Septoplasty and other nasal surgeries might be covered

Difficulty breathing and nosebleeds are just two of the potential health risks caused by a deviated septum. So can Medicare help cover the surgery to straighten your nose? If the surgery is determined to be medically necessary, then yes. Otherwise, Medicare will not offer coverage for cosmetic procedures.

Speak with a Medicare Advocate

Let's talk more about what goes into this determination.

What is a deviated septum and what causes it?

A deviated septum is when the thin wall of cartilage that separates the nostrils in your nose shifts to one side. This can lead to an obstruction of airflow and make breathing difficult. It's estimated that 80% of people have some degree of a deviated septum, with severe cases causing difficulty sleeping, headaches, and sinus infections.

The causes of a deviated septum can vary but include congenital issues or trauma such as a broken nose.

Symptoms and diagnosis of a deviated septum

Common symptoms of a deviated septum include difficulty breathing, poor sense of smell, frequent nosebleeds, sinus infections, and snoring. Sometimes the obstructed nasal airway can lead to nasal polyps, benign growths in the sinus that can further impede your breathing.

In order to diagnose the condition properly, your doctor will ask you questions about your medical history and conduct a physical exam that may include a rhinoscopy (an examination using an endoscope that is passed through the nostrils).

Septoplasty

The surgery to correct a deviated septum is known as septoplasty. In this procedure, the doctor will straighten and reposition the septum to improve airflow. The surgery is typically done under general anesthesia in an outpatient setting and may involve other procedures, such as sinus resection or turbinate reduction.

Septoplasty is usually regarded as minor procedure. Most operations take only 30-90 minutes, with recovery lasting for a couple weeks on average. These are among the most common medical procedures performed by ear, nose, and throat doctors. Before your procedure, you might be asked to stop taking certain medications that can increase the risk of bleeding during surgery.

Costs of septoplasty

The cost of septoplasty can vary depending on the complexity of your case, but the cost can range from $6,000 to $30,000.

As mentioned earlier, Medicare will only help to cover the cost if the procedure is deemed medically necessary. But if that is not the case, you still have some options for reducing the cost of your surgery. For example, you can talk to your doctor about financing options and paying in installments.

Medicare coverage for surgery to correct a deviated septum

What does Medicare cover for treating a deviated septum?

For Medicare to offer coverage for any type of surgery, it must be deemed medically-necessary. Medicare Part B may cover the costs associated with a septoplasty if it is deemed to be medically necessary. However, they will not cover cosmetic procedures. In order to determine if you qualify for coverage, your doctor must present documentation of the medical necessity of the procedure. The documentation should include the diagnosis, a description of the procedure, and a plan for post-operative care.

If you meet all of the criteria, Medicare Part B will cover 80% of the costs associated with the septoplasty. You will be responsible for the remaining 20%, although a Medicare Supplement Plan can help cover the remaining 20%.

Takeaway

Deviated septum surgeries are covered by Medicare if they are determined to be medically necessary. If not, there are other ways to cover the costs, such as working with a doctor on financing options. No matter what route you take, it's important to speak with a medical professional about any questions or concerns you have before making major decisions. This content is for informational purposes only. If you have any questions about your Medicare coverage, give us a call today at 1-888-376-2028.

Recommended Articles

Does Medicare Cover Disposable Underwear?

Dec 8, 2022

Health Savings Accounts (HSAs) and Medicare

Jan 24, 2024

Does Medicare Cover Penile Implant Surgery?

Dec 9, 2022

Does Medicare Cover Macular Degeneration?

Nov 30, 2022

Does Medicare Cover Zilretta?

Nov 28, 2022

Does Medicare Cover PTNS?

Dec 9, 2022

The Fair Square Bulletin: October 2023

Oct 2, 2023

How Much Does Rexulti Cost with Medicare?

Jan 24, 2023

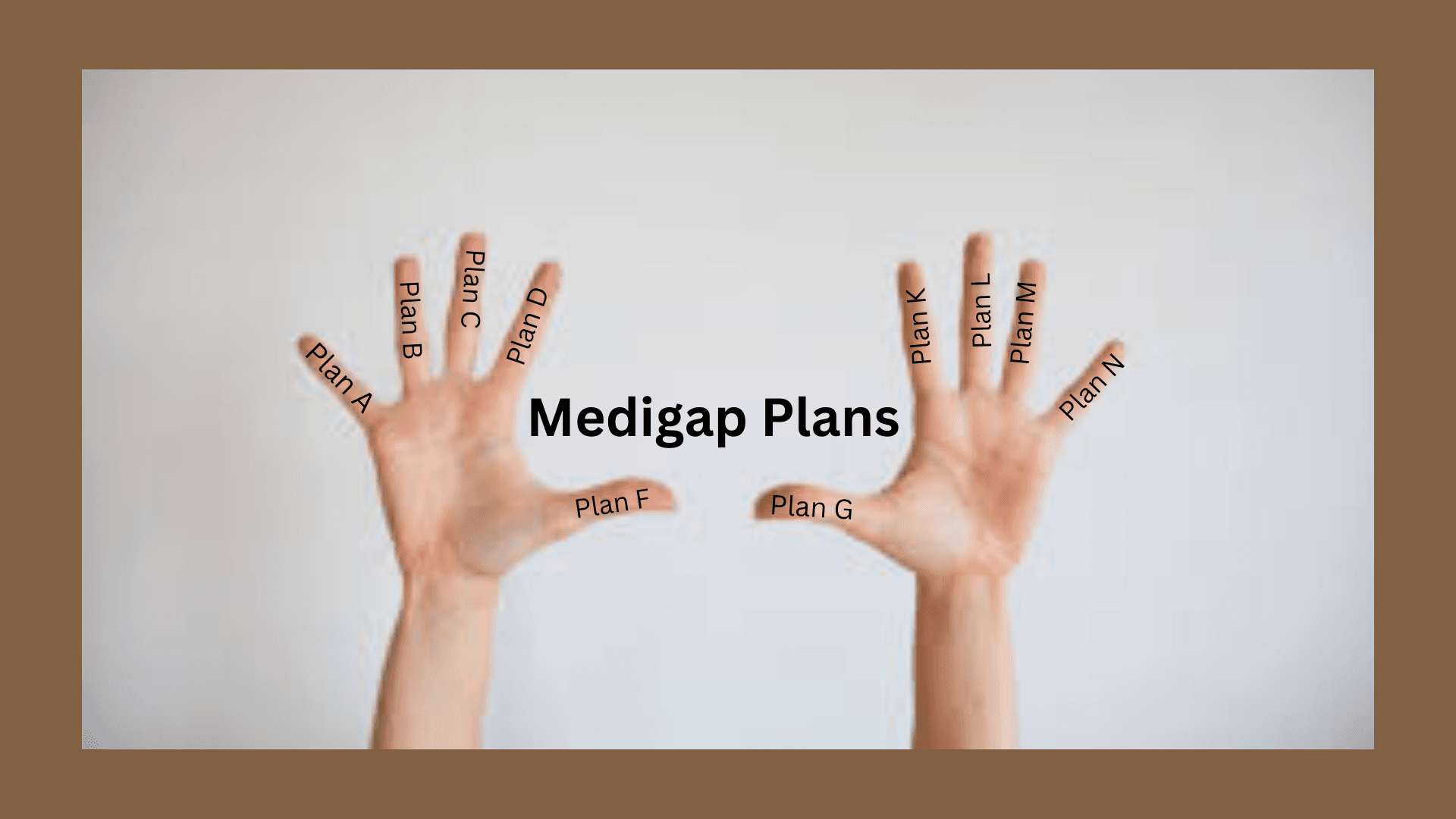

How Do Medigap Premiums Vary?

Apr 12, 2023

What is a Medicare Beneficiary Ombudsman?

Apr 11, 2023

The Easiest Call You'll Ever Make

Jun 28, 2023

What is the 8-Minute Rule on Medicare?

Dec 21, 2022

How Does Medicare Pay for Emergency Room Visits?

Nov 21, 2022

Does Your Plan Include A Free Gym Membership?

Jul 12, 2023

Can Medicare Advantage Plans be Used Out of State?

Jun 12, 2023

Does Medicare Cover Compounded Medications?

Apr 4, 2023

Does Medicare Cover Cala Trio?

Nov 23, 2022

What's the Difference Between HMO and PPO Plans?

Dec 1, 2022

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Philadelphia

13 Best Ways for Seniors to Stay Active in Phoenix

14 Best Ways for Seniors to Stay Active in Nashville

14 Best Ways to Stay Active in Charlotte

2024 Cost of Living Adjustment

Can Doctors Choose Not to Accept Medicare?

Can I Have Two Primary Care Physicians?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Do You Need Books on Medicare?

Does Medicare Cover Abortion Services?

Does Medicare Cover Cosmetic Surgery?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Exercise Physiology?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Jakafi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Nexavar?

Does Medicare Cover Ofev?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Ozempic?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Piqray?

Does Medicare Cover Qutenza?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover TENS Units?

Does Medicare Cover Tymlos?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Varicose Vein Treatment?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Does Your Medicare Plan Cover B12 Shots?

Fair Square Bulletin: We're Revolutionizing Medicare

Fair Square Client Newsletter: AEP Edition

Finding the Best Dental Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medicare Agents Get Paid?

How Much Does a Medicare Coach Cost?

How Much Does Open Heart Surgery Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Choose a Medigap Plan

How to Enroll in Social Security

Is Displacement Affecting Your Medicare Coverage?

Is HIFU Covered by Medicare?

Last Day to Change Your Medicare Part D Plan

Medicare 101

Medicare Advantage MSA Plans

Medicare Consulting Services

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

What Happens to Unused Medicare Set-Aside Funds?

What is Plan J?

What Is the Medicare Birthday Rule in Nevada?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

When to Choose Medicare Advantage over Medicare Supplement

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare