Things You Need to Know Before Switching Plans

We all know the feeling of buyer’s remorse. This feeling is not unique to shopping for clothes; it could relate to your choice of Medicare.

Speak with a Medicare Advocate

Regarding health insurance, you might find that your current plan isn't the right fit.

Luckily, Medicare has an exchange policy — letting you switch your Medicare Advantage plan to a Medigap plan.

But before you make the switch, let's consider what you need to know and how you can start the process.

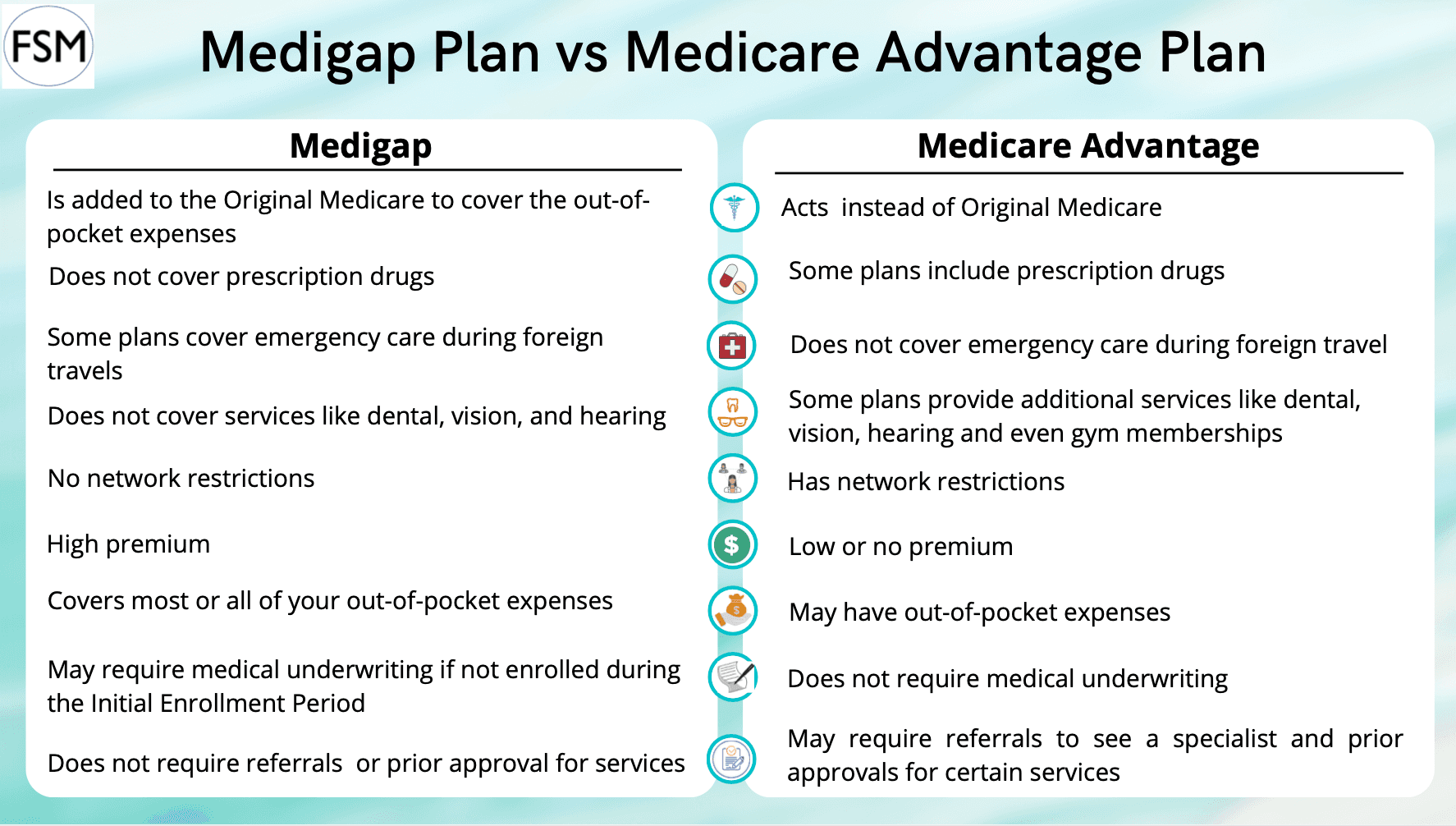

Medicare Advantage Vs. Medigap

Medicare Advantage plans Medigap plans

Here's a chart that compares the two:

Medigap Plan Vs. Medicare Advantage Plan

A Medicare Advantage plan replaces Original Medicare. Medicare Advantage typically has lower premiums and additional benefits, such as dental and vision services.

Medigap plans supplement Original Medicare by covering deductibles and coinsurance costs. That's why you'll often see Medigap referred to as Medicare Supplement Plans. They don't have network restrictions and don't need prior approval.

Can I Switch From a Medicare Advantage Plan to Medigap?

Yes, you can change your Medicare Advantage (MA) Plan to a Medigap Plan.

Medicare Advantage plans usually offer more benefits. But, you might want to switch to a Medigap plan if:

Your doctor drops from the network.

You're not satisfied with the benefits.

Getting prior approval is a burden.

You're moving out of your plan's service area.

Your plan provider moves from your area.

You want more flexibility to see doctors outside the network.

Your out-of-pocket expenses grow more than you expected.

While making the switch can be simple, you don't want to cancel your MA plan and later find out that you're not eligible for the Medigap plan of your choice.

Also, make sure you switch plans during one of the specified periods (detailed below).

When Can I Switch From Medicare Advantage to Medigap?

You can change to Medigap while still enrolled in a Medicare Advantage plan. However, you'll almost always have to switch during one of these specified periods:

Open Enrollment Period: January 1st – March 31st

Annual Election Period: October 15th – December 7th

Here's the catch: If you enroll during one of these periods, you must undergo medical underwriting

Switching plans during any other time of the year is only possible if:

You've moved out of your plan's service area.

Your insurance provider ends its contract with Medicare.

You enrolled in a Medicare Advantage plan during your initial enrollment period (when you turned 65), and you want to switch back to your Original Medicare within the first 12 months.

You had a Medigap plan before enrolling in the Medicare Advantage plan, and you want to switch back within the first 12 months.

Can Medigap Be Denied?

Short answer: Yes, your Medigap application could be denied.

When you apply for a Medigap plan, you'll have to answer health questions and undergo medical underwriting. Your insurance provider will accept or reject your application based on your medical history.

So, there's no guarantee that you'll be approved for Medigap — unless you have " Guaranteed Issue Rights

Guaranteed Issue Rights protect you in the following ways:

You won't go through medical underwriting.

Insurance companies can't reject your application or charge you more due to medical reasons, including pre-existing conditions.

You have Guaranteed Issue Rights if any of the following apply:

You move out of your plan's service area.

Your old insurance plan stops providing service.

You return to Original Medicare within 12 months of joining a Medicare Advantage Plan (at age 65).

You had a Medigap plan before enrolling in the Medicare Advantage plan, and you want to switch back within the first 12 months.

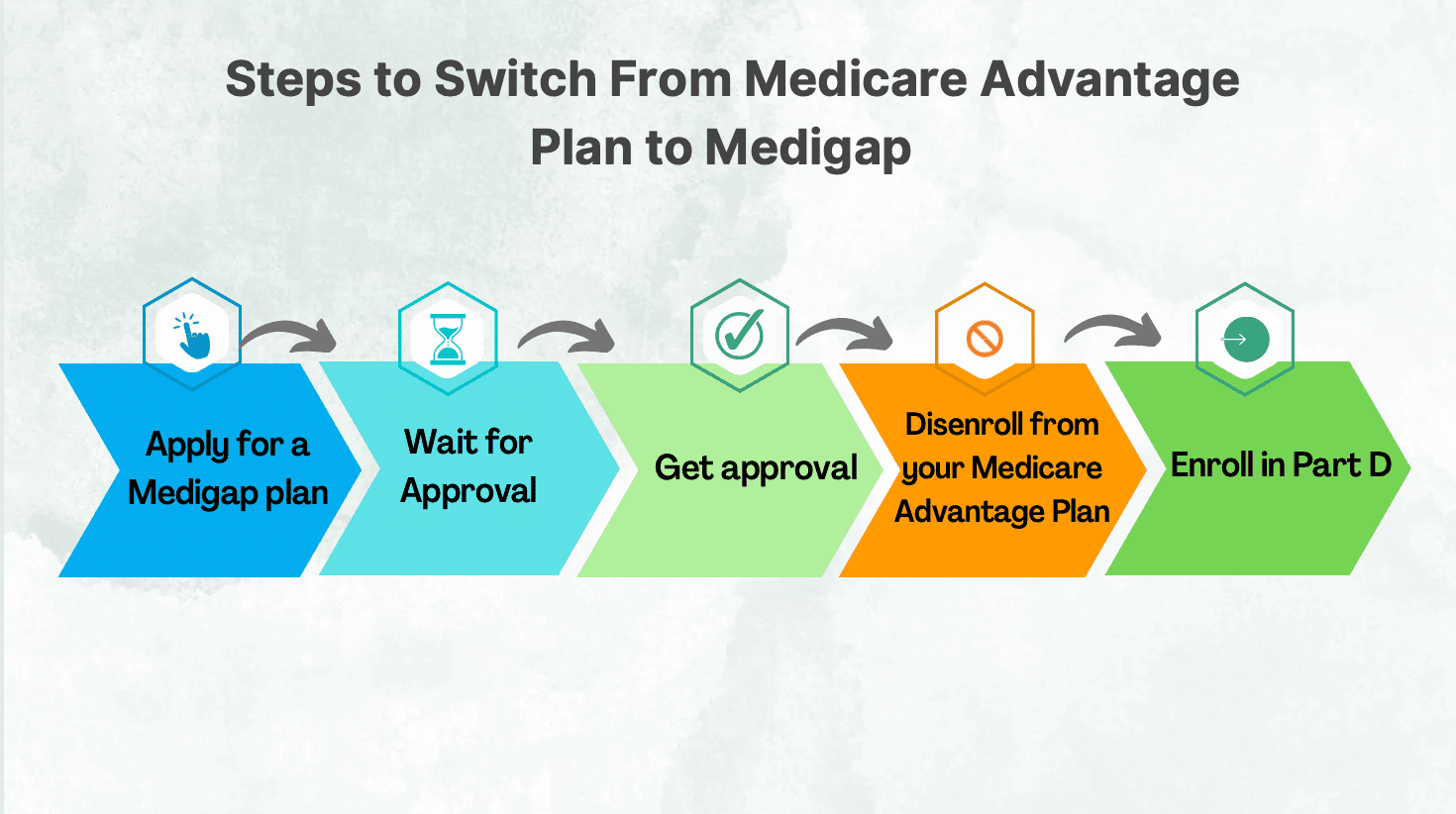

How to Switch From a Medicare Advantage Plan to Medigap

First, make sure a Medigap plan will cover all your needs. In some cases, you may need to get additional coverage.

For example, if your current Medicare Advantage Plan covers prescription drugs, you'll have to add Medicare Part D with your Medigap plan to get drug coverage.

To avoid any hurdles while switching plans, follow these steps in order:

Apply for a Medigap Plan

Wait for approval

Get Approved

Unenroll from your Medicare Advantage Plan

Enroll in Part D

Order for Switching From Medicare Advantage to Medigap Plan

Due to the medical underwriting requirement, approval for Medigap coverage takes time. Make sure to apply early during the Annual Election period so you will have plenty of time to enroll in Part D before the period ends.

Takeaway

Medicare lets you switch health insurance plans if you're dissatisfied with your current one.

Both Medicare Advantage and Medigap have their pros and cons. Understand the benefits and drawbacks of each before choosing which plan works best for you.

If you decide to switch, follow the correct procedures to avoid losing health insurance coverage. And if you have a pre-existing condition, make sure you understand the health requirements of each Medigap Plan before applying.

If you're unsure where to begin, talk to our insurance advisors

Recommended Articles

What Does Medicare Cover for Stroke Patients?

Jan 20, 2023

Does Medicare Cover Xiafaxan?

Jan 19, 2023

Does Medicare Cover Flu Shots?

Dec 9, 2022

15 Best Ways for Seniors to Stay Active in Denver

Mar 9, 2023

Do I Need Medicare If My Spouse Has Insurance?

Dec 19, 2022

Plan G vs. Plan N

Jan 28, 2022

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

Why You Should Keep Your Medigap Plan

Sep 21, 2023

Does Medicare Cover Vitamins?

Dec 5, 2022

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Does Medicare Cover Cataract Surgery?

Dec 22, 2022

Does Medicare cover Deviated Septum Surgery?

Nov 18, 2022

Does Retiring at Age 62 Make Me Eligible for Medicare?

Jun 16, 2022

Does Medicare Cover Air Purifiers?

Nov 18, 2022

Which Medigap Policies Provide Coverage for Long-Term Care?

Sep 16, 2022

What is the Medicare ICEP?

Apr 7, 2023

Is Gainswave Covered by Medicare?

Dec 6, 2022

Is Fair Square Medicare Legitimate?

Jul 27, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Washington, D.C.

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Building the Future of Senior Healthcare

Can I Laminate My Medicare Card?

Can I Use Medicare Part D at Any Pharmacy?

Costco Pharmacy Partners with Fair Square

Denied Coverage? What to Do When Your Carrier Says No

Do All Hospitals Accept Medicare Advantage Plans?

Do Medicare Supplement Plans Cover Dental and Vision?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover an FMT?

Does Medicare Cover Bariatric Surgery?

Does Medicare Cover Cervical Disc Replacement?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Geri Chairs?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Ilumya?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Linx Surgery?

Does Medicare Cover PTNS?

Does Medicare Cover Qutenza?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Tymlos?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Does Your Plan Include A Free Gym Membership?

Explaining the Different Enrollment Periods for Medicare

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How Does Medicare Pay for Emergency Room Visits?

How Much Does a Medicare Coach Cost?

How Much Does Medicare Part B Cost in 2025?

How Much Does Open Heart Surgery Cost with Medicare?

How to Apply for Medicare?

How to Compare Medigap Plans in 2025

Is Balloon Sinuplasty Covered by Medicare?

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is HIFU Covered by Medicare?

Is PAE Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare 101

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Saving Money with Alternative Pharmacies & Discount Programs

The Fair Square Bulletin: October 2023

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Advantage POS Plan?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What's the Deal with Flex Cards?

When Can You Change Medicare Supplement Plans?

When to Choose Medicare Advantage over Medicare Supplement

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare