Find Out When You Can Switch Medicare Advantage Plans

If there is one constant in life, it's change. And if your medical needs or living circumstances change, so should your healthcare coverage.

Speak with a Medicare Advocate

Medicare helps you adapt. It lets you switch health insurance plans at specific times each year.

Keep reading to find out when you can change your Medicare Advantage plan and how to qualify for Special Enrollment Periods.

Can I Change My Medicare Advantage Plan?

Yes!

If you're unhappy with your current plan or want to change your coverage, you can switch from one Medicare Advantage Plan to another, or return to Original Medicare. However, there are exceptions to when you can switch plans.

Note: Before switching plans, compare the costs

When Can I Change My Medicare Advantage Plan?

You can join, change, or drop your Medicare Advantage plan during these specific periods:

Initial Enrollment period

Annual Election Period

Medicare Advantage Open Enrollment Period

Let's look at each period in detail.

Initial Enrollment Period

You first sign up for Medicare during the Initial Enrollment period.

You start by enrolling in Parts A and B. Then, you can switch to any Medicare Advantage plan of your choice.

Your Initial enrollment period (IEP)

Below are some examples:

You’re Eligible as Soon as You Turn 65

Your IEP is a 7-month window:

It begins 3 months before you turn 65.

It ends 3 months after your birth month.

If you enroll in a Medicare Advantage Plan during this time and aren't satisfied, you can drop it anytime within the next 12 months and return to Original Medicare.

You’re Eligible Due to a Disability (And You're Under 65)

Your IEP is a 7-month window:

It begins 3 months before your Medicare coverage begins (24 months after you get Social Security or RRB benefits)

It extends to 3 months after you start getting Medicare benefits

You’re Eligible Due to a Disability (and You Turn 65)

Your IEP is a 7-month window:

It begins 3 months before you turn 65.

It ends 3 months after your birth month.

During this period, you can either join, drop, or switch your Medicare Advantage Plan.

You Have Medicare Part A and Get Part B During the General Enrollment Period

If you add Medicare Part B during the GEP (January 1st – March 31st), your IEP lasts from April 1st – June 30th.

Annual Election Period

The Annual Election Period (AEP) also known as the Fall Open Enrollment occurs from October 15th – December 7th each year.

During this period, you can:

Switch from Original Medicare to Medicare Advantage Plan.

Return to Original Medicare from a Medicare Advantage Plan.

Switch from one Medicare Advantage Plan to another (with or without drug plans).

Join a Medicare drug plan (Part D).

Switch from one Medicare drug plan to another.

Disenroll from a Medicare drug coverage.

Changes made during the AEP come into effect on January 1st.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period (MA OEP) occurs from January 1st – March 31st each year.

During this period, you can:

Switch from a Medicare Advantage Plan to another plan

Return to Original Medicare from a Medicare Advantage Plan

However, you can’t:

Switch from Original Medicare to the Medicare Advantage Plan

Join a Medicare drug plan (Part D)

Switch from one Medicare drug plan to another

The change made during the MA OEP comes into effect the first of the month following enrollment.

Note: you can only switch your plan once during this period.

Can You Change Medicare Advantage Plans at Any Other Time?

Yes. You can switch plans outside the three enrollment periods.

To do this, you must qualify for the Special Enrollment Period (SEP).

You're eligible for the Special Enrollment Period if:

You move to a different location

You lose your current coverage

You have a chance to get other coverage

Your plan changes its contract with Medicare

The state you live in grants an SEP

Let's look at some specific situations in more detail and discuss some steps you can take.

1. Your Change of Address Affects Your Coverage

If you move to a new address outside your plan's service area or your original service provider introduces plan options in your new location, you can:

Switch to a new Medicare Advantage plan or Medicare drug plan

Return to Original Medicare (if you’re outside your plan’s service area)

Note: If you don’t enroll in a new Medicare Advantage plan, you’ll automatically get Original Medicare when you disenroll from your old MA plan.

How Long Is the Special Enrollment Period?

If you inform your service provider before you move — your SEP begins the month before you move and extends to 2 months after you move.

If you inform your service provider after you move — your SEP starts the month you tell your provider and ends after 2 months.

2. You Move Back to the United States

If you leave the U.S. and move back, you can join a Medicare Advantage Plan or a Medicare drug plan.

How Long Is the Special Enrollment Period?

Your SEP lasts from 1 month before you move until 2 months after you move back to the U.S.

3. You Move Out of an Institution

If you recently moved out of a nursing home or rehabilitation hospital, you can:

Join a Medicare Advantage Plan or Medicare drug plan.

Switch from your current plan to another Medicare Advantage Plan or Medicare drug plan.

Return to Original Medicare.

Drop your Medicare drug coverage.

How Long Is the Special Enrollment Period?

Your SEP lasts as long as you live in the institution. It ends 2 months after you move out.

4. You're No Longer Eligible for Medicaid

If you no longer qualify for Medicaid, you can:

Join a Medicare Advantage Plan or Medicare drug plan

Switch from your current plan to another Medicare Advantage Plan or Medicare drug plan

Return to Original Medicare

Drop your Medicare drug coverage

How Long Is the Special Enrollment Period?

Your SEP lasts for 3 months from whichever date is later:

The date you’re no longer eligible

The date you find out you’re no longer eligible

5. You Lose Coverage With Your Employer

If your employer or union no longer provides coverage (including COBRA coverage), you can join a Medicare Advantage Plan or Medicare drug plan.

How Long Is the Special Enrollment Period?

Your SEP lasts for 2 months after your coverage ends or 2 months after you are notified, whichever is later.

6. You're Impacted by Medicare Exclusions

If Medicare takes an official action (a “sanction”) because of a problem with the plan, you can switch from your Medicare Advantage Plan or Medicare drug plan to another plan.

How Long Is the Special Enrollment Period?

Medicare determines your SEP on a case-by-case basis.

7. Your Plan Terminates Its Contract with Medicare

If your plan is no longer part of Medicare, you can switch from your Medicare Advantage Plan or Medicare drug plan to another plan.

How Long Is the Special Enrollment Period?

Your SEP begins 2 months before the contract ends and extends till one month after.

8. Your Plan Isn't Renewed

If your Medicare Advantage plan, Medicare drug plan, or Medicare Cost Plan isn’t renewed for the next contract year, you can switch from your Medicare Advantage Plan or Medicare drug plan to another plan.

How Long Is the Special Enrollment Period?

Your SEP acts as an extension of the AEP and starts on October 15th and ends on the last day of February.

9. You're Eligible for Both Medicare and Medicaid

If you qualify for both Medicare and Medicaid, you can:

Join a Medicare Advantage Plan or Medicare drug plan

Switch from your current plan to another Medicare Advantage Plan or Medicare drug plan

Return to Original Medicare

Drop your Medicare drug coverage

How Long Is the Special Enrollment Period?

You can join, switch, or drop once during each of these periods:

January – March

April – June

July – September

10. You Drop Medigap and Join Medicare Advantage

If you switch from Medigap to Medicare Advantage, you can:

Drop your Medicare Advantage Plan and enroll in Original Medicare

Buy a Medigap policy (with special rights)

How Long Is the Special Enrollment Period?

Your SEP lasts 12 months after you first join a Medicare Advantage Plan.

Other Situations

Some other special circumstances list

Takeaway

You may want to change or drop your Medicare Advantage Plan if:

You're unhappy with your current plan

Your doctor moves out of network

You move to a new place

Your medical situation changes

Whatever the case, Medicare lets you switch plans during specific enrollment periods.

You may also qualify for a Special Enrollment Period. Call Medicare or talk to our licensed advisors at 1-888-376-2028 to check your eligibility.

If switching plans feels confusing, Fair Square Medicare

Recommended Articles

Does Medicare Cover the WATCHMAN Procedure?

Dec 1, 2022

How Often Can I Change Medicare Plans?

May 5, 2023

Can Medicare Advantage Plans Deny Coverage for Pre-Existing Conditions?

Mar 28, 2023

13 Best Ways for Seniors to Stay Active in Phoenix

Mar 6, 2023

Do I Need Medicare If My Spouse Has Insurance?

Dec 19, 2022

Last Day to Change Your Medicare Part D Plan

Jul 14, 2025

Does Medicare Cover Cartiva Implants?

Nov 29, 2022

Does Medicare Cover RSV Vaccines?

Sep 13, 2023

Does Medicare Cover Cold Laser Therapy (CLT)?

Jun 14, 2023

Is HIFU Covered by Medicare?

Nov 21, 2022

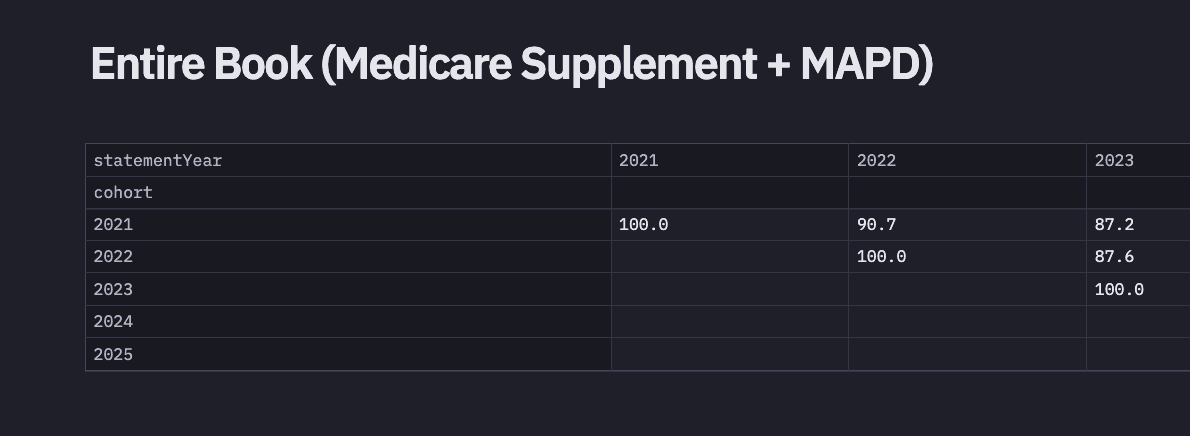

2024 Fair Square Client Retention and Satisfaction Report

Mar 4, 2025

Medicare 101

May 20, 2020

What is Plan J?

Jul 14, 2025

Is Emsella Covered by Medicare?

Nov 21, 2022

How to Enroll in Social Security

Apr 28, 2023

Does Medicare Cover Diabetic Eye Exams?

Jan 11, 2023

Does Medicare Cover Cardiac Ablation?

Dec 9, 2022

How to Compare Medigap Plans in 2025

Jul 14, 2025

More of our articles

10 Top Medicare Supplement (Medigap) Companies for 2025

13 Best Ways for Seniors to Stay Active in Philadelphia

2024 Cost of Living Adjustment

2025 Medicare Price Changes

Building the Future of Senior Healthcare

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Have Two Primary Care Physicians?

Can Medicare Advantage Plans be Used Out of State?

Comparing All Medigap Plans | Chart Updated for 2025

Do All Hospitals Accept Medicare Advantage Plans?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover Abortion Services?

Does Medicare Cover an FMT?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Driving Evaluations?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hypnotherapy?

Does Medicare Cover Inqovi?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Krystexxa?

Does Medicare Cover Mental Health?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Nuedexta?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Physicals & Blood Work?

Does Medicare Cover Robotic Surgery?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover Service Animals?

Does Medicare Cover SIBO Testing?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Tymlos?

Does Medicare Cover Vitamins?

Does Medicare Cover Zilretta?

Does Medicare Have Limitations on Hospital Stays?

Does Medicare Pay for Funeral Expenses?

Does Medicare pay for Opdivo?

Does Medicare Require a Referral for Audiology Exams?

Does Your Medicare Plan Cover B12 Shots?

Everything About Your Medicare Card + Medicare Number

Explaining IRMAA on Medicare

Explaining the Different Enrollment Periods for Medicare

Finding the Best Dental Plans for Seniors

Finding the Best Vision Plans for Seniors

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Health Savings Accounts (HSAs) and Medicare

How Are Medicare Star Ratings Determined?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Do Medigap Premiums Vary?

How Much Does Medicare Cost?

How Much Does Trelegy Cost with Medicare?

How to Apply for Medicare?

How to Choose a Medigap Plan

Is Balloon Sinuplasty Covered by Medicare?

Is Vitrectomy Surgery Covered by Medicare?

Medicare Deductibles Resetting in 2025

Medicare Explained

Medicare Supplement Plans for Low-Income Seniors

Medigap Plan N vs. Plan G — Which One Fits You in 2025?

Moving? Here’s What Happens to Your Medicare Coverage

Seeing the Value in Fair Square

The Fair Square Bulletin: October 2023

Top 10 Physical Therapy Clinics in San Diego

What Is a Medicare Supplement SELECT Plan?

What's the Difference Between HMO and PPO Plans?

When to Choose Medicare Advantage over Medicare Supplement

Why Is Medicare So Confusing?

Will Medicare Cover Dental Implants?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare