Ways to Cover Your Ketamine Therapy Costs

If you or your loved ones struggle with depression

Speak with a Medicare Advocate

But what exactly is ketamine infusion, and will your insurance plan help cover the costs?

Keep reading to find out. In this article, we'll answer all your questions about ketamine infusion therapy and discuss ways to get coverage.

What Is Ketamine Infusion Therapy?

Ketamine infusion is an FDA-approved therapy for treatment-resistant depression.

It involves a 40-minute procedure — in a hospital or clinical setting — in which a doctor administers ketamine intravenously.

Ketamine infusion therapy requires multiple sessions:

It begins with an induction period — the patient typically receives six infusions over 2-3 weeks

Then follows the maintenance period — the dosage is slowly reduced to one infusion every 2-6 weeks

How Much Does Ketamine Infusion Therapy Cost?

A single ketamine infusion costs between $450 and $500.

The total cost of the Ketamine infusion therapy — which includes six ketamine infusions, a pretreatment consultation, and post-treatment follow-ups — is around $4,500.

Exact treatment costs may vary depending on your healthcare provider.

Does Medicare Cover Ketamine Infusions?

No. Medicare

However, Medicare does cover a derivative of ketamine known as esketamine (Spravato). Spravato is an FDA-approved intranasal spray used on patients with treatment-resistant depression.

Note: To get Medicare coverage for Spravato, you must be enrolled

Do Private Insurance Companies Cover Ketamine Infusions?

Typically, no.

Most private insurance companies only cover ketamine as an anesthetic. They probably won't cover ketamine treatments for depression.

However, insurance might cover certain parts of your treatment — like doctor visits or medical exams.

The extent of your insurance coverage depends on your plan and provider.

How Can I Cover the Costs of Ketamine Infusions?

Here are some ways to make ketamine infusions more affordable:

Talk to your insurance provider

Look for out-of-network reimbursements

Provide a Superbill

Use HSA/FSA accounts

Look into Advance Care

Seek Veteran Support

Ask about installment payments

Let's look at each option in more detail.

1. Talk to Your Insurance Provider

Check whether your insurance provider covers ketamine therapy. Some offer coverage under specific circumstances:

For example, if your provider classifies the treatment as “an infusion of a generic drug,” they may be able to cover some out-of-pocket expenses

2. Look for Out-of-Network Reimbursements

See if your insurance provider reimburses out-of-network claims. Pay your clinical provider for the service and ask your insurance for a reimbursement.

Most insurance companies accept out-of-network claims for healthcare services — unless their policy states otherwise. But each insurance company has different rules regarding out-of-network coverage. Talk to your provider for more info.

3. Provide a Superbill

A Superbill is an itemized list of all services provided to a client. It includes detailed visit summaries, doctors' names, CPT codes, etc.

Request a Superbill from your doctor. You might need it to claim your out-of-network coverage or get financial assistance with doctor visits, medical exams, etc.

4. Use HSA/FSA Accounts

HSA (Healthcare Spending Account) and FSA (Flexible Spending Account) are pre-tax accounts that help you save money for qualified healthcare expenses.

Paying for your ketamine therapy using these "pre-tax" dollars is like receiving a discount on your treatment.

Note: Stop HSA contributions at least six months before enrolling in Medicare to avoid potential tax penalties.

5. Look Into Advance Care

Advance Care

Using Advance Care can help reduce up-front expenses.

6. Seek Veteran Support

The Ketamine Fund

7. Ask About Installment Payments

Ask your healthcare provider if they provide installment payment options. Enrolling in a payment plan can help you cover up-front treatment costs.

Will Ketamine Infusion Coverage Change in the Future?

It's possible! Insurance companies might decide to cover ketamine infusion therapy as more research shows its safety and effectiveness in treating depression.

Several organizations are already trying to spark this change:

For example, a non-profit organization called the Ketamine Task Force

Takeaway

Ketamine infusion therapy is an effective depression treatment — with results lasting days or weeks. Talk with your doctor before starting or stopping treatment for depression. This content is for informational purposes only.

Currently, Medicare doesn't provide coverage of ketamine treatments for depression. But you can seek out-of-network reimbursements, HSA/FSA accounts, and other payment options to reduce your expenses.

If you need help, our team at Fair Square Medicare

Give us a call at 1-888-376-2028.

Recommended Articles

13 Best Ways for Seniors to Stay Active in Indianapolis

Mar 9, 2023

How Do I Sign up for Medicare? A Simple How-To Guide For You

Apr 8, 2022

Is Emsella Covered by Medicare?

Nov 21, 2022

What You Need to Know About Creditable Coverage

Jan 18, 2023

Does Medicare Require a Referral for Audiology Exams?

Nov 22, 2022

Does Medicare Pay for Allergy Shots?

Nov 29, 2022

Is Botox Covered by Medicare?

Jan 19, 2023

Everything About Your Medicare Card + Medicare Number

May 12, 2022

How Much Does Medicare Part B Cost in 2025?

Dec 27, 2022

What is Plan J?

Jul 14, 2025

When Can You Change Medicare Supplement Plans?

Nov 18, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

Which Medigap Policies Provide Coverage for Long-Term Care?

Sep 16, 2022

How to Become a Medicare Agent

Aug 30, 2023

Does Medicare Cover Boniva?

Nov 29, 2022

Does Medicare Cover Vitamins?

Dec 5, 2022

Finding the Best Vision Plans for Seniors

Jan 6, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Building the Future of Senior Healthcare

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Have Two Primary Care Physicians?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover an FMT?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Chiropractic Visits?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Fosamax?

Does Medicare Cover Hearing Aids?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Ilumya?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Krystexxa?

Does Medicare Cover Kyphoplasty?

Does Medicare Cover Light Therapy for Psoriasis?

Does Medicare Cover Lipoma Removal?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nexavar?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Urodynamic Testing?

Does Medicare pay for Opdivo?

Does Your Medicare Plan Cover B12 Shots?

Does Your Plan Include A Free Gym Membership?

Explaining IRMAA on Medicare

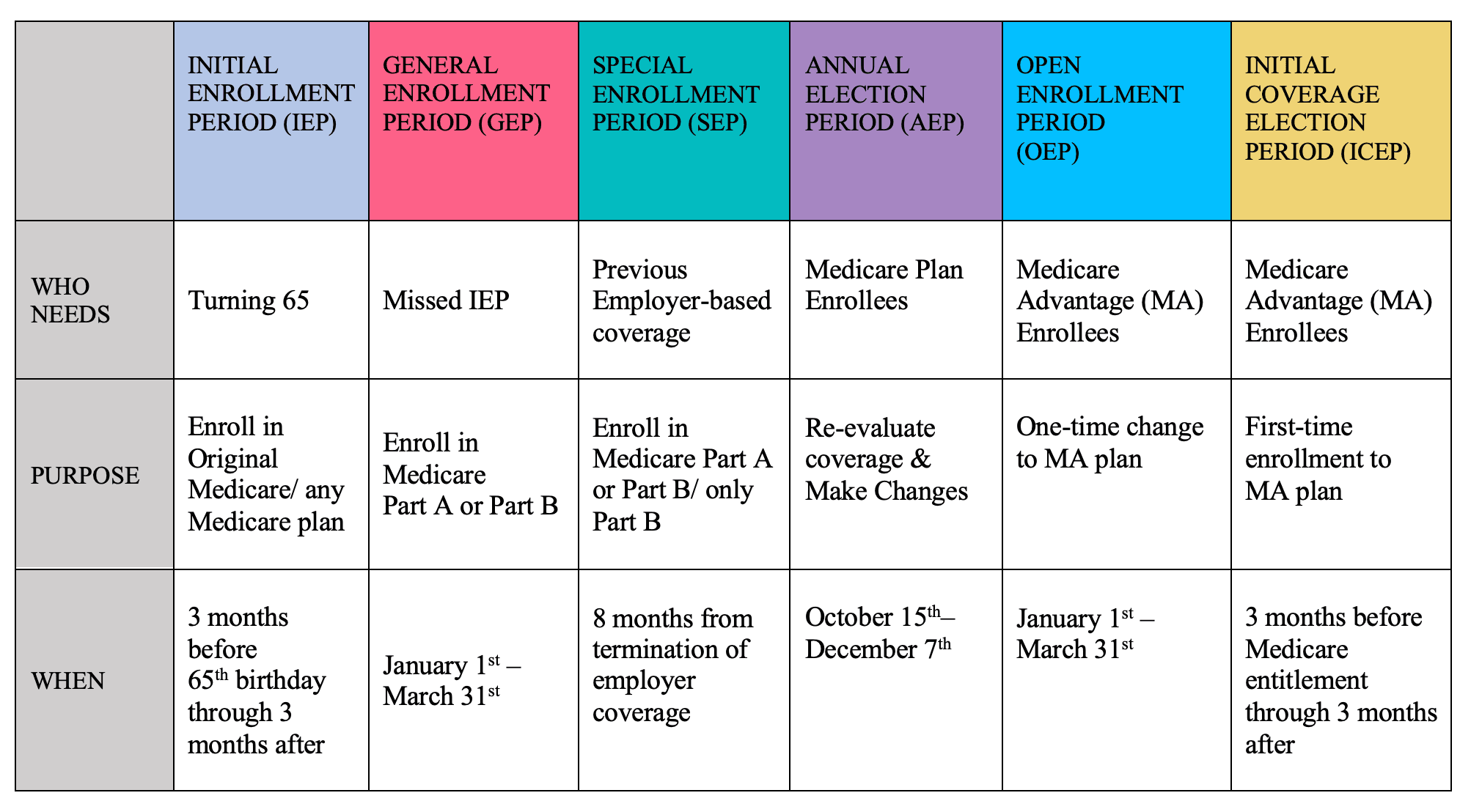

Explaining the Different Enrollment Periods for Medicare

Finding the Best Dental Plans for Seniors

How Do Medicare Agents Get Paid?

How is Medicare Changing in 2025?

How Medicare Costs Can Pile Up

How Much Does Open Heart Surgery Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Choose a Medigap Plan

How to Compare Medigap Plans in 2025

How to Enroll in Social Security

How Your Employer Insurance and Medicare Work Together

Is HIFU Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare 101

Medicare Advantage Plans for Disabled People Under 65

Medicare Savings Programs in Kansas

Moving? Here’s What Happens to Your Medicare Coverage

Plan G vs. Plan N

What Does Medicare Cover for Stroke Patients?

What Is a Medicare Advantage POS Plan?

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What's the Deal with Flex Cards?

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare