See if Medicare Advantage is the right choice for you

Are you under 65 and living with a disability? Medicare is not just for seniors looking for healthcare. Medicare Advantage plans are available for disabled people under the age of 65 who are struggling to find affordable coverage. Knowing your options can save you money on your healthcare. So let’s dive deep into Medicare Advantage plans for disabled people under 65 years old.

Speak with a Medicare Advocate

Eligibility for Medicare Advantage plan for disabled under 65

There are several criteria that qualify you for Medicare under the age of 65.

If you're receiving Social Security disability benefits

Similarly, if you have kidney failure, also known as end-stage renal disease ( ESRD

Note: If you are a railroad worker with ESRD, contact Social Security, not the Railroad Retirement Board, to see if you are eligible for Medicare.

Also, if you have amyotrophic lateral sclerosis ( ALS/Lou Gehrig’s disease

Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs offer assistance to people and families who meet the Social Security Administration’s

The programs are separate but have the same medical requirements. If you are trying to apply for SSDI or SSI, you can do so at the link here definition of disability

Once you qualify for Original Medicare, you can sign up for a Medicare Advantage plan.

Benefits of Medicare Advantage plans

Medicare Advantage plans, also known as Part C of Medicare, are a way for you to get more coverage than what Original Medicare has to offer. These are insurance plans offered by private companies that, by law, have to meet the same standard of coverage as Original Medicare. You are likely to have a plan premium in addition to the Part B premium and a specific copay amount for your in-network services. You will be responsible for your copay until you hit your yearly Out-of-Pocket maximum. Most Medicare Advantage plans include a Part D prescription drug plan as well.

One of the major benefits of a Medicare Advantage plan is that some of the plans include a series of extra benefits that are not typically covered by Original Medicare. This might include dental, vision, and hearing, depending on your plan.

One of the drawbacks of Medicare Advantage plans is the potential for network restrictions. Medicare Advantage plans are either HMO or PPO. With HMO plans, you might be limited to in-network providers only, and you have to pay entirely out-of-pocket to seek care outside of your network. PPO plans allow you to go outside your network, but you still have to pay more for out-of-network providers.

Special Needs Plans

Special Needs Plans are different kinds of Medicare Advantage plans that are more selective with who can enroll. SNPs offer a variety of benefits that are tailored to the specific needs of the plan members, including personalized care plans, coordinated care management, and access to specialists and care providers who specialize in treating their particular health conditions.

According to the Medicare.gov website

Chronic Condition SNP (C-SNP) - you might qualify if you have one or more of the following conditions: chronic alcohol and other dependence, autoimmune disorders, cancer (excluding pre-cancer conditions), cardiovascular disorders, chronic heart failure, diabetes mellitus, end-stage liver disease, HIV/AIDS, chronic lung disorders, chronic and disabling mental health conditions, neurologic disorders, stroke, and more.

Institutional SNP (I-SNP) - you might qualify if you are expected to live for at least 90 days in one of the following institutions: nursing home, intermediate care facility, skilled nursing facility, rehab hospital, and more.

Dual Eligible SNP (D-SNP) - you might qualify if you have both Medicaid and Medicare.

Since these are special types of Medicare Advantage plans, your prescription drug plan (Part D) is still included. However, your monthly premiums and out-of-pocket costs will be determined by your specific choice of plan.

Enrolling in a Medicare Advantage plan for disabled under 65

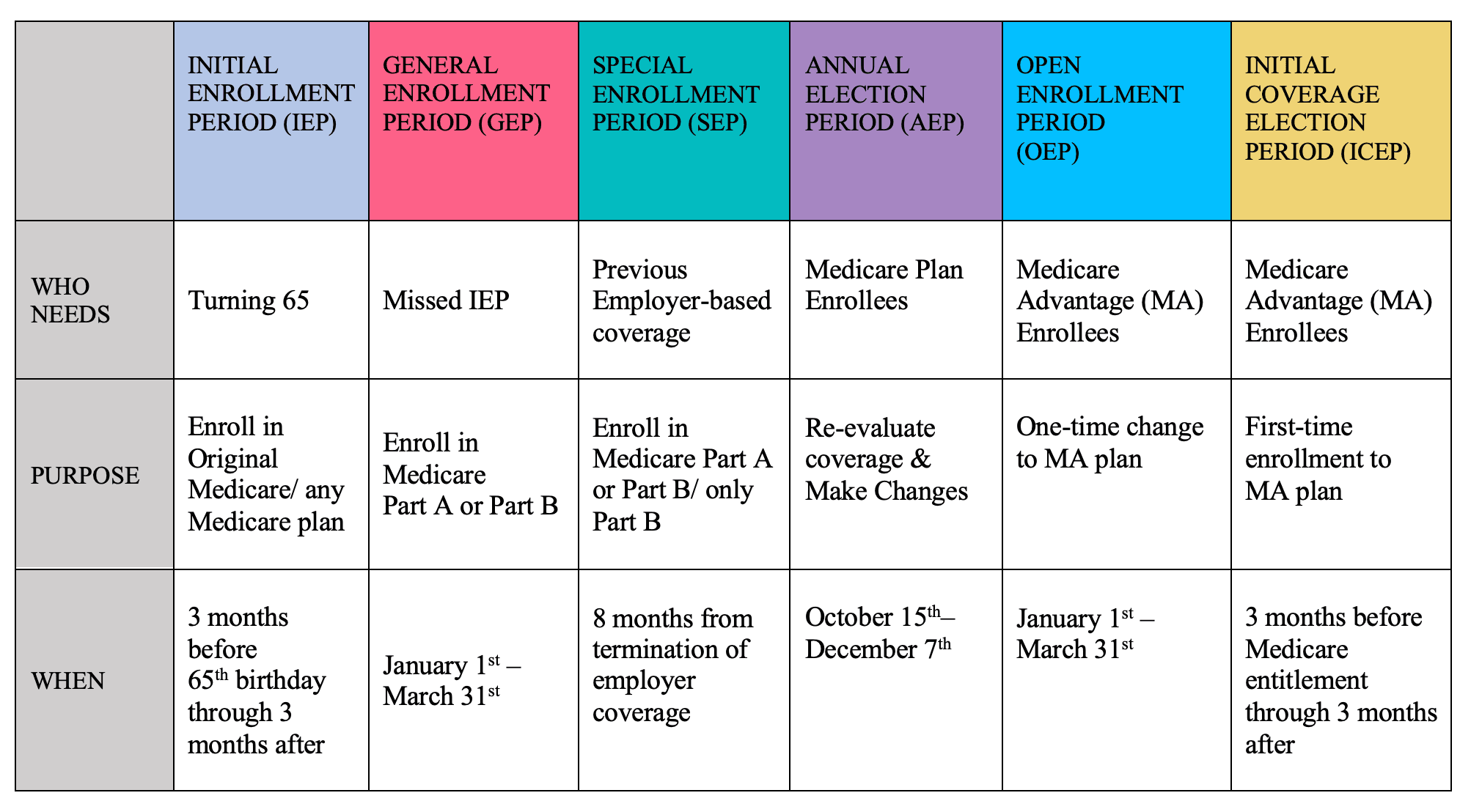

The enrollment periods of Medicare are similar for those who are eligible due to age and those eligible due to their disability.

Initial Enrollment Period - this is a seven-month window that begins three months before your 25th month on Social Security benefits and ends three months after your 25th month on Social Security benefits. If you enroll during the three months before, you receive coverage starting the 25th month. If you enroll after your 25th month, then your coverage begins the following month.

Annual Enrollment Period

- this period, which occurs from October 15 to December 7 each year, allows you to apply to enroll in a Medicare Advantage plan. You might also use this time to switch plans if you are looking for a new plan.Special Enrollment Period - there are various life circumstances that would necessitate a change in your insurance plan. Check out

Medicare.gov’s list of special circumstances.

When it’s time for you to enroll in Medicare, the best practice is to speak with a licensed Medicare advisor at Fair Square.

Cost of Medicare Advantage plan for disabled under 65

The cost of your specific Medicare Advantage plan will vary based on where you live, which plan provider you choose, and your plan-specific details. Schedule a call with a licensed Medicare Advisor

Medicare Advantage plans are not inherently bad

Deductibles—The amount you pay before your insurance coverage begins.

Coinsurance— The amount you pay as your share of the cost for services after you pay any deductibles, usually a percentage.

Copays—The amount you pay as your share of the cost for a medical service you use.

You’ll have an Out-of-Pocket maximum with your Medicare Advantage plan. Different plans can offer different yearly Max. OOP, but the maximum for 2025 across Medicare Advantage plans is $9,350.

Luckily, there are Medicaid and Medicare Savings Programs available through federal and state governments. These can help cover some of the out-of-pocket costs outlined above. If you are interested in applying for low-income subsidy programs, you can apply here

Frequently asked questions about Medicare Advantage plan for disabled under 65

1. Who is eligible for a Medicare Advantage plan for disabled individuals under 65?

To be eligible, you must be under the age of 65 and have a qualifying disability. You must also be enrolled in either Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) for at least 24 months.

2. What benefits do Medicare Advantage plans for disabled individuals under 65 cover?

These plans cover all the benefits that Original Medicare (Part A and Part B) covers, such as hospitalization, doctor visits, and medical equipment. In addition, Medicare Advantage plans may offer additional benefits such as prescription drug coverage, dental, vision, and hearing care, and wellness programs.

3. How do I enroll in a Medicare Advantage plan for disabled individuals under 65?

You can enroll during your Initial Enrollment Period (IEP), which is the seven-month period that starts three months before the month of your 25th month of disability payments and ends three months after. You can also enroll during the Annual Enrollment Period (AEP) from October 15 to December 7 each year or during a Special Enrollment Period (SEP) if you experience certain life events such as moving or losing other health coverage.

4. How much does a Medicare Advantage plan for disabled individuals under 65 cost?

Costs vary depending on the plan you choose, your location, and your specific healthcare needs. You may have to pay a monthly premium in addition to your Part B premium, as well as co-pays, deductibles, and other out-of-pocket costs.

5. Can I change my Medicare Advantage plan for disabled individuals under 65?

Yes, you can change your plan during the Annual Enrollment Period (AEP) or during a Special Enrollment Period (SEP) if you experience certain life events.

6. Can I have both a Medicare Advantage plan and Medicaid?

Yes, you may be eligible for both Medicare and Medicaid and may enroll in a Medicare Advantage plan that is designed for individuals who are eligible for both programs. These plans are called Dual Eligible Special Needs Plans (D-SNPs).

It's important to understand the details of Medicare Advantage plans for disabled individuals under 65, so you can choose the best plan for your healthcare needs and budget. If you have additional questions, you can contact Medicare directly or consult with a licensed insurance agent.

Conclusion

For those who are looking for a Medicare Advantage Plan before the age of 65 due to a disability, you have options. Your eligibility is reliant upon receiving at least 24 months of SSDI or SSI, and your enrollment windows are similar to those of age-eligible beneficiaries. The cost of your Medicare Advantage plan will depend on your unique situation. If you need a plan, look no further than the Medicare experts at Fair Square

Recommended Articles

How is Medicare Changing in 2025?

Dec 21, 2022

What Does Medicare Cover for Stroke Patients?

Jan 20, 2023

Does Medicare Cover SI Joint Fusion?

Nov 28, 2022

Does Medicare Cover Fosamax?

Nov 30, 2022

Does Medicare Cover Flu Shots?

Dec 9, 2022

Top 10 Physical Therapy Clinics in San Diego

Nov 18, 2022

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

Do You Need Books on Medicare?

Apr 6, 2023

Does Medicare Cover LVAD Surgery?

Nov 30, 2022

What is a Medicare Beneficiary Ombudsman?

Apr 11, 2023

Finding the Best Dental Plans for Seniors

Jan 4, 2023

Does Medicare Cover Lipoma Removal?

Dec 8, 2022

When Can You Change Medicare Supplement Plans?

Nov 18, 2022

Does Medicare Cover Light Therapy for Psoriasis?

Jan 17, 2023

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

Does Medicare Cover Boniva?

Nov 29, 2022

Does Medicare Cover Cartiva Implants?

Nov 29, 2022

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can I Change My Primary Care Provider with an Advantage Plan?

Can Medicare Help with the Cost of Tyrvaya?

Denied Coverage? What to Do When Your Carrier Says No

Does Medicare Cover Abortion Services?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cataract Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Ilumya?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Mental Health?

Does Medicare Cover Nexavar?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover Vitamins?

Does Medicare Cover Xiafaxan?

Does Medicare Pay for Bunion Surgery?

Does Medicare pay for Opdivo?

Explaining the Different Enrollment Periods for Medicare

Fair Square Bulletin: We're Revolutionizing Medicare

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do Medicare Agents Get Paid?

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

How Medicare Costs Can Pile Up

How Much Does Open Heart Surgery Cost with Medicare?

How to Apply for Medicare?

How to Compare Medigap Plans in 2025

How to Deduct Medicare Expenses from Your Taxes

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare & Ozempic

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Savings Programs in Kansas

Medigap vs. Medicare Advantage

Seeing the Value in Fair Square

The Easiest Call You'll Ever Make

Welcome to Fair Square's First Newsletter

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Advantage POS Plan?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What People Don't Realize About Medicare

What to Do When Your Doctor Leaves Your Network

When to Choose Medicare Advantage over Medicare Supplement

Which Medigap Policies Provide Coverage for Long-Term Care?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare