Exploring Medicare Coverage for End Stage Renal Disease

Roughly 786,000 people in the U.S. suffer from kidney failure — ESRD.

Speak with a Medicare Advocate

While long-term treatments make the condition more manageable, they're expensive; ESRD patients often need medical care for years, and these costs add up over time.

Luckily, Medicare covers treatments for qualifying candidates.

Let's take a look at Medicare's ESRD benefits. We'll discuss who's eligible for treatments, what services Medicare covers, and how long coverage lasts.

What Is ESRD?

ESRD (End Stage Renal Disease) — also known as kidney failure — occurs when chronic kidney disease reaches an advanced stage.

Kidney function deteriorates so much that the kidneys can no longer meet the body's needs. To survive, you need either dialysis or a kidney transplant.

Am I Eligible for ESRD Medicare Coverage?

To qualify for ESRD benefits, you must meet the following conditions:

Your kidneys are no longer functioning

You need regular dialysis, or you've had a kidney transplant

In addition, one of the following should apply:

You've fulfilled the necessary duration of employment under Social Security, the Railroad Retirement Board (RRB), or as a government employee

You receive or qualify for Social Security or Railroad Retirement benefits

You are the spouse or child of an individual who meets one of the criteria listed above

Note: While ESRD most commonly affects older adults, age doesn't impact your eligibility for Medicare benefits.

What ESRD Services Does Medicare Cover?

ESRD coverage depends on your specific Medicare plan

ESRD Services Covered by Original Medicare

Original Medicare covers the following services:

Dialysis treatments and services:

Inpatient dialysis treatments

Outpatient dialysis treatments

Home dialysis training — instruction for you and the person helping you with your home dialysis treatments

Home dialysis equipment and supplies — dialysis machine, water treatment system, basic recliner, alcohol, wipes, sterile drapes, rubber gloves, and scissors

Certain home support services — such as visits by trained hospital or dialysis facility workers who monitor your home dialysis, help during emergencies, and check your dialysis equipment and water supply

Most drugs for outpatient or home dialysis

Other dialysis-related services and supplies — e.g., lab tests

Kidney transplants and transplant-related services:

Kidney registry fee

Tests that evaluate your condition and the condition of potential kidney donors

Inpatient services in a Medicare-certified hospital

The costs of finding the proper kidney for your transplant surgery (if there’s no kidney donor)

The total cost of care for your kidney donor. This includes the following:

Services before, during, and after the surgery

Any inpatient hospital care needed if surgical complications arise

Doctor services during a donor's hospital stay

Doctor services for your kidney transplant surgery — including care before, during, and after surgery

Transplant drugs (i.e., immunosuppressive drugs) after you leave the hospital following a transplant

Note: Coverage lasts for a limited amount of time

Blood — whole or units of packed red blood cells, blood components, and the cost of processing and giving you blood

ESRD Drug Coverage: Original Medicare (Parts A and B)

ESRD patients who undergo kidney transplants or dialysis qualify for drug coverage.

Here's what to expect if you have Medicare Part A and Part B:

Medicare Part B covers transplant drugs and most other drugs needed for dialysis

Medicare covers immunosuppressant drugs for 36 months after your kidney transplant surgery — but ONLY if you have both A and B

Parts A and B do NOT cover prescription drugs for other health issues like diabetes or blood pressure

ESRD Drug Coverage: Medicare Part D

Here's what to expect if you have Medicare Part D:

Medicare Part D helps with drug costs not covered by Medicare Part B

If you don't have Medicare Part A at the time of your transplant, you need Part D to cover the costs of your immunosuppressant drugs

ESRD Services Covered by Medicare Advantage Plans

A Medicare Advantage plan Original Medicare

You also have the option to enroll in additional Medicare Advantage programs to get extra benefits — like prescription drugs, vision, hearing and dental coverage. Here's one option:

Special Needs Plan

A Special Needs Plan

Specifically, ESRD patients can enroll in C-SNP (Chronic Condition SNP).

What ESRD services does C-SNP provide?

The same services provided by all Medicare Advantage plans

Additional specialized services for those with chronic conditions (e.g., extra days in the hospital)

ESRD Services Covered by Medicare Supplement Plans

Medicare Supplement plans, also known as Medigap plans help cover the expenses left by Original Medicare. They may cover a portion or all of your out-of-pocket costs.

(Exact coverage depends on your specific Medicare Supplement plan

How Do I Get ESRD Benefits From Medicare?

First, you need to sign up for Medicare. Visit the nearest Social Security branch or dial 1-800-772-1213. (If you use TTYs, dial 1-800-325-0778).

To get full ESRD benefits, you'll need both Parts A and B of Original Medicare. If you qualify for Medicare Part A, you can also get Part B.

I Enrolled in Medicare Part B Past the Deadline. Will I Have to Pay a Late Fee?

If you're eligible for Medicare due to ESRD, you're exempt from a late enrollment penalty for Medicare Part B.

Already paying a late enrollment fee for Medicare Part B? Don't worry. Once you qualify for ESRD benefits, this penalty discontinues.

When Do My ESRD Medicare Benefits Start?

Medicare provides retroactive coverage. So, if you're eligible for Medicare due to ESRD but delay your enrollment, Medicare may provide coverage up to 12 months before you apply.

However, your exact Medicare coverage start date depends on your ESRD treatments.

Start Dates for Dialysis Treatments

Medicare coverage begins on the first day of the fourth month of your dialysis treatments — even if you haven’t signed up for Medicare yet.

For example, if your dialysis starts in May, your Medicare coverage will begin on August 1st

Note: If you're enrolled in an employer group health plan, your Medicare coverage still starts during the fourth month of dialysis treatments. Your group health plan may pay for the first three months of dialysis.

Does Medicare coverage ever begin sooner?

Yes! Coverage can begin as early as the first month of regular dialysis treatments if you meet all of these conditions:

You complete a home dialysis training program (offered by a Medicare-certified training facility) during the first three months of treatment

Your doctor expects you to finish training and be able to manage your dialysis treatments at home

You maintain a regular course of dialysis throughout the waiting period — i.e., the three-month period before Medicare begins

So, Medicare won’t cover surgery or other preparatory services (e.g., surgery for blood access) before the fourth month. But if you complete home dialysis training, your Medicare coverage starts the month you begin regular dialysis treatments.

In addition, if you already have Medicare due to age or disability, you'll receive coverage for physician-ordered fistula placements and other preparatory services.

Start Dates for Kidney Transplants

Generally, Medicare coverage begins the month you are admitted to a Medicare-certified hospital for a kidney transplant (or transplant-related services).

This rule applies if your transplant occurs within two months of your admission. If your transplant is delayed for more than two months after your hospital admission, Medicare coverage can begin two months before your transplant.

How Long Do My ESRD Medicare Benefits Last?

If you have Medicare only because of permanent kidney failure, Medicare coverage will end:

12 months after the month you stop dialysis treatments.

36 months after the month you have a kidney transplant.

Your Medicare coverage will resume if:

You start dialysis again, or you get a kidney transplant within 12 months after the month you stopped getting dialysis

You start dialysis or get another kidney transplant within 36 months after the month you get a kidney transplant

How Much Do ESRD Treatments Cost with Medicare?

Medicare covers most ESRD treatment costs. But you'll still have to pay some out-of-pocket expenses. The exact price depends on the type of treatment you get.

In-patient kidney transplant and dialysis costs include:

Your annual deductible

A daily hospital coinsurance if your stay exceeds your benefit period

Days 1-60: $0 coinsurance for each benefit period

Days 61-90: $400 (in 2023) copayment each day

Days 91-150: $800 (in 2023) copayment each day while using your 60 lifetime reserve days

After day 150: You pay all costs

20% coinsurance of the Medicare-Approved Amount for doctor services (if your provider accepts Medicare assignments)

Out-patient dialysis costs include:

Your Part B deductible

20% coinsurance for the Medicare-approved amount for all covered dialysis services

Home dialysis costs include:

Your Part B deductible

20% coinsurance for the Medicare-approved amount for all covered dialysis services

If you have Medicare Part A and B, Medicare will cover your immunosuppressant drugs for 36 months after the month of your transplant.

You might have to pay much less if you have a Medicare Advantage or Medicare Supplement plan, as these plans cover most or all of your out-of-pocket expenses.

What Is Part B Immunosuppressant Drug Benefit?

The Immunosuppressant Drug Benefit helps you afford immunosuppressive drugs beyond 36 months if you don’t have other health coverage.

If you sign up, here's what you'll pay:

Monthly premium — based on your income

Annual deductible — $226 for 2023

20% of the Medicare-approved amount for your immunosuppressive drugs

This new benefit begins on January 1, 2023. To sign up, call the Social Security line at 1-877-465-0355. (TTY users can contact our general line at 1-800-325-0778).

Takeaway

Medicare

ESRD Medicare benefits and their coverage limits can be confusing. If you have further questions, feel free to talk to our experts

Recommended Articles

Does Medicare Cover Jakafi?

Dec 12, 2022

Can I Laminate My Medicare Card?

Dec 22, 2022

What is a Medicare Beneficiary Ombudsman?

Apr 11, 2023

Does Medicare Cover Exercise Physiology?

Jan 11, 2023

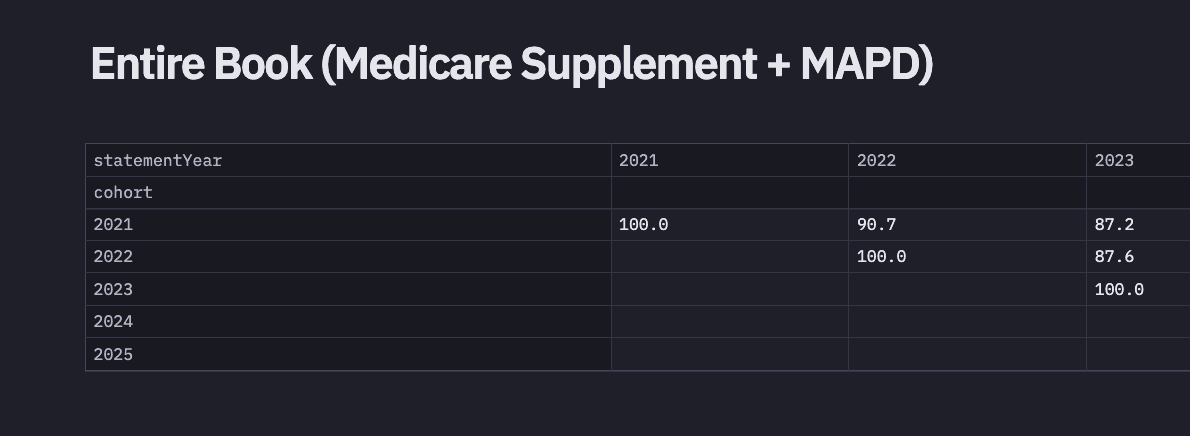

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Does Medicare Cover Bladder Sling Surgery?

Jan 11, 2023

What's the Deal with Flex Cards?

Dec 15, 2022

Does Medicare Pay for Allergy Shots?

Nov 29, 2022

Does Medicare Cover Hepatitis C Treatment?

Nov 22, 2022

The Easiest Call You'll Ever Make

Jun 28, 2023

14 Best Ways for Seniors to Stay Active in Seattle

Mar 10, 2023

Is Displacement Affecting Your Medicare Coverage?

Oct 6, 2022

Is Emsella Covered by Medicare?

Nov 21, 2022

The Fair Square Bulletin: October 2023

Oct 2, 2023

Does Medicare Cover Cardiac Ablation?

Dec 9, 2022

Estimating Prescription Drug Costs

May 25, 2020

Health Savings Accounts (HSAs) and Medicare

Jan 24, 2024

Does Medicare Cover Qutenza?

Jan 13, 2023

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Columbus

13 Best Ways for Seniors to Stay Active in Jacksonville

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2024 Cost of Living Adjustment

2024 Fair Square NPS Report

2025 Medicare Price Changes

Are Medicare Advantage Plans Bad?

Building the Future of Senior Healthcare

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can Medicare Advantage Plans be Used Out of State?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Air Purifiers?

Does Medicare Cover an FMT?

Does Medicare Cover COVID Tests?

Does Medicare Cover Disposable Underwear?

Does Medicare Cover ESRD Treatments?

Does Medicare Cover Fosamax?

Does Medicare Cover Geri Chairs?

Does Medicare Cover Hearing Aids?

Does Medicare cover Hyoscyamine?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Nexavar?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover PTNS?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the Urolift Procedure?

Does Medicare Pay for Antivenom?

Does Medicare pay for Opdivo?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Everything About Your Medicare Card + Medicare Number

Finding the Best Dental Plans for Seniors

Finding the Best Vision Plans for Seniors

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Does Medicare Pay for Emergency Room Visits?

How Medicare Costs Can Pile Up

How Much Does a Medicare Coach Cost?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How to Deduct Medicare Expenses from Your Taxes

Last Day to Change Your Medicare Part D Plan

Medicare & Ozempic

Medicare Advantage MSA Plans

Medicare Advantage Plans for Disabled People Under 65

Medicare Consulting Services

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

What Are Medicare Part B Excess Charges?

What Does Medicare Cover for Stroke Patients?

What If I Don't Like My Plan?

What Is a Medicare Advantage POS Plan?

What To Do If Your Medicare Advantage Plan Is Discontinued

When Can You Change Medicare Supplement Plans?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare