Most plans don't offer coverage

Medicare has you covered with medically necessary treatments or medications to help with incontinence. Unfortunately, for over-the-counter purchases like disposable underwear Medicare generally does not offer coverage or reimbursement. However, you might be able to get over-the-counter benefits on some Medicare Advantage plans.

Speak with a Medicare Advocate

Limitations on Medicare coverage

Medicare is a government-funded health insurance program for people age 65 and over, as well as certain disabled individuals. It covers a wide range of medical services and treatments, including doctor visits, hospital stays, surgeries, lab tests, prescription drugs, preventive care, and more. However, it generally does not cover items that can be purchased over the counter, such as disposable underwear. It also does not cover long-term care or custodial care services. For more information about Medicare coverage, you can visit the official website at medicare.gov.

Coverage for disposable underwear

Unfortunately, Medicare does not cover disposable underwear as a medical necessity. However, some Medicare Advantage plans may offer over-the-counter benefits for items like this. If you have a Medicare Advantage plan, it is best to check with your provider to see what types of coverage are available. You can also contact your local Area Agency on Aging (AAA) for more information.

Alternatives to disposable underwear if you do not have Medicare coverage

Even if you do not have Medicare coverage, there are other options available for those dealing with incontinence. You may be able to purchase disposable underwear at a discounted rate through your local pharmacy or medical supply store. Additionally, some organizations provide assistance or resources in the form of discounts and grants for the purchase of incontinence products. Finally, you may also be able to find assistance from your local Area Agency on Aging. Be sure to explore all of these options before making a purchase.

How to choose the right type of disposable underwear for you

Disposable underwear can be a helpful tool for those dealing with incontinence, but it is important to understand the pros and cons before deciding if this type of product is right for you. Some benefits of using disposable underwear include increased protection against leaks, improved comfort and convenience, and ease of use. However, the cost can add up over time, and some people may find that the disposable materials are less breathable than cloth underwear. Additionally, disposable underwear may not be as durable as reusable options. To ensure you make the right choice, talk to your doctor or healthcare provider about what type of product would best fit your needs.

Tips for using and caring for disposable underwear

If you decide that disposable underwear is the right choice for your incontinence needs, it is important to know how to properly use and care for them. To make sure they last as long as possible, always follow the instructions on the packaging when putting on and taking off the underwear. Also, keep them away from heat sources such as dryers and radiators, and avoid exposing them to extreme temperatures. And remember: when it comes time to dispose of them, be sure to place them in an appropriate bag or container for safe disposal.

Takeaway

Medicare does not offer coverage for disposable underwear. But those with Medicare Advantage should check their plan to see if any additional benefits are available. For any Medicare-related questions, call a Fair Square Medicare expert. We are here for you.

Recommended Articles

Does Medicare Require a Referral for Audiology Exams?

Nov 22, 2022

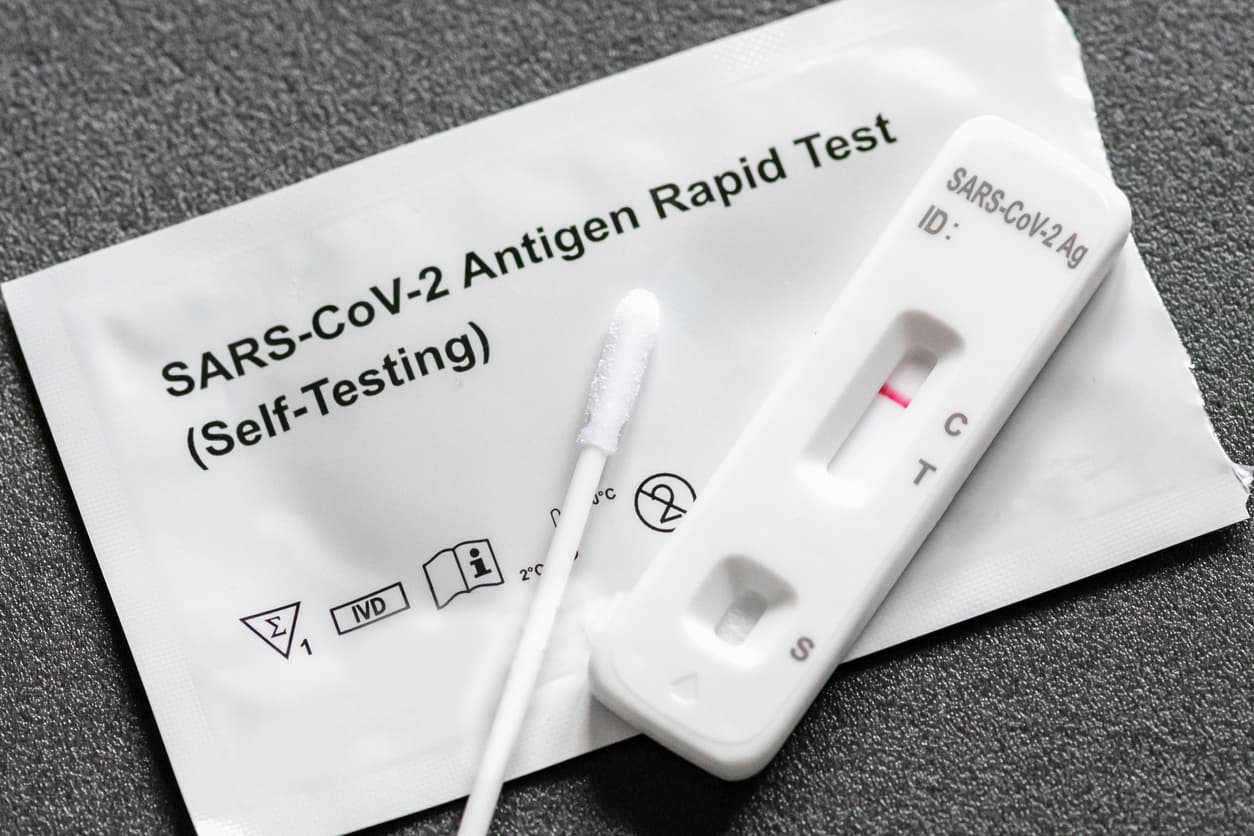

Does Medicare Cover COVID Tests?

Dec 21, 2022

Is PAE Covered by Medicare?

Nov 23, 2022

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Nov 30, 2022

How Do Medicare Agents Get Paid?

Apr 12, 2023

Does Medicare Cover Exercise Physiology?

Jan 11, 2023

Does Medicare Cover Diabetic Eye Exams?

Jan 11, 2023

Fair Square Bulletin: We're Revolutionizing Medicare

Apr 27, 2023

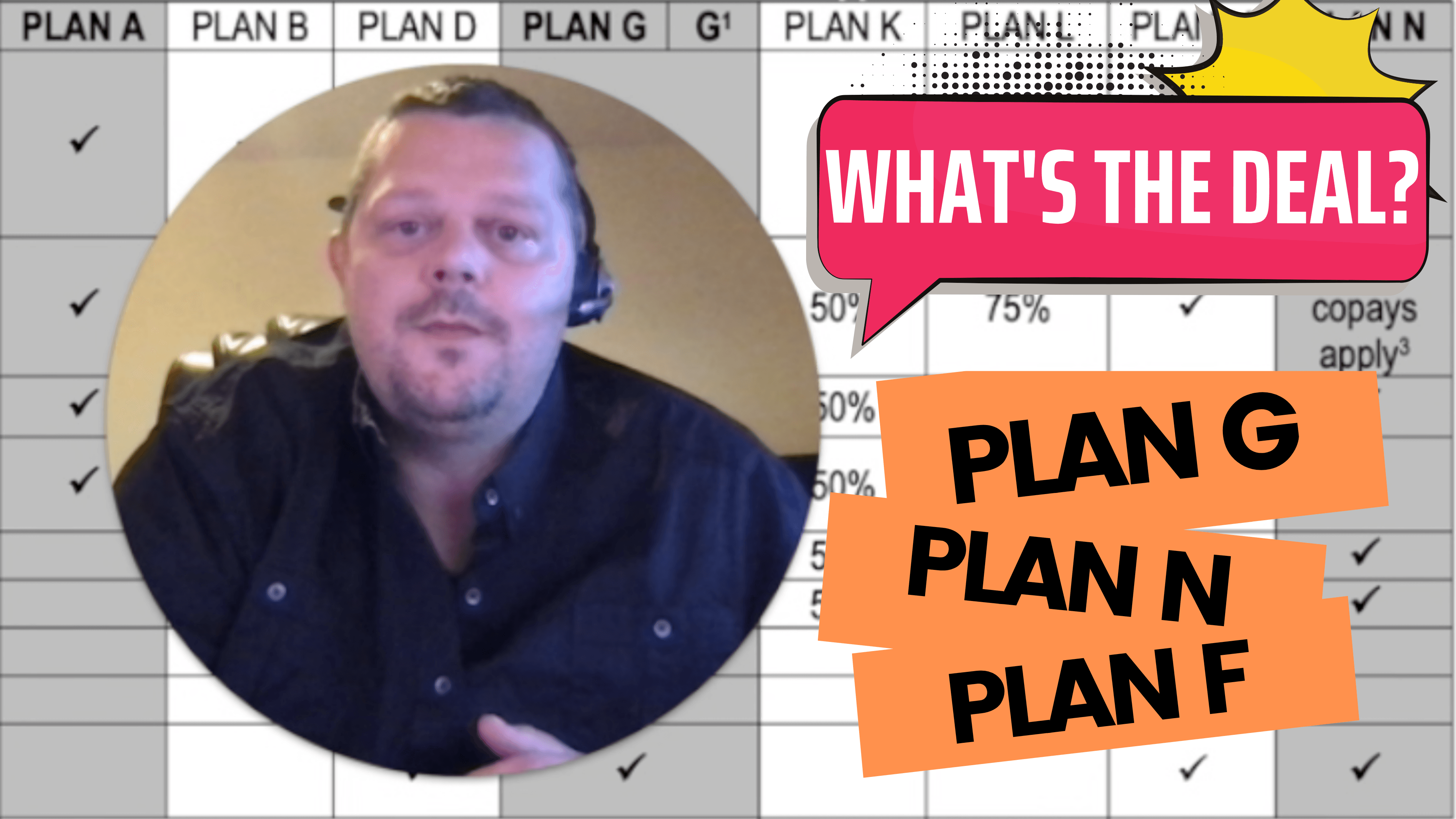

Plan G vs. Plan N

Jan 28, 2022

Does Medicare Pay for Varicose Vein Treatment?

Nov 18, 2022

Does Medicare Cover Kyphoplasty?

Dec 9, 2022

Does Medicare Cover Iovera Treatment?

Jan 11, 2023

Medicare & Ozempic

Jul 20, 2023

When Can You Change Medicare Supplement Plans?

Nov 18, 2022

Does Medicare Cover SI Joint Fusion?

Nov 28, 2022

Does Medicare Cover Hepatitis C Treatment?

Nov 22, 2022

Does Medicare Cover Geri Chairs?

Dec 7, 2022

Does Medicare Cover Krystexxa?

Nov 18, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways for Seniors to Stay Active in Seattle

14 Best Ways for Seniors to Stay Active in Washington, D.C.

15 Best Ways for Seniors to Stay Active in Denver

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

2024 Fair Square NPS Report

Building the Future of Senior Healthcare

Can I Change My Primary Care Provider with an Advantage Plan?

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Do I Need to Renew My Medicare?

Do You Need Books on Medicare?

Does Medicare Cover Abortion Services?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cala Trio?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Compounded Medications?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Ilumya?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Nuedexta?

Does Medicare Cover Piqray?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Urodynamic Testing?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Funeral Expenses?

How Does Medicare Cover Colonoscopies?

How Does Medicare Pay for Emergency Room Visits?

How is Medicare Changing in 2025?

How Much Does Medicare Part A Cost in 2025?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Choose a Medigap Plan

How to Compare Medigap Plans in 2025

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Is Emsella Covered by Medicare?

Is Fair Square Medicare Legitimate?

Is the Shingles Vaccine Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Consulting Services

Medicare Guaranteed Issue Rights by State

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Medigap vs. Medicare Advantage

Welcome to Fair Square's First Newsletter

What Are Medicare Part B Excess Charges?

What Happens to Unused Medicare Set-Aside Funds?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What is the Medicare ICEP?

What to Do When Your Doctor Leaves Your Network

What's the Deal with Flex Cards?

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare