The answer depends on your situation

The answer to whether Medicare covers bariatric surgery is based on the reason behind it. If your doctor deems the procedure medically necessary, you will have coverage. If the reason is primarily cosmetic

Speak with a Medicare Advocate

Overview of Bariatric Surgery

Bariatric surgery is an effective and long-lasting solution for individuals who are severely obese. It involves the surgical alteration of the digestive tract to help people reduce their caloric intake, leading to significant weight loss. In order to be considered eligible for bariatric surgery, patients must meet certain medical criteria set by their doctors or insurance providers.

What is considered medically necessary for Medicare to cover bariatric surgery?

In order for Medicare to cover bariatric surgery, the procedure must be medically necessary. This means that your doctor or healthcare provider must determine that you are severely obese and unable to lose weight through diet and exercise alone. Additionally, your doctor must document that the potential health benefits of the surgery outweigh the associated risks.

Eligibility requirements for Medicare coverage of bariatric surgery

In order to be eligible for Medicare to cover bariatric surgery, you must meet the following medical criteria:

You have a body mass index (BMI) of at least 35

You have at least one obesity-related condition, such as type 2 diabetes, high blood pressure, or sleep apnea.

You have tried other weight loss methods, such as a supervised diet and exercise program, and have been unable to achieve and maintain significant weight loss.

Medicare may cover the cost of the surgery and related hospital stays. However, you may be responsible for paying some out-of-pocket costs, such as deductibles, copayments, and coinsurance. The best way to avoid these out-of-pocket costs is with Medicare Supplement Plan G

Potential risks and complications associated with the procedure

As with any surgical procedure, there are potential risks and complications associated with bariatric surgery. These include infection, bleeding, hernias, and even death. It’s important to talk to your doctor about the risks associated with the procedure before deciding whether or not to proceed.

Benefits of weight loss through bariatric surgery

The benefits of bariatric surgery can be far-reaching. Along with helping you achieve and maintain significant weight loss, the procedure may also reduce or even eliminate obesity-related conditions such as type 2 diabetes, high blood pressure, and sleep apnea.

How to find a qualified surgeon who accepts Medicare insurance

If you have decided to pursue bariatric surgery and your doctor has determined that it is medically necessary, the next step is to find a qualified surgeon who accepts Medicare insurance. You can search online for surgeons in your area or ask your doctor for a recommendation. It’s also important to do some research on the surgeon’s qualifications and experience to make sure they are qualified to perform the procedure safely.

Steps to take if you are considering bariatric surgery and have Medicare insurance

If you are considering bariatric surgery and have Medicare insurance, it’s important to take the following steps:

Consult with your doctor or healthcare provider to determine if you meet the medical criteria for the procedure.

Research qualified surgeons in your area who accept Medicare insurance.

Ask questions about the surgeon’s qualifications and the risks associated with the procedure.

Discuss any additional costs that may not be covered by Medicare.

Make an informed decision about whether or not to proceed with the surgery.

Ultimately, it’s important to work closely with your doctor throughout the process in order to make an informed decision.

Takeaway

If you are severely obese and have been unable to lose weight through diet and exercise, bariatric surgery may be an effective solution for you. However, before proceeding with any type of surgery, ensure you understand all the risks and speak with your doctor. This content is for informational purposes only. For all your Medicare questions, call an expert at Fair Square Medicare.

Recommended Articles

Can I Choose Marketplace Coverage Instead of Medicare?

May 2, 2023

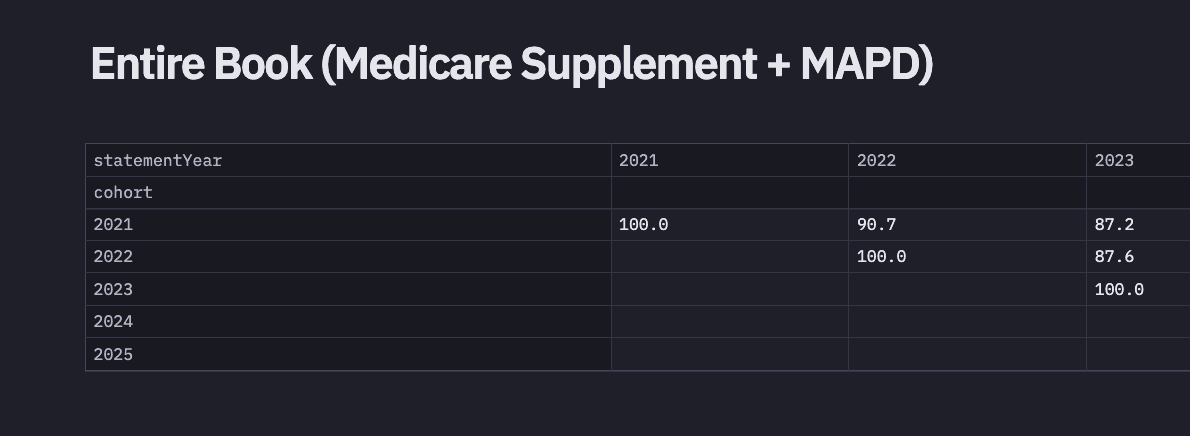

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Is PAE Covered by Medicare?

Nov 23, 2022

Does Medicare Cover Boniva?

Nov 29, 2022

How Are Medicare Star Ratings Determined?

Sep 6, 2023

Does Medicare Cover Scleral Lenses?

Dec 5, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Medicare Advantage MSA Plans

May 17, 2023

Does Medicare cover Hyoscyamine?

Nov 30, 2022

Does Medicare Cover Macular Degeneration?

Nov 30, 2022

Does Medicare Cover Penile Implant Surgery?

Dec 9, 2022

Does Medicare Cover Medical Marijuana?

Jan 6, 2023

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

Will Medicare Cover Dental Implants?

Jun 2, 2022

14 Best Ways for Seniors to Stay Active in Seattle

Mar 10, 2023

What is Plan J?

Jul 14, 2025

Does Medicare Cover Bladder Sling Surgery?

Jan 11, 2023

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

20 Questions to Ask Your Medicare Agent

2024 Fair Square NPS Report

2025 Medicare Price Changes

Can I Have Two Primary Care Physicians?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Help with the Cost of Tyrvaya?

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Books on Medicare?

Does Medicare Cover Cartiva Implants?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inqovi?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Mental Health?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Ozempic?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover SI Joint Fusion?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Funeral Expenses?

Does Your Plan Include A Free Gym Membership?

Estimating Prescription Drug Costs

Everything About Your Medicare Card + Medicare Number

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Do Medicare Agents Get Paid?

How Does Medicare Pay for Emergency Room Visits?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Deduct Medicare Expenses from Your Taxes

How Your Employer Insurance and Medicare Work Together

Is Gainswave Covered by Medicare?

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medicare Supplement Plans for Low-Income Seniors

Moving? Here’s What Happens to Your Medicare Coverage

Seeing the Value in Fair Square

Should You Work With A Remote Medicare Agent?

The Easiest Call You'll Ever Make

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Supplement SELECT Plan?

What Is the Medicare Birthday Rule in Nevada?

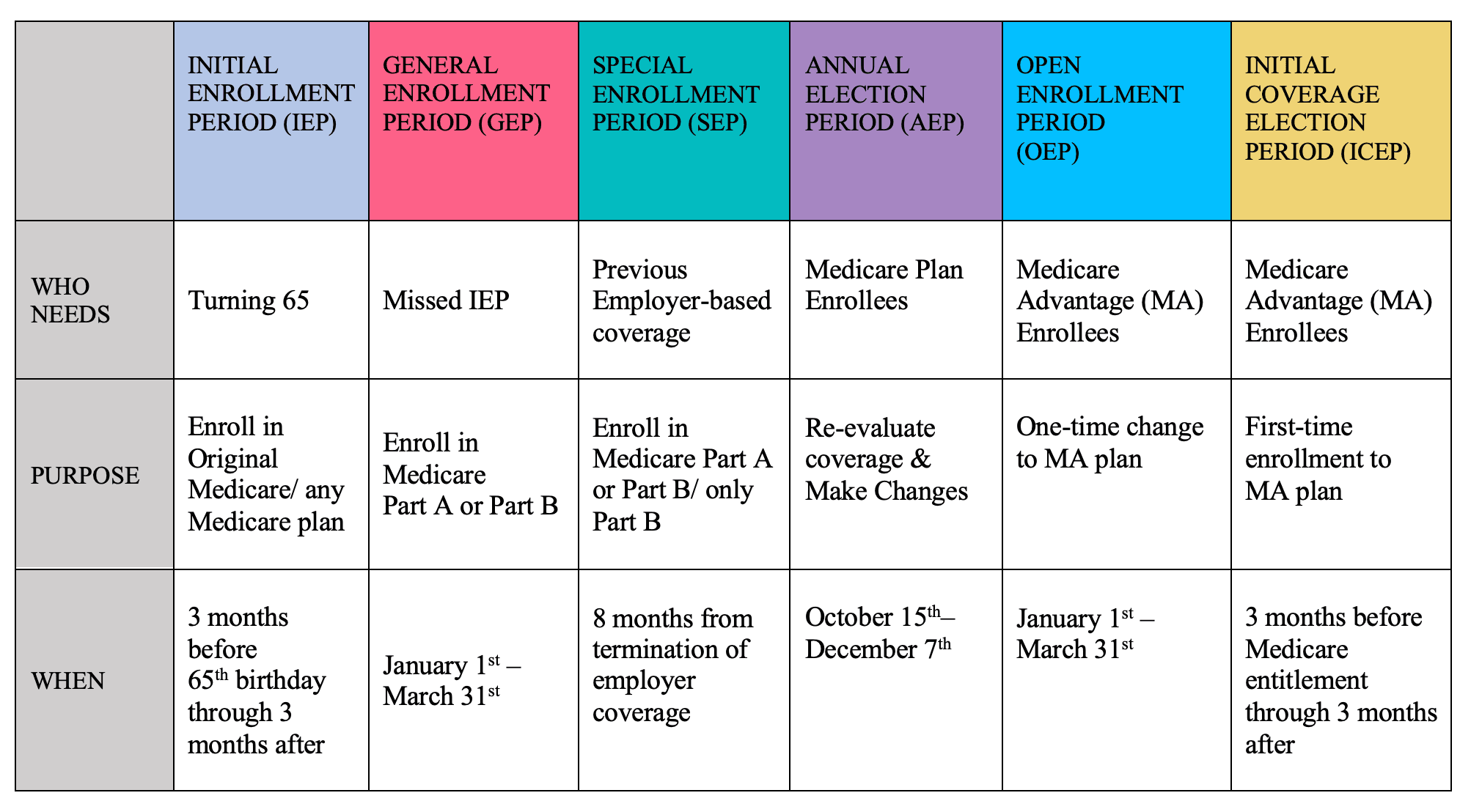

What is the Medicare ICEP?

What to Do When Your Doctor Doesn't Take Medicare

What to Do When Your Doctor Leaves Your Network

When Can You Change Medicare Supplement Plans?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare