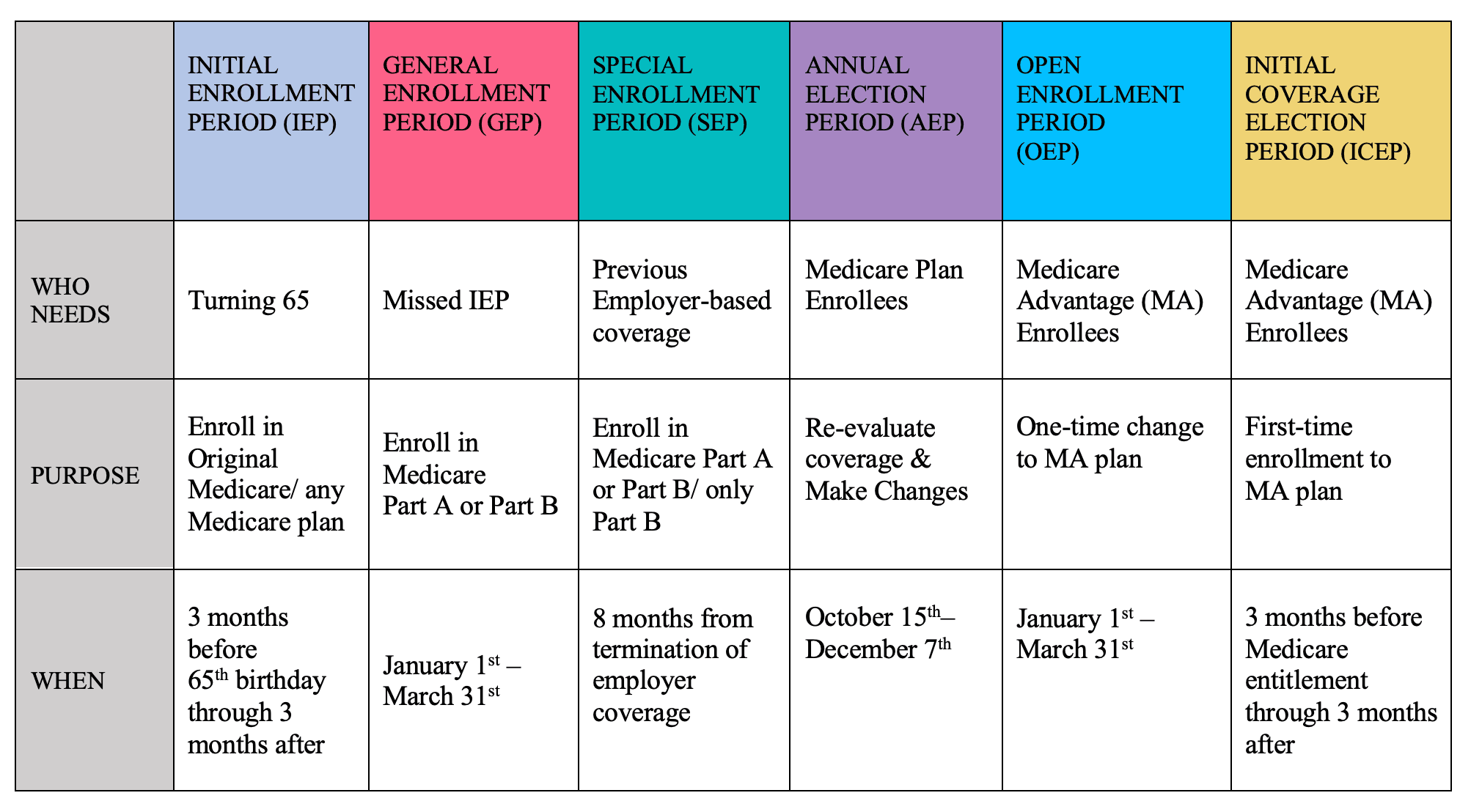

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Jan 7, 2023

Welcome to Fair Square's First Newsletter

Feb 28, 2023

How Much Does Medicare Part B Cost in 2025?

Dec 27, 2022

What Is a Medicare Advantage POS Plan?

May 10, 2023

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

Does Medicare Cover Chiropractic Visits?

Dec 22, 2022

Finding the Best Vision Plans for Seniors

Jan 6, 2023

Explaining IRMAA on Medicare

Dec 21, 2022

More of our articles

14 Best Ways to Stay Active in Charlotte

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Cost of Living Adjustment

2024 Fair Square Client Retention and Satisfaction Report

2024 Fair Square NPS Report

Are Medicare Advantage Plans Bad?

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Costco Pharmacy Partners with Fair Square

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Do Medicare Supplement Plans Cover Dental and Vision?

Do You Need Books on Medicare?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover Air Purifiers?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cartiva Implants?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mental Health?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Qutenza?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Estimating Prescription Drug Costs

Fair Square Bulletin: We're Revolutionizing Medicare

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Can I Get a Replacement Medicare Card?

How Do Medigap Premiums Vary?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Become a Medicare Agent

Is Gainswave Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Savings Programs in Kansas

Medigap vs. Medicare Advantage

Plan G vs. Plan N

Saving Money with Alternative Pharmacies & Discount Programs

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What To Do If Your Medicare Advantage Plan Is Discontinued

What's the Difference Between HMO and PPO Plans?

Which Medigap Policies Provide Coverage for Long-Term Care?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare