How "returns" work in the Medicare world.

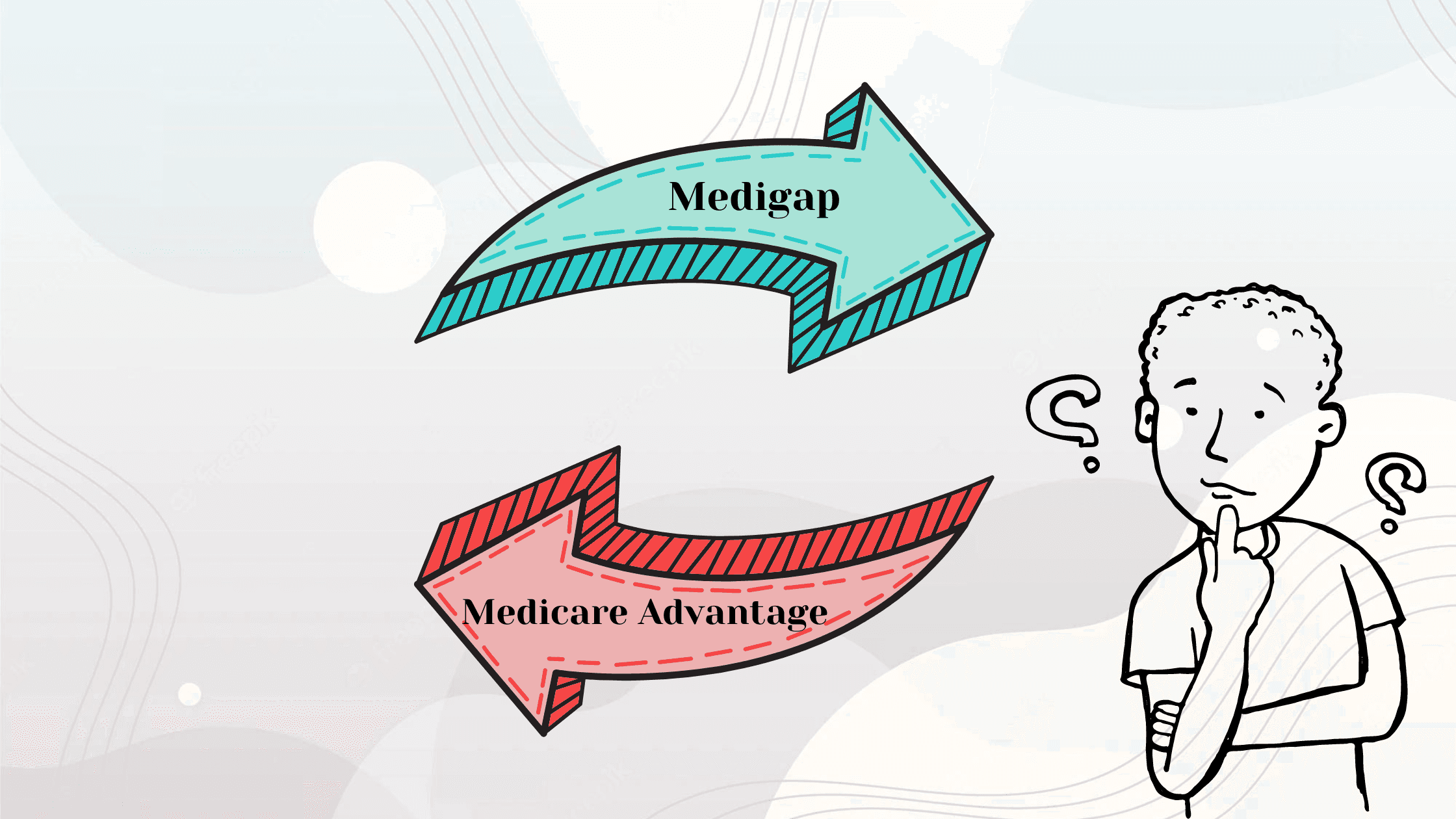

When you buy a package on Amazon, you get thirty days to return it, but what happens if you don't like your Medigap (Medicare Supplement) or Medicare Advantage policy?

Speak with a Medicare Advocate

Medigap (Medicare Supplement)

There are two opportunities to enroll in Medigap without any pre-existing conditions affecting your premium:

During the six months after your 65th birthday and enrollment in Part B

For 63 days after you lose employer health insurance coverage

During these periods you can enroll and unenroll in as many Medigap policies as you like. Once these periods pass, Medigap plan carriers can generally screen you, raise your premium, or delay coverage based on any pre-existing conditions you have. In California, however, you have a a 30 day window after your birthday to switch to a Medigap plan that offers equal or fewer benefits than your current one without disclosing any pre-existing conditions.

If you want to switch from a Medigap plan to a Medicare Advantage plan, you can do so between October 15th and December 7th every year.

Medicare Advantage

If you enroll in a Medicare Advantage plan when you turn 65, you may switch to a Medigap plan for any reason during the first year.

If you want to swap your current Medicare Advantage plan for another one, you can change Medicare Advantage plans between October 15th and December 7th and between January 1st and March 31st every year.

Recommended Articles

Does Medicare Cover SIBO Testing?

Dec 1, 2022

Does Medicare Cover Qutenza?

Jan 13, 2023

How to Apply for Medicare?

Jul 15, 2022

Medicare Deductibles Resetting in 2025

Jan 18, 2024

13 Best Ways for Seniors to Stay Active in Jacksonville

Mar 3, 2023

How Does the End of the COVID-19 Public Health Emergency Affect Your Medicare?

Mar 3, 2023

Does Medicare Cover the WATCHMAN Procedure?

Dec 1, 2022

Moving? Here’s What Happens to Your Medicare Coverage

Jul 15, 2025

15 Best Ways for Seniors to Stay Active in Denver

Mar 9, 2023

Can I switch From Medicare Advantage to Medigap?

Sep 14, 2022

Can I Use Medicare Part D at Any Pharmacy?

Aug 28, 2023

How Medicare Costs Can Pile Up

Oct 11, 2022

Does Medicare Cover Ilumya?

Dec 7, 2022

14 Best Ways for Seniors to Stay Active in Nashville

Mar 10, 2023

20 Questions to Ask Your Medicare Agent

Mar 17, 2023

Why Is Medicare So Confusing?

Apr 19, 2023

What's the Deal with Flex Cards?

Dec 15, 2022

Does Medicare Cover Abortion Services?

Dec 13, 2022

More of our articles

13 Best Ways for Seniors to Stay Active in Indianapolis

13 Best Ways for Seniors to Stay Active in Philadelphia

14 Best Ways to Stay Active in Charlotte

Can Doctors Choose Not to Accept Medicare?

Can I Laminate My Medicare Card?

Costco Pharmacy Partners with Fair Square

Do All Hospitals Accept Medicare Advantage Plans?

Do I Need Medicare If My Spouse Has Insurance?

Do I Need to Renew My Medicare?

Do You Need Medigap if You're Eligible for Both Medicare and Medicaid?

Does Medicare Cover Bladder Sling Surgery?

Does Medicare Cover Cardiac Ablation?

Does Medicare Cover Cataract Surgery?

Does Medicare Cover Cold Laser Therapy (CLT)?

Does Medicare Cover Cosmetic Surgery?

Does Medicare Cover COVID Tests?

Does Medicare Cover Diabetic Eye Exams?

Does Medicare Cover Flu Shots?

Does Medicare Cover Fosamax?

Does Medicare Cover Hepatitis C Treatment?

Does Medicare Cover Hoarding Cleanup?

Does Medicare Cover Incontinence Supplies?

Does Medicare Cover Inspire for Sleep Apnea?

Does Medicare Cover Ketamine Infusion for Depression?

Does Medicare Cover Kidney Stone Removal?

Does Medicare Cover Krystexxa?

Does Medicare Cover Macular Degeneration?

Does Medicare Cover Medical Marijuana?

Does Medicare Cover Nuedexta?

Does Medicare Cover Orthodontic Care?

Does Medicare Cover Oxybutynin?

Does Medicare Cover Penile Implant Surgery?

Does Medicare Cover Service Animals?

Does Medicare Cover Shock Wave Therapy for Plantar Fasciitis?

Does Medicare Cover Stair Lifts?

Does Medicare Cover the Urolift Procedure?

Does Medicare Cover Vitamins?

Does Medicare Cover Wart Removal?

Does Medicare Cover Zilretta?

Does Medicare Pay for Allergy Shots?

Does Medicare Pay for Antivenom?

Does Medicare Pay for Bunion Surgery?

Does Medicare Require a Referral for Audiology Exams?

Does Retiring at Age 62 Make Me Eligible for Medicare?

Estimating Prescription Drug Costs

Explaining the Different Enrollment Periods for Medicare

How Can I Get a Replacement Medicare Card?

How Do I Sign up for Medicare? A Simple How-To Guide For You

How Does Medicare Cover Colonoscopies?

How Much Does a Medicare Coach Cost?

How Much Does a Pacemaker Cost with Medicare?

How Much Does Rexulti Cost with Medicare?

How Much Does Xeljanz Cost with Medicare?

How to Choose a Medigap Plan

How to Deduct Medicare Expenses from Your Taxes

Medicare Advantage MSA Plans

Medicare Explained

Medicare Guaranteed Issue Rights by State

Medicare Savings Programs in Kansas

Plan G vs. Plan N

Should You Work With A Remote Medicare Agent?

Top 10 Physical Therapy Clinics in San Diego

Turning 65 and Thinking of Keeping COBRA? Here’s Why It Usually Backfires

What Is a Medicare Supplement SELECT Plan?

What Is Medical Underwriting for Medigap?

What is the 8-Minute Rule on Medicare?

What to Do When Your Doctor Doesn't Take Medicare

What You Need to Know About Creditable Coverage

When to Choose Medicare Advantage over Medicare Supplement

Why You Should Keep Your Medigap Plan

Will Medicare Cover Dental Implants?

Will Medicare Cover it?

Get the Fair Square Bulletin

Medicare savings tips, helpful guides, and more.

Virgil Insurance Agency, LLC (DBA Fair Square Medicare) and www.fairsquaremedicare.com are privately owned and operated by Help Button Inc. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. This is a solicitation of insurance. A licensed agent/producer may contact you. Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and, in some states, to those under age 65 eligible for Medicare due to disability or End-Stage Renal disease. Virgil Insurance Agency is a licensed and certified representative of Medicare Advantage HMO, HMO SNP, PPO, PPO SNP and PFFS organizations and stand-alone PDP prescription drug plans. Each of the organizations we represent has a Medicare contract. Enrollment in any plan depends on contract renewal. The plans we represent do not discriminate on the basis of race, color, national origin, age, disability, or sex. Plan availability varies by region and state. For a complete list of available plans please contact 1-800-MEDICARE (TTY users should call 1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov. © 2026 Help Button Inc

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MULTIPLAN_FairSquareMedicare_01062022_M

Fair Square Medicare