Most plans don't cover this nasal spray

Tyrvaya is one of the more unique prescription treatments for dry eyes available. Rather than eye drops, this solution comes in the form of a nasal spray. Unfortunately, most Medicare plans do not offer coverage for Tyrvaya. Keep reading to see what other options you have when seeking treatment for dry eyes.

Speak with a Medicare Advocate

Overview of Medicare Part D Coverage

Medicare Part D

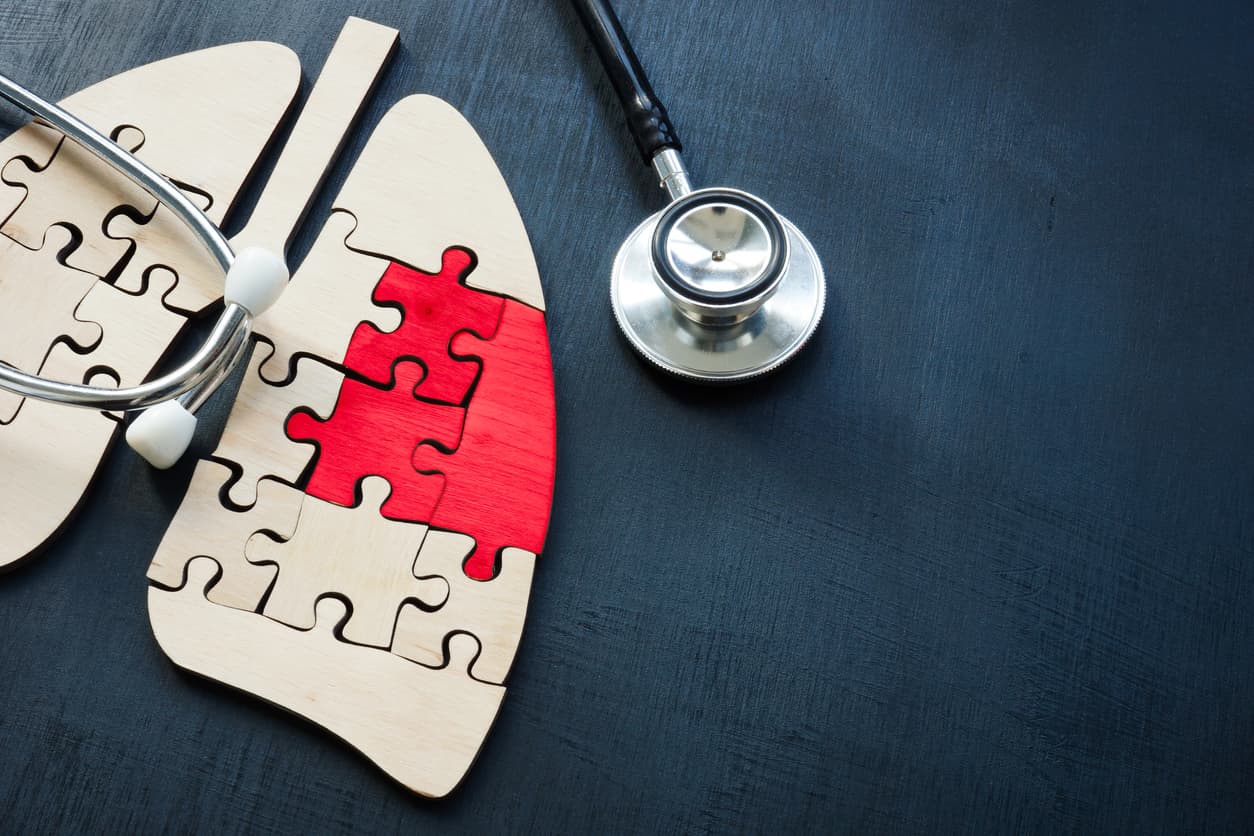

What is Tyrvaya and How Does it Work?

Tyrvaya is a prescription nasal spray used to treat dry eyes. Many other medications might have dry eyes as a symptom, so consult your doctor about whether Tyrvaya is suitable for you. The nasal spray works by increasing tear production in the eyes, which helps relieve dryness and discomfort.

Regarding Medicare Part D coverage, Tyrvaya is generally not covered by most plans. It's essential to check with your provider before purchasing any medications. They can provide you with the most up-to-date information.

What are the Benefits of Taking Tyrvaya?

Taking Tyrvaya can help improve your eyesight by reducing dryness and discomfort. It can also reduce the frequency and severity of dry eye symptoms, such as blurry vision or redness. Additionally, it can treat other common problems associated with dry eyes, such as burning sensations or difficulty keeping them open.

How Much Does Tyrvaya Cost?

This medication can be costly since you're typically paying out-of-pocket. According to GoodRx, the cost of Tyrvaya can be $681

Are There Any Other Costs Associated With Taking Tyrvaya?

There may be additional costs associated with taking Tyrvaya. For example, you may need to pay for medical appointments and tests related to your treatment. You might also have additional charges for any medications needed to treat the nasal spray's side effects. Be sure to speak with your doctor about what costs you can expect when taking Tyrvaya.

Where to Get More Information About Tyrvaya and Medicare Part D Coverage

If you have any questions about Tyrvaya or Medicare Part D coverage, be sure to speak with your doctor. Additionally, you can contact the customer service team of your Medicare plan provider for more information on costs and eligibility. You can also refer to GoodRx for more details on prescription drug prices.

Takeaway

In conclusion, Tyrvaya is an effective prescription nasal spray used to treat dry eyes. It may not be covered by most Medicare Part D plans, so it's important to research your plan and speak with your doctor and pharmacist before purchasing any medications. Although the cost of Tyrvaya can be expensive, there might be other treatment options for you. This content is for informational purposes only. For all your Medicare questions, talk with an expert at Fair Square.

Recommended Articles

Which Medigap Policies Provide Coverage for Long-Term Care?

Sep 16, 2022

Medicare Explained

Jan 3, 2022

Does Medicare Cover Cartiva Implants?

Nov 29, 2022

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

10 Top Medicare Supplement (Medigap) Companies for 2025

Jul 14, 2025

Seeing the Value in Fair Square

May 15, 2023

Last Day to Change Your Medicare Part D Plan

Jul 14, 2025

How to Deduct Medicare Expenses from Your Taxes

Dec 28, 2022

Medicare 101

May 20, 2020

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Finding the Best Vision Plans for Seniors

Jan 6, 2023

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

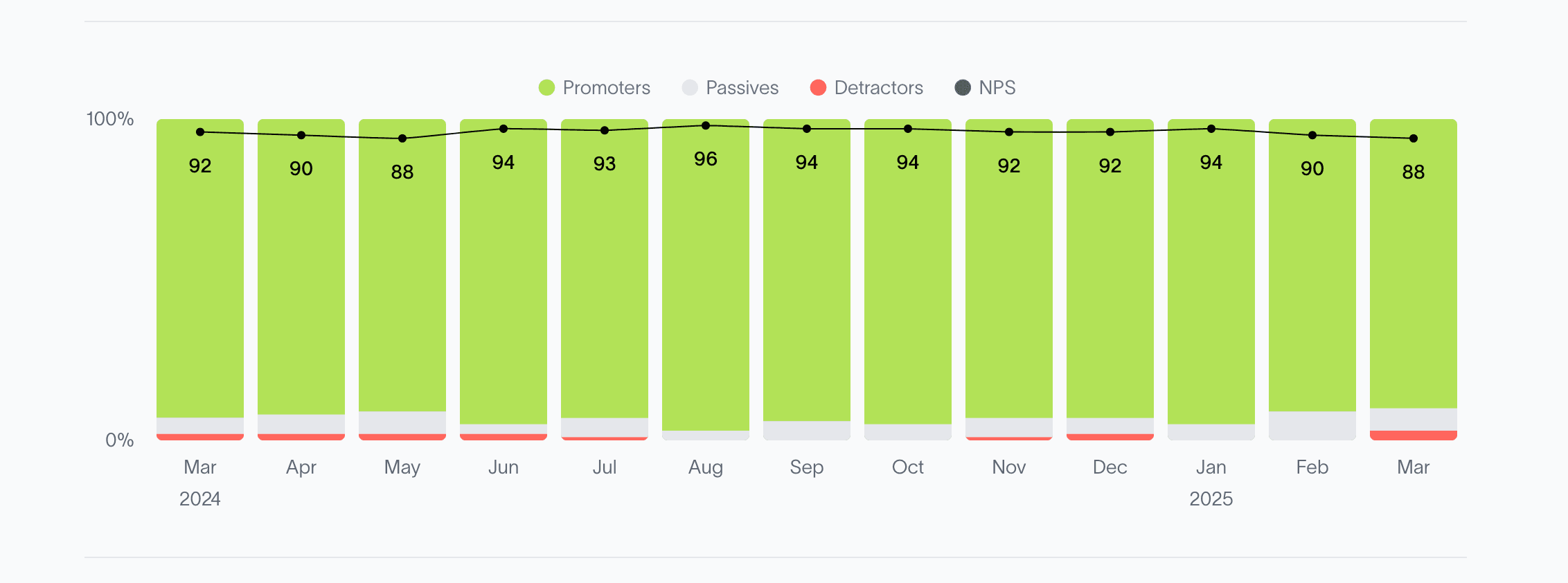

2024 Fair Square NPS Report

Mar 19, 2025

Does Medicare Cover Ofev?

Dec 2, 2022

How Much Does Medicare Part A Cost in 2025?

Nov 18, 2022

Does Medicare Cover Linx Surgery?

Dec 6, 2022

Will Medicare Cover it?

Oct 3, 2023

More of our articles

14 Best Ways for Seniors to Stay Active in Seattle

15 Best Ways for Seniors to Stay Active in Denver

2025 Medicare Price Changes

Are Medicare Advantage Plans Bad?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Have Two Primary Care Physicians?

Can I Laminate My Medicare Card?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Costco Pharmacy Partners with Fair Square

Do I Need to Renew My Medicare?

Do You Need Books on Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Inqovi?

Does Medicare Cover Jakafi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mental Health?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Service Animals?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Tymlos?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Allergy Shots?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Explaining the Different Enrollment Periods for Medicare

Fair Square Client Newsletter: AEP Edition

Health Savings Accounts (HSAs) and Medicare

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Savings Programs in Kansas

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Saving Money with Alternative Pharmacies & Discount Programs

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Advantage POS Plan?

What is the 8-Minute Rule on Medicare?

What to Do When Your Doctor Doesn't Take Medicare

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare