Not so fast

As you age, it's still important to have the freedom and independence to drive a car. But it is more important to keep the roads safe, so driving evaluations are a necessity for elderly citizens. Unfortunately, they are not considered a medical necessity, so driving evaluations are not covered by Medicare. Let's talk about how you could still get help with paying for a driving evaluation.

Speak with a Medicare Advocate

What is a driving evaluation and why do you need one?

A driving evaluation is an assessment of your ability to safely drive a car. It involves examining your physical, cognitive, and visual abilities that are needed to drive. It could also include a road test or simulation.

Older citizens may need a driving evaluation if they have medical conditions such as dementia, impaired vision or hearing, balance issues, or uncontrolled seizures. A doctor may order a driving evaluation if they observe any of these issues in the patient and feel as though it could affect their ability to safely operate a motor vehicle.

How can you pay for a driving evaluation if Medicare doesn't cover it?

If you need to have a driving evaluation done, there are several options for you. If you are enrolled in an insurance plan that covers the cost of driving evaluations, then they may be able to help with the costs. You could also try contacting your local motor vehicle department and see if they offer any special discounts or programs for elderly citizens.

What are the benefits of getting a driving evaluation?

There are many benefits to getting a driving evaluation. It can help you remain safe on the road and stay independent for longer periods of time. It can also give your family peace of mind since they will know that you are receiving the appropriate care and support when it comes to driving. Lastly, by getting a professional opinion about your driving abilities, you can make sure that you’re not putting yourself or other drivers in danger.

How to prepare for a driving evaluation

In order to have a successful driving evaluation, it is important for you to be prepared. Make sure that you bring all necessary documents and forms to the appointment, such as your driver’s license or ID card. You should also dress comfortably in loose-fitting clothing so that you can move freely during the evaluation. Be sure to practice driving for a few days before the evaluation, and practice parking in different spots to help prepare you. Lastly, be sure to review any rules of the road that you may have forgotten.

What to expect during and after your driving evaluation

During your driving evaluation, you may be asked to complete some physical tests and answer questions about your cognitive abilities. You will then be asked to drive a vehicle under the supervision of an evaluator. After the evaluation, you will receive feedback about your ability to safely drive a car. In some cases, you may need additional training or coaching in order to remain safe on the road.

Conclusion

No matter the cost, getting a driving evaluation is an important part of ensuring that you can remain independent and safe on the roads. If Medicare doesn't cover it, other options may be available to help pay for it. For help choosing your Medicare plan, give us a call. We are here to help.

Recommended Articles

Does Medicare Cover Incontinence Supplies?

Dec 22, 2022

Do I Need to Renew My Medicare?

Nov 29, 2022

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

Mar 3, 2023

Comparing All Medigap Plans | Chart Updated for 2025

Aug 1, 2022

Does Medicare Cover Cervical Disc Replacement?

Jan 20, 2023

Does Medicare Cover PTNS?

Dec 9, 2022

Does Medicare Cover Orthodontic Care?

Nov 18, 2022

What is a Medicare Beneficiary Ombudsman?

Apr 11, 2023

Does Medicare Cover Light Therapy for Psoriasis?

Jan 17, 2023

Can I Change My Primary Care Provider with an Advantage Plan?

Aug 25, 2023

Does Medicare Pay for Funeral Expenses?

Dec 6, 2022

Gap Health Insurance: The Secret Sidekick to Your High-Deductible Plan

Jul 14, 2025

Does Medicare Cover Urodynamic Testing?

Dec 2, 2022

When to Choose Medicare Advantage over Medicare Supplement

Jun 7, 2023

How Much Does a Medicare Coach Cost?

Mar 20, 2023

The Easiest Call You'll Ever Make

Jun 28, 2023

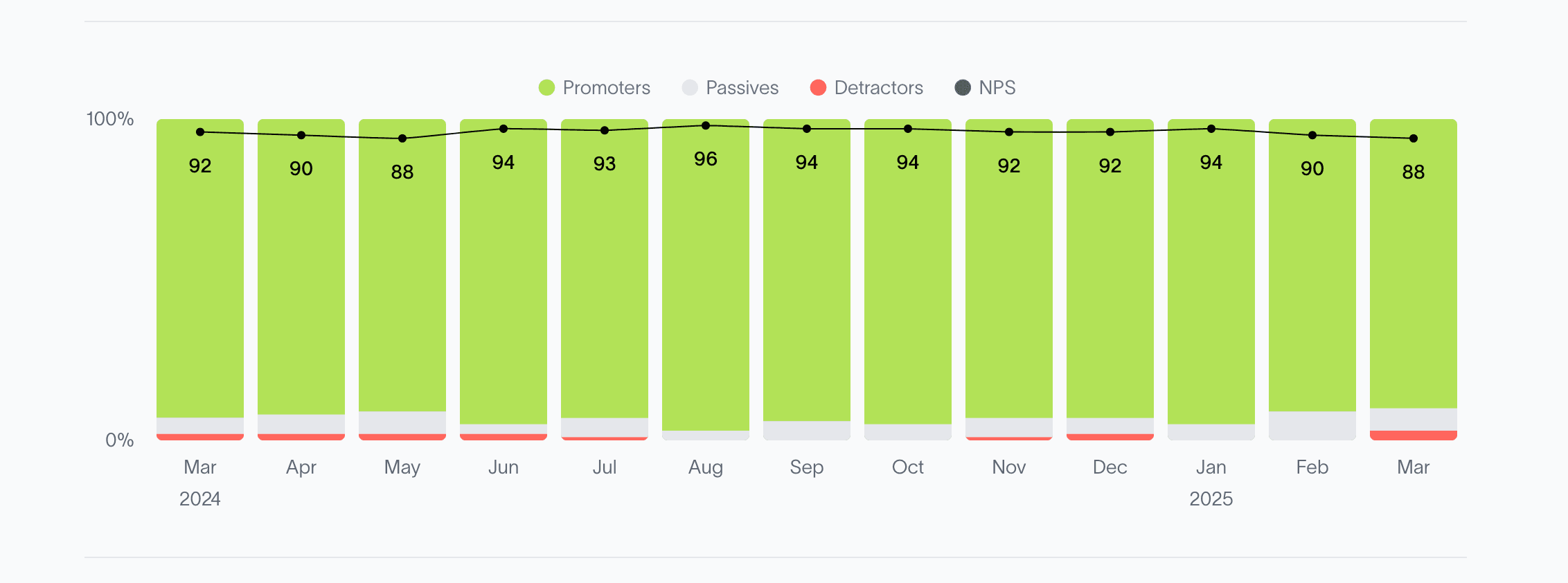

2024 Fair Square NPS Report

Mar 19, 2025

What You Need to Know About Creditable Coverage

Jan 18, 2023

More of our articles

13 Best Ways for Seniors to Stay Active in Jacksonville

14 Best Ways to Stay Active in Charlotte

20 Questions to Ask Your Medicare Agent

2024 Fair Square Client Retention and Satisfaction Report

Are Medicare Advantage Plans Bad?

Can Doctors Choose Not to Accept Medicare?

Can I Change Medicare Advantage Plans Any Time? | Medicare Plans

Can I Choose Marketplace Coverage Instead of Medicare?

Can I Laminate My Medicare Card?

Can I switch From Medicare Advantage to Medigap?

Can I Use Medicare Part D at Any Pharmacy?

Can Medicare Advantage Plans be Used Out of State?

Can Medicare Help with the Cost of Tyrvaya?

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Does Medicare Cover a Spinal Cord Stimulator?

Does Medicare Cover an FMT?

Does Medicare Cover Boniva?

Does Medicare Cover Breast Implant Removal?

Does Medicare Cover COVID Tests?

Does Medicare cover Deviated Septum Surgery?

Does Medicare Cover Fosamax?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Home Heart Monitors?

Does Medicare Cover Iovera Treatment?

Does Medicare Cover Jakafi?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Linx Surgery?

Does Medicare Cover LVAD Surgery?

Does Medicare Cover Mouth Guards for Sleep Apnea?

Does Medicare Cover Ofev?

Does Medicare Cover RSV Vaccines?

Does Medicare Cover Scleral Lenses?

Does Medicare Cover SIBO Testing?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the WATCHMAN Procedure?

Does Medicare Cover Xiafaxan?

Does Medicare Cover Zilretta?

Does Medicare Pay for Antivenom?

Does Medicare pay for Opdivo?

Health Savings Accounts (HSAs) and Medicare

How Medicare Costs Can Pile Up

How Much Does Medicare Part A Cost in 2025?

How Much Does Medicare Part B Cost in 2025?

How Much Does Rexulti Cost with Medicare?

How Much Does Trelegy Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How Often Can I Change Medicare Plans?

How to Apply for Medicare?

How to Become a Medicare Agent

How to Deduct Medicare Expenses from Your Taxes

Is Botox Covered by Medicare?

Is Displacement Affecting Your Medicare Coverage?

Medicare & Ozempic

Medicare Explained

Moving? Here’s What Happens to Your Medicare Coverage

Saving Money with Alternative Pharmacies & Discount Programs

Should You Work With A Remote Medicare Agent?

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Does Medicare Cover for Stroke Patients?

What If I Don't Like My Plan?

What is Plan J?

What is the Medicare ICEP?

What To Do If Your Medicare Advantage Plan Is Discontinued

What to Do When Your Doctor Doesn't Take Medicare

What to Do When Your Doctor Leaves Your Network

What's the Difference Between HMO and PPO Plans?

Why Is Medicare So Confusing?

Why You Should Keep Your Medigap Plan

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare