The answer depends on your situation

Warts can be irritating nuisances or dangerous warnings for more severe potential health issues. Beyond that, they could be as expensive as $600, depending on your treatment. Luckily, you might be able to get some help from Medicare if you receive a doctor's approval for medical necessity. Read on to see the best way to save money on your wart removal.

Speak with a Medicare Advocate

Overview of Medicare coverage for wart removal

If you have a wart that needs to be removed, Medicare may cover the cost of your procedure. Medicare covers wart removal when it's medically necessary to treat an issue such as pain, infection or reduction of risk related to cancer and other serious health conditions. However, Medicare does not cover wart removal for cosmetic reasons. If you're unsure whether Medicare will cover your specific procedure, speak to your provider for more information.

Medicare may require approval before wart removal is performed, so be sure to check ahead of time. You may also need a referral from your doctor if the wart removal procedure requires specialized services or equipment. It's important to note that Medicare does not cover all wart removal treatments, so it's important to ask your doctor which treatments are covered and what out-of-pocket costs you may have to pay.

What types of wart removal will Medicare cover?

Medicare may cover wart removal treatments such as cryotherapy, cauterization, surgical excision or laser ablation. However, the type of wart removal covered will depend on your specific medical needs and the specifics of your policy. Your provider can give you more information about which wart removal treatment may be most appropriate for you.

Warts can be a sign of other potential issues, including but not limited to the following:

Human papillomavirus (HPV)

Diabetes

Autoimmune conditions

Cirrhosis of the liver

Infections caused by bacteria or fungi

Be sure to speak to your provider if you are experiencing any persistent wart issues. Warts can be removed with proper medical care, so don’t hesitate to seek help.

How to know if Medicare will cover your wart removal procedure?

It's important to speak with your Medicare provider or insurance provider to determine if Medicare covers your wart removal. They'll be able to give you more information about specific coverage details and whether the wart removal procedure is eligible for coverage under your policy. Generally, if your wart removal is primarily for cosmetic purposes, it is unlikely to be covered by Medicare. Your provider may also require prior authorization before wart removal can be performed, so make sure to check ahead of time.

If you have questions or need more information about wart removal coverage under Medicare, speak with your insurance provider or doctor, and they'll be able to provide you with the answers you need.

What you need to do before getting a wart removed

Before getting a wart removed, it's important to consult with your doctor or another healthcare professional. They'll be able to assess your wart and determine whether wart removal is medically necessary for you. If wart removal is covered by Medicare, make sure you understand exactly what the coverage includes so that you can plan for any out-of-pocket expenses. Wart removal is usually a simple procedure, but it's important to be informed and prepared before getting wart removal done.

Tips on how to prepare for a wart removal procedure

These tips can help as you go through your procedure:

Make sure to get all necessary authorizations before wart removal

Speak with your doctor about any potential risks associated with wart removal

Understand what Medicare covers and be prepared for any out-of-pocket expenses

Follow your doctor's instructions on pre-operative and post-operative care carefully

Ask questions if there is anything you don't understand about wart removal

Schedule a follow-up visit to ensure that your wart has been removed completely.

Medicare coverage for wart removal can make the procedure more affordable and accessible, so it's important to research the specifics of your policy and speak with your provider or doctor before getting wart removal done.

Potential risks associated with wart removals and what to look out for

Wart removal is generally a safe procedure, but as with any medical procedure, there are potential risks and side effects associated with wart removal. Common side effects of wart removal include pain, infection and scarring. In rare cases, wart removal can also cause nerve damage or more serious complications. It's important to speak with your doctor about any potential risks associated with wart removal and to be aware of any signs or symptoms that may indicate something is wrong.

If you have Medicare and think wart removal is a necessary procedure for your medical condition, speak with your provider or doctor to determine if it is covered under your policy. Make sure you understand all the details of

Alternatives treatments for warts and when they may be necessary

Not all wart removal procedures are covered by Medicare, and in some cases, wart removal may not be the best option. Alternatives to wart removal include creams, ointments or other topical treatments that can help reduce the size of the wart. Speak with your doctor about any potential alternatives you may want to consider before getting wart removal done.

Conclusion

If you need wart removal, Medicare may cover the cost of your procedure if it's deemed medically necessary. However, coverage will depend on the specifics of your policy, so it's important to speak with your Medicare provider or insurance company before scheduling wart removal. Be sure to follow the instructions given by your doctor and ask any questions that you may have before getting wart removal done. This content is for informational purposes only.

If you have questions about your Medicare coverage, reach out to an expert at Fair Square Medicare.

Recommended Articles

Do I Need to Renew My Medicare?

Nov 29, 2022

Explaining the Different Enrollment Periods for Medicare

Feb 3, 2023

Does Medicare Cover a Spinal Cord Stimulator?

Nov 19, 2022

Does Retiring at Age 62 Make Me Eligible for Medicare?

Jun 16, 2022

13 Best Ways for Seniors to Stay Active in Columbus

Mar 8, 2023

Everything About Your Medicare Card + Medicare Number

May 12, 2022

Does Medicare Cover Hearing Aids?

Nov 9, 2022

Is PAE Covered by Medicare?

Nov 23, 2022

How is Medicare Changing in 2025?

Dec 21, 2022

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Is Vitrectomy Surgery Covered by Medicare?

Dec 2, 2022

13 Best Ways for Seniors to Stay Active in Philadelphia

Mar 7, 2023

Do You Need Books on Medicare?

Apr 6, 2023

Does Medicare Cover Macular Degeneration?

Nov 30, 2022

What Is a Medicare Advantage POS Plan?

May 10, 2023

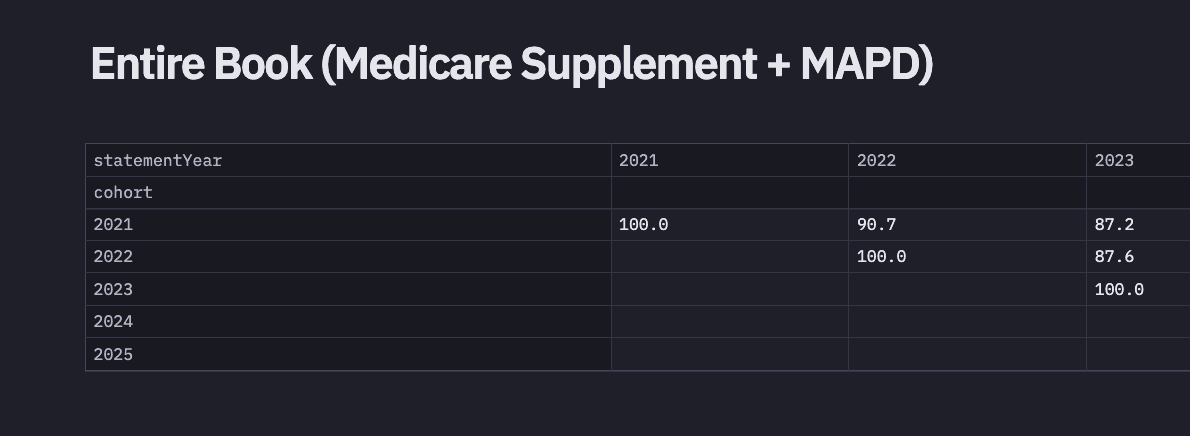

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Light Therapy for Psoriasis?

Jan 17, 2023

14 Best Ways for Seniors to Stay Active in Washington, D.C.

Mar 11, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways to Stay Active in Charlotte

2024 Cost of Living Adjustment

Building the Future of Senior Healthcare

Can Doctors Choose Not to Accept Medicare?

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Have Two Primary Care Physicians?

Can I Laminate My Medicare Card?

Can I Use Medicare Part D at Any Pharmacy?

Denied Coverage? What to Do When Your Carrier Says No

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cala Trio?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Ofev?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Piqray?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Service Animals?

Does Medicare Cover TENS Units?

Does Medicare Cover Xiafaxan?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare pay for Opdivo?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Much Does Medicare Part B Cost in 2025?

How Often Can I Change Medicare Plans?

How to Deduct Medicare Expenses from Your Taxes

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is Botox Covered by Medicare?

Is Gainswave Covered by Medicare?

Is the Shingles Vaccine Covered by Medicare?

Medicare & Ozempic

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Deductibles Resetting in 2025

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Saving Money with Alternative Pharmacies & Discount Programs

The Easiest Call You'll Ever Make

The Fair Square Bulletin: October 2023

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What If I Don't Like My Plan?

What is a Medicare Beneficiary Ombudsman?

What Is a Medicare Supplement SELECT Plan?

What to Do When Your Doctor Leaves Your Network

What's the Difference Between HMO and PPO Plans?

When Can You Change Medicare Supplement Plans?

When to Choose Medicare Advantage over Medicare Supplement

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare