Understanding the Different Medicare Plans, When to Enroll, and How

Healthcare is important, especially as we get older. If you're approaching 65, you're eligible to enroll in Medicare.

Speak with a Medicare Advocate

Medicare provides healthcare for retired folks 65 and older and those with certain disabilities. However, many seniors don't know what kind of coverage they have or even if they have coverage at all. While 34% of people

Let's help you navigate Medicare so you can get covered.

What Is Medicare?

Medicare is a federal program in the United States that provides health insurance for people 65 and older. It's a safety net that protects you from high medical bills. You might also be eligible if you have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS/Lou Gehrig's disease).

In 2022, 13.8 million people

Different Medicare Parts, How They Work, And What They Do

Medicare is divided into four parts:

Medicare Part A (Hospital Insurance): This covers inpatient hospital care, some skilled nursing care, hospice care, and home health care

Medicare Part B (Medical Insurance): This covers outpatient care, doctor visits, medical equipment, and many preventive care services

Medicare Part C (Medicare Advantage): This Medicare-approved plan is administered through private companies. It covers all services listed in Part A, Part B, and usually Part D

Medicare Part D (Prescription Drug Coverage): This covers the cost of prescription drugs

Medicare Parts A & B comprise what's known as "Original Medicare".

Additional coverage

There are two types of additional coverage: Medigap Plans and Medicare Advantage Plans.

Medigap Plans (Medicare Supplements)

After you enroll in Medicare Parts A and B (Original Medicare), you may (and likely should) add Part D. Medigap Plans, such as Plan G, work on top of Original Medicare to give you more coverage and doctor flexibility.

With Medigap Plans, you can visit any doctor who accepts Medicare in the United States.

Medicare Advantage

Medicare Advantage is also known as Medicare Part C. It is managed by private insurance companies (HMOs or PPOs), but follows the rules set by Medicare. You're technically still enrolled in "Original Medicare" with Medicare Advantage.

Enrollment in the Original Medicare Part A and B is required to enroll in Medicare Advantage.

Medicare Advantage combines the benefits of Medicare Part A, Part B and, (usually), Part D. You still have to pay the Part B premium just as in the Original Medicare plan, but there are no other additional costs.

Most Medicare Advantage plans have Part D, so you don't need to purchase it separately. Medicare Advantage also covers extra benefits like vision, dental, and hearing services, which are not covered in Original Medicare.

The downside of Medicare Advantage is that you can use the benefits only within a network of doctors. Your choice of care is limited.

You can choose any Medicare plan you'd like based on your budget, health conditions, medications, doctors, and personal preferences.

We can help you work through the decision-making process.

When Do I Sign-up for Medicare?

There are different factors to consider regarding when you should sign up for Medicare:

What If I'm Collecting Retirement Benefits?

If you are collecting social security retirement benefits when you turn 65, you will automatically be enrolled in Medicare Parts A and B. You do have the option to opt-out of Part B in certain situations.

If you live outside the fifty states or Washington D.C. (e.g. Puerto Rico), you will automatically be enrolled in Medicare Part A, but you must enroll in Part B manually.

What If I'm Receiving Disability Benefits?

If you're not yet 65 and have received disability benefits for 24 months, you will automatically be enrolled in Medicare Part A and Part B.

However, if you have end-stage renal disease (ESRD) and have undergone a kidney transplant or need continuous dialysis, you can immediately enroll for Medicare with no waiting period.

If you have amyotrophic lateral sclerosis (ALS/Lou Gehrig’s disease), you will be automatically enrolled in Original Medicare, and you get its benefits at the same time you receive your disability benefits.

What If I Don't Have Retirement Benefits?

You can enroll in Medicare during your Initial Enrollment Period (IEP). This is a 7-month window that spans the three months before the month of your 65th birthday and extends to the three months after the month you turn 65.

During the Initial Enrollment Period, you can enroll in:

A Medicare Supplement Insurance Plan

A Medicare Prescription Drug Plan

A Medicare Advantage Plan

Although you can enroll in any of the plans mentioned above, you must enroll in Original Medicare Parts A and B first.

If you enroll in Medicare before you turn 65, your Medicare insurance starts from the first date of the month of your birthday. However, if your birthday is on the 1st day of a month, your insurance benefits begin on the 1st day of the previous month.

It's advisable to enroll in Medicare during your IEP, since late enrollments may lead to hefty premiums—or sometimes even penalties.

If you missed enrolling in Medicare during your IEP, you could enroll during the General Enrollment Period (GEP). The GEP extends from January 1st through March 31st every year. You can enroll in Medicare Parts A and B during this time, but you might have to pay a late enrollment fee.

When Can I Sign Up For a Medigap?

Medicare Supplemental Insurance, or "Medigap," fills the gaps in Parts A and B. It gives you added coverage to help meet your out-of-pocket expenses. You must be enrolled in Medicare Part B to get Medigap coverage. You can enroll during your IEP, which is the 6-month period that starts from the first day of the month you turn 65 (if you have Part B).

The main advantage of enrolling during the IEP is that insurance companies cannot reject your application because of your medical history, pre-existing conditions, or disabilities. There is a chance of rejection from insurance companies if you enroll outside this period. We always recommend folks enroll during their IEP.

Other Medicare Enrollment Periods

The Medicare Special Enrollment Period

If you want to make changes to your plan due to an unforeseeable event in your life, you can use the Special Enrollment Period (SEP). This unforeseeable event could be job loss, end of group insurance coverage, or some other major life event.

The Special Enrollment Period is an 8-month period that begins either from the date your employment or group insurance ends, whichever comes first.

Suppose you chose not to enroll in Part B during your IEP, since you were already covered by group medical insurance. If you later decide you want to enroll in Part B, you may enroll at any time during the Special Enrollment Period.

The SEP is not applicable if you are eligible for Medicare due to end-stage renal disease (ESRD).

Neither COBRA

Annual Enrollment Period

Every year from October 15th through December 7th, Medicare beneficiaries get the chance to change their Medicare plans, switch plans, or unenroll from a plan.

You can change your Medicare plans in the following ways:

Shift from a Medicare Supplement Plan to a Medicare Advantage Plan

Shift from a Medicare Advantage Plan back to Original Medicare

Shift from one Medicare Advantage Plan to another Medicare Advantage Plan

Shift from one Prescription Drug Plan to another

Enroll in Medicare Part D

Unenroll from a Prescription Drug Plan

Open Enrollment Period

You can change your Medicare Advantage Plan during the Medicare Advantage Open Enrollment Period, from January 1st through March 31st every year. You can use the Medicare Advantage Open Enrollment Period to do the following:

Shift from one Medicare Advantage Plan to another.

Unenroll from a Medicare Advantage Plan and enroll in Original Medicare (with or without Part D).

Initial Coverage Election Period

If you are new to Medicare, you can enroll in a Medicare Advantage Plan during your Initial Coverage Election Period (ICEP). This enrollment coincides with your IEP.

Your ICEP is also a 7-month period that begins three months before you are eligible for Medicare benefits and continues until you enroll in Part A and Part B — or until your last eligibility date for the IEP.

For example, if you will be 65 on June 12th, and your Medicare coverage starts from June 1st, your ICEP to enroll for the Medicare Advantage Plan is from March 1st through September 30th. However, if you have delayed your Part B, your ICEP will end on the date you enroll in Part B.

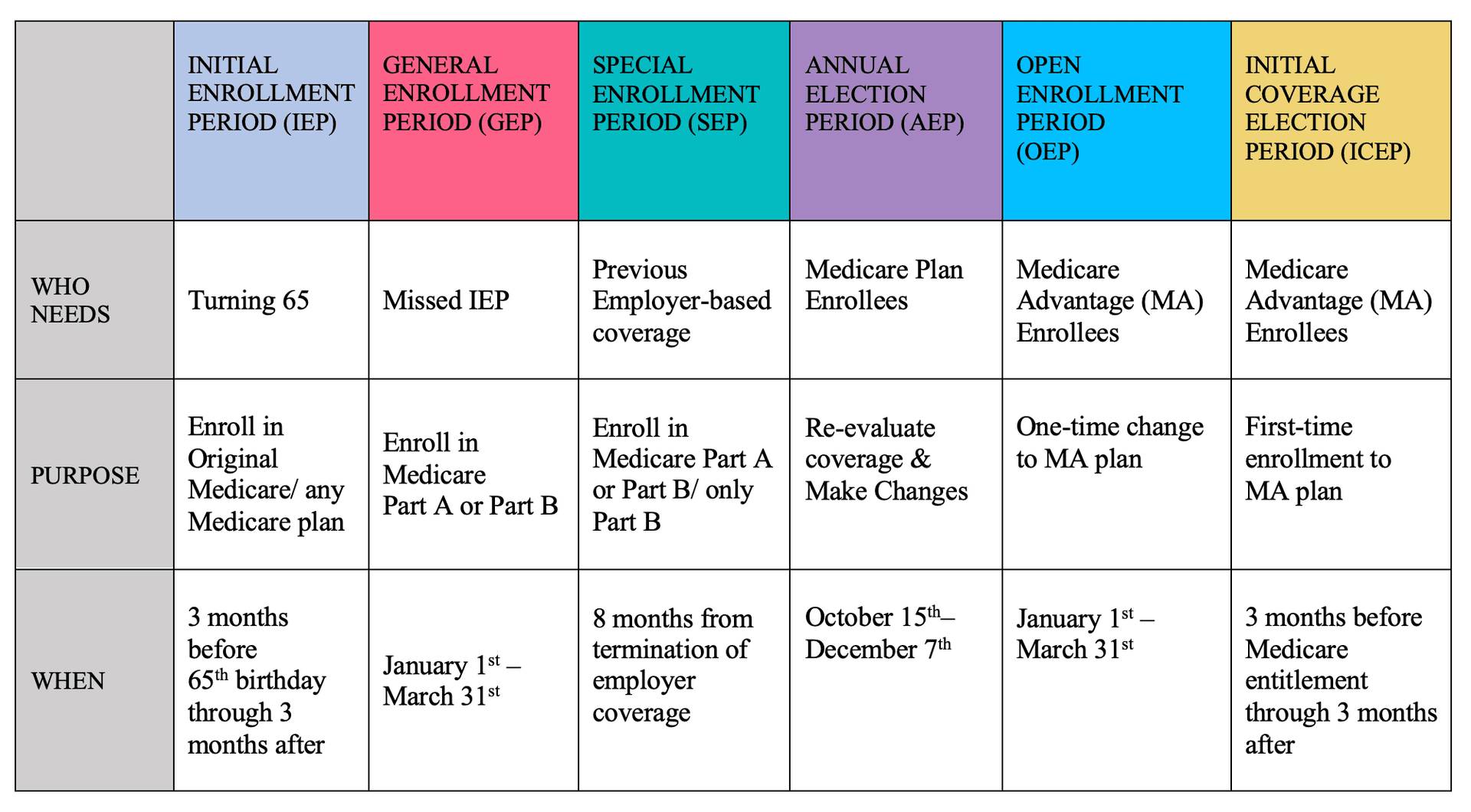

Medicare Enrollment Periods

What's Medicare Prescription Drug Coverage, and When Do I Sign Up?

Medicare prescription drug coverage is voluntary. It helps cover your prescription drug costs. Even though you might not be using many prescription drugs right now, coverage can give you an advantage down the road.

You can get Medicare prescription drug coverage by enrolling in the Medicare Prescription Drug Plan or the Medicare Advantage Plan (with drug coverage) during the following periods:

The Initial Enrollment Period (IEP)

The Annual Enrollment Period

The Open Enrollment Period

Initial Coverage Election Period

You may be subject to late enrollment penalties if you decide to enroll later.

How Do I Sign-up for Medicare?

Here are a few ways to enroll in Medicare.

You can apply online at the

Social Security website

.You can call your local Social Security office or their toll-free Number at 1-800-772-1213, Monday-Friday, 8:00 a.m. to 7:00 p.m.

You can visit your Social Security office in person.

You can call Fair Square Medicare at 1-888-376-2028. We can walk you through the whole process, step by step.

If you have trouble enrolling online, we created this video to help you apply for Medicare

Recommended Articles

Does Medicare Cover COVID Tests?

Dec 21, 2022

Does Medicare cover Deviated Septum Surgery?

Nov 18, 2022

What If I Don't Like My Plan?

Jun 8, 2020

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

13 Best Ways for Seniors to Stay Active in Philadelphia

Mar 7, 2023

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

What Is a Medicare Supplement SELECT Plan?

Apr 25, 2023

What Is the Medicare Birthday Rule in Nevada?

Mar 28, 2023

Does Medicare Cover Exercise Physiology?

Jan 11, 2023

10 Top Medicare Supplement (Medigap) Companies for 2025

Jul 14, 2025

Medicare Advantage MSA Plans

May 17, 2023

What Is a Medicare Advantage POS Plan?

May 10, 2023

How Much Does Trelegy Cost with Medicare?

Jan 24, 2023

What Does Medicare Cover for Stroke Patients?

Jan 20, 2023

Why Is Medicare So Confusing?

Apr 19, 2023

14 Best Ways for Seniors to Stay Active in Nashville

Mar 10, 2023

Does Medicare Cover Orthodontic Care?

Nov 18, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Seattle

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Laminate My Medicare Card?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Fosamax?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Nexavar?

Does Medicare Cover Nuedexta?

Does Medicare Cover Piqray?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover TENS Units?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Vitamins?

Does Medicare Pay for Funeral Expenses?

Does Medicare Pay for Varicose Vein Treatment?

Does Medicare Require a Referral for Audiology Exams?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Explaining IRMAA on Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does Medicare Part B Cost in 2025?

How to Apply for Medicare?

How to Choose a Medigap Plan

Is Vitrectomy Surgery Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medigap vs. Medicare Advantage

Plan G vs. Plan N

Seeing the Value in Fair Square

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What is Plan J?

What People Don't Realize About Medicare

What You Need to Know About Creditable Coverage

When Can You Change Medicare Supplement Plans?

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare